[ad_1]

da-kuk/E+ via Getty Images

Thesis

Dividend growth investing has seen an increase in popularity, especially when investors in their 20s and 30s consider building cash flow generating portfolios that will accumulate large dividend payments over the long run. WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ:DGRW) is one of the ETFs offering investors dividend growth factor exposure through quality large and mid-cap holdings. In this analysis, the fund’s structure, performance, and attractiveness are examined, while I also hope to provide some insights on the broader prospects of dividend growth funds.

Fund Identity and Purpose

DGRW seeks to track the WisdomTree U.S. Dividend Index, consisting of 300 U.S. equities with a market capitalization greater than $2.0B. Unlike many other popular dividend growth ETFs, DGRW offers some exposure toward mid-cap stocks as well as large-cap names.

The fund can serve a couple of different purposes. Investors closer to retirement can combine DGRW with a high-yield portfolio, so that they do not completely forego the growth factor, while also harvesting dividend payments. Younger investors, on the other hand, will benefit from the long-term growth in income distributions the ETF will offer through the following decades.

One area of weakness for DGRW lies in its fees. Currently, the ETF charges a 0.28% expense ratio, which is significantly higher than what competitors like Vanguard Dividend Appreciation ETF (VIG) – 0.06% expense ratio – or iShares Core Dividend Growth ETF (DGRO) – 0.08% expense ratio – charge. For long-term investors what currently looks like a small difference can have large compounding effects leading to underperformance over large periods of time, and is definitely something to consider.

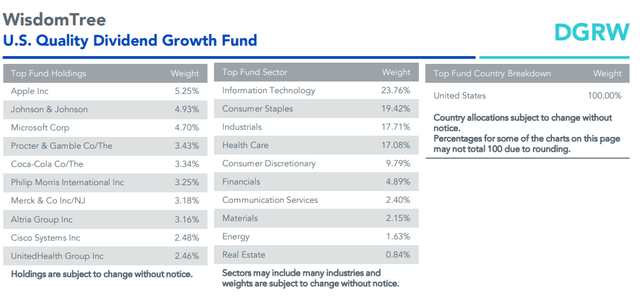

WisdomTree

The fund’s top ten holdings include blue-chip companies like Apple (AAPL), Johnson & Johnson (JNJ), Microsoft (MSFT), Procter & Gamble (PG), and more, offering both growth and defensive exposure at the same time. Aggregated, DGRW’s 10 largest holdings account for approximately 36% of the total weighting, indicating more concentration than an S&P 500 ETF, where the top 10 holdings accumulate to around 30%. In terms of sector exposure, technology leads, mainly due to the holdings of AAPL and MSFT, followed by less popular sectors for broad market ETFs, like Industrials, Consumer Staples, and Healthcare. Again, DGRW seems to maintain a balance between cyclicals and defensives, appropriate for a turbulent stock market.

A New Dividend-Friendly Market

With the growth factor consistently outperforming for more than a decade, some analysts feared that a reversion to the mean was inevitable and, therefore, a broader rotation in the markets towards the value factor was bound to happen. In the midst of inflationary and other macroeconomic pressures, the broader market has retreated in 2022, with growth names, especially tech stocks, facing tremendous selling pressures. Valuations have more or less reverted back to historical averages and Dividend and Value factor investing has proven to be prudent, at least for the time being.

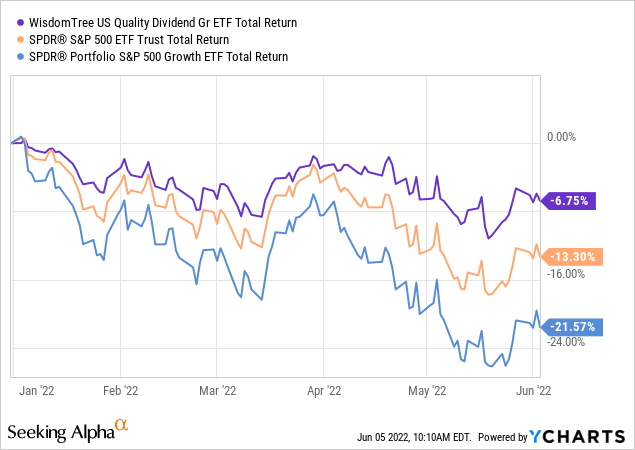

As shown in the graph below, with the S&P 500 pulling back -13.30% YTD, DGRW has mounted losses of -6.75%, displaying resilience. Its performance looks even better when compared to SPYG, a popular large-cap growth ETF.

Rising rates have applied gravitational pull to valuation multiples as the era of quantitative accommodation appears to phase out. Moreover, raging inflation leads investors to seek assets that provide income distributions to offset the erosion of their purchasing power.

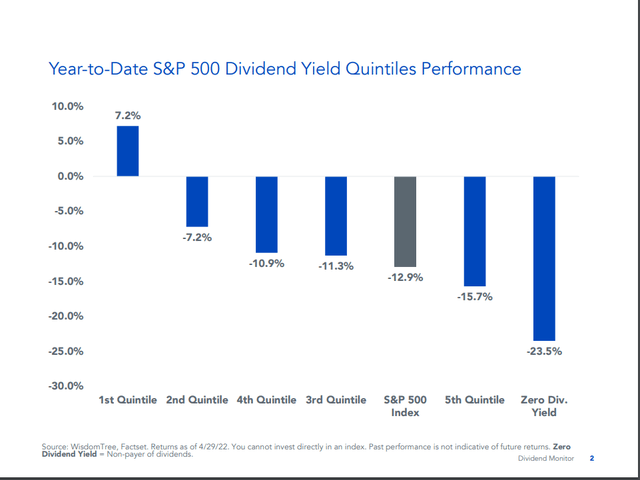

An interesting conclusion can be drawn from the chart below, provided by WisdomTree. Ranking S&P 500 stocks in quantiles, based on the size of their respective dividend payments, we can see that the top 10% of dividend payers have actually delivered a respectable positive performance YTD while the rest of the market has tanked. Stocks that pay no dividends on the other hand are facing the largest selling pressures, marking -23.5% losses.

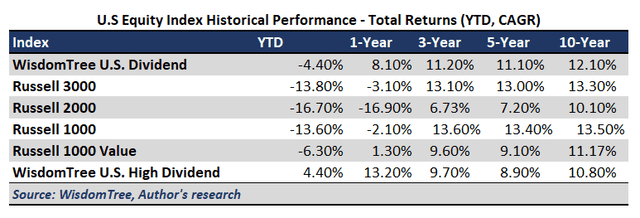

Focusing on long-term historical performance, since a dividend growth ETF is most likely to appeal to investors focusing further on down the road, 5 and 10-year CAGR returns for DGRW (based on the performance of the underlying index) are satisfying. 10-year CAGR returns reach 12.10%, with 5-year returns lagging a bit, at 11.10%. Still, large-caps (Russell 1000) outperform, with the dividend factor, however, poised for a comeback in the coming years the new monetary restrictive regime is established. The small-cap factor exhibits the worst performance over the past decade, with 5 and 10-year returns amounting to 8.90% and 10.805 respectively.

Battling Inflation

As mentioned in the previous segment, dividend stocks are often viewed as a prudent choice when inflationary pressures rise. While the 1.90% yield DGRW offers, currently, does not even come close to the percentage increases in the CPI, it still provided investors with some comfort, hoping that sooner or later inflation will recede back to more manageable levels.

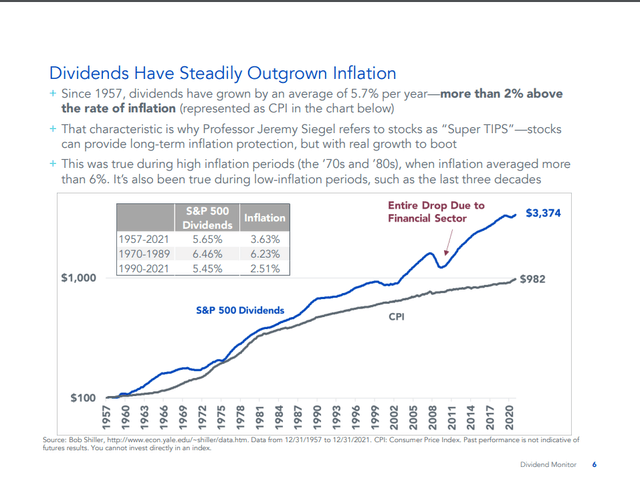

For more than 50 years, dividends have been a reliable setup for defeating inflation. With the average rate of dividend growth of 5.7%, exceeding the average 2.0% inflation rate, even without considering any appreciation in price, investors should handily outgrow increases in CPI just by receiving dividends.

Final Thoughts

After all things are considered, dividend growth investing, especially through a quality ETF like DGRW is likely to prove beneficial for investors both in the mid and the short term. As the market rotates away from high-multiple names and turns to more traditional sectors and blue-chip names dividend growth positioning is likely to deliver market-beating gains over the next couple of years. Of course, the long-term argument for employing a dividend growth strategy is unchanged. It revolves around progressively beating a balanced portfolio that eventually will provide the cash flow the investors will retire on. For these reasons, I would rate DGRW as a buy.

[ad_2]

Source links Google News