[ad_1]

RomoloTavani/iStock via Getty Images

Investment Thesis

Since its inception in May 2013, the WisdomTree U.S. Dividend Growth ETF (NASDAQ:DGRW) has been the third-best performer out of 26 dividend ETFs with sufficient history. It’s also in the top 10% for risk-adjusted returns, has a double-digit dividend growth rate, and yields close to 2%. DGRW’s track record is undoubtedly strong. But I want dividend investors to understand why, and it’s because it has less of a value lean than other dividend ETFs. Growth stocks have trumped value for most of DGRW’s history, but with that trend reversing, investors should manage expectations.

Still, for dividend ETFs yielding around 2%, DGRW is a solid choice. I’ll compare it with the largest fund in the category, the Vanguard Dividend Appreciation ETF (VIG), and I think you’ll agree DGRW’s fundamentals are more robust across the board. If you want market-like returns with a slight value lean, buy DGRW, but if you’re confident that value stocks will remain in favor for the foreseeable future, I’ll provide you with a list of other funds likely to do better.

ETF Overview

Strategy & Fund Basics

DGRW tracks the WisdomTree U.S. Quality Dividend Growth Index, selecting dividend-paying U.S. securities based on long-term earnings growth and the three-year average return on assets and equity. This process should translate to solid dividend growth, but it’s not explicitly defined in the methodology. Other ETFs, like the Vanguard Dividend Appreciation ETF, require ten consecutive years of dividend growth and are more exclusive with fewer holdings.

While DGRW isn’t a dividend growth ETF, it weights its constituents based on their aggregate future one-year dividend payments. WisdomTree does this for most of its dividend ETFs. This dividend-dollar-weighting scheme is a cross between weighting by yield and market capitalization since low-yielding stocks can still make up a good chunk of the fund so long as the number of shares outstanding is large enough. The process lessens the impact yield has on the allocations and makes it closer to a broad-based fund like the SPDR S&P 500 Index ETF (SPY). There isn’t anything wrong with this approach, but it’s better suited to passive investors who want a bit more yield and are undecided about whether growth or value will outperform. I’ve listed some additional fund information below for your reference:

- Current Price: $63.04

- Assets Under Management: $6.87 billion

- Shares Outstanding: 108.55 million

- Expense Ratio: 0.28%

- Launch Date: May 22, 2013

- Trailing Dividend Yield: 1.83%

- Three-Year Dividend CAGR: 5.52%

- Five-Year Dividend CAGR: 10.83%

- Dividend Frequency: Monthly

- Five-Year Beta: 0.92

- Number of Securities: 299

- Portfolio Turnover: 30.00%

- Assets in Top Ten: 35.69%

- 30-Day Median Bid-Ask Spread: 0.05%

- Tracked Index: WisdomTree U.S. Quality Dividend Growth Index

- Reconstitution Frequency: Annually In December

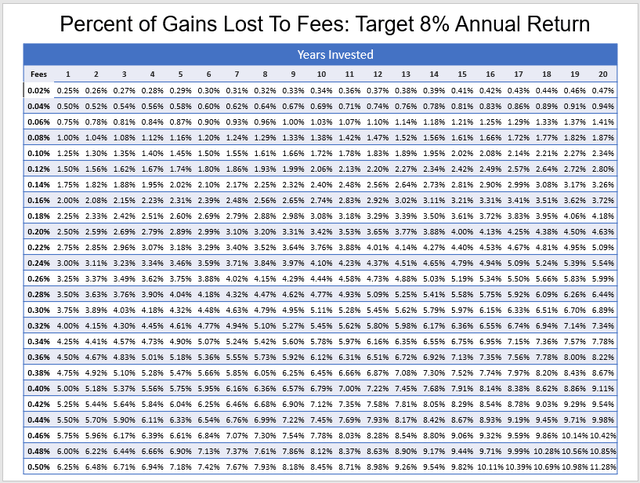

As shown, DGRW isn’t the cheapest ETF available. If held long enough, its 0.28% expense ratio could take a decent portion of your gains. For example, assuming an 8% return continuously compounded over ten years, 4.77% of your profits will be lost to fees. For a satellite holding, this might be okay, but for core holdings like how DGRW is intended, it’s getting a little high.

Author

Having said that, you might not mind paying a little extra for the monthly dividends. DGRW is the largest dividend ETF by assets under management to offer this and is the most successful. Two other monthly payers are the Invesco High Yield Equity Dividend Achievers ETF (PEY) and the WisdomTree Large Cap Dividend ETF (DLN), but they have underperformed DGRW by around 1-2% per year since DGRW launched.

Finally, I’d like to highlight DGRW’s strong 10.83% five-year dividend growth rate. Current constituents have grown their dividends at a five-year rate of 11.84%, so DGRW’s indirect approach to dividend growth seems to be working. For context, only 15/64 dividend ETFs, including DGRW, have current holdings growing their dividends at this rate or better. The only other monthly payer happens to be WisdomTree’s small-cap equivalent, DGRS.

Sector Exposures and Top Ten Holdings

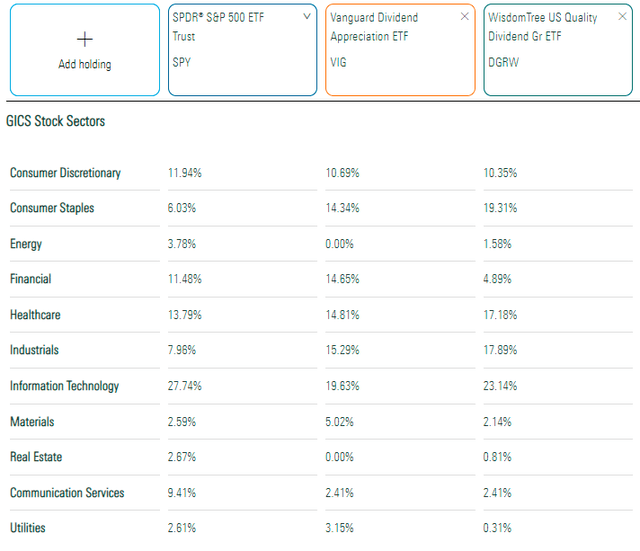

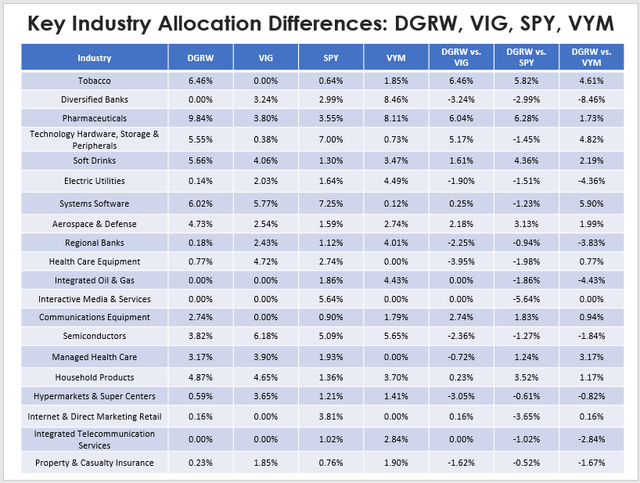

Compared to SPY, DGRW is overweight Consumer Staples by 13.28% and Industrials by 9.93%. It’s underweight Financials by 6.59% and Communication Services by 7.00%. Note that there isn’t a significant allocation difference in tech stocks, and many well-known names are included, like Apple (AAPL), Microsoft (MSFT), and Cisco Systems (CSCO).

Morningstar

I included VIG in the chart because that’s one ETF I’ll be comparing DGRW with on a fundamental basis later. The two have similar dividend yields and are widely popular. Still, DGRW favors Consumer Staples and Technology more, while VIG is geared more toward banking, insurance, and asset management stocks in the Financials sector.

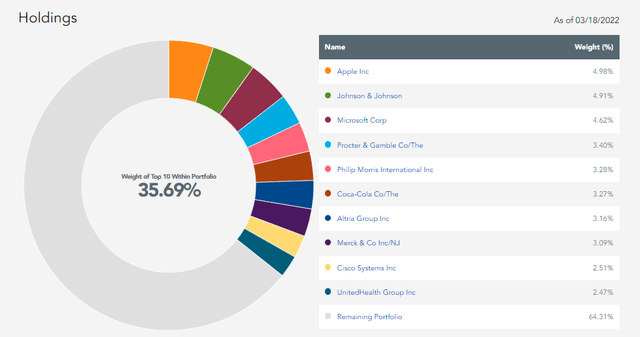

A list of DGRW’s top ten holdings is below. In addition to Apple and Microsoft, Johnson & Johnson (JNJ), Procter & Gamble (PG), and Philip Morris (PM) International all have significant weights. The Index places a cap of 5% per stock and 25% per sector (10% for Real Estate) when rebalancing.

WisdomTree

Historical Performance

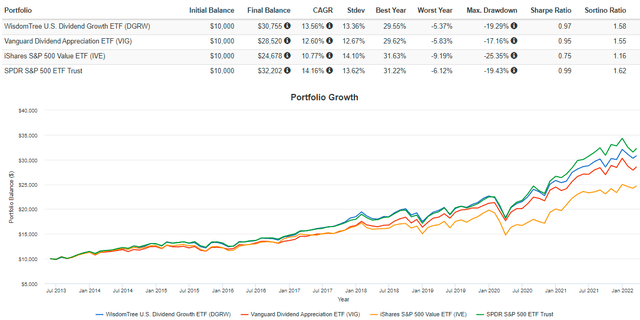

I mentioned earlier how very few dividend ETFs have been able to match the long-term performance of DGRW, but that’s because we’ve been in a long bull market with very few sustained drawdowns. DGRW still owns its fair share of growth stocks, so it’s performed better than low P/E, more value-oriented ETFs. The largest large-cap value ETF that’s market-cap-weighted is the iShares S&P 500 Value ETF (IVE), and the graph below compares DGRW’s performance with that fund, VIG, and SPY since its inception.

Portfolio Visualizer

Assuming reinvested dividends, DGRW gained an annualized 13.56%, which was 0.96% better than VIG, 2.79% better than IVE, but 0.60% worse than SPY. Volatility levels were about the same for all four ETFs. It’s not surprising to see IVE at the bottom. However, the trend in 2022 favors value, and IVE has outperformed DGRW, VIG, and SPY by 2.88%, 4.57%, and 4.86%, respectively. It might be helpful to think of ETFs on a scale from one to ten, where one is pure value and ten is pure growth. While an ETF like SPY might be considered a six or a seven, DGRW is probably more like a five or a six. It’s not an overly aggressive value move, but investors should get some benefits in this environment.

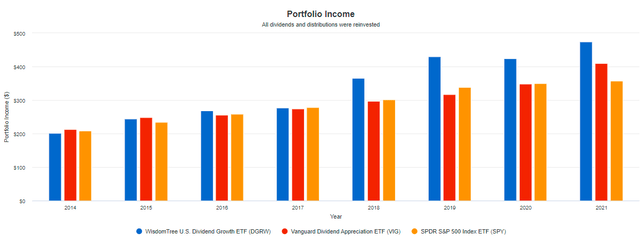

Another area where DGRW investors benefit is with dividend growth. Tax considerations aside, it’s rewarding to see your income stream grow. On a $10,000 investment in 2014, income was only $202 for the first year and slightly below VIG and SPY. But the graph below shows that income accelerated to $475 in 2021 compared to $411 and $357 for VIG and SPY.

Portfolio Visualizer

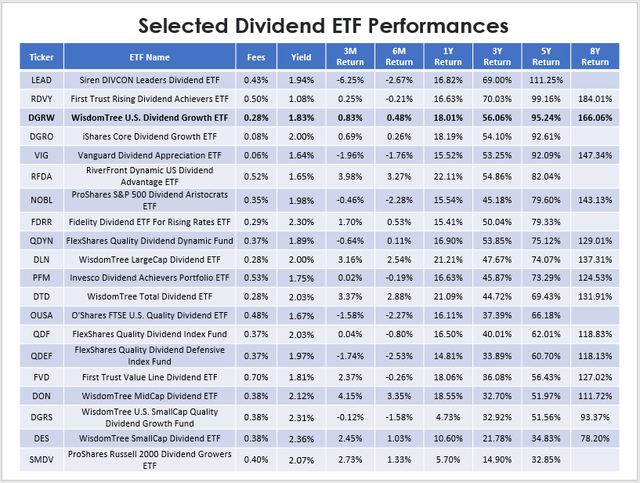

For more comparisons, consider the table below showing periodic returns for 20 dividend ETFs through February 2022. All funds have a minimum five-year history, and I chose them based on how similar their yields are. Only the Siren DIVCON Leaders Dividend ETF (LEAD) and the First Trust Rising Dividend Achievers ETF (RDVY) performed better in the last five years.

Author

Fundamental Analysis

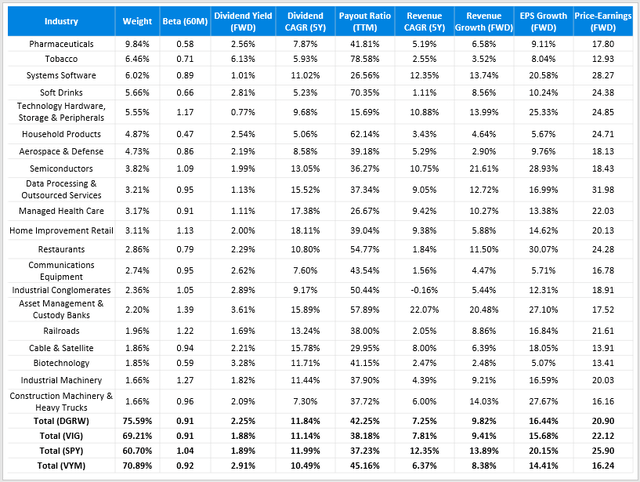

I hope I’ve established that DGRW is a solid but relatively low-yielding dividend ETF fund. However, relying solely on past performance presumes growth will continue to outperform, which can be misleading. That is why I prefer looking at the fundamentals to understand the options better. The table below highlights selected risk, growth, and valuation metrics for DGRW’s top 20 industries. I’ve also included summary metrics for VIG, SPY, and the Vanguard High Dividend Yield ETF (VYM) for investors looking for more value.

Author

First, notice how the five-year beta figure for all three dividend ETFs (DGRW, VIG, VYM) are nearly identical. A beta of 0.92 is the median for the 64 dividend ETFs I track monthly, so I consider this normal. Strategies prioritizing dividends are value-oriented since yield and price move in opposite directions. Investors should expect them to be less volatile than the market.

Second, DGRW’s constituents have a weighted-average forward yield of 2.25%, which is 0.37% more than VIG, 0.36% more than SPY, and 0.66% less than VYM. The differences in payout ratios reflect this, but DGRW looks better because of its higher dividend growth rate. It’s remarkably similar to what the ETF has experienced over the last five years (10.83%), so I think the strategy continues to be well-executed. Typically, one sacrifices dividend growth for yield, but that’s not necessary compared to the largest U.S. dividend ETF on the market (VIG).

Third, all three dividend ETFs score relatively poorly on revenue and earnings growth compared to SPY. You’ll need to decide what compensation you require for that lack of growth, and one metric you can use is the forward price-earnings ratio. Below are some observations and points I’d like you to consider.

1. Compared with VIG, DGRW is easily the better buy. It has a more substantial dividend, revenue, and earnings growth rate, and it’s trading at a cheaper forward P/E (20.90 vs. 22.12).

2. DGRW’s valuation sits nicely between SPY’s and VYM’s. In my view, VYM’s discount on forward earnings (16.24 vs. 20.90) is considerable, and investors are only giving up about 1% growth on revenue and earnings. VYM is also less concentrated with a higher starting yield, so it may be considered less risky.

3. DGRW’s industry allocations don’t seem optimal. It’s overweight Tobacco and Pharmaceuticals, and underweight Diversified Banks and Electric Utilities. Diversified Banks like JPMorgan Chase (JPM) and Bank of America (BAC) look cheap, and I like their chances in a rising rate environment. Also, Electric Utilities are perhaps the easiest way to protect your portfolio should a recession occur. I recently reviewed the Utilities Select Sector SPDR ETF (XLU), and XLU outperformed an average of 8% over SPY’s ten largest drawdowns since 1999. I don’t think it’s wise to ignore these industries, which is one key reason why it’s not my favorite dividend ETF.

Author

Investment Recommendation

DGRW checks a lot of boxes. It offers a strong performance record, great dividend growth, risk reduction, and is well-diversified. I think it’s appropriate as a substitute for SPY, but not necessarily as a compliment. Despite being more attractive than VIG on almost all fronts, the valuation discount isn’t enough to get me excited.

Remember that ETFs have been performing according to their valuations this year, and I don’t think this will change soon. Vanguard projects U.S. value will return between 3.1% and 5.1% per year for the next ten years, while U.S. growth will lose about 1%. DGRW should slightly outperform SPY in this scenario but lag high dividend and pure value ETFs. Therefore, I recommend owning DGRW should dividend growth be your top priority. Otherwise, look into the many dividend ETFs trading at lower valuations today. After all, sometimes it’s better to go with the flow rather than fight the market.

[ad_2]

Source links Google News