[ad_1]

alexsl/iStock via Getty Images

I’ve covered several emerging market dividend ETFs in the recent past, including the Global X SuperDividend Emerging Markets ETF (SDEM) and the iShares Emerging Markets Dividend ETF (DVYE). These ETFs offer investors strong yields and cheap valuations but tend to focus on comparatively risky countries and companies. Potential returns are quite high, but so are risks.

Considering the above, I decided to look for an emerging markets dividend ETF with more diversification, and less risk, than SDEM and DVYE. The WisdomTree Emerging Markets High Dividend ETF (NYSEARCA:DEM) seems to fit the bill. DEM invests in a diversified set of over 1,000 emerging market equities, sports a competitive valuation, and yields 6.8% to boot. DEM’s diversified holdings, cheap valuation, and strong yield make the fund a buy. Although the fund is a relatively risky investment, it is materially safer than its peers, a significant benefit for shareholders.

DEM – Basics

- Investment Manager: Global X

- Underlying Index: WisdomTree Emerging Markets High Dividend Index

- Expense Ratio: 0.63%

- Dividend Yield: 6.82%

- Total Returns CAGR 10Y: 1.74%

DEM – Overview

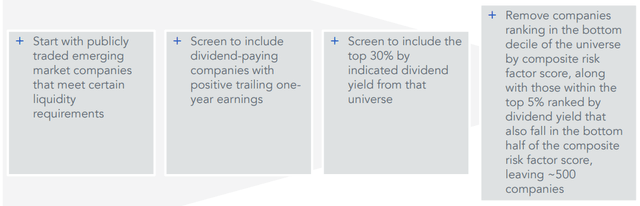

DEM is an emerging market dividend index ETF. It tracks the WisdomTree Emerging Markets High Dividend Index, an index of these same securities. It is a relatively in-depth index, including all relevant securities subject to a set of liquidity, yield, earnings, quality, momentum, and risk criteria. The index screening process is quite in-depth, seems well-designed, and is likely effective in excluding yield traps and worst-performing stocks. It is a modified market-cap-weighted index, which overweighs comparatively safe securities. There are country and industry caps to ensure diversification.

A quick graph summarizing the index selection process.

DEM Corporate Website

DEM – Diversification and Holdings Analysis

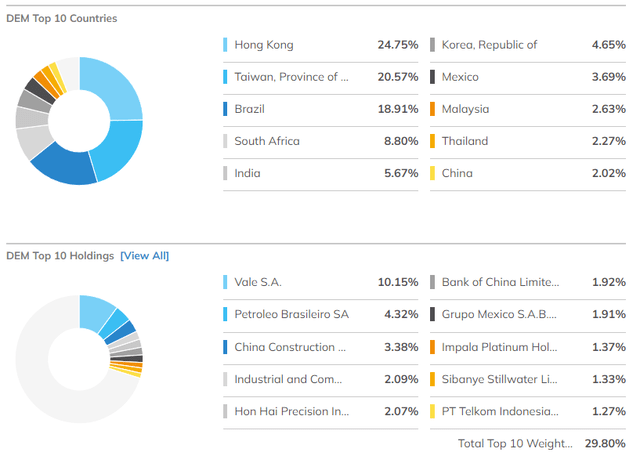

Although DEM’s underlying index is somewhat restrictive, as emerging markets, combined, are quite large, the resultant portfolio is well-diversified. DEM invests in over 1,000 stocks, with exposure to all relevant industries, and over a dozen countries. Diversification serves to reduce portfolio risk, volatility, and the possibility of significant losses, all key benefits for the fund and its shareholders. The fund’s largest holdings and country exposures are as follows.

ETF.com

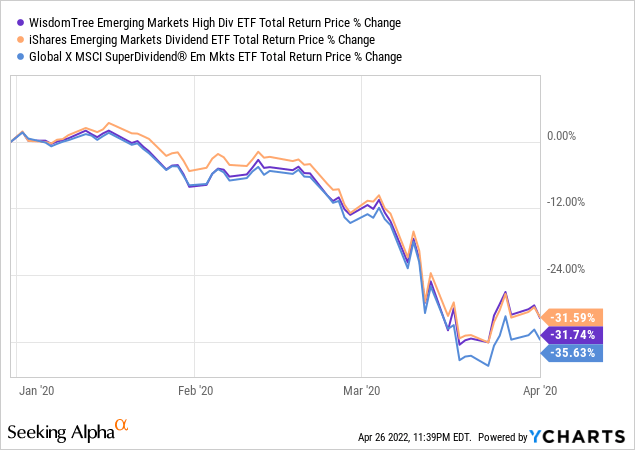

In general terms, I think it is clear that/how diversification reduces the possibility of significant losses, and DEM is a fantastic illustration of that. DEM is significantly more diversified than its peers, including SDEM and DVYE. In most cases, diversification does not materially impact a fund’s risk, volatility, or (expected) losses during downturns. As an example, these three funds performed in line with each other during 1Q2020, the onset of the coronavirus pandemic.

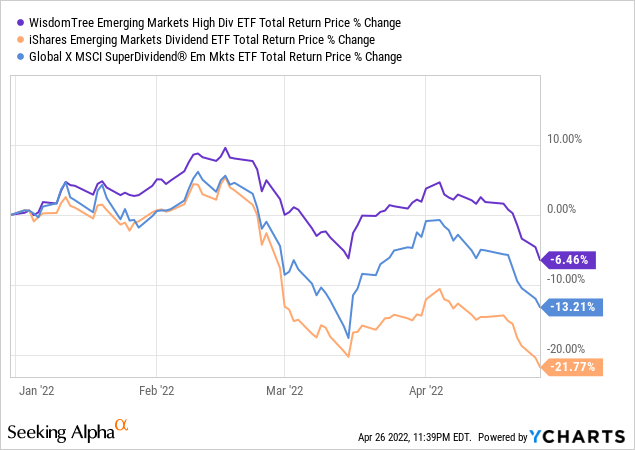

What diversification does do is reduce issuer, country, and industry concentration, which prevents significant losses when a specific issuer, country, or industry posts above-average losses. This has been the case YTD, during which Russian equities were effectively wiped out due to sanctions. DEM had a relatively broad index, with comparatively low investments in Russian equities. SDEM and DVYE had narrower indexes, focused more heavily on higher-yielding equities, which meant Russian equities. DEM outperformed SDEM and DVYE, as expected.

DEM’s greater diversification reduces the possibility of further significant losses from issues like the above, as the fund simply includes too many holdings from too many countries and industries to significantly underperform from these idiosyncratic issues. The possibility is still there, the fund is simply not that diversified, but diminished.

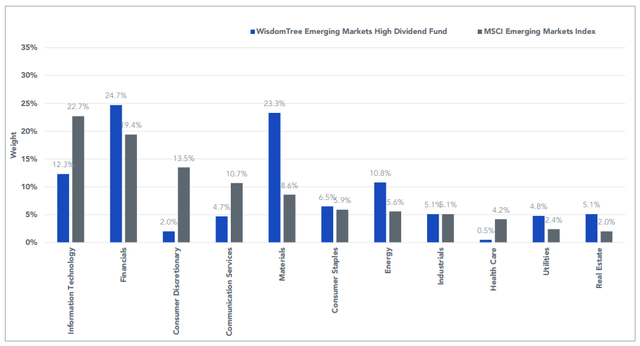

Industry-wise, the fund is moderately overweight materials and energy, two comparatively large industries in emerging markets, while being underweight tech, a relatively small regional industry.

DEM Corporate Website

DEM’s industry exposures increase the fund’s sensitivity to commodity prices and inflation. When commodity prices surge, the fund’s materials and energy holdings outperform, and so does the fund. This has been the case YTD, a period of surging commodity prices and inflation.

DEM should continue to outperform as long as inflation remains elevated, which seems exceedingly likely. Supply chain disruptions are continuing, with China locking down several cities to combat surging coronavirus cases. Russian sanctions will significantly decrease supply of several key commodities in the coming months, including oil, natural gas, and wheat. Monetary policy in the U.S. remains accommodative, but will undoubtedly tighten in the coming months. In my opinion, prices will continue to surge for at least a few months, benefitting DEM and its shareholders.

DEM – Dividend Analysis

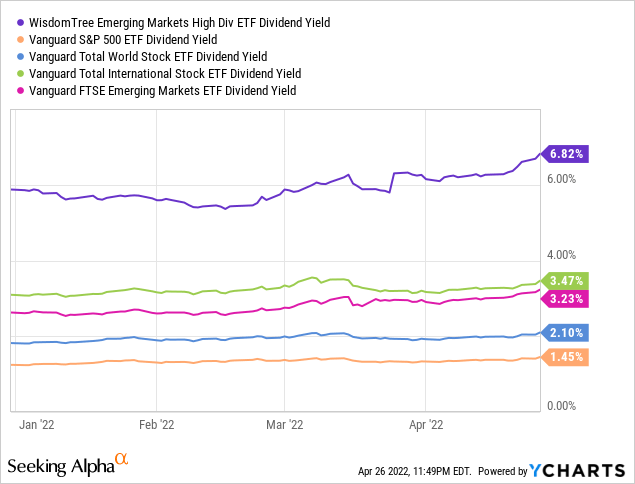

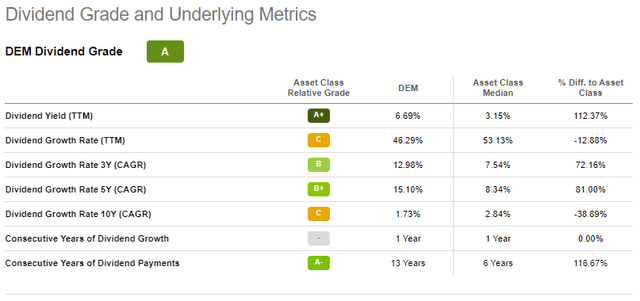

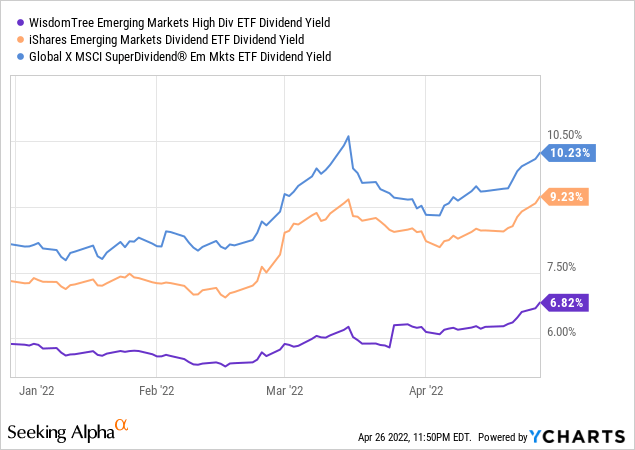

DEM focuses on securities with above-average yields, which results in a fund with a reasonably strong 6.8% yield. DEM’s yield is reasonably good on an absolute basis, and higher than that of all relevant broad-based equity indexes.

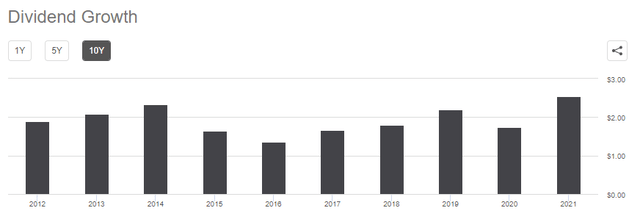

DEM’s dividend growth track-record is extremely strong too, with the fund’s dividend growing at a double-digit annual rate since inception. Growth was particularly strong during 2021, during which the fund’s dividends grew by a massive 46%, on the back of improved economic fundamentals and rising commodity prices.

Seeking Alpha

On a more negative note, DEM’s dividends are not particularly stable or safe. Dividend cuts are common and have occurred during previous downturns and commodity price slumps. Dividends also fluctuate quarter to quarter, sometimes significantly so. These are not safe, dependable dividends, but I do think economic fundamentals will support strong, growing dividends in the coming years.

Seeking Alpha

Finally, DEM does yield quite a bit less than both DVYE and SDEM, due to greater diversification into comparatively low-yielding securities. Diversification generally comes at a price, and for DEM, that price is a relatively low yield. More aggressive, yield-seeking investors could consider DVYE and SDEM over DEM but do consider the added level of risk that entails.

DEM – Valuation Analysis

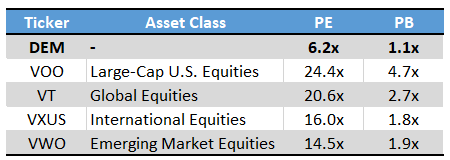

Emerging market equities currently offer investors comparatively cheap valuations, as prices have yet to (fully) recover from the coronavirus pandemic. DEM itself sports a PE ratio of 6.2x and a PB ratio of 1.1x. These are incredibly low figures and significantly lower than those of most broad-based equity indexes. DEM’s valuation is even cheaper than average for an emerging market equity fund, and by a lot, due to its focus on high-yield securities.

ETF.com – Chart by author

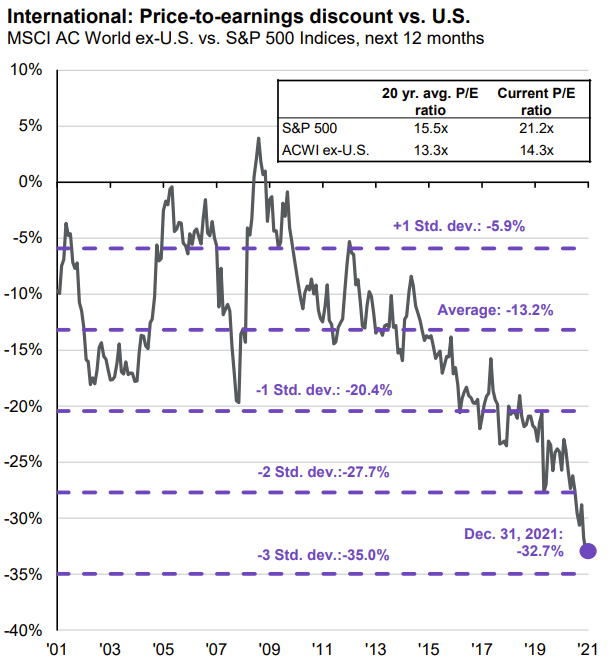

On the other hand, emerging market equities generally trade with cheaper valuations than U.S. equities, due to higher risks and perceptions of risk. Investors pay a premium for safe, dependable, high-return U.S. equities, and for good reason. Nevertheless, the valuation gap between these markets is almost certainly at historical highs: emerging market equities are simply rarely this cheap.

J.P. Morgan Guide to the Markets

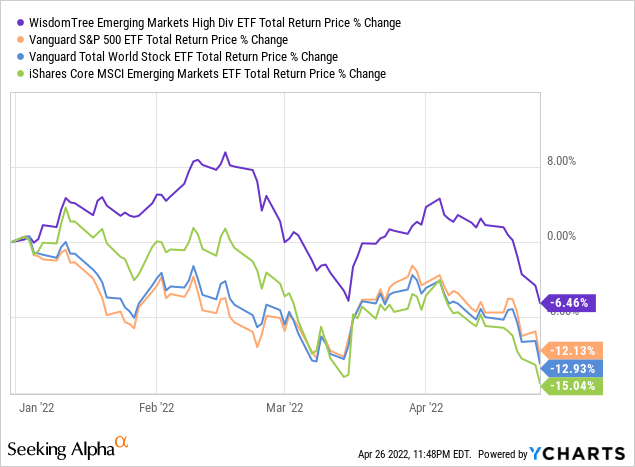

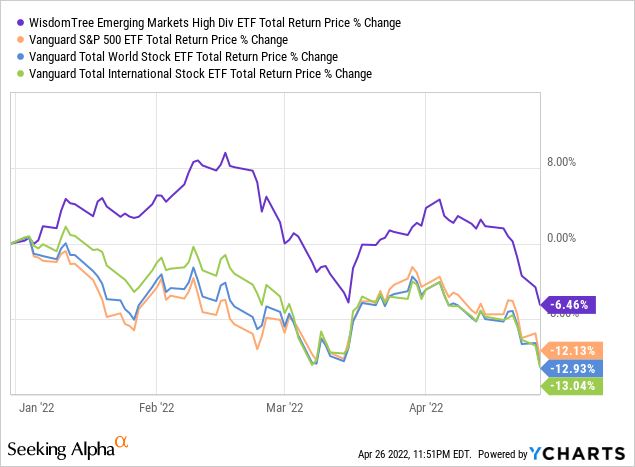

Cheap valuations could lead to strong, market-beating returns if valuations were to normalize. This has been the case YTD, with DEM significantly outperforming relative to its peers.

Further outperformance is partly dependent on market sentiment, which seems broadly favorable. Investors have rewarded cheap stocks, industries, and countries for several months now, and seem likely to continue to do so as long as these massive valuation gaps persist. Even if valuations prove stubborn, the fund’s 6.8% dividend yield is quite strong and will ensure a modicum of returns even if valuations remain stubbornly low.

Conclusion – Buy

DEM’s diversified holdings, cheap valuation, and strong yield make the fund a buy.

[ad_2]

Source links Google News