[ad_1]

Consumer Staples

2018 was a difficult year for many stocks within the consumer staples sector. Generally speaking, the larger household names still provide consistently steady returns and pay dividends, but price increases and competition have put pressure on many names in the sector. The Amazon effect cannot be understated, as it has provided consumers with seemingly unlimited choices and price points and has put downward price pressure on many products. Typically, the consumer staples names would be considered somewhat of a safe haven in periods of market volatility or downturns. Given the recent run of the S&P 500 to all time highs, a more defensive approach through consumer staples may make sense for a balanced portfolio. The Vanguard Consumer Staples ETF (VDC) provides exposure to the consumer staples sector. In this article, we will break down the characteristics of the fund, why consumer staples may be suitable within a balanced portfolio, and some reasonable investment alternatives.

Consumer Staples Performance

As shown above, over the preceding 3 years, the Vanguard Consumer Staples ETF has trailed the S&P 500 considerably. Based solely on price and return, the S&P 500 is more expensive than the basket of consumer staples stocks offered in VDC. Given the defensive nature of many of the companies held in the fund, it is worth exploring if the fund is an appropriate addition to a balanced portfolio.

VDC Fund Profile

The summary prospectus of VDC describes the objective of the ETF quite simply, as follows:

The Fund seeks to track the performance of a benchmark index that measures the investment return of consumer staples stocks.” The ETF has over 90 individual holdings and has a weighted average market capitalization of approximately $5.3 billion as of March 31, 2019. As VDC is an ETF, the minimum investment would be the cost of one share, approximately $147. The ETF is also available as a mutual fund by purchasing the Vanguard Consumer Staples Index Fund Admiral Shares (VCSAX), however the minimum investment is $100,000.

Source: VDC and VCSAX Fund Profiles

Holdings

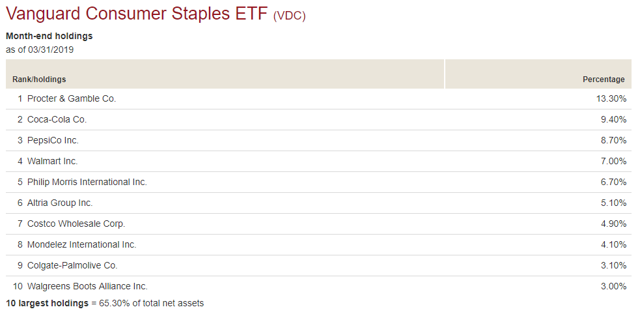

The Vanguard Consumer Staples ETF holds the large consumer staples names that many investors would expect. The top ten holdings as of March 31, 2019 are shown below:

Source: VDC Fund Profile

As shown, the 10 largest holdings of the fund represent approximately 65.3% of the total net assets of the fund. There are only 92 companies in the fund; however. the concentration is somewhat concerning. With Proctor and Gamble being held at a 13.3% allocation and Coca-Cola and PepsiCo comprising over 18% of the fund, there is company-specific risk in the ETF. The sector exposure breakdown of VDC is provided below:

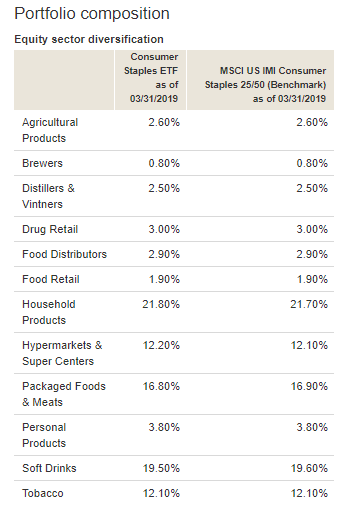

Source: VDC Fund Profile

This sector diversification breakdown is fairly consistent with the top 10 holdings in the portfolio. It is the most heavily weighted to household products, soft drinks, packaged food, tobacco and hypermarkets & super centers.

Why Consumer Staples?

Consumer staples, specifically the basket of companies held in VDC, as shown by the price performance above, have trailed the S&P 500 significantly over the past 3 years. Based on price alone, it could be argued that this sector is cheaper than the broad market as a whole. As well, the common sentiment from many experts would be that consumer staples would not be as negatively impacted from a broad market selloff. This Barron’s article discusses how investors often take comfort in defensive type stocks likes consumer staples. In addition, a regular dividend provides portfolio income as discussed further below.

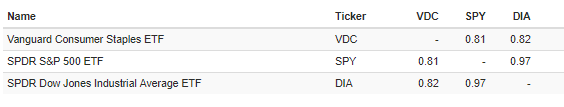

Correlation Matrix

The correlation matrix of VDC as compared to the domestic market (SPY) and (DIA) is provided below. Note that ETF correlations are for the time period 01/01/2009 – 12/31/2018 and based on monthly returns.

Source: Portfolio Visualizer Asset Correlations Tool

There is still some correlation between the S&P 500 and the Vanguard Consumer Staples ETF. Given the concentration risk in the individual names and sectors described above, it would make sense to want to be long those specific companies before considering VDC.

Who Should Invest in VDC?

Per the Vanguard fund profile, some of the key features of the fund are as follows:

-

Seeks to track the performance of a benchmark index that measures the investment return of stocks in the consumer staples sector.

-

Passively managed, using a full-replication strategy when possible and a sampling strategy if regulatory constraints dictate.

-

Includes stocks of companies that provide direct-to-consumer products that, based on consumer spending habits, are considered nondiscretionary.

Source: VDC Fund Profile

The VDC ETF is a good way to get exposure to a basket of consumer staples stocks if that fits in with your portfolio goals. The ETF also has penny wide option spreads available in both the weekly and monthly duration time periods.

Fees

Per Vanguard, the fund has an expense ratio of 0.1% and the current net assets of the fund are $5.3 billion as of March 31, 2019. This is clearly a very low fee which makes the fund attractive from an efficiency standpoint.

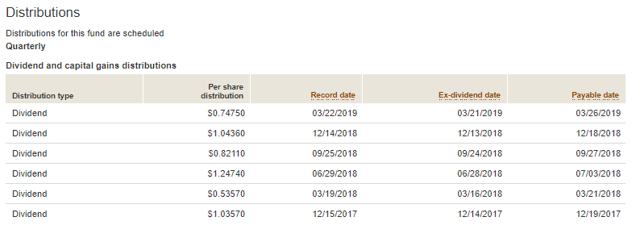

Distributions

The ETF does payout distributions and the current yield of the fund is 2.69%. This yield is slightly higher than U.S. total market or S&P 500 based funds which is to be expected. Dividends are declared and paid semi-annually, with the most recent dividends being shown below:

Source: VDC Fund Profile.

ETF Alternatives to The Vanguard Consumer Staples ETF

One main alternative to the VDC would be the Consumer Staples Select SPDR Fund (XLP). Both of the funds have a similar expense ratio as the XLP management fee is 0.13%. XLP is larger with approximately $11.2 billion assets under management and only holds 33 companies. The top three holdings in the fund are the same with Proctor and Gamble, Coca-Cola and PepsiCo making up over 35% of the fund. Therefore, the funds are quite similar with VDC having a bit more diversification than XLP.

Source: XLP Fund Profile

Overall Takeaway

Vanguard Consumer Staples ETF could be suitable for complementing a balanced portfolio if the investor wanted exposure to the consumer staples market. Additionally, a VDC investment would help diversify a portfolio that already had long U.S. exposure but in different sectors like financials or information technology. . Based on the all-time highs that are being experienced in the U.S. market, a look at a more defensive investing approach could be warranted. Overall, the Vanguard Consumer Staples ETF provides a simple way to gain exposure to a basket of consumer staples stocks with a very low expense ratio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is for information purposes only. Please do your own research and due diligence and consult a financial advisor and/or tax professional if necessary before making any investment decisions.

[ad_2]

Source link Google News