[ad_1]

Susan Vineyard

For those looking to participate in the crude oil market without managing a futures market account, the Invesco DB Oil ETF (NYSEARCA:DBO) (the “Fund”) provides an exchange-traded fund (“ETF”) that performs that service. The returns from DBO do not match a straightforward calculation of investing in NYMEX WTI Crude Oil Futures contracts (“NYMEX”), but the difference could be due to “rolling” contracts and related commissions, as discussed below.

Furthermore, DBO had a maximum drawdown of 92% since inception (2007), which is an unacceptable result. Therefore, it is not suitable as a long-term investment, but may serve as a trading vehicle for sophisticated traders.

Finally, I explain my crude oil trading strategy and present real-time results compared to DBO since June 2022.

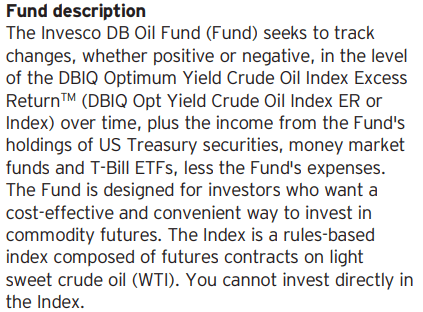

As Invesco states in its summary fact sheet:

This Fund is not suitable for all investors due to the speculative nature of an investment based upon the Fund’s trading which takes place in very volatile markets. Because an investment in futures contracts is volatile, such frequency in the movement in market prices of the underlying futures contracts could cause large losses. Please see Investment Risks, Important Information and the Prospectus for additional risk disclosures.”

Invesco

The Fund was created to provide investors with a financial product that is aimed at replicating the returns of the Index.

Invesco

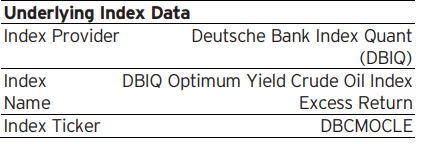

Holdings

The Fund currently has a long position in the December 2022 WTI Crude Futures contract, which is the third-nearby contract, October being the nearby.

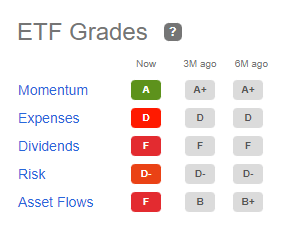

Seeking Alpha

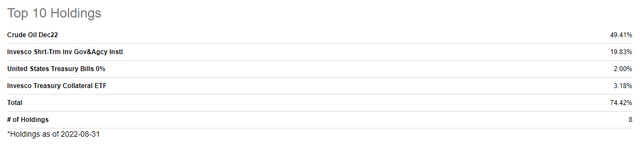

Expense Ratio and AUM

The Fund charges an Expense Ratio of 0.75% and has Assets Under Management (“AUM”) of about $371 million.

Seeking Alpha

Seeking Alpha has given the Fund a “D” grade for its Expense Ratio.

Seeking Alpha

Performance

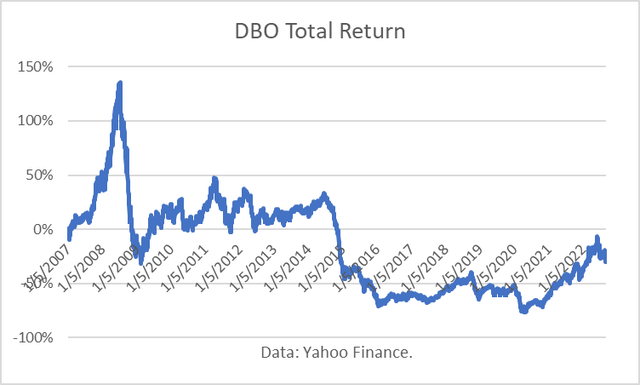

Since inception, January 2007, DBO has had a total return of -30 %, even with the surge in oil prices over the past year.

Yahoo Finance

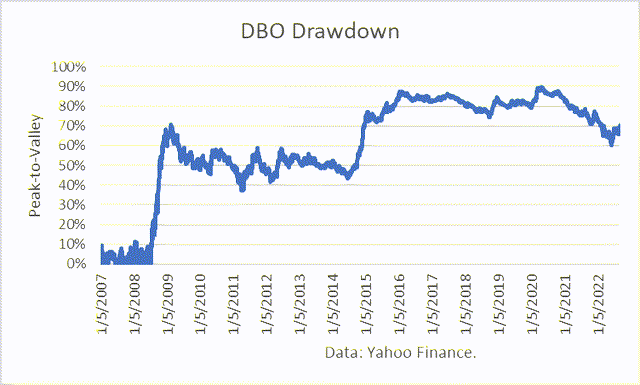

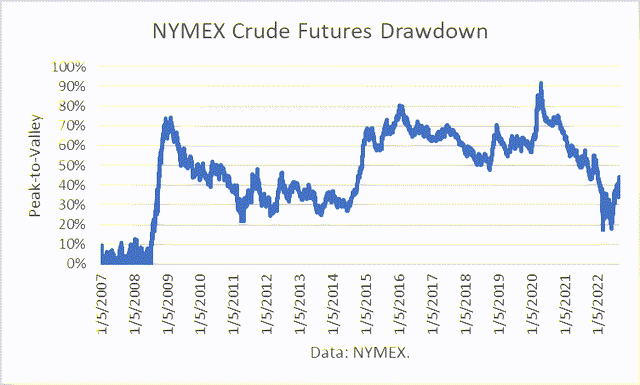

In addition to the loss since 2007, the risk of the Fund was massive. Typically, downside risk is measured as Peak-to-Valley (“P2V”) and the maximum drawdown (“MD”) over a period is the largest P2V experienced. For more about P2V calculations, read here. (I take the opposite sign of the drawdown, so that it is a positive number.)

According to my calculations, DBE’s MD was 90%. In other words, from the Fund’s highest peak since mid-2008, it lost 90% of its investment value. The Fund is still down 70% from its peak since inception.

Yahoo Finance

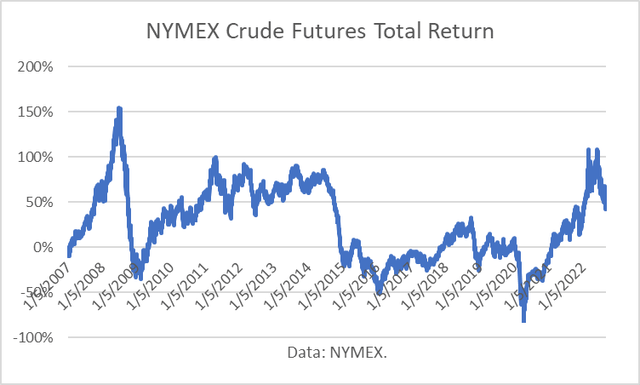

The NYMEX second nearby WTI crude futures contract excludes roll gain/loss, excludes brokerage fees, returned 44.75% over the same timeframe as the DBO results. “Rolling” refers to transactions that sell a long contract and buy the next contract.

Rolling gains or losses result depending on whether the futures market is in backwardation (i.e., distant months are cheaper than the nearby month) or contango (i.e., distant months are more expensive than the nearby month). Over the months since DBO’s inception, I calculated that the market was in contango in 64% of the months and that the average premium paid (a loss) was $0.19/bbl.

In addition, Brokerage Commissions and Fees would apply. Such fees vary and depend on trading volume in many cases.

In summary, the rolling costs and brokerage fees may explain the difference in results between DBO and a simple calculation of futures market results.

NYMEX

The MD of the futures strategy was 92% over the same period of DBO results. That was a nearly-identical outcome.

NYMEX

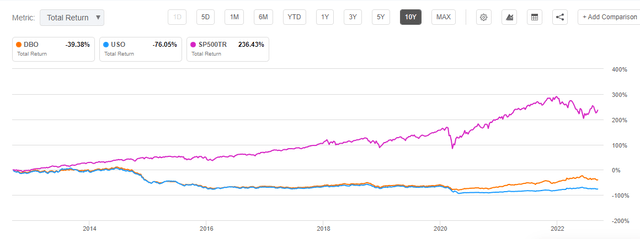

Over the past 10 years, DBO lost -39.30%, less than a large (AUM $2.1 Billion) peer fund, USO, which lost -76.08%. However, the (SP500TR) returned 236.53% over the same period.

Seeking Alpha

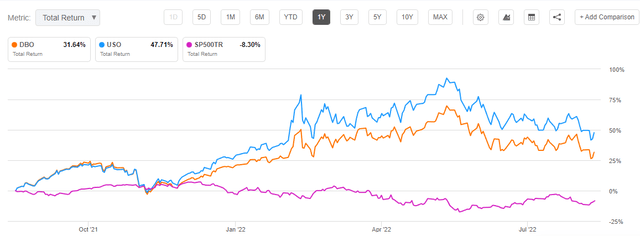

But over the past year, when crude oil prices surged, DBO posted a 31.64% return. That lagged the 47.71 % return for (USO) but beat the 8.3% loss in SP500TR.

Seeking Alpha

Comparison to BRS Crude Oil Trading Results

I commenced trading an energy futures portfolio as of June 23, 2022, consisting of NYMEX WTI crude, RBOB Gasoline, Heating Oil and Natural Gas. I post the daily positions and track record on my Seeking Alpha Marketplace service, Boslego Risk Services (“BRS”).

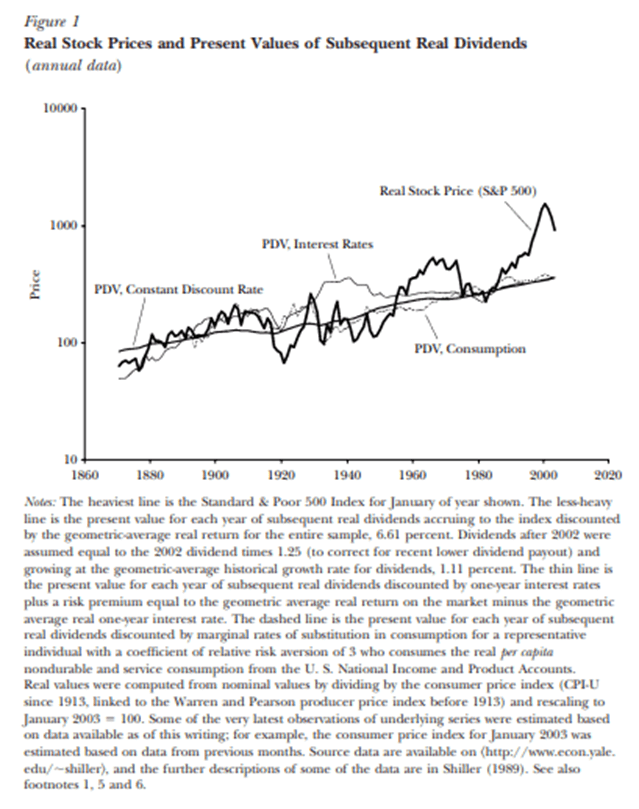

My algorithmic trading (AT) strategy is based on behavioral finance theory and, more specifically, an article written by Nobel economics laureate (2013), Robert J. Shiller. In his paper, “From Efficient Markets Theory to Behavioral Finance,” Shiller discusses the failure of the efficient markets’ theory to explain stock market prices and the “blooming of behavioral finance.” He proved that stock market prices exhibited “excessive volatility” from what would be expected, if market prices behaved according to the efficient markets’ theory.

In particular, he describes one of the oldest theories about financial markets, which he calls price-to-price feedback theory. Essentially, he argues that the emotions of greed and fear drive market prices far too high on the upside, and much too low in downturns.

Journal of Economic Perspectives

Source: Journal of Economic Perspectives -Volume 17, Number 1-Winter 2003-Pages 83-104.

In his book, Irrational Exuberance (2000), Shiller argued that:

“market feedback, transmitted by word-of-mouth as well as the media, was at work in producing the bubble we were seeing then. I further argued that the natural self-limiting behavior of bubbles, and the possibility of downward feedback after the bubble was over.”

He created a feedback model to describe price changes with a distributed lag and compared them to price changes, if they had behaved like a random walk, as held by the efficient markets’ theory.

Journal of Economic Perspectives

Source: Journal of Economic Perspectives-Volume 17, Number 1-Winter 2003-Pages 83-104.

I developed and tested hypotheses to try to quantify conditions that might make investors feel greedy or fearful. And, it turns out that the size of market gains and losses, combined with the speed of them, does a pretty good job in determining when to be long (bullish), when to be short (bearish), and when to be out (neutral). There are other unique positioning techniques built into my model, such as a position adjustment based on market price volatility for risk control.

Risk Management is Key

In The Intelligent Investor, Benjamin Graham states, “the essence of investment management is the management of risks, not the management of returns.” At the heart of this approach is loss minimization, deliberately protecting oneself against serious losses. Warren Buffett described this book as “by far the best on investing ever written.”

My approach is to separate emotions from investment decisions by running an algorithmic trading (AT) strategy that provides systematic, quantitative signals. The benefit of an AT strategy is that it can be back-tested under many different market conditions to determine the potential risks and returns of its future use. While such a strategy cannot guarantee future results, it can show how it would have performed in the past, unlike discretionary strategies, dependent on the skills of a trader. And at the least, it can eliminate strategies that would have performed poorly in the past.

Real-Time Results

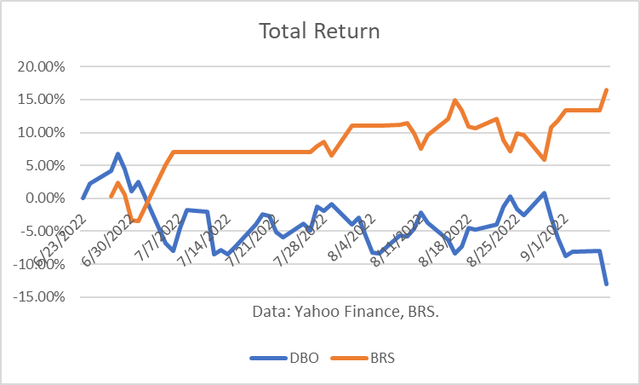

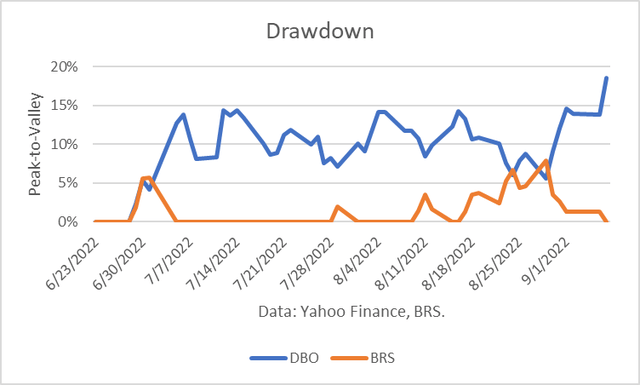

For the period June 23rd through September 7th, the total return for DBE was – 13.03 %, whereas my BRS crude strategy was 16.5%.

Tahoo Finance Data, BRS.

The MD of DBO over that same period was 19%, whereas it was 8% for the BRS strategy.

Yahoo Finance Data, BRS.

Conclusions

DBO provides futures account management while offering exposure to the NYMEX crude futures market. For many individual investors, that is an attractive feature because managing margins in a futures market account can be time-consuming and lead to mistakes.

However, DBO should not be a long-term investment for anyone. It simply exposes the investor to much larger losses than anyone should take.

That leaves short-term oil trading. Relatively few individual investors have the knowledge and skill to be successful in oil trading. That activity is best left to sophisticated traders.

[ad_2]

Source links Google News