[ad_1]

Igor Kutyaev/iStock via Getty Images

Investment Thesis

The past 18 months have been very tumultuous for Chinese equities. It all started with Beijing’s crackdown on technology companies and more specifically on Alibaba (NYSE:BABA) back in late 2020. The crackdown has been followed by new antitrust regulations and a data security overhaul targeting the country’s biggest tech players. As a result of the new regulation, companies like Alibaba struggled to achieve historical revenue growth levels, which negatively impacted the stock price of many Chinese equities. In recent months, the Chinese real estate crisis added another layer of complexity for foreign investors and highlighted how fragile the local real estate market is and how dependent the Chinese economy is on this particular market.

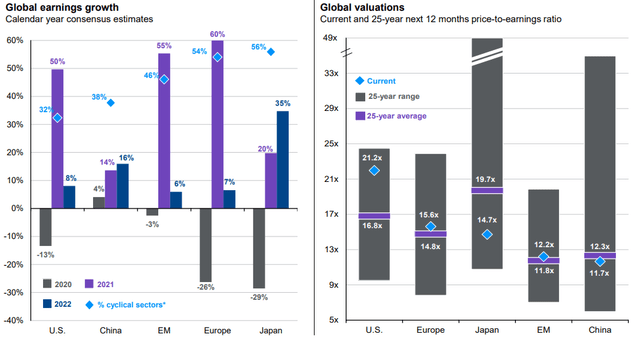

Despite all the bad news, China’s long-term economic prospects are appealing. According to JP Morgan, Chinese equities are expected to post solid earnings in 2022, with growth rates much higher than in the US or Europe. Moreover, equity valuations in China are below the 25-year average at the moment, and certainly much lower than in the US and in Europe.

JPMorgan Asset Management – Guide to the Markets 1Q 2022

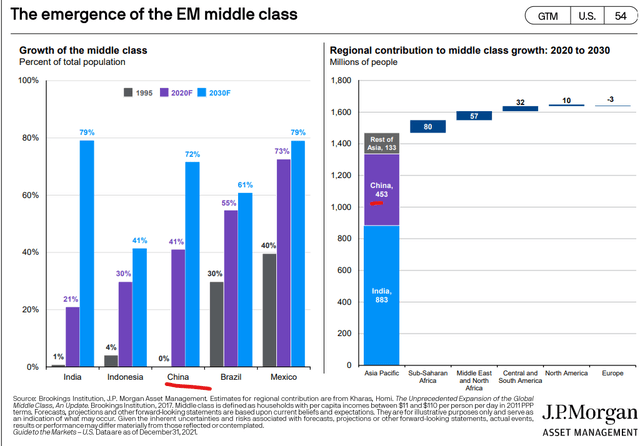

On top of that, China is expected to be one of the biggest contributors to middle-class growth during this decade. It is expected that 453 million Chinese will enter the middle class by 2030.

JPMorgan Asset Management – Guide to the Markets 1Q 2022

Even if there are some signs that the Chinese economy is slowing down in the short term, I am confident China will do well in the long term. In this article, I will review the WisdomTree China ex-State-Owned Enterprises ETF (NYSEARCA:CXSE) which provides exposure to a basket of Chinese equities, and more broadly, to the Chinese economy.

Strategy Details

The WisdomTree China ex-State-Owned Enterprises Fund seeks to track the investment results of Chinese companies that are not state-owned enterprises, which is defined as government ownership of greater than 20%. CXSE can be used to gain exposure to a diversified basket of Chinese equities or to complement Chinese market exposure while neutralizing companies potentially influenced by government decisions.

If you want to learn more about the strategy, please click here.

Portfolio Composition

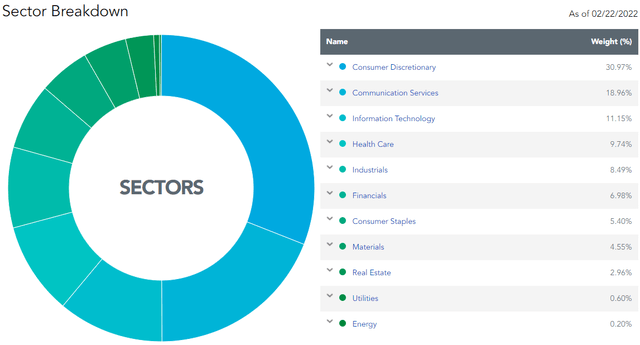

From the sector allocation chart below, we can see the index places a high weight on the consumer discretionary sector (representing around 31% of the index), followed by communication services (accounting for 19% of the index) and the information technology sector (representing around 11% of the fund). The largest three sectors have a combined allocation of approximately 61%. In terms of geographical allocation, the index invests more than 98% of the funds in mainland Chinese firms.

WisdomTree

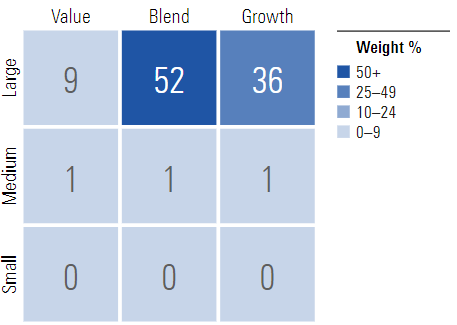

CXSE invests over 52% of the funds into large-cap blend issuers, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap growth equities which account for 36% of the portfolio. It is interesting to see that CXSE puts approximately 97% of the funds into large-cap issuers, which are generally considered less volatile than small and mid-caps.

Morningstar

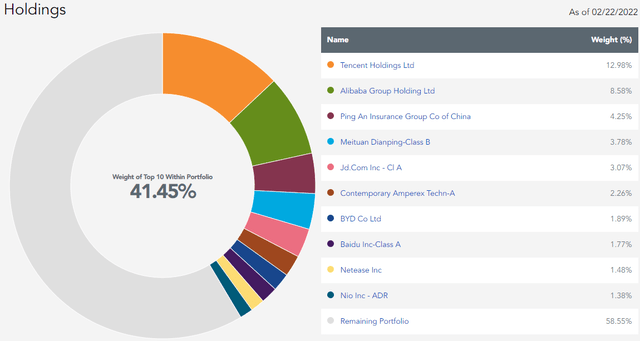

The fund is currently invested in 249 different stocks. The top ten holdings account for 41% of the portfolio, with no single stock weighting more than 13%. All in all, I would say that CXSE is well-diversified across constituents.

WisdomTree

Since we are dealing with equities, one important characteristic is the valuation of the portfolio. According to WisdomTree, the fund currently trades at an average price-to-book ratio of 2.88 and at an average forward price-to-earnings ratio of ~21. I don’t find the current valuation to be extremely cheap, especially if you account for the risk premium that comes with investing in the Chinese stock market. I personally think cheaper alternatives exist in the market at the moment. For instance, the iShares China Large-Cap ETF (NYSEARCA:FXI) trades at ~13x earnings, which makes it cheaper than CXSE.

Is This ETF Right for Me?

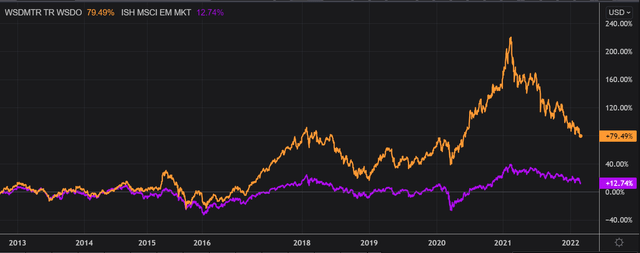

I have compared below CXSE’s price performance against the performance of the iShares MSCI Emerging Markets ETF (NYSEARCA:EEM) over the last 5 years to assess which one was a better investment. Over that period, CXSE outperformed EEM. However, it is interesting to see that both strategies delivered similar returns up until mid-2016 when the performance spread started to widen. Chinese stocks did very in 2020 and early 2021 where there was a lot of exuberance on many names. However, valuations are mean-reverting and we can see that CXSE clearly underperformed EEM since early 2021. To put CXSE’s performance into perspective, a $100 investment 5 years ago in this ETF would now be worth ~$163.35, excluding dividends. This represents a compound annual growth rate of ~10% which is a good absolute return.

Refinitiv Eikon

If we take a step back and look at the performance from a 10-year perspective, the results don’t change much. CXSE came on top once again, outperforming EEM. I personally think this ETF is suitable for a long-term investor looking to get exposure to the Chinese economy and who doesn’t mind the short-term swings. However, CXSE is competing with other ETFs which in my opinion offer a better value for money given the low valuation. Some names include FXI, but also the iShares MSCI China ETF (NYSEARCA:MCHI). Lastly, I don’t think CXSE offers a risk premium at the moment for holding Chinese stocks which is a clear turn-off for me.

Refinitiv Eikon

Key Takeaways

Investing in China comes with risks that are less common in developed markets. China is known to be a market where the CCP has a strong grip on the economy and where many firms have defrauded Western investors over the past decade by cooking their books. As a result of these country-specific risks, I believe investing in China requires a risk premium. Based on CXSE’s valuation, I don’t think this ETF provides a wide margin of safety at the moment. If you want to get exposure to the Chinese economy, I would suggest looking into MCHI and FXI which trade at a lower valuation.

[ad_2]

Source links Google News