[ad_1]

Laurence Dutton/E+ via Getty Images

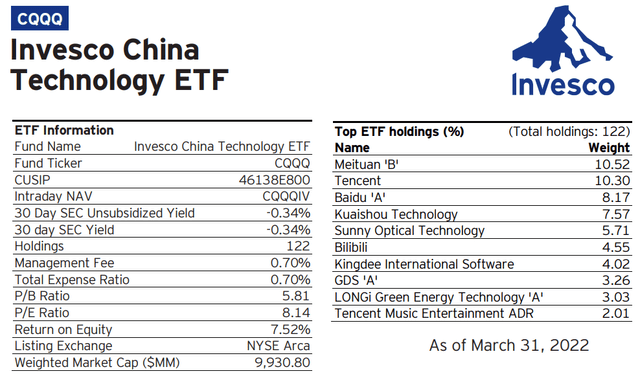

The Invesco China Technology ETF (NYSEARCA:CQQQ) invests in the leading Chinese tech stocks, covering a range of segments like search, social media, gaming, fintech, industrial automation, and even solar. Most readers will be aware that the group has been a disaster over the past year, with CQQQ down more than 55% from its peak in 2021. The combination of a shifting market cycle with high-growth names globally facing a reset of valuation along with China-specific regulatory concerns has resulted in deep risk aversion to the region.

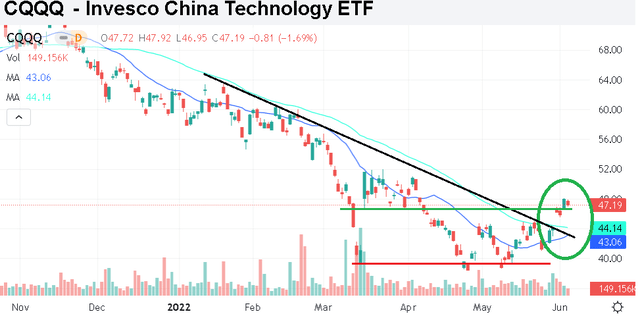

That being said, today we are highlighting what has evolved into a favorable trading pattern, suggesting Chinese stocks have bottomed and are poised to rally higher. With our article today focused on the technical outlook, we’ll get straight to the point. For CQQQ, there are three indicators that we believe signal a buy.

- CQQQ tested and held the $40.00 support level multiple times in recent months, with a series of higher lows indicating underlying strength.

- An ongoing breakout above the long-running downtrend since 2021 has placed the bulls back in control.

- The 20-day moving average is on the verge of crossing above the 50-day moving average for the first time since October last year, which can add to the momentum.

Seeking Alpha

While there’s no such thing as a crystal ball, we believe there’s a good chance the ETF and underlying group of stocks will be trading higher over the next several months. As long as CQQQ continues to trade above $44.00, the near-term momentum is positive. To the upside, ~$51.00 appears to be the next level of resistance, while further momentum can retarget $60.00 as our price target for the move.

The Bullish Case For Chinese Tech Stocks

It’ll be clear that the scenario remains highly complex. Economic data out of China has been disappointing, in part based on a surge of Covid-19 in recent months that was met by strict restrictions to contain the spread, which impacted activity levels in all sectors. All this comes in the context of the global macro environment muddled by elevated inflation, record energy prices, supply chain disruptions, and the ongoing Russia-Ukraine crisis.

source: Invesco

Still, the case here for traders is that the selloff since 2021 has already priced in some of the worst-case scenarios and near-term headwinds. A positive development has been the reports out of China that the Covid surge and country-wide lockdowns are easing, opening the door for a rebound of economic conditions. As it relates to the government’s hard-line antitrust crackdown, we’re encouraged by the latest government messaging suggesting a slowdown in its policies.

For reference, China’s “State Administration of Market Regulation” has fined major tech companies citing perceived monopolistic practices while also set restrictions on certain industries. Companies like Meituan (OTCPK:MPNGY), Tencent Holdings Limited (OTCPK:TCEHY), and Baidu Inc (BIDU) which are the top 3 holdings in the CQQQ ETF have all been targeted by regulators for issues like failing to disclose mergers, misleading marketing tactics, and anticompetitive contracts. The fear among investors regarding the uncertainty of who or what’s next explains much of the underperformance of CQQQ to global benchmarks.

One line of thinking is that the Chinese government recognizes the negative consequences the policies are having on both the economy and investing environment. It makes sense to ease up on the regulatory efforts so as to not undermine the stability of the broader financial system, which is critical to national policies. Furthermore, there is an effort by China to reach an agreement with the U.S. that would allow for audits of U.S.-listed Chinese companies, which addresses a separate area of concern with a threat by the delistings by the SEC.

The silver lining to the selloff is that the valuation for Chinese tech has been reset lower, with most stocks trading at a discount relative to global peers. We argue that with some confidence economic conditions can improve, there is good value in Chinese stocks. Better than expected data should support a repricing of local risk assets higher.

Final Thoughts

There are a couple of other Chinese tech ETFs with overlapping holdings but tracking different indexes. The KraneShares CSI China Internet ETF (KWEB), for example, is a larger fund with $6.1 billion in AUM compared to CQQQ with $1.1 billion. In this case, KWEB with its “internet” theme has a more concentrated portfolio with just 50 holdings compared to CQQQ, which has a broader profile in tech with 126 stocks. We expect both funds to rally, but view the larger diversification in CQQQ as a strength that makes it our pick between the two.

Putting it all together, the bullish case for CQQQ is that the extreme pessimism that defined much of 2021 and the start of 2022 can swing around to an improving forward outlook. The chart setup looks compelling and ties into some positive developments. The fund is a good option to gain tactical and/or strategic exposure to the important market segment of Chinese tech.

In terms of risks, the economic indicators from China are key monitoring points. Signs that the economy continues to deteriorate would open the door for a return of bearish sentiment. Headlines related to Covid in the country or regulatory changes can also add volatility.

[ad_2]

Source links Google News