[ad_1]

Trots1905/iStock via Getty Images

My thought process

There is no doubt that stocks are off to a volatile start in 2022. With the Federal Reserve set to raise interest rates throughout the year to lull inflation, many investors are transitioning out of high growth tech names and into less speculative stocks. Many of those stocks include the companies featured in The Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP). This is because consumer staples companies – more often than not – have more predictable businesses. And when uncertainty seizes the equity market, companies that can showcase consistency in the numbers are often more attractive than those that can’t. We’re talking enterprises with foreseeable revenue figures, strong bottom lines, and robust balance sheets. The companies found in XLP possess these characteristics, which is why I think the ETF is a shrewd investment given the blurriness of the stock market today.

More about XLP

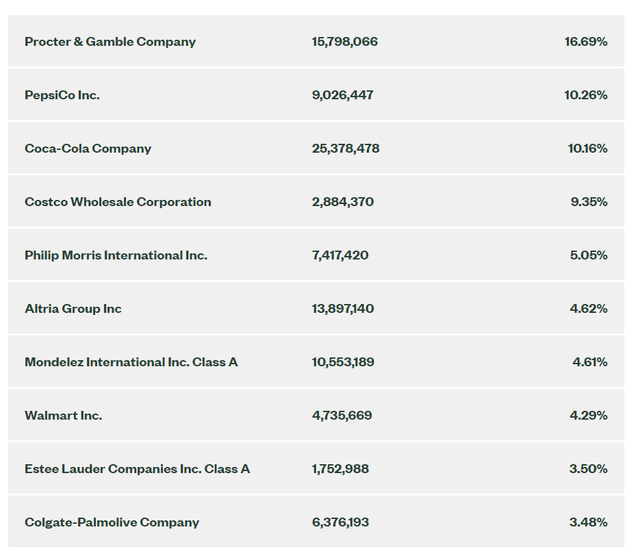

XLP, a passively managed ETF that tracks the Consumer Staples Select Sector Index, provides investors with exposure to companies from the food and staples retailing, beverage, food product, tobacco, household product, and personal product industries within the United States. The ETF, which currently trades at $76/share and carries an expense ratio of 0.10%, comprises of 32 total holdings and $15 billion assets under management. The image below illustrates the ETF’s top 10 holdings.

Fund Fact Sheet

Why now?

XLP comprises of companies with consistent financials and exceptional balance sheets. Gloomy investor sentiment surrounding technology stocks and other high growth companies in recent weeks has led to a favorable situation for the Consumer Staples Sector. These companies have sales figures and cash flows that are predictable for investors, especially compared to technology companies that are years away from profitability. The Federal Reserve is expected to raise interest rates several times throughout the year, suggesting a potential bumpy road for growth stocks. When interest rates are rising, investors expect growth companies to provide superior growth rates in order to justify the risk. Likewise, higher interest rates lessen the value of forecasted cash flows, which in turn decreases stock prices. Thus, XLP is a great defensive play for investors who are looking to mitigate risk. Besides, the Consumer Staples Sector has outperformed the S&P 500 during the past three recessions.

Drawbacks

XLP should be purely used as a defense mechanism in response to current and future economic conditions. In other words, investors should not expect superior long-term returns. When comparing the total return of XLP to the S&P 500 over the past ten years, the broader market has handily outperformed the Consumer Staples Sector. Over the ten year span, the S&P 500 returned ~301% compared to XLP’s ~135%. Thus, although I see XLP as a safe investment with “recession-proof” characteristics, investors should not invest in the ETF if they are seeking substantial long-term gains. I would only buy the ETF if I were looking for additional diversification and short to mid-term protection from rising interest rates.

Seeking Alpha

Closing comments

Goldman Sachs and Deutsche Bank now predict the Fed will raise interest rates five times in 2022. BNP Paribas forecasts six hikes, and Bank of America foresees seven. The point is that rates are going up, and investors can buy XLP to combat the increase. Rising interest rates may continue to put pressure on growth stocks, which could inversely create positive momentum for companies like those held in XLP’s portfolio. In times of uncertainty, it is a good idea to own proven businesses with stable balance sheets. The Consumer Staples Select Sector SPDR Fund provides investors with the opportunity to do just that.

[ad_2]

Source links Google News