[ad_1]

Comparing the Three Monthly Pay 2X-leveraged mREIT-based ETNs

From its inception on July 13, 2016, through to March 28, 2019, the Credit Suisse X-Links Monthly Pay 2x Leveraged Mortgage REIT ETN (REML) has had a total return of 68.16% assuming reinvestment of dividends. That is an average annual return over the 2.71-year period of 21.17%. REML is based on the FTSE NAREIT All Mortgage Capped Index. There are also another two 2X-leveraged mREIT-based ETNs that are sponsored by UBS Group AG (UBS). They are the UBS ETRACS Monthly Pay 2X Leveraged Mortgage REIT ETN (MORL) and a twin which is essentially identical in all economic respects, the UBS ETRACS Monthly Pay 2X Leveraged Mortgage REIT ETN Series B (MRRL). They are based on MVIS® Global Mortgage REITs Index, which is very similar to the index of mREITs as that used by REML. The average annual return over the same 2.71-year period was 22.62% for MORL. A more relevant comparison could be the average annual return of 19.66% over the same 2.71-year period for MRRL

On July 13, 2016 MRRL closed at $14.75. The price of MORL on that date was $14.56. On March 28, 2019 MRRL closed at $14.29. The price of MORL on that date was $15.13. The entire difference in the returns on MORL and MRRL during that period was the change in the spread between the two. The dividends paid by both were exactly the same, totalling $8.21 over that 2.71-year. On July 13, 2016 the MORL – MRRL spread was: $14.56 – $14.75 = -$0.19. On March 28, 2019 the MORL – MRRL spread was: $15.13 – $14.29 = $0.84. Thus, the spread moved by $1.03. The -$0.19 MORL – MRRL spread was about as large as the spread ever got in either direction prior to September 6, 2018.

As was discussed in Sell MORL, Buy MRRL, UBS AG (UBS) stopped creating new shares of MORL on September 6, 2018. The price of MRRL has continued to closely track net indicative (asset) value since that announcement. However, MORL began trading above MRRL (and the net asset value of both). Since MORL and MRRL have identical components and pay identical dividends, with a lower market price, MRRL now has a higher current yield than MORL. While typically called dividends, the monthly payments from ETNs are technically distributions of interest payments on the ETN based on the dividends paid by the underlying components, pursuant to the terms of the indenture.

Generally, an investor now initiating a position, considering either MORL or MRRL, should buy whichever one is cheaper at the time. That has been MRRL for at least the last six months. Likewise, a seller, that owned both should sell the higher priced one. That has been MORL for at least the last six months. A very nimble trader trying to arbitrage the spread between might attempt to buy MORL when the spread was very close to the low end a range, with the hope of reversing into MRRL at some later date when the spread was higher.

Those investors that already own MORL, have a more complex situation. Any time one sells MORL and uses the proceeds to buy MRRL, they pick up yield and value as long as the price of MORL exceeds that of MRRL. However, they give up the opportunity of selling MORL at an even higher spread at a later date. In Opportunities In The 2X Leveraged High Yield ETN Sector, published on March 25, 2019, I discussed statistical methods that could be used to identify optimal points to execute swaps between pairs such as MORL – MRRL.

There are some investors who may be “trapped” in MORL, relative to being able to sell MORL and use the proceeds to buy MRRL. Fidelity does not allow new purchases of MRRL or MORL. A comment on the above-mentioned article pointed out another reason why some will not switch out of MORL and into MRRL:

.. many large brokerage firms (like Vanguard) banning new leveraged asset purchases, while not preventing DRIP.

In other words, many investors with existing MORL investments will be compelled to stay in MORL (not switching to MRRL) and let DRIP keep going, because the dividends are attractive at these levels and they have no other choice…

Other Choices for MORL Holders

The reason to sell MORL and buy another 2X-leveraged mREIT-based ETN is that MORL is usually trading significantly above net indicative (asset) value. Eventually, that premium will cease to exist as the price of MORL converges to net indicative (asset) value. At some point, all 2x-leveraged ETNs will be only worth their respective net indicative (asset) values. This will be when they are redeemed, either prior to maturity or at maturity net indicative (asset) value. In What To Do With 20%+ Yielding ETNs – MORL And SMHD? published on March 30, 2019, I discussed various parameters for strategies for holders of MORL and SMHD.

TheMarch 25, 2019 article also discussed trading between MORL and UBS ETRACS Monthly Pay 2xLeveraged US Small Cap High Dividend ETN Series B (SMHB). Fidelity does allow new purchase of SMHB. Furthermore, there is some overlap between SMHB and MORL, since some of the mREITs in the index upon which MORL is based, also are in the index upon which SMHB is based. Fidelity also does allow new purchase of REML. There is a much higher correlation between MORL and REML than between MORL and SMHB. REML is still being created and sold by Credit Suisse (CS). Thus, as is the case with MRRL and SHMB, REML usually trades very close to net indicative (asset) value.

There are other reasons to consider REML as a replacement for MORL. In The Most Bullish Thing For A 2X Leveraged High-Yield ETN, I discussed the windfall that can benefit the holder of a 2X-leveraged ETNs when the sponsor stops creating and selling new notes. This happened to the holders of MORL and SMHD. It is unlikely, that UBS will suspend the issuance and sales of new MRRL and SMHB notes in the foreseeable future, as they were replacements for MORL and SMHD. However, there has been no replacement for REML, thus it is possible that CS could suspend the issuance and sales of new REML notes and create a replacement. That could potentially result in a windfall for existing REML holders.

In order to assess the possibility of a sponsor suspending the issuance and sales of one 2X-leveraged ETN and creating a substitute based on the same index, we must try to understand why sponsor of 2X-leveraged ETN might do that. MRRL was created along with a number of other series B ETNs. On October 8, 2015 UBS issued a press release which included:

.. New York, October 8, 2015 – UBS AG announced today that it does not intend to issue any new notes in 38 of its outstanding ETRACS ETNs, which are listed in Table I below and form part of a series of UBS AG debt securities designated as “Medium-Term Notes, Series A” (the “Series A ETRACS ETNs”). These Series A ETRACS ETNs will continue to trade on the NYSE Arca. UBS AG expects that its affiliate UBS Securities LLC may continue to sell these Series A ETRACS ETNs that UBS AG has previously issued or that UBS Securities LLC may acquire in the future. As described in the table below for each Series A ETRACS ETN, this includes outstanding Series A ETRACS ETNs previously issued by UBS AG that UBS Securities LLC may repurchase from the public from time to time as well as Series A ETRACS ETNs issued by UBS AG prior to the date of this announcement and not yet sold to the public. The maximum number of each Series A ETRACS ETN that could be outstanding at any time is set forth in the last column of Table I below.

This announcement does not affect the terms of the outstanding Series A ETRACS ETNs identified below, including the right of noteholders to require UBS AG to redeem their notes on the terms, and at the redemption price, set forth in the applicable prospectus supplement (or product supplement and pricing supplement) and the right of UBS AG to call the notes at the prices and under the circumstances set forth in the applicable prospectus supplement (or product supplement and pricing supplement).

UBS AG also announced today the launch of six new ETRACS ETNs, identified below, which form part of a series of UBS AG debt securities designated as “Medium-Term Notes, Series B“ (the “Series B ETRACS ETNs”). The six new Series B ETRACS ETNS are each linked to an index underlying one of six Series A ETRACS ETNs subject to this announcement as identified in Table II below. In connection with the previously announced transfer by UBS AG to UBS Switzerland AG of specified assets, UBS Switzerland AG became a co-obligor of all outstanding debt securities designated as Series A, including the Series A ETRACS ETNs, issued by UBS AG prior to the transfer date. Any UBS ETRACS ETNs issued after the transfer date have been or will be designated as Series B, including the six new products launched today, and do not have the benefit of the co-obligation…

That suggested that some type of change is the UBS corporate organization among its subsidiaries was the reason for this action. On October 9, 2018 UBS issued a press release which included:

New York, October 9, 2018 – UBS AG today announced that it has suspended further sales from inventory of its outstanding ETRACS Monthly Pay 2xLeveraged Small Cap High Dividend ETN (NYSE Arca Ticker: SMHD). This suspension will remain in effect until further notice from UBS AG. As previously announced on October 8, 2015, UBS AG does not intend to issue any new notes of this ETN, which is part of a series of UBS AG debt securities designated as “Medium-Term Notes, Series A.” As a result, following this announcement, UBS does not intend to make further sales of previously issued but unsold notes of this ETN or notes of this ETN that UBS Securities LLC may acquire in the future. This ETN will continue to trade on the NYSE Arca, subject to further notice…

Many suggested that UBS had reached a limit on the amount of SMHD notes that could be issued. However, that was not in the press release. It is possible that after UBS saw the profit potential for themselves and possibly others that could be made involving arbitrage between 2X-leveraged ETNs whose sales had been suspended and replacement ETNs based on the same index, they decided to suspend sales of SMHD. In my March 25, 2019 article I said:

…Some large market participants may be able to profit easily from the spreads that are presenting arbitrage opportunities involving 2x leveraged high-yield ETNs. Brokerage firms that have hypothecated shares in their customers’ accounts can usually short those shares and receive the proceeds of the short sale. It would be very profitable to short the higher priced 2x leveraged high-yield ETN and buy the lower priced one of the pair and just collect the difference in yield. Using the actual prices when Sell SMHD Yielding 21.5%, Buy SMHB Yielding 23.6%. was written, a firm that could short SMHD and simultaneously buy SMHB could collect 2.1% on the notational amount of the transaction indefinitely and also get a capital gain at maturity or when the prices eventually converged so that SMHB was equal to SMHD x 1.53. This would not require any outlay of cash if hypothecated shares were shorted.

The phenomena of the old 2x leveraged high-yield ETN trading significantly above its net indicative (asset) value, after new sales are suspended, while the new one trades very close to its net indicative (asset) value, means that the holders of the old 2x leveraged high-yield ETN can possibly receive a windfall when new sales of it are suspended. Thus, a consideration when choosing how much of any 2x leveraged high-yield ETN to own is the probability that sales might be suspended by the issuer at some point in the future.

One reason that sales might be suspended by the issuer, could be to allow its brokerage arm to generate essentially risk free income that would not require any outlay of cash, if hypothecated shares were shorted. I think it is likely that some customers of UBS might have hypothecated shares of 2x leveraged high-yield ETNs in their accounts. Paine Webber, a large retail brokerage firm, was acquired by UBS in 2000. See The Most Bullish Thing For A 2X Leveraged High-Yield ETN. For a discussion of why CEFL might be a candidate to have new sales suspended and a new version issued…

One reason to consider REML as a replacement for MORL, rather than MRRL or SMHB is the possibility that CS might suspend sales of REML and create a replacement. This could result in a windfall for existing REML holders at that time.

Trading REML, MORL, and MRRL

MORL started in 2012, MRRL in 2015, and REML in 2016. There are some investors such as myself that have positions in MORL and may be wondering whether and/or when, to switch to MRRL or REML. They and others may be trying to decide as to which of 2X leveraged mREIT ETNs to add to, or establish new positions in. Likewise, some may be trying to decide which to sell.

For some, liquidity is a major issue. REML is followed much less than MORL or MORL. The volume and liquidity of REML is in the category of what some would derisively refer to as a “trades by appointment” security. There are some who see advantages in low volume securities. At times, I have been able to execute very favorable trades utilizing limit orders with prices far away from the market in low-volume securities. During periods of extreme market volatility, it is possible to buy and/or sell low volume securities if you have limit orders in place at prices drastically better than previous levels. Recently, there has been some improvement in the liquidity of REML, as measured by the spread between the bid and ask. That said, REML is probably not for those who plan on trading in and out frequently. Limit orders should be used for now when trading REML. Market orders are usually not advised.

At the other extreme, those who plan to hold a 2X Leveraged ETN until maturity do not care about liquidity. They might be interested to know that REML matures on July 11, 2036. MORL and MRRL mature on October 16, 2042. Waiting 19 years until REML redeems the shares at net asset value may be more attractive for those very long-term investors than waiting 25 years for the maturity of MORL. It should be noted that it is unlikely that 2X Leveraged Mortgage REIT ETNs will pay their $25 face value at maturity. They will pay whatever the net indicative (asset) value is at the maturity date. That is likely to be lower than $25. The fees and expenses for most 2x Leveraged High-Yield ETNs including REML, are deducted from principal rather than income. This imparts a downward bias in price. The methodology used by most 2x Leveraged High-Yield ETNs that I follow, and why in terms of the total return, it generally does not matter whether the fees and expenses reduce dividend or the principal, was discussed in: Is An ETN Yielding 20%, Expected To Decline In Price By 4% A Year, Better Than One Yielding 15% Not Expected To Decline?

Another reason MORL holders might consider REML as a good substitute, for at least some of their holdings is to diversify the credit exposure. As was discussed in Bank Issues Could Impact 20% Yielding ETNs, recently, a French court ordered UBS, Switzerland’s largest bank to pay 4.5 billion Euros ($5.1 billion) in fines and damages for helping wealthy French clients evade tax authorities. UBS is the sponsor of MORL and MRRL. REML is sponsored by CS another very larger Swiss bank. It is possible CS that might face similar issues.

I do not regard the credit risk relating to ETNs to be very significant. However, diversification among ETN sponsors could reduce whatever small risk exists in that regard. In UBS Leveraged ETNs: Separating Fact From Fiction, I said regarding the credit risk posed to the dependence on UBS to make payments to ETNs:

…that does expose the investor to some degree of credit risk. However, it is very different and of much less magnitude than the type of credit risk one would face by buying a regular senior bond issued by UBS.

If you were to buy a bond from UBS and something drastic happens causing UBS to be downgraded, to say BBB, you would suffer an immediate loss since the credit risk of the downgraded bond would be reflected in the market price. However, the net asset value of UBS redeemable ETNs such as MORL and CEFL would not be affected, and because shares of the ETN can be redeemed at net asset value, the market price of the ETN would not be impacted either.

If giant meteors were to simultaneously destroy Zurich, London and New York overnight there might be an advantage to holding a UBS fund which was bankruptcy remote as compared to a note. However, under reasonably foreseeable circumstances the redemption feature eliminates the credit risk.

Even if the ability to redeem shares did not exist, the UBS credit risk with MORL and CEFL would be rather small. USB has a relatively high percentage of their revenue from fees for managing assets, which is a much more stable revenue base than making loans, underwriting or trading securities. UBS is the biggest bank in Switzerland, operating in more than 50 countries with about 63,500 employees globally, as of 2012. It is considered the world’s largest manager of private wealth assets; with over CHF2.2 trillion in invested assets. According to the Scorpio Partnership Global Private Banking Benchmark 2013, UBS had assets under management of US$1,705.0 billion, representing a 9.7% increase versus 2012…”

The gist of that is still essentially true regarding the credit risk posed to UBS ETN holders. The rating agencies still rate UBS highly. I have not seen any rating changes since the announcement of the French fines and penalties. The most recent rating action was on June 18, 2018, under the headline: “Moody’s upgrades UBS AG’s long-term senior debt ratings to Aa#, outlook stable.” That is a very high rating. Additionally, UBS is appealing the action of the French court. It will take years for this to work its way through the legal system.

I am going to keep an eye on both UBS and CS with regard to any possible credit concerns. However, I still do not see either UBS or CS going from investment grade to default in the less than the 5 days that a redemption at net indicative (asset) value can be effectuated.

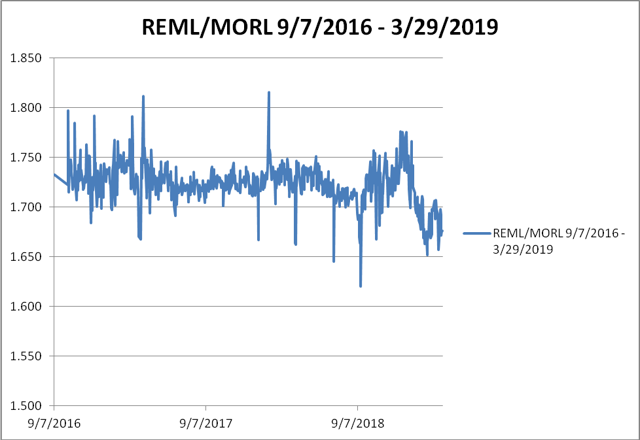

That said, in order to trade out of MORL and into REML efficiently, observation of some metrics is advisable. The Chart I below shows the ratio of REML over MORL since September 7, 2016 through to March 29, 2019. For that entire period the mean spread was 1.723. The highest spread was 1.816, on February 5, 2018. The lowest spread was 1.621 on September 14, 2018, the business day prior to the publication of Sell MORL, Buy MRRL on Seeking Alpha. The standard deviation was 0.022. It should be noted that REML and MORL do not always have the same ex-dates. That would tend to increase volatility and thus possibly cause the observed standard deviation to overstate the “true” standard deviation. More importantly, anyone considering a transaction involving out of MORL and into REML should be sure that either they both are trading ex-dividend or cum-dividend, but that it is not a date where one is ex-dividend and the other is not. Such problems do not happen every month, but there are some months when both ex-dates do not occur on the same day. That would distort the spread.

Chart I

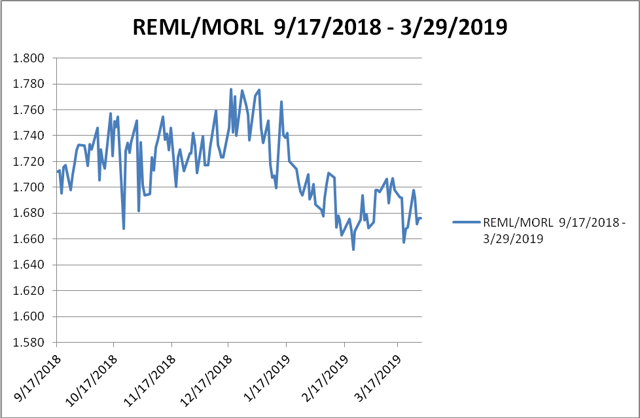

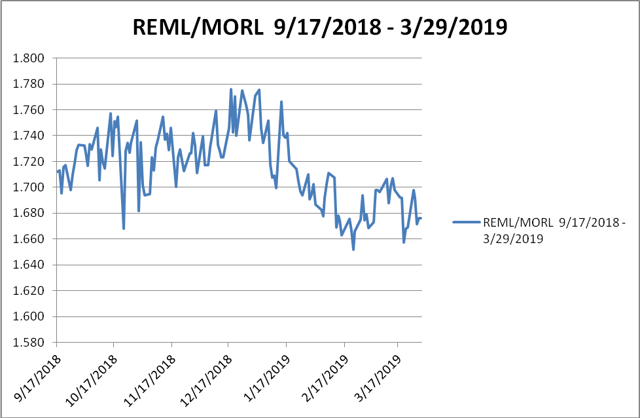

Since, the relationship between MORL, MRRL and REML changed after Friday September 14, 2018, it may be useful to look at the period after that. The Chart II below shows the ratio of REML over MORL since September 17, 2018 through to March 29, 2019. For that period the mean spread was 1.715. The highest spread was 1.776, on December 18, 2018. The lowest spread was 1.652 on September 21, 2018. The standard deviation was 0.029.

Using a guideline of two standard deviations, the ratio of REML over MORL data since September 17, 2018 through to March 29, 2019 would suggest that a good point to sell MORL and use the proceeds to buy REML would be when the spread is equal to or less than: 1.715 – (2x 0.029) = 1.657. If we used the data for September 7, 2016 through to March 29, 2019, the two standard deviation threshold would be 1.723 – (2x 0.022) = 1.679.

Analysis of the April 2019 REML Dividend Projection

My projected April 2019 REML monthly dividend of $0.99 is a function of the calendar. Most of the REML components pay dividends quarterly, typically with ex-dates in the last month of the quarter and payment dates in the first month of the next quarter. The January, April, October, and July “big month” REML dividends are much larger than the “small month” dividends paid in the other months, since very few of the quarterly payers have ex-dividend dates that contribute to the dividends in the “small months.” Thus, the $0.99 REML dividend paid in April 2019 will be a “small month” dividend.

As can be seen in the table below, only four of the REML components – AGNC Investment Corp. (NASDAQ:AGNC), ARMOUR Residential (NYSE:ARR) Dynex Capital Inc. (DX), and Orchid Island (NYSE:ORC) – now pay dividends monthly. Arbor Realty Trust Inc. (ABR) pays quarterly, but on a cycle that has an ex-date in February 2019. New Residential Investment Corp (NRZ) has an ex-date of 4/3/2019. Pennymac Mortgage Investment (PMT) has an ex-date of 4/12/2019. Hannon Armstrong Sustainable Infrastructure Capital Inc (HASI) has an ex-date of 4/2/2019 Thus, those four quarterly payers will not contribute to the April 2019 dividend. This typically makes the April REML monthly dividend smaller than the other big month dividends

My projection for the April 2019 REML monthly dividend of $0.99 is calculated using the contribution by component method. The table below shows the ticker, name, weight, dividend and ex-date for all of the components. Additionally, it includes the price and contribution to the dividend for the REML components that will contribute to the April 2019 REML monthly dividend.

The iShares Mortgage Real Estate Capped ETF (REM) is a fund based on the same index as REML, rather than a note and does not employ the 2X leverage that REML does. REM also pays dividends quarterly rather than monthly. As a fund, the dividend is discretionary by the fund management as long as it distributes the required percentage of taxable income to maintain its investment company status. Thus, it does not lend itself to contribution by component dividend projections as an ETN like REML, which must pay dividends pursuant to an indenture.

Conclusions and Recommendations

This article is primarily for those who own MORL now or who share or are interested, at least in part, on my views regarding the attractiveness of the 2X-leveraged mREIT-based ETNs. Those views were elaborated on in prior articles. My view regarding the Federal Reserve has been a significant aspect of my decision to buy mREITs and then 2X leveraged mREIT ETNs when MORL appeared in 2013. In 2013, the recovery from the financial crisis that began in 2007 was well underway. Many were forecasting that much higher interest rates were imminent. My contrarian view was based in part on my opinion that the Federal Reserve was not artificially depressing short-term, risk-free interest rates, but rather was preventing them from declining even more. In 2013, I said in my article “Federal Reserve Actually Propping Up Interest Rates: What This Means For mREITs“:

… Most investors now believe three things about the Federal Reserve, money and interest rates. They think that the Federal Reserve is artificially depressing rates below what would be a “normal” level. They believe that in the process of doing so the Federal Reserve has enormously increased the supply of money and they believe that the USA is on a fiat money system. All three of those beliefs are incorrect…

I updated that article on August 23, 2018, with “Federal Reserve Actually Propping Up Interest Rates: What This Means For mREITs: An Update,” which presented new evidence supporting my original conclusions that the Federal Reserve has been and still is keeping interest rates higher than what a free market in risk-free, short-term, fixed-income securities would be. Recently, some seem to be adopting in part my view on the Federal Reserve regarding short-term interest rates. Chairman Powell has indicated that the Federal Reserve is no longer anticipating any increases in short-term interest rates. Newly nominated Federal Reserve Governor Stephen Moore has called for the Federal Reserve to cut interest rates by half a percentage point.

Interest rates are the key determinant of both the dividends paid and the share prices of mREITs, and thus are the major source of risk. For MORL, MRRL, and REML, interest rates are even more important because of the 2X leverage. The spread between the longer-term interest rates paid by the mortgage-backed securities held by the mREITs and the shorter-term rates they pay on the borrowing they do to finance their mortgage-backed securities generates the income that’s used to pay their dividends. MORL, MRRL and REML add another level of leverage and effectively borrow at an interest rate based on three-month LIBOR in order to increase their monthly distributions.

I am still willing to collect the very high yields that REML, MRRL, and MORL pay, while waiting to see if my views of the future course of interest rates and economic conditions prevail. Those views include that despite all of the risks posed by the exploding Federal Budget deficit, the massive shift in the tax burden away from the rich and onto the middle class will eventually bring interest rates down. This argument is based on the fact that the wealthy clearly have a lower marginal propensity to consume than do the non-rich. My rationale was explained in the Seeking Alpha article, A Depression With Benefits: The Macro Case For mREITs.

There are a number of risks to the financial markets that were not much on anyone’s radar a few years ago. These include protectionism. All trade restrictions result in “dead-weight loss,” which occurs when the benefits to the favored entities are always less than the costs to the many losers who pay higher prices. On balance, this makes the entire population poorer. Protectionism would result in higher input costs and shift the aggregate supply curve to the left. The resulting higher inflation would inevitably increase interest rates and depress economic activity. See: Trump’s Trade Policies: America’s Brexit?, a discussion of the risks of protectionism

A new set of risks that I had not previously considered particularly relevant has arisen since the 2018 election. There are some newly elected Democrats and others that appear to be favoring far left policies that have previously been tried and subsequently been rejected and reversed to a major extent, in countries such as France, Sweden and the Netherlands. It is unlikely that these could ever be enacted in the United States. However, many things have taken place in the last few years that may have previously been considered unlikely. These far left policies such as increasing the minimum wage to a level where a large portion of the workforce is covered by it, as is the case in France, are distinct from adopting modern social welfare policies that are in place in every developed country except for America, such as controlling health care prices. See: Single Payer, Medicare-For-All And The Investment Implications.

Addressing the acceleration in inequality caused by the tax code is not just a concern of those on the left. There is a growing view that the 2017 tax bill went too far in what Warren Buffett, CEO of Berkshire Hathaway (BRK.A) (BRK.B), was describing when he said that “through the tax code, there has been class warfare waged, and my class has won. It’s been a rout.” Whatever one thinks of the advisability of enacting legislation that reverses the massive shift in the tax burden onto the middle class and away from the rich, it could have negative implications for the financial markets. Since shifting the tax burden from the rich and onto the middle class results in there being more funds being available for investment, reversing that results in less funds being available for investment.

My focus in this article is not to examine the merits or feasibility of these proposals, or if the amounts that advocates claim would be raised from such taxes on the rich are accurate. I do think there is a reasonable likelihood that the 2020 Democratic nominee for president will be someone who favors, to a greater or less extent, something along the lines of the “tax the rich” plans being recently proposed by Sanders, Warren, and Ocasio-Cortez, among others.

The probability of the 2020 election resulting in a change in the tax code that significantly reverses the massive shift in the in the tax burden away from the rich and onto the middle class is still very probably low as long as the Democrats continue to combine such tax proposals with plans to spend the proceeds on various social programs like free college tuition. However, a plan to raise taxes on those with assets above $50 million and/or incomes above $10 million and use all of the proceeds to reduce the taxes on everyone else might have a much higher probability of being enacted.

It is hard to envision the Democrats being politically savvy or ideologically flexible enough to embrace a policy of directly shifting the tax burden away from the middle class and onto the rich. Rather than using the proceeds of taxes on the rich for spending programs. The Democrats have generally been deluded in their belief that the current level of taxes on the middle class is politically sustainable. In Hilary Clinton’s speech announcing her candidacy, she said that the middle class pays too much taxes. She never mentioned a middle class tax cut again. Presumably due to pressure from Sanders, who pushed her to the left, which severely hurt her chances in the general election.

Most Democrat politicians are not aware that, by far, the best thing government could do for most middle-class households would be to lower their taxes. Thus, in many cases, middle-class voters have been willing to grasp at any chance they think could lower their tax burden, and thus support candidates who promise them a tax cut, no matter how odious the candidates might be otherwise.

Regarding REML, one item that should be addressed relates to the possibility of early redemption, or the lack thereof. Some comments in Seeking Alpha articles have asserted that while MORL and MRRL can be called, REML cannot. I do not consider that among the valid reason to switch from MORL to REML. Fidelity does not allow new purchases of any of the UBS 2X leveraged ETNs such as MORL and MRRL, but does allow new purchases REML (for now). Conversations with people at Fidelity seem to have led some to believe that REML cannot be called. This is not correct, as can be seen from the REML prospectus:

…Our Call Right: On any Business Day through and including the Maturity Date, we may, at our option, call all, but not less than all, of the issued and outstanding ETNs. To exercise our Call Right, we must provide notice to the holders of the ETNs (the “Call Notice”) not less than sixteen (16) calendar days prior to the Call Settlement Date specified in the Call Notice. Upon our call in the event we exercise this right, you will receive a cash payment equal to the Call Settlement Amount, which will be paid on the third Business Day following the Call Valuation Date (the “Call Settlement Date”)…

REML Components and Contributions to the Dividend

|

Ticker |

Name |

Weight |

Price |

ex-div |

dividend |

frequency |

contribution |

|

NLY |

Annaly Capital Management Inc |

18.21% |

10.25 |

3/28/2019 |

0.30 |

q |

0.147528 |

|

AGNC |

AGNC Investment Corp |

11.86% |

18 |

3/28/2019 |

0.18 |

m |

0.032828 |

|

NRZ |

New Residential Investment Corp |

8.54% |

16.59 |

4/3/2019 |

0.50 |

q |

|

|

STWD |

Starwood Property Trust Inc |

7.68% |

22.6 |

3/28/2019 |

0.48 |

q |

0.04515 |

|

MFA |

MFA Financial Inc |

4.51% |

7.22 |

3/28/2019 |

0.20 |

q |

0.034581 |

|

CIM |

Chimera Investment Corp |

4.38% |

19.02 |

3/28/2019 |

0.50 |

q |

0.031871 |

|

BXMT |

Blackstone Mortgage Trust Inc |

4.32% |

34.6 |

3/28/2019 |

0.62 |

q |

0.021427 |

|

TWO |

Two Harbors Investment Corp |

4.30% |

13.8 |

3/28/2019 |

0.47 |

q |

0.040537 |

|

ARI |

Apollo Commercial Real Estate Finance Inc |

4.19% |

18.36 |

3/28/2019 |

0.46 |

q |

0.029058 |

|

IVR |

Invesco Mortgage Capital Inc |

3.36% |

16.09 |

3/28/2019 |

0.45 |

q |

0.026011 |

|

LADR |

Ladder Capital Corp |

2.88% |

16.73 |

3/8/2019 |

0.34 |

q |

0.016201 |

|

HASI |

Hannon Armstrong Sustainable Infrastructure Capital Inc |

2.45% |

25.11 |

4/2/2019 |

0.34 |

q |

|

|

RWT |

Redwood Trust Inc |

2.43% |

15.8 |

03/14/2019 |

0.30 |

q |

0.012771 |

|

PMT |

PennyMac Mortgage Investment Trust |

2.32% |

20.42 |

4/12/2019 |

0.47 |

q |

|

|

NYMT |

New York Mortgage Trust Inc |

1.74% |

6.09 |

3/28/2019 |

0.20 |

q |

0.015817 |

|

ABR |

Arbor Realty Trust Inc |

1.56% |

12.83 |

2/28/2019 |

0.27 |

q |

|

|

ARR |

ARMOUR Residential REIT Inc |

1.55% |

19.38 |

3/14/2019 |

0.19 |

q |

0.004206 |

|

GPMT |

Granite Point Mortgage Trust Inc |

1.48% |

18.59 |

3/29/2019 |

0.42 |

q |

0.009255 |

|

CMO |

Capstead Mortgage Corp |

1.40% |

8.28 |

3/28/2019 |

0.08 |

q |

0.003744 |

|

TRTX |

TPG RE Finance Trust Inc |

1.33% |

19.75 |

3/28/2019 |

0.43 |

q |

0.008015 |

|

STAR |

iStar Inc |

1.02% |

7.84 |

3/1/2019 |

0.09 |

q |

0.003241 |

|

MITT |

AG Mortgage Investment Trust Inc |

0.92% |

17.35 |

3/28/2019 |

0.50 |

q |

0.007339 |

|

WMC |

Western Asset Mortgage Capital Corp |

0.91% |

10.46 |

3/29/2019 |

0.31 |

q |

0.007465 |

|

KREF |

KKR Real Estate Finance Trust Inc |

0.82% |

20.37 |

3/28/2019 |

0.43 |

q |

0.004791 |

|

ACRE |

Ares Commercial Real Estate Corp |

0.76% |

15.14% |

3/28/2019 |

0.33 |

q |

0.45853 |

|

ANH |

Anworth Mortgage Asset Corp |

0.75% |

4.1 |

3/28/2019 |

0.13 |

q |

0.006582 |

|

JCAP |

Jernigan Capital Inc |

0.72% |

21.15 |

3/29/2019 |

0.35 |

q |

0.003298 |

|

ORC |

Orchid Island Capital Inc |

0.66% |

6.77 |

3/28/2019 |

0.08 |

m |

0.002159 |

|

DX |

Dynex Capital Inc |

0.65% |

5.92 |

3/21/2019 |

0.06 |

m |

0.001824 |

|

XAN |

Exantas Capital Corp |

0.61% |

10.50 |

3/28/2019 |

0.20 |

q |

0.003216 |

|

CHMI |

Cherry Hill Mortgage Investment Corp |

0.55% |

17.23 |

3/15/2019 |

0.49 |

q |

0.00433 |

|

RC |

Ready Capital Corp |

0.52% |

14.94 |

3/27/2019 |

0.40 |

q |

0.003854 |

|

AJX |

Great Ajax Corp |

0.41% |

13.35 |

3/14/2019 |

0.32 |

q |

0.00272 |

|

EARN |

Ellington Residential Mortgage REIT |

0.22% |

11.96 |

3/28/2019 |

0.34 |

q |

0.001731 |

Disclosure: I am/we are long MORL, MRRL, SMHB, REML, AGNC, ARR, ORC, TWO, CEFL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News