[ad_1]

JuSun/iStock via Getty Images

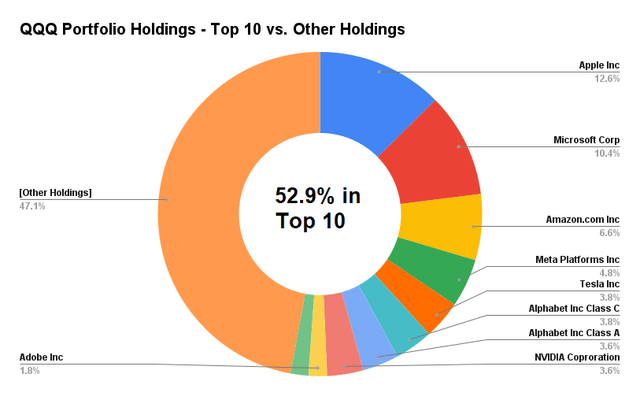

Recent volatility in the tech space has made me think about taking advantage of the change in sentiment to increase my exposure to the tech sector. While plain-vanilla funds such as QQQ can give investors ample exposure to tech, there are a number of other funds which can provide investors exposure to technology through an alternative mix of fund holdings. One such fund is the First Trust NASDAQ-100-Technology Sector Index Fund (QTEC). QTEC stands out from its competition by offering a distinct mix of technology-focused equity exposure which makes it arguably more appropriate for portfolio diversification purposes than a plain-vanilla NASDAQ tracker such as QQQ.

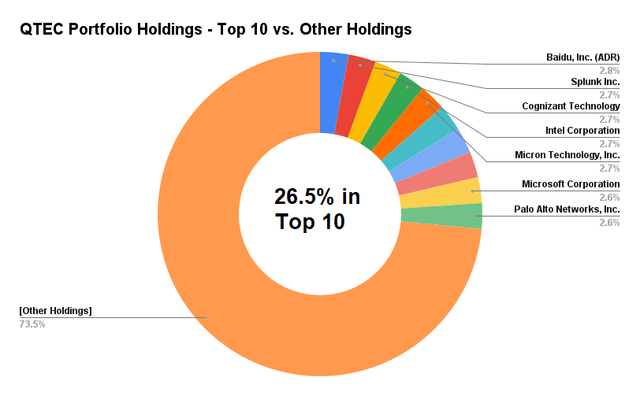

QTEC has been around since 2006. The fund manages over $3 billion in assets, on which it charges a relatively hefty 0.57 percent expense ratio. The fund tracks the NASDAQ-100 Technology Sector Index, which is made up of companies in the NASDAQ-100 index which have an ICB classification of ‘Technology’. These holdings are then equally weighted on a quarterly basis, in order to ensure a truly diversified portfolio.

First Trust Website

QTEC is significantly more concentrated around tech relative to QQQ. While QQQ has become virtually synonymous with the tech sector, the fact of the matter is that a significant portion of QQQ is given over to companies which aren’t usually associated with tech, including PepsiCo, CSX, and Marriott International. Additionally, QTEC’s equal-weighting methodology means that the QQQ has significantly greater degrees of single-stock concentration in its portfolio relative to QTEC.

Invesco Site

Another important point to make when comparing the two is that QTEC’s holdings tend to tilt more toward smaller-capitalized companies than those of QQQ. That being said, because the NASDAQ-100 consists of the largest 100 companies traded on NASDAQ, over time those smaller-cap companies whose share price winds up collapsing will eventually exit the index which underlies QTEC, ensuring that the fund doesn’t ride a failing small-cap all the way to zero.

While the current momentum-driven environment has rewarded the mega-cap stocks which dominate the QQQ, there may come a time when the current crop of dominant FAANG stocks either lose their luster or find it more difficult to deliver additional market-beating returns on top of the trillion-dollar capitalizations which many of them have accumulated in the current bull market. If and when that time comes, the companies which make up QTEC may begin to catch up to their larger-cap counterparts in terms of return.

Another interesting exercise is to compare QTEC to other equal-weighted tech focused funds, such as RYT and QQQE. While RYT is less of a suitable comparison, since its selection universe is the entire S&P 500 index, QQQE is tailored towards the NASDAQ-100, much the same as QTEC. However, QQQE shares its parent index’s willingness to incorporate non-technology companies into its holdings. This fact dilutes the degree to which QQQE can serve as a means to add tech exposure to a portfolio in the way that QTEC can.

QTEC’s value comes from the fact that, unlike the funds above, it both focuses on technology companies and uses an equal-weighting methodology which keeps a handful of companies from dominating its portfolio. While this sector-specific focus can lead to some counterintuitive exclusions (for example, Amazon.com is categorized as consumer discretionary and thus excluded from QTEC), many of the most notable exclusions from the fund are well-represented in the S&P 500 and other broad equity indices.

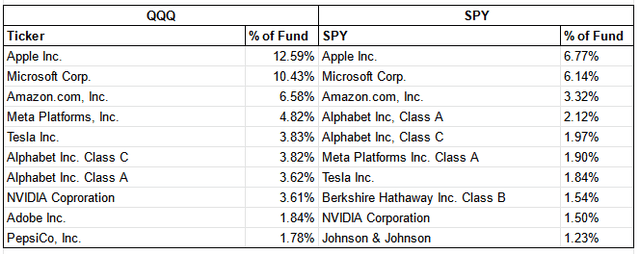

To get a sense of the overlap between some of the names which QTEC does not own and the S&P 500, take a look at the following comparison between the top holdings of the SPY and the QQQ. Virtually half of the names are identical! When I’m looking to add an ETF to my overall investment mix for diversification purposes, my personal preference is to choose something that offers something significantly different from the investments I already own. On this measure, QTEC clearly has an advantage over the QQQ.

State Street Website (See previous image for QQQ source)

Risks

As with any investment, there are ample risks to consider. One concern that should be considered is that, while QTEC is a better diversified way to gain exposure to the tech sector, the tech sector is still a richly-valued space at the moment. Should interest rate hikes cause tech price multipliers to fall, QTEC will not be exempt from this phenomenon. It is also worth pointing out that QQQ’s diversification into less-volatile sectors aside from tech has sometimes caused it to exhibit less downside than QTEC during equity price downturns. Additionally, a momentum-driven market may continue to favor the super-large companies that dominate alternatives to QTEC such as the QQQ. These facts being the case, investors should be very clear about what they are trying to achieve by adding QTEC to their portfolio. While I believe it does a good job of providing diversified tech exposure to investors who already have significant investments in non-tech focused index funds and/or companies, it should be treated as a supplemental holding as opposed to a core holding that comprises a majority of an investor’s investible assets.

Closing Thoughts

While recent volatility is certainly a reminder that equity investing is not without its risks, the old adage “time in the market beats timing the market” is likely to continue to hold true into the future. That being said, investors might want to think twice about assuming that their market-cap weighted ETFs are truly diversified. This is particularly true in the technology space, where a small handful of companies can account for a lion’s share of a fund’s assets. Investors desiring true diversification in their tech holdings might consider a fund such as QTEC. While the management fee is a little on the higher side, I like the fund’s equal weighting philosophy and feel that this helps the fund to truly serve as a portfolio diversifier for investors already long the S&P 500.

Use my work as a starting point for your own due diligence, not as a substitute. All investments involve the risk of loss of income as well as the principal. Consider consulting with an investment adviser before making any investment. I am not a tax professional or investment advisor. Please consider consulting with a tax professional before making any investment.

[ad_2]

Source links Google News