[ad_1]

shisheng ling/E+ via Getty Images

Investment thesis

Six months back, I started covering Blackrock’s iShares MSCI China A Shares ETF (BATS:CNYA), as several investors approached me asking how they could get some diversified exposure to Asia in general.

I also cover Blackrock’s ETF for the Hong Kong market (EWH) and the Singapore market (EWS).

Back in October last year, my initial article concluded that if you were looking for a short-term gain within the next year there were too many challenges in China that most likely would hold the price of CNYA down. This has happened. However, if your time horizon for this investment would be in terms of several years or decades, I believed that the gap between CNYA and (SPY) would narrow.

Much has happened in China over the last six months, their stock markets and the companies that ultimately are in this ETF.

We shall examine if the thesis still remains the same.

Fundamentals of CNYA

The net asset value of the ETF has gone down by 16.4% from USD 695 million in October last year to USD 581 million as of May 20th. With the lowering in the value and still fairly strong earnings from the companies, we do get a reduction in the P/E from 21.5 to a more moderate level of 14.8

The price to book value has also gone down from 2.6 to 1.9

CNYA and SPY – The gap is narrowing (SA)

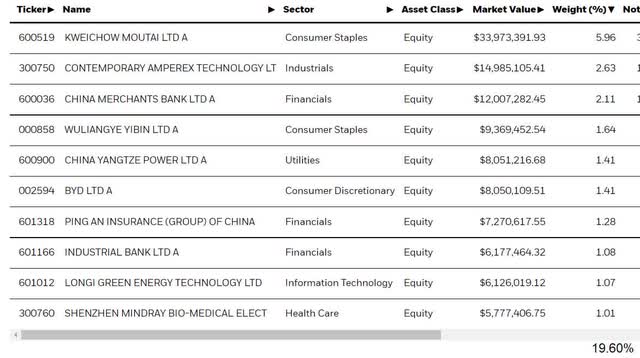

We looked at the top 10 holdings of CNYA in my last article. Most of the same companies are still on the list. Except for last time, back in October of 2021, they had as much as 1.65% in USD cash. This has now been allocated to shares. BYD has also moved up on the list.

CNYA – Top 10 holdings as of 14 May 2022 (Blackrock)

It is too early to tell how the slowdown in the economy has impacted the companies’ results. Many companies in China only report financial results twice a year.

I did look at Kweichow Moutai’s full-year results for 2021. They did very well, with EPS increasing by 12% y-o-y to RMB 41.76 per share. Out of this earning, they paid out a dividend of RMB 21.675 per share. This corresponds to a yield of just 1.22%.

It is a solid business with an ROE of 30%, and judging from the balance sheet it held as much as RMB 51.8 billion, equivalent to USD 5.9 billion, in cash or cash equivalent. This was an increase of 43% from last year. They have a solid balance sheet with no bank debt and total liabilities including taxes due of RMB 34.8 billion.

Kweichow Moutai (Kweichow Moutai website)

Incidentally, Kweichow Moutai is the world’s most valuable liquor brand.

We get a better idea of how the pandemic has affected the economy through the first few months of 2022 by looking at some of their financial companies since they report quarterly results. Financials are also the most weighted sector in the fund.

The largest bank in this ETF is China Merchants Bank.

In the first quarter of 2022, the bank had a positive EPS growth of 12.6% y-o-y with a net profit margin of 51.5%. Their P/E is attractive at just 7.9 and their dividend yield is 3.9%.

Although the share prices of the individual companies in this ETF have come down, and the price of CNYA has followed this downward trend, we cannot see any deterioration in these large companies’ earnings at this point in time.

Economic development in China over the last six months

With nearly 400 million people being locked down since April, it was clear that the economy was going to take a hit at the beginning of the year.

Estimates from analysts and economists vary greatly. Earlier this year the consensus was for the GDP to grow by about 5.5% this year. Using a typical linear approach most have reduced this to just low 5% growth. Some, like Capital Economics, have cut their forecast to a growth of just 2% for this year.

On the 15th of April this year PBOC, which is China’s central bank, cut its reserve requirement ratio, which is the amount of cash that banks must hold in reserve, by 0.25%

This was aimed at boosting the economy by releasing the equivalent of US$83.2 billion into the banking system.

They also reduced the interest rate. While central banks around the world are increasing their interest rates in an effort to reduce inflation, China is doing the opposite. This is understandable because China had a much higher interest rate than the rest of the world. On the 20th of May POBC cut their 5-year loan prime rate by 15 basis points from 4.6% to 4.45%

It remains to be seen how effective these stimulus moves will be, as they are all dependent upon people’s ability and willingness to invest and spend.

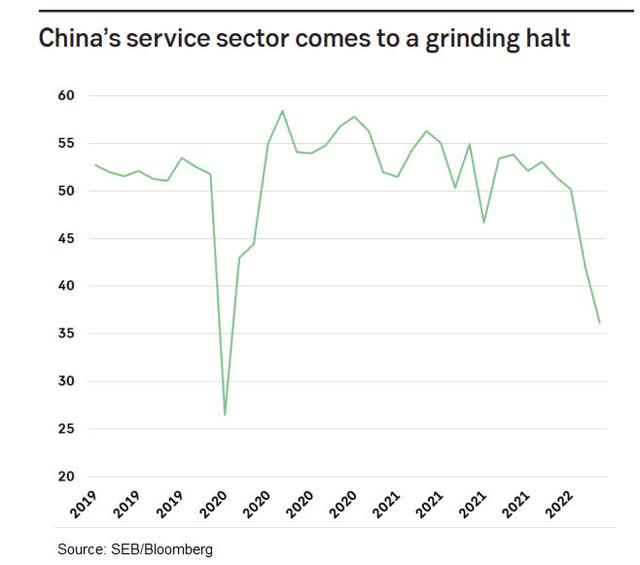

Consumers have pulled back over the last few months, as can be seen by the activities in the services sector.

Services Sector comes to a grind (SEB)

Shanghai is probably the most important city for the country’s commerce. It is also very large with a population of more than 25 million people

Their lockdown is now approaching the third month for some of the worst-affected companies. This has taken a crucial quarter out of earnings and is driving many to the brink of collapse. Local authorities earmarked 140 billion yuan (US$21 billion) of tax relief, incentives, and subsidies

Authorities there are technically allowing some businesses to resume in low-risk areas that had been declared Covid-free in the past 14 days, as the prelude to a formal citywide reopening scheduled on June 1 before the city’s plan to return to full normality by the end of June 2022.

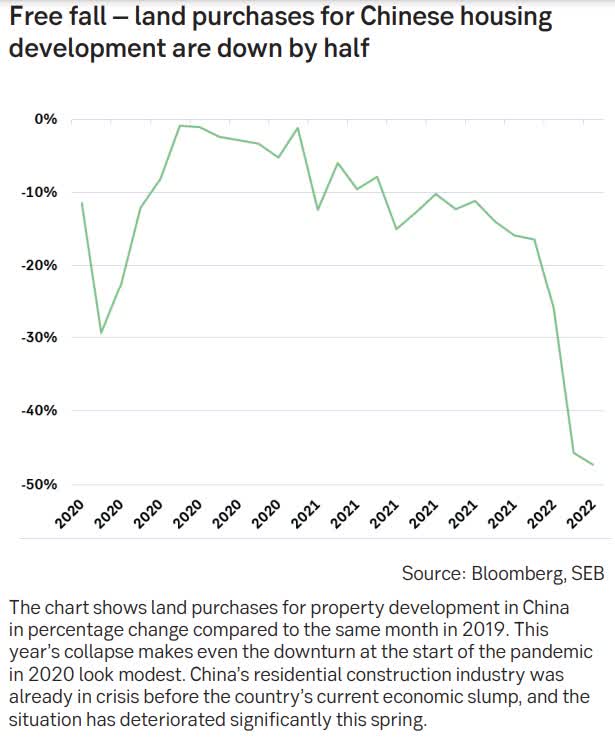

The real estate sector is important to China. We need to monitor the activities going forward, as the property developers have shown muted interest to acquire land from the government to build new properties.

Muted interest by Property Developers for land acquisitions (SEB)

There is much concern in the investment community about the Chinese government’s intervention in how certain sectors are operating.

After clamping down on tuition centers they reigned in the technology sector with a particular interest in companies such as Alibaba, Tencent, and the likes.

They will still be under strict control on what they can and cannot do, but I do think they will also want to make sure these giants will operate profitably and continue to grow.

Their growth is very important to the economy. Especially, in terms of employing many young, educated graduates that are coming out each year looking for jobs. I believe that improvement in employment will outweigh any other concerns they have with the tech giants.

Conclusion

All is not well in the Chinese economy at the moment. Nevertheless, it would be wishful thinking that they could escape market cycles and only see good days.

There will be a turnaround.

The question is how quickly this can take place. Although the political leaders are determined to tackle the pandemic their own way, they are acutely aware of the negative impact it is having on the economy. To solve this problem, they have promised massive stimulus packages to remedy the lack of economic growth and the deteriorating labor market. They will use regulatory changes as well as both fiscal and monetary stimulus to bring the economy out of its current slump.

In order for this to be effective, the behavior of the consumers is vital. They need to be able and willing to spend. I do think that once the economy opens up with fewer restrictions, this will return back to normal.

As a matter of fact, we could then see a new boom in the economy, similar to what we saw in the summer of 2020 and after the 2009 financial crises. Such a boom will benefit the service sectors and also the heavy industries and commodities.

The best time to invest is when everybody is pessimistic. There are plenty of pessimists out there. Some even think and say that “China is un-investable”.

I disagree.

If you are looking for diversification, and unlike me who already have plenty of exposure to China through investments directly in companies that do their business there, you could buy CNYA at this moment in time.

But you do need patience, and just to remind my readers, this is not a recommendation to buy or sell any financial products. It is purely my own personal opinion.

[ad_2]

Source links Google News