[ad_1]

zhuyufang/iStock via Getty Images

Investment Thesis

Investors have been fascinated by China’s spectacular economic development for decades. However, as China’s economy matures, its future growth prospects become increasingly dependent on certain sectors and themes. Among the most important are those related to the growing influence of China’s customers, who have witnessed years of high salary growth, migration into cities, and increased internet access. These are some of the reasons why investors have focused on the Chinese consumer discretionary sector in the last couple of years.

However, China had a very tough start to the year. A large number of cities entered a lockdown in March 2022, and these cities are only now starting to ease some of the measures taken to achieve the zero COVID policy. The measures taken by the CCP have had a profound negative impact on the economy, especially on retailers and consumer discretionary stocks. Retail sales, for instance, have reached -11% YoY in April, levels last seen during the March 2020 COVID-19 lockdown.

Refinitiv Eikon

Another area where these measures put tremendous pressure is employment. The unemployment rate in urban areas reached 6.1% in April 2022, which is very close to the unemployment peak of February 2020.

Refinitiv Eikon

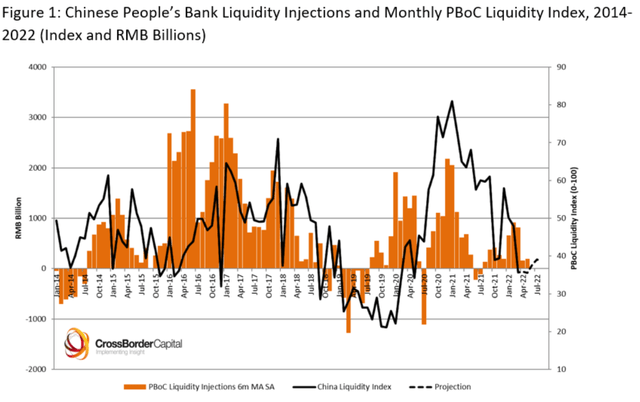

On top of that, liquidity remains an issue for Chinese demand. Beijing hasn’t yet clearly come to the rescue of the economy as many market participants expected. This could lead to weaker demand for a prolonged period, which is something that will put further downside pressure on Chinese consumer discretionary stocks.

CrossBorder Capital

While I believe this sector is attractively priced, I think the uncertainty of the situation makes it a risky bet, as the bullish thesis could take several months to play out without a clear catalyst.

Strategy Details

The Global X China Consumer ETF (NYSEARCA:CHIQ) tracks the investment results of the MSCI China Consumer Discretionary 10/50 Index. The index is designed to provide exposure to publicly-listed Consumer Discretionary stocks in the world’s second-largest economy by GDP, China.

If you want to learn more about the strategy, please click here.

Portfolio Composition

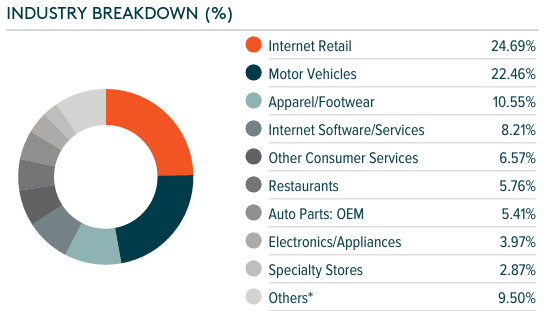

The index places a high weight on Internet Retail stocks (representing around 25% of the index), followed by Motor Vehicles companies (accounting for~22%) and Apparel/footwear brands (representing around 11%). The largest three categories have a combined allocation of approximately 58%.

Global X ETFs

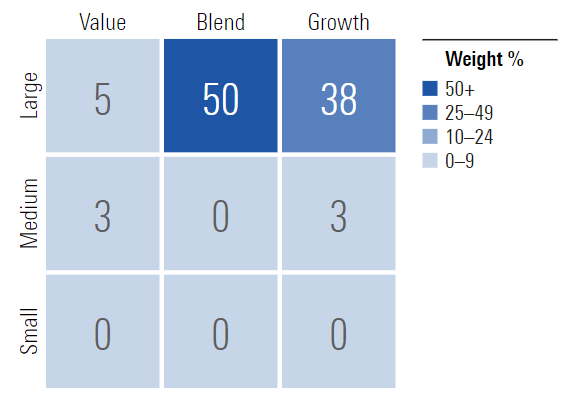

~50% of the portfolio is invested in large-cap blend issuers, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap growth equities. The strategy invests over 93% of the funds into large-cap stocks and has only a ~7% exposure to mid and small-cap stocks which generally have the potential to deliver higher returns.

Morningstar

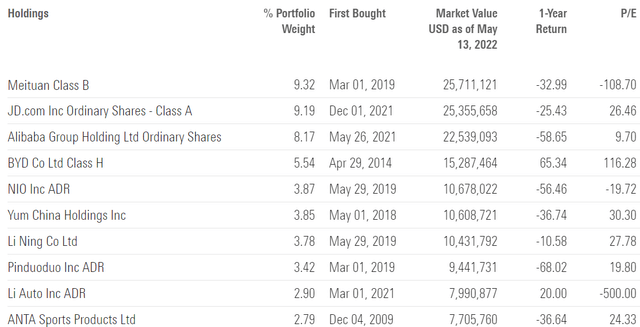

The portfolio is composed of 74 different stocks. The top 10 holdings account for 53% of the portfolio, with no single stock weighting more than 10%. In my opinion, CHIQ runs a concentrated portfolio and a handful of names will drive future returns. I think it is important to see how that fits your investment goals and if you are comfortable holding a concentrated portfolio. The way this portfolio is structured can remove some of the benefits of diversification, which is something many investors would like to avoid when investing in ETFs.

Morningstar

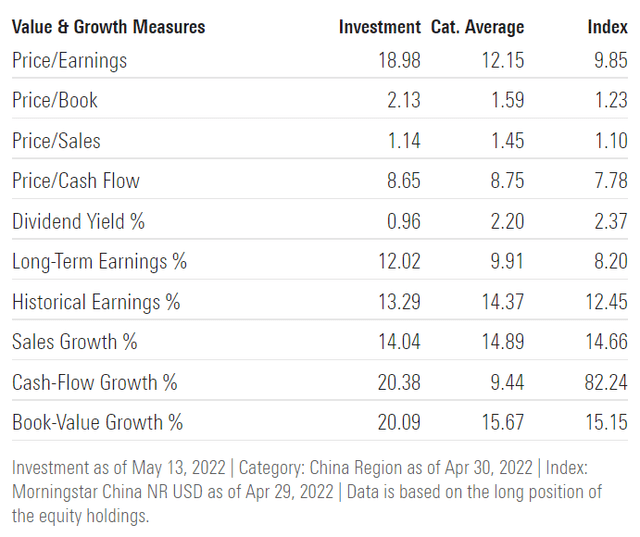

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, CHIQ trades at a price-to-book ratio of ~2 and has a price-to-earnings ratio of ~19. This doesn’t seem extremely cheap, which is what I would expect given how bad the Chinese economy looks at the moment. The dividend yield is also pretty low which makes me believe there can be more pain ahead for Chinese consumer discretionary stocks.

Morningstar

Is This ETF Right for Me?

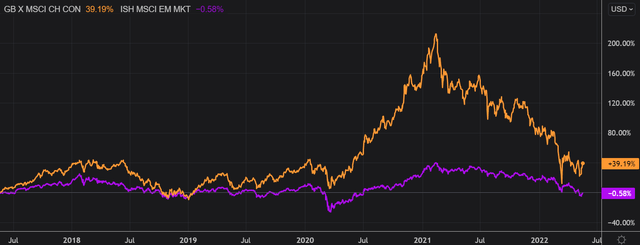

I have compared below CHIQ’s price performance against the iShares MSCI Emerging Markets ETF (EEM) over the last 5 years to assess which one was a better investment. Over that period, CHIQ outperformed EEM by a ~40 percentage points margin. It is interesting to see that both strategies delivered similar returns up until 2020, when the performance spread widened once the global economy reopened and China emerged as one of the few economies with a positive GDP growth rate that year.

To put CHIQ’s performance into perspective, a $100 investment 5 years ago in this ETF would now be worth ~$139.19. This represents a ~6.8% compound annual growth rate, excluding dividends, which is an average absolute return.

Refinitiv Eikon

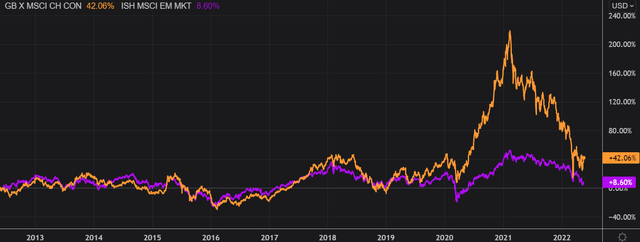

If we take a step back and look at the 10-year price returns, the results don’t change much. CHIQ came on top once again, outperforming EEM since Q1 2019.

Refinitiv Eikon

The recent lockdowns in several Chinese cities hurt the Chinese consumer discretionary sector. However, the COVID-19 new cases in China might suggest that things are about to change. According to the government, Shanghai has already reached its zero-COVID policy target this week and other cities are expected to emerge from lockdown in the upcoming weeks. This would be good news for Chinese consumer discretionary stocks. However, there is no real sign showing a booming economy and strong demand just yet, which makes this category of stocks risky until a clear catalyst can be found.

Refinitiv Eikon

Key Takeaways

CHIQ provides exposure to publicly-listed Consumer Discretionary stocks in the world’s second-largest economy by GDP. China has had a difficult start to the year after a number of cities went into lockdown in March 2022. The CCP’s actions have had a significant detrimental impact on the economy, particularly on retailers and consumer discretionary companies. As some cities are just now beginning to relax some of the measures put in place to accomplish the zero COVID policy, the outlook for Chinese demand is still highly uncertain, which makes investing in consumer discretionary stocks a risky trade.

[ad_2]

Source links Google News