[ad_1]

Vladimir Zakharov/iStock via Getty Images

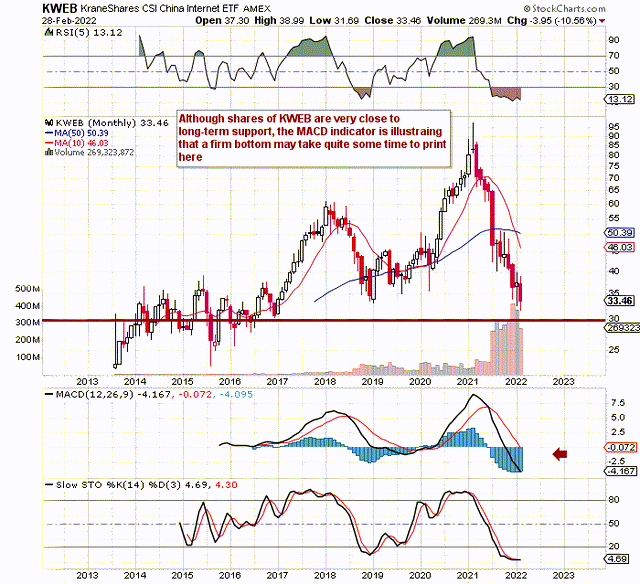

If we pull up a monthly chart of KraneShares Trust – KraneShares CSI China Internet ETF (KWEB), we see that shares experienced a horrible 2021 and the first two months of 2022 have also resulted in losses for the ETF. Fortunately, shares are now coming up against long-term support just above the $30 level, so we may finally see a stop to this carnage. Investors though need to be prepared for more downside to come here in KraneShares Trust as the scale of the decline to date has resulted in the MACD indicator continuing to diverge. This is confirmed by the monthly histogram which still shows no signs of moving upward at this stage.

KWEB ETF coming up against long-term support (StockCharts)

Therefore, with respect to timing a potential long position in here, it may be better to wait until at least the support level alluded to above gets tested. What also may not be attractive to long-term investors is the fact that KWEB charges a 0.7% expense ratio, which comes in well ahead of the 0.5% average in this asset class.

On the contrary, however, the sizable annual dividend of $2.58 per share which was paid out last December is sure to attract attention. The strong growth in the dividend has come off the back of aggressive growth in the fund’s assets. Although assets under management may have fallen by roughly 12% over the past month, AUM has still more or less doubled in the fund over the past 12 months alone.

Suffice it to say, we would wager that a hard bottom in the fund will take place around the technical support levels depicted above, and then a subsequent rally should put an end to the trend of assets being withdrawn from the ETF. Similar to traditional value investing, one has to give some level of pretense to KWEB’s long-term trends and not solely rely on what has been happening to the fund over the past few months.

Given though the expense ratio and the technicals (which are signaling a long-drawn-out bottoming process), our play here is to take advantage of the uncertainty in KWEB at present (through options) instead of waiting to get long the ETF through buying shares.

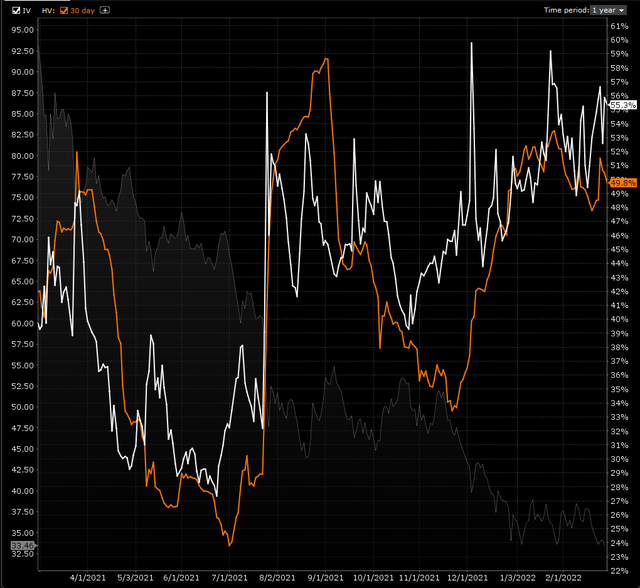

As we can see from the implied volatility chart in KWEB below, IV is trading well above its average over the past 12 months. Historic volatility (HV) is backward-looking in that it gives us information with respect to volatility on how KWEB has traded over this timeframe. Implied volatility or IV on the contrary is forward-looking, so when we have a difference in the two metrics (which we have presently in KWEB), we can say that opportunity exists here due to the inflated nature of KWEB’s derivatives.

IV Spike in KWEB (Interactive Brokers)

So then the question which presents itself is how do we take advantage of this sustained down move in KWEB (which we believe will eventually bottom) while at the same time controlling our risk? Before we get into the strategy we have in mind, let’s delve into some of the pillars we adopt when trading options. All of this work can be done outside of market hours. Suffice it to say, success many times is 90% preparation and 10% execution. The more detailed we can be in our preparation and mechanics, the higher the probability that our emotions will stay out of the game during the trade.

- We must be able to determine our maximum loss, potential profit, and breakeven points before any capital is committed to the KWEB trade/investment.

- We are risk managers first and foremost. Being able to make a profit always comes in second in terms of priority.

- An exit strategy must be written down if our investment goes against us.

- The exit strategy must be obeyed at all times no matter how convincing the market may be telling us otherwise.

- An exit strategy must also be written down for when to take profit.

The strategy we have in mind for KWEB is a put broken wing butterfly. This involves the purchase of a long put spread plus the sale of a wider put spread further out of the money. We place both short put options at the same strike price and we ensure we rout the butterfly for a credit. The broken wing butterfly is a high probability of profit trade because we can make money if wither KWEB goes up or down. We will put this trade on shortly and post in the back office.

To sum up, we believe downside risk is limited in KraneShares Trust – KraneShares CSI China Internet ETF at present although uncertainty (volatility) remains high. For the reasons cited above, we believe the best way to trade/invest in this ETF at present is by means of selling rich option premium through a broken wing butterfly strategy. We look forward to continued coverage.

[ad_2]

Source links Google News