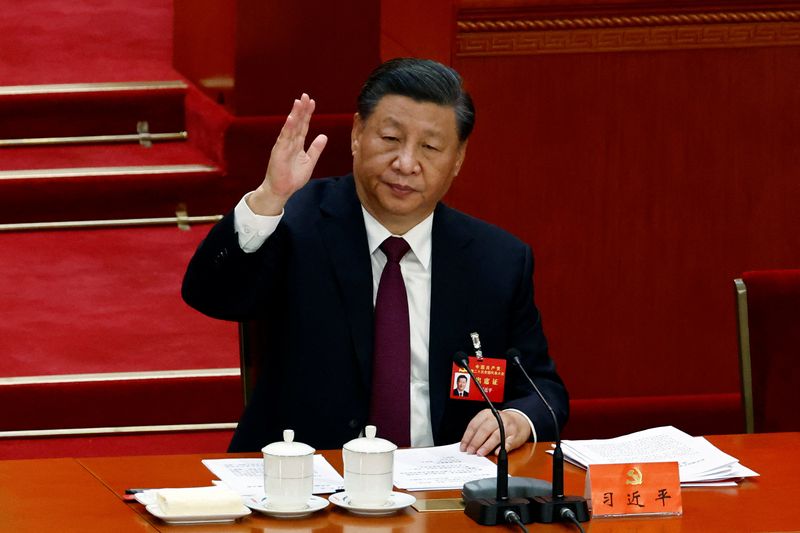

© Reuters. FILE PHOTO: Chinese President Xi Jinping votes during the closing ceremony of the 20th National Congress of the Communist Party of China, at the Great Hall of the People in Beijing, China October 22, 2022. REUTERS/Tingshu Wang

© Reuters. FILE PHOTO: Chinese President Xi Jinping votes during the closing ceremony of the 20th National Congress of the Communist Party of China, at the Great Hall of the People in Beijing, China October 22, 2022. REUTERS/Tingshu Wang2/2

(Reuters) – U.S.-listed shares of China firms slumped in premarket trading after Xi Jinping’s newly unveiled leadership team sparked investor fears that ideology-driven policies would be prioritized at the cost of private sector growth.

Ecommerce firms Alibaba (NYSE:) and JD (NASDAQ:).com and internet giant Baidu (NASDAQ:) dropped between 11% and 16%.

The iShares MSCI China ETF skid 8.6%, tracking a sharp fall in Hong Kong shares, led by losses in technology and property sector.

Xi secured a precedent-breaking third leadership term on Sunday and introduced the new Politburo Standing Committee stacked with loyalists.

Music streaming co Tencent Music, e-commerce platform Pinduoduo (NASDAQ:) and mobile game publisher Bilibili (NASDAQ:) shed between 10% and 15%.

Education companies New Oriental Education & Technology Group and Gaotu Techedu dropped about 12% each, while electric vehicle firms Nio (NYSE:) Inc, Xpeng (NYSE:) and Li Auto fell between 10% and 13%.

The changes in leadership suggest little chances of fresh stimulus or changes in COVID policy in the months ahead, strategists at TD Securities wrote in a note.

“While there were no new announcements on the policy front, the departure of perceived pro-stimulus officials and reformers from the Politburo Standing Committee and replacement with allies of Xi, suggests that ‘Common Prosperity’ will be the overriding push of officials,” they said.