[ad_1]

(Pic Sourced Here)

U.S. equities may have started the second quarter with a bang, but it was a stunning turn of events in China that has captured all the headlines. That’s not surprising given the shock global markets received when the country’s official GDP forecast was lowered to just 6-6.5% for 2019, an absurdly optimistic target for us, but the lowest growth rate for China since 1990. But with the official PMI score (and the unofficial China Beige Book) rising, showing that industrial orders and hiring have begun to pick up, investors are optimistic that the tide may be turning for the world’s second-largest economy. And, that has investors scurrying to add China exposure to their portfolios for the first time in years.

Unfortunately, many of them are finding out that while we’ve been obsessed with political developments and the Fed, the notoriously volatile China A-share market (and the ETFs that hold them) has been steadily gaining ground since last fall with one of the largest funds, the X-trackers Harvest CSI 300 China A-Shares Fund (ASHR), up over 33% YTD while bringing in over $800m in new assets! Nor is ASHR the only fund feeling the love, but while that might have some traders thinking the time to go long China has already come and gone, our quantitative models are suggesting that all the ingredients are in place for even more gains to come.

A-Share Fever:

Taking the pulse of the A-share market has always been challenging. The market was long closed off to outside investors, leaving it to be dominated by retail investors who treat it more like a casino than a place to build long-term wealth. That means extremely high turnover and volatility with short-lived bubbles followed by steady sell-offs. What ignites those rallies have always been investor expectations for future stimulus and changes in lending practices, not surprising, given that much of China’s economy continues to operate on the principal of targeted GDP growth, no matter the economic reforms of the last few decades.

That attitude, along with the ongoing trade dispute between China and the U.S. and our respective economic slowdowns, could scare away a lot of capital, but instead quite the opposite is happening, at least with the U.S. domiciled China A-share funds we track. All have been recipients of strong inflows over the last few months with the largest, ASHR, taking in over $800m in new assets over the last three months, while it’s small-cap equivalent, X-trackers Harvest CSI 500 China-A Shares Small Cap Fund (ASHS) has seen its assets more than double!

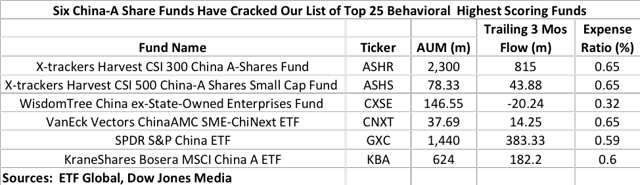

Strong inflows are always a useful confirmation signal, call it putting your money where your mouth is, although that’s not the basis for our belief that the A-share market might be primed for more gains. Nor are we experts on the Chinese markets or economy, as much as anyone can be, given the unreliable nature of government statistics. Instead, our insights come from our quantitative models, principally from our ETFG Behavioral Model. It’s an important part of our overall quantitative scoring system although some investors find its insights valuable enough to stand on their own. It ranks every equity ETF in our universe daily on a variety of metrics, including price momentum and contrarian factors. Not surprisingly, China-A share funds are holding down some of the top spots as of April 4th, seven of the top twenty-five in fact, after that strong double-digit rally that began at the start of the year, although focusing only on performance can be misleading and isn’t the sole source for our optimism.

Tear it Apart, Put it Back Together:

First, there’s no denying that China A-share funds (we’ll continue using ASHR for this analysis) have seen a substantial improvement in their momentum scores while their U.S. rivals were beginning to lag. In fact, while ASHR and other funds have had a strong first quarter, their prices were already showing signs of strength long before that. Most investors can only think about how 2018 was brutal to ASHR, with the fund down more than 28% for the year compared a more modest 4.3% loss for the S&P 500 or a 9% loss for the MSCI ACWI ETF (NASDAQ:ACWI). To be fair, it also significantly outperformed in 2017 after underperforming in 2016. That strongly cyclical behavior is just par for the course among some of the most volatile equity funds we track with ASHR’s 5-year standard deviation more than 2x that of ACWI or SPDR S&P 500 Trust ETF (NYSEARCA:SPY).

In fact, ASHR and other China A-share funds began to see a significant improvement in the price momentum last fall as their steep descent from early 2018 highs began to slow. You can see in the chart below that ASHR began to trade within a tight range between $20 and $22 per share for much of the fall. That had been a prior support level going all the way back to 2016 after the 2015 debt-fueled economic spurt in China came to a vicious end.

Another factor that’s helped those A-share funds climb our charts of top behavioral scorers has been the fact that their relative performance improved even as the domestic technology and internet funds began to suffer. No one doubts that China and the U.S. may have a strong economic interdependency, but our equity markets are anything but synchronized with Chinese A-shares operating in a boom-bust cycle that domestic investors would never tolerate. But as the technology shares began to weaken last fall, the China A-share market held its own as some investors began to buy in anticipation that the Chinese government would have to loosen credit conditions to help lift the economy. Remember that old adage to buy when there’s blood in the street? A relative strength chart, here using ASHR over SPY, shows how the long period of strong domestic to A-share performance came to a screeching halt in the 4th quarter. That’s helped those A-share funds dominate our Top 25 list by clearing the board of many domestic funds.

Strong price momentum may always be appreciated by investors, at least when it’s to the upside, but neither our Behavioral scorers nor optimism is being pushed solely by that. In fact, re-ranking our universe just on price momentum would show a different list of top performers, a veritable mishmash of funds, including some technology and internet names, along with country specific ETFs. Price momentum is just one factor we consider, to be a top-scoring fund overall, ETFs need to score strong in both price momentum and several contrarian indicators that we label with the heading “sentiment.”

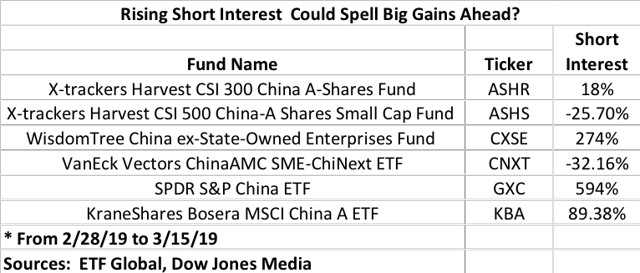

We look at a variety of indicators, including implied volatility because after all, big moves are necessary for big returns, but that’s only part of it. One factor that we think could help boost A-share funds to new heights is short interest, the percentage of shares outstanding that have been sold short. Like most contrarian investors, our models view that short interest as a source of rocket fuel in a rally as rising prices forces “investors” to cover their shorts, thus sending fund prices even higher, leading to more short covering, etc. Think of it as “rinse, wash, and repeat.”

Our interest isn’t just in the absolute number of shares sold sort, or as a percentage of volume or even the percentage increase from the prior reporting period although all of that can be valuable. Knowing how many shares of SPY are currently short, or how long it would take to unwind those positions is useful information, but it requires context to be truly important to investors. We’re more focused on the percentage of each ETFs shares sold short relatively to its own past. Are investors optimistic or pessimistic about the direction of share prices going forward? Funds with higher short interest relative to their own history receive a higher score which when you combine it with rising momentum and high volatility could signal a major move is underway or at least possible. And despite the strong performance in the first quarter, those same six funds we’ve already talked about might be primed for a serious take-off!

All six are currently trading with short interest levels close to historic highs with several, including SPDR S&P China (NYSEARCA:GXC) and WisdomTree China ex-State-Owned Enterprises ETF (NASDAQ:CXSE) having seen substantial increases in their short-interest in the most recent reporting period. And, that’s despite the already substantial performance these funds have logged in the first quarter. Even ASHR, one of the oldest and largest China A-share ETFs, saw an 18% increase in its short interest!

That rising short interest also helps explain the substantial inflows into these funds. Remember that for institutional investors, working with an authorized participant to create a new bloc of shares can often be the easiest way for them to acquire a substantial bloc to sell short. From a cash flow perspective, it appears as an increase in the fund’s assets although the shares were created with the express purpose of being sold short! So, despite that strong performance, some portion of the recent inflows into these A-share funds is from investors betting against the trend rather than going with it!

More Cash in the Pipeline:

One final reason why investor might want to rethink their stance on A-share funds is because the coolest kid on the playground is already doing the same. In this case, that cool kid is MSCI, one the leading index sponsors whose Emerging Market Index is the most widely tracked EM index in the world!

China may dream of being a major player in the global financial market, but up until recently, their actions kept its RMB-dominated exchanges very much on the sidelines. Strict restrictions on international investors along with a lack of readily available information, not to mention fears of open government intervention, had made it easy for index providers to avoid adding A-shares to their benchmarks. That only helped to keep the A-share market relatively insular, further exacerbating the lack of liquidity and volatility. Call it a very unvirtuous cycle.

But that began to change last year when A-shares finally began to be included in MSCI’s indices with more capital on the way. In fact, MSCI plans to increase the amount of A-share exposure in three stages with the first coming as early as next month according to a recent article we found on Reuters (MSCI to quadruple weighting of China A-shares in its global benchmarks) and which according to Eric Moffett at T.Rowe Price could ultimately add $40 billion in capital to the Chinese markets (PIOnline : MSCI to increase weight of China A shares in indexes).

$40 billion spread across hundreds of stocks might not be enough to get some U.S. investors out of bed, but in a relatively illiquid and small market, it could have a transformative impact.

Conclusion:

Relying on contrarian analysis is never easy, but between strong price momentum, high short interest, and the promise of more capital to come, this rally in the China A-share market could still be in its early stages.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor.

[ad_2]

Source link Google News