[ad_1]

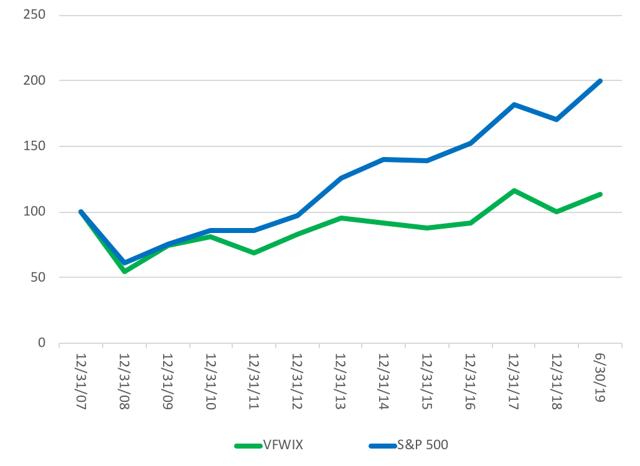

Total Return S&P 500 vs. VFWIX (Global ex-U.S. ETF)

Source: Yahoo Finance

It has been a disheartening decade for investors focused on equities outside the U.S. VFWIX, an exchanged traded fund (ETF) that tracks the FTSE All Word ex U.S. Index, finished 2018 at almost the same level it began 2008 compared with an 80% gain for the S&P 500. VFWIX’s underperformance can be blamed on a myriad of factors including unfavorable exchange rate movements, slower real GDP growth, languishing corporate earnings, and political instability. While certain countries still face significant challenges, others look like attractive opportunities especially if the trend in exchange rates reverts to its 2014 levels.

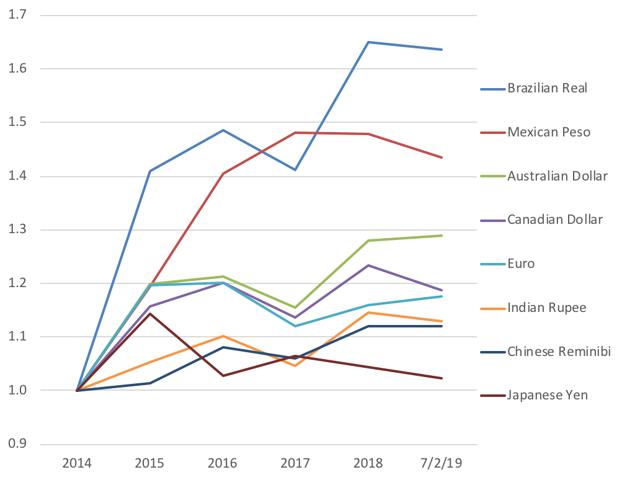

Exchange Rate Movements (2014 =1.00)

Source: OANDA

Between 2014 and 2018, exchange rates were generally a headwind for U.S. investors in foreign equities especially for investments in Latin America, Australia or Europe. However, this trend has shown signs of reversing in 2019, and investors who agree with the IMF’s projections should expect exchange rates to become a significant tailwind in late 2019 or 2020. The IMF’s latest World Economic Outlook (WEO) provides several potential catalysts for reversing the dollar’s recent appreciation.

- Consistent with its expectations for weaker growth in the U.S., the IMF predicts the U.S.’s current account deficit will swell to over $600 billion in 2021 from $469 billion in 2018. Significant growth in the U.S. current account would increase demand for foreign currencies, which would result in downward pressure on the dollar.

- The IMF believes the combination of U.S. Tax and Jobs Act and increased federal government spending has created an “unsustainable” fiscal position. If investors conclude the U.S. has serious fiscal problems, it will jeopardize the dollar’s status as the world’s primary reserve currency. Losing that status would cause a significant decline in demand for dollars and deterioration in the dollar’s exchange rate.

- Most experts believe the European Central Bank’s next action will be to raise interest rates next year while US traders are assuming a rate cut in July. Narrowing the gap in interest rates between the U.S. and Europe should cause the dollar to weaken against the euro.

Valuations and Recommendations

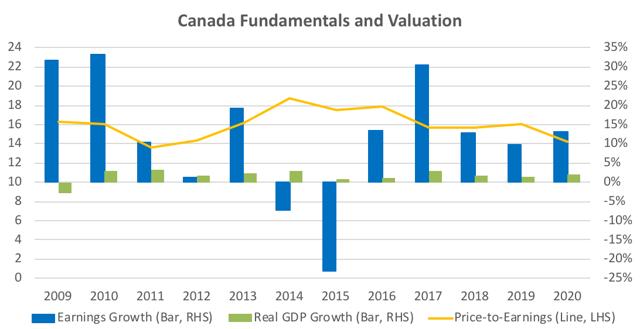

Canada Recommendation: Strong Buy EWC (Top Pick)

Canada is one of the few countries that looks more attractive than the U.S. when considering fundamentals, valuation and geopolitical risk. According to Thomson Reuters, publicly traded Canadian companies reported double-digit earnings for three consecutive years, and analysts expect this trend to continue through at least 2020. The IMF’s projections for Canada include average real GDP growth of 1.6% per year over the next five years, the same as the U.S. Canada has a stable government, a strengthening currency, and a deal with its largest trading partner. Given this backdrop, Canada seems like a bargain at less than 16 times analysts’ estimate of earnings for 2019.

Sources: International Monetary Fund, Thomson Reuters

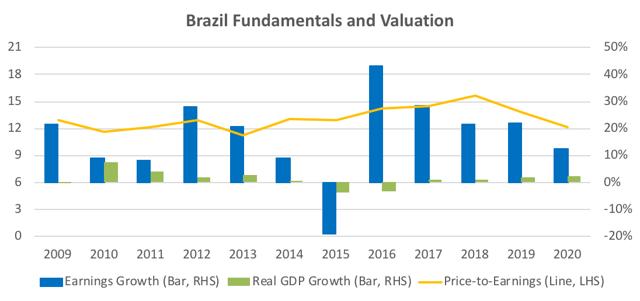

Latin America Recommendation: Hold ILF

Sources: International Monetary Fund, Thomson Reuters

Sources: International Monetary Fund, Thomson Reuters

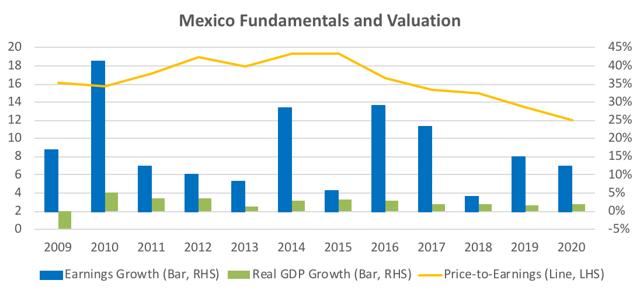

Latin America could be a value trap. A combination of political instability and tariffs has reduced price-to-earnings ratios to 14 in Brazil and Mexico. Stocks in Latin America are trading below their price-to-earnings multiple range for the past decade despite expectations for robust earnings and real GDP growth in 2019 and 2020 due to corruption, political instability and concerns about trade wars with the U.S. Operation Car Wash revealed stunning corruption in Brazil that culminated in two presidents being arrested, a third president being stripped of her power and numerous rank and file civil servants, politicians and businessmen being ousted.

Mexico’s transition to a left leaning president has been fairly smooth. However, the U.S.’s repeated threats of tariffs have been weighing on Mexican corporations. ILF’s shares fairly balance analysts’ expectations for strong growth in Latin America with the political risks facing the region.

Europe Recommendation: Hold EZU

|

Corporate Earnings |

Real GDP |

Price-to-Earnings |

|

|

Germany |

4.6% |

0.8% |

14 |

|

United Kingdom |

1.8% |

1.2% |

14 |

|

France |

7.8% |

1.3% |

15 |

|

Italy |

11.6% |

0.1% |

13 |

|

Spain |

9.3% |

2.1% |

15 |

|

Netherlands |

6.6% |

1.8% |

17 |

Sources: International Monetary Fund, Thomson Reuters

Europe seems fairly priced. Price to 2019 earnings ratios for the largest European nations range from 13 to 17 compared with 19 times for the S&P 500. This discount is justified by Europe’s unattractive mix of sluggish real GDP growth, modest corporate earnings growth and trade related issues. The real issue is whether Europe can meet even low expectations.

United Kingdom’s vote to exit the Euro Zone (Brexit) has renewed questions on the continent about whether most Europeans benefit from greater unity. Remember it was only a few years ago when many German and Dutch citizens voiced objections to paying for fiscal management by Greece. Europe has also received its share of US tariffs, which dampen demand for European exports. In addition to trade and political concerns, Mario Draghi, President of the European Central Bank (ECB), cited lower consumer confidence in explaining the ECB’s decision to restart one of its stimulus programs.

If investors feel compelled to allocate assets to Europe in an effort to maintain appropriate global diversification, EZU, an ETF that focuses on countries that use the euro, is a better position than buying a mutual fund that invests across Europe, including the U.K.

China and Hong Kong Recommendation: Sell

Sources: International Monetary Fund, Thomson Reuters

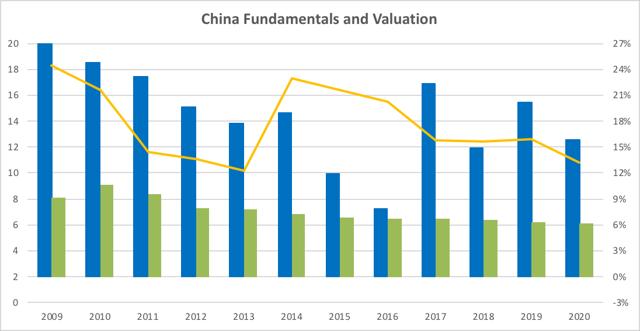

China’s stock market has always traded at a discount relative to investors’ expectations for Chinese companies’ earnings and the country’s real GDP growth, but that discount is justifiably greater today. The discount usually reflects investors’ concerns about the reliability of macro and micro data as well as political risk of owning assets in a communist country. Trade tensions with the U.S. and persistent concerns about the resiliency of the Chinese economy have magnified this discount.

Sources: International Monetary Fund, Thomson Reuters

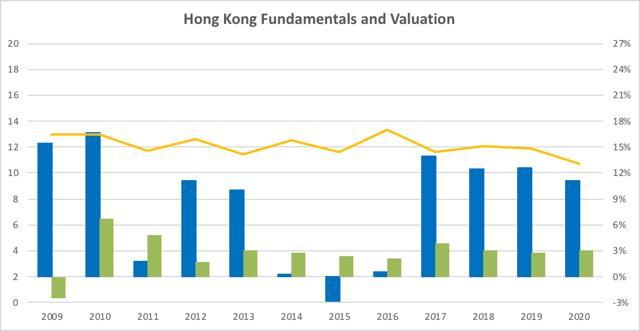

China’s problems have been weighing on Hong Kong since 2015. Although it is technically autonomous, Hong Kong’s economic prospects are inextricably linked to the health of the Chinese economy. Trade is critical to Hong Kong. A World Bank report showed exports represented 188% of Hong Kong’s GDP compared with 12% for the U.S., and China received 44% of Hong Kong’s exports according to the Trade and Industry Department.

In addition to the trade-related issues and economic malaise affecting China, the mainland infused political tensions by proposing a law that would allow China to extradite Hong Kong residents in certain circumstances. Police estimate 250,000 Hong Kong residents participated in protests.

India Recommendation: Buy EPI

Sources: International Monetary Fund, Thomson Reuters

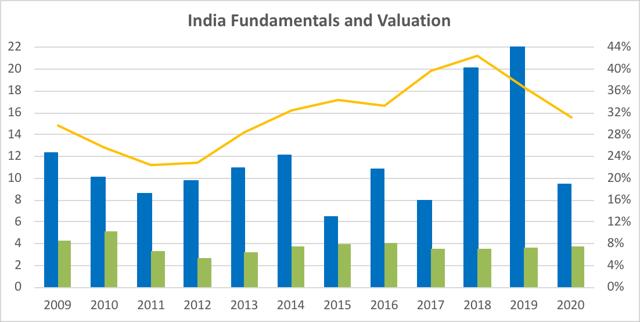

Investors willing to accept some risk could reap significant rewards in India. The country boasts exceptionally strong historical and projected growth rates for both real GDP and corporate earnings. The political environment is fairly stable following the re-election of reform minded businessman Narendra Modi. Although the U.S. has imposed tariffs on India, it has never been in President Trump’s crosshairs like Mexico and China.

Today, one U.S. dollar can be exchanged for 69 rupees within 3% of its 2016 exchange rate. The Reserve Bank of India (RBI) has been effective at taming inflation, which was less than 3% in 2018 according to the IMF. RBI has reduced its rate to 5.75% from 8.50% in 2012 when inflation was over 10%.

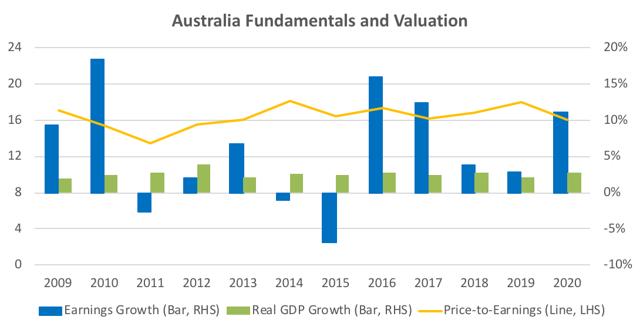

Australia Recommendation: Buy and Hedge EWA

Sources: International Monetary Fund, Thomson Reuters

Australia could be an attractive long-term investment if analysts’ expectations for a jump in corporate profitability in 2020 initiates a period of sustained earnings growth and certain macroeconomic risks do not materialize. Today, Australian equities are trading at a higher price-to-earnings multiple (18) than their typical level (16) in the past decade. Australia has consistently reported robust real GDP growth for an advanced economy, but corporate earnings in recent years have reflected volatility in commodities, a key sector of Australia’s economy. In addition to the volatility of commodity prices, there are concerns about a housing bubble in parts of Australia.

Investors who find Australia’s long-term fundamentals appealing but have concerns about the near-term risks should consider writing a covered call on EWA. A covered call, which is a combination of a long position in a stock or ETF and a short position in a call on that security. The money received from selling the call improves the investor’s total return in scenarios where the price of the stock or ETF is below the call’s strike price. Covered call investors forfeit any additional upside if the stock or ETF’s price exceeds the strike price at the call’s expiration. The article titled “Use Covered Calls To Mitigate Downside Risk” explains this strategy.

Conclusion

After more than a decade of underperformance relative to the S&P 500, foreign equities could be poised for a strong couple of years particularly in Canada, India and Australia. A covered call strategy could be effective at mitigating some near-term issues in Australia. Prospects for investments in Latin America, China and Europe are riskier due to political issues and lagging growth.

Disclosure: I am/we are long EPI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News