[ad_1]

primeimages/iStock via Getty Images

By Brian Manby

In October 2021, in collaboration with Valmark, we launched the WisdomTree Target Range Fund (GTR) as a potential solution for market volatility. The new strategy attempts to address one of investing’s most fundamental concerns: how to potentially limit downside exposure during steep sell-offs while retaining as much upside potential as possible during market rallies.

Option Mechanics

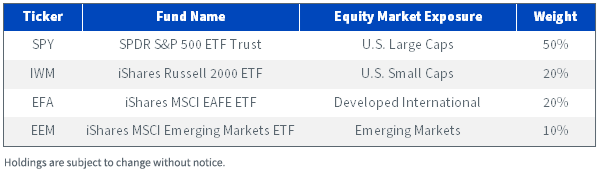

As an options-based strategy, the Fund seeks to provide capital appreciation while attempting to hedge risk in equity markets through bull call option spreads. Each January, the Fund purchases call options that are 15% in the money (ITM) on four ETFs, offering exposure to U.S., international, and emerging market equities in the following proportions:

ETFs Underlying GTR’s Options

Author

Simultaneously, the Fund also sells options on the same ETFs, in the same proportions, which are 15% out of the money (OTM), completing a spread strategy that attempts to deliver performance for the year ahead in a prespecified “target range.” Selling options collect premium income from buyers, which helps offset some of the premiums paid for the other options purchased as part of the strategy.

How Does This Work?

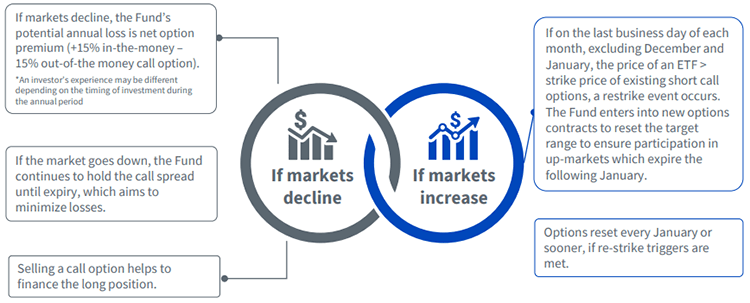

GTR and its options strategy attempt to balance risk management and upside potential by limiting the range of total returns.

If markets decline substantially (i.e., by more than the 15% range indicated by the ITM and OTM options purchased and sold), then both options would expire worthlessly, and an investor’s loss is limited to the net premium paid for the long option position.

On the other hand, if markets rally, then the long option position would theoretically be exercised to purchase the asset at a price below the prevailing market value. Depending on how much markets rallied, however, the option positions sold may be ITM (i.e., if they rallied beyond 15%) and would require delivery of the underlying to whom it was sold (again, at a price below prevailing market value). This effectively caps an investor’s upside from the strategy when markets rise while also limiting the downside to the net premium paid when markets fall.

Author

Monitoring the Strategy throughout the Year

Obviously, not every investor in GTR will purchase the strategy on the same date the options are purchased each January (referred to as the option rollover date) and have the same defined “target range” experience described above.

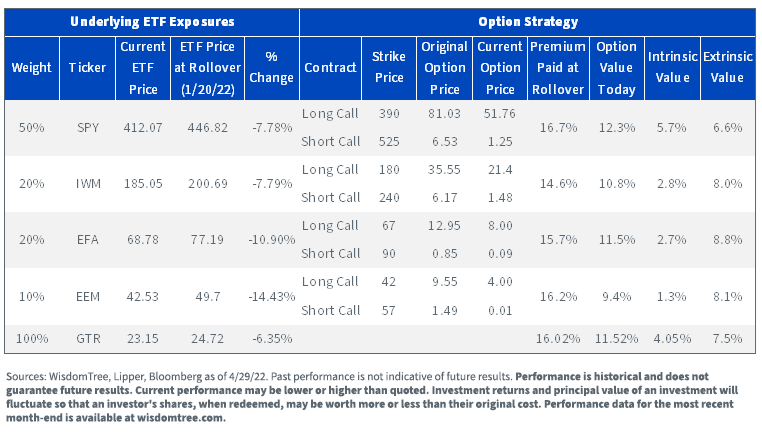

To illustrate how the strategy changes with prevailing market conditions throughout the year, we recently introduced a monitor for financial professionals available on our website that tracks the current option mechanics. It details the original options purchased during the January rollover and the updated prices so that investors can better assess the potential target range outcomes for their portfolios.

For example, as of April 29, a new investor in GTR would theoretically pay about 11.5% in option premiums (less than what would have been paid at rollover in January). This is based on the difference between prevailing long and short call option premiums as a percentage of the underlying ETF’s price on April 29, weighted for each position’s exposure in the strategy and summed accordingly. This 11.5% represents the long exposure in global equities and is what allows you to retain upside potential during bull markets.

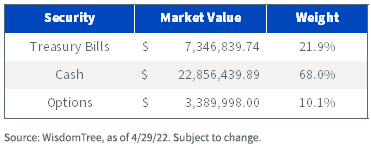

However, it is also what provides the target range for the floor. For example, if markets were to plummet, these option values would fall toward 0 and expire OTM. The rest of the Fund is held in cash and collateral securities that are unimpacted by equity market fluctuations.

Fund Composition as of 4/29/22

Author

Author

For the most recent GTR performance click here.

Furthermore, each option position currently contains both intrinsic and extrinsic value, which reflects how markets have moved since the positions were established in January.

Of the total 11.5% option value as of April 29, about 4% is due to the underlying ETF exposures trading slightly above their long strike prices while remaining comfortably below the short strike prices. This may be particularly attractive amid the choppy markets that have characterized 2022 so far. Although global equities have fallen, rangebound markets are an ideal environment for GTR, and as of now, there seems to be no immediate end in sight for many of the risk factors that have weighed on sentiment this year.

The remaining value comes from extrinsic value, or time value, which represents additional upside potential that can still occur before expiry if markets catch a tailwind.

We think this new tool will be helpful for educating investors about GTR as a potential solution for market volatility while also clarifying what their “target range” experiences might be, depending on when they invest. Please take a look at GTR’s web page for more information.

Important Risks Related to this Article

The Fund is actively managed and implements a strategy similar to the methodology of the TOPS® Global Equity Target Range™ Index (the “Index”), which seeks to track the performance of a cash-secured call spread option strategy. There can be no assurance that the Index or the Fund will achieve its respective investment objectives or that the Fund will successfully implement its investment strategy. Moreover, while the Fund seeks to target returns within a prescribed range, thereby minimizing downside investment loss, there can be no guarantee that an investor in the Fund will experience limited downside protection, particularly short-term investors, investors that seek to time the market and/or investors that invest over a period other than the annual period. The Fund’s options strategy will subject Fund returns to an upside limitation on returns attributable to the assets underlying the options. The Fund’s investments in options may be subject to volatile swings in price influenced by changes in the value of the underlying ETFs or other reference asset. The return on an options contract may not correlate with the return of its underlying reference asset. The Fund may utilize FLEX Options to carry out its investment strategy. FLEX Options may be less liquid than standard options, which may make it more difficult for the Fund to close out of its FLEX Options positions at desired times and prices. The Fund’s use of derivatives will give rise to leverage, and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning, and you may lose money. Investment exposure to securities and instruments traded in non-U.S., developing or emerging markets can involve additional risks relating to political, economic or regulatory conditions not associated with investments in U.S. securities and more developed international markets. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby, Senior Analyst, Research

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016, and is pursuing the Chartered Financial Analyst designation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source links Google News