[ad_1]

Bet_Noire/iStock via Getty Images

If you are a classic over-thinker, and it keeps getting you into problems with your portfolio, perhaps the best idea is to keep things simple. This might be especially sensible when the market is correcting, and things are looking frantic. Vanguard’s Total Stock Market ETF (VTI) is the ETF version of the largest equity mutual fund in terms of assets under management, VTSAX. It is a reasonable choice and also a pretty popular one, for good reason.

VTI is the third largest equity ETF. The fund uses an index investment approach that is designed to track the performance of the CRSP U.S. Total Market Index. This index essentially represents all stocks traded on both the New York Stock Exchange and the Nasdaq Stock Market. VTI is the standard for broad index investing, though many competitors have shown up that are also quite reasonable passive funds.

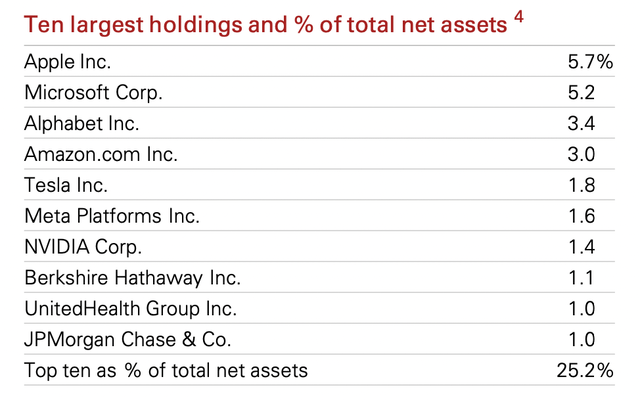

VTI is composed of over 3,600 companies. VTI’s holdings are based on key characteristics that include market capitalization and industry weightings, but also considers certain financial measures, such as P/E ratio and dividend yield. About 80% of VTI weighting is within the S&P 500, and the top holdings are almost always the same, due to the sheer mass of the largest companies.

VTI top 10 holdings

Vanguard VTI fact sheet

The last time a holding made it into the top ten holdings of VTI without also being in the S&P 500 was in 2020, when Tesla (TSLA) appreciated by over 700% within the year before getting into the S&P 500 in late December.

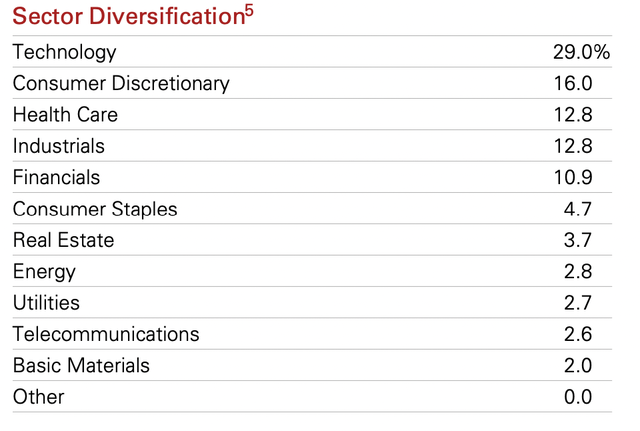

Much like the broader market, VTI frequently suffers from excessive concentration in popular sectors and stocks. This is a risk, but it is only in proportion to the market itself. VTI is currently most heavily concentrated in the technology sector, which makes up over 29% of the fund.

VTI sector weighting

Vanguard’s VTI fact sheet

VTI is the third largest ETF in the market, with both the first and second place being held by S&P 500 tracking ETFs. It is clearly a very popular choice. Investors allocated over $44 billion into VTI in 2021.

An allocation into VTI is basically guaranteed to not beat the market, but rather to be the market. To that end, investors in VTI are not trying to find outperformance, but rather simply accept the proposition that equities are likely to appreciate over time, and that a fund like VTI will closely track that movement. Therefore, while it should not outperform the market, it should also not underperform it.

Due to VTI’s broad structure and low fee, it is a reasonable choice for dollar cost averaging into over a long period of time. Moreover, advisors are fond of such funds because the construction eliminates much of the potential liability a fiduciary could suffer from portfolio construction under modern portfolio theory.

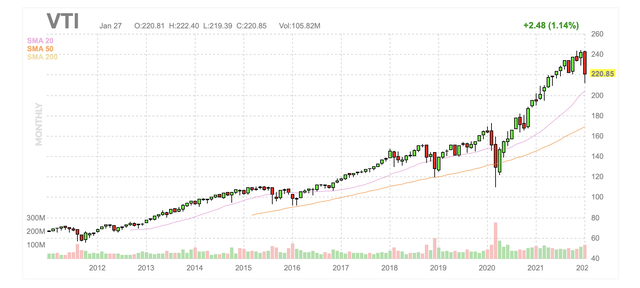

The market is currently experiencing a dramatic and broad drawdown in a short period of time. This appears a reasonable point at which to dollar cost average into a total market fund like VTI, because almost everything is selling off. While one does not enjoy what now appears like hourly opportunities to dollar cost average, these highly volatile drawdowns are almost always sensible points to buy the market. VTI’s size also provides it with a good level of liquidity and narrow spreads on these occasions.

Another advantage here is that a total market allocation like VTI requires significantly less oversight than a basket of stocks. This is not only the case when reviewing a portfolio and its performance over time, but also when considering what to buy when the market is in a state of panic, or which to sell when you might have your own personal reasons to do so.

Rather than get stuck wondering which choice to make, you make the average choice. It might not be the best choice, but it is almost certainly not the worst choice. Further, relative performance seems to increase over time versus most other possible selections. Moments of such weakness are to be bought.

VTI monthly candlestick chart

Finviz

Passive total market index funds might outperform active selections over long time frames, but they are still susceptible to market volatility and risk. VTI is down about 9% since the start of 2022, which is rather significant, but in line with the market. Moves like this are always hard to stomach, but they are also usually great times to buy equities.

Conclusion

VTI and the market may continue this move downward, but it is also quite possible that the bottom was already set. In either case, this decline is likely to be a great buying opportunity over mid and long term time frames. VTI is one of the most reasonable ways to slowly add equity exposure during this contraction, and it is also likely to remain a sensible core holding for years.

[ad_2]

Source links Google News