[ad_1]

Jetlinerimages/E+ via Getty Images

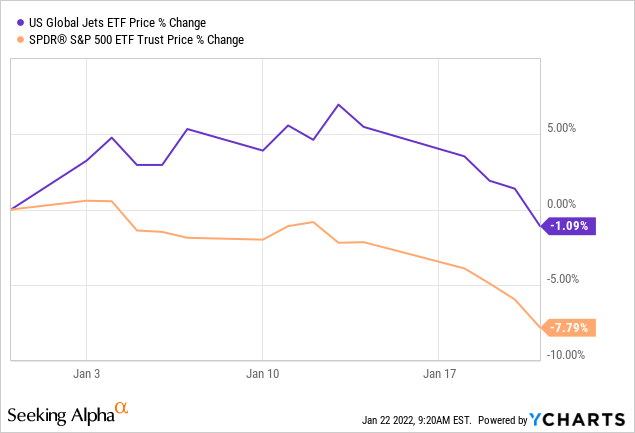

Stocks have been getting crushed so far in 2022. Tech stocks are leading the downside as investors are concerned about sky-high valuations.

Despite the recent selloff, which may continue, I am bullish on the airline sector and the JETS ETF (JETS). The set-up for airlines is similar to what happened in early 2021. Back then, I made a similar prediction: JETS: 35% Upside In 2021, Airline Recovery Accelerating.

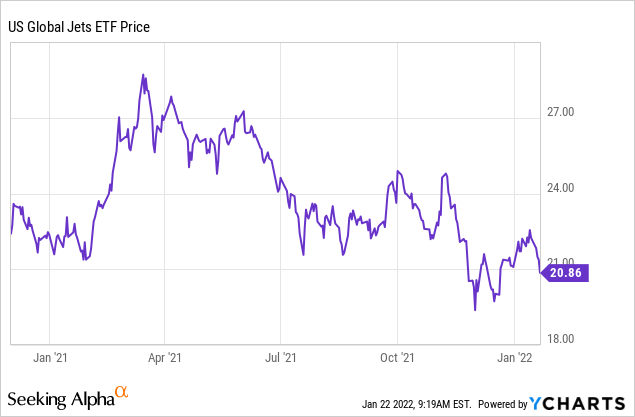

JETS had a strong start to 2021 and rallied up to $28.98 in March. The 1Q 2021 rally was driven by the increase in air travel as COVID vaccines were distributed. After getting close to $30 in 1Q, JETS declined for the rest of the year as airlines faced cost pressures from rising oil prices. Also, the Delta and Omicron variants pushed out the timeline for the end of the pandemic.

JETS is now back to the $21 range and I think it has 44% upside potential in 2022 to reach $30 per share. The fundamentals are much stronger in 2022 as the airlines are positioned for significant earnings growth.

The JETS ETF is holding up better than the S&P 500 so far in 2022. The airlines may be benefiting from investors rotating into cyclical sectors.

Return to 2019 Revenue in Late 2022

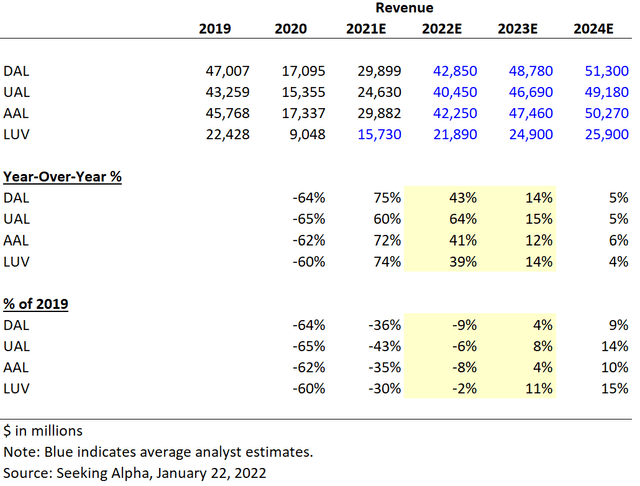

The top-4 airlines represent approximately 40% of the JETS ETF. I use these airlines as a proxy for the JETS ETF because of their significant weighting.

- Delta Air Lines (DAL): 10.3%

- United Airlines (UAL): 10.1%

- American Airlines (AAL): 10.0%

- Southwest Airlines (LUV): 9.5%

Analysts are forecasting that these airlines will grow revenue approximately 50% in 2022. If the airlines meet these targets, 2022 revenue would be slightly below 2019 (pre-COVID) levels.

Revenue for the airlines will be negatively impacted by the Omicron variant in 1Q 2022. Revenue should accelerate during the year, assuming no further variants.

The airlines are positioned for a very strong holiday season in 2022. Analyst forecasts suggest that the revenue run-rate at the end of 2022 will be back to 2019 levels.

Airline Revenue Growth

Seeking Alpha, Average Analyst Estimates

Earnings Momentum in 2022

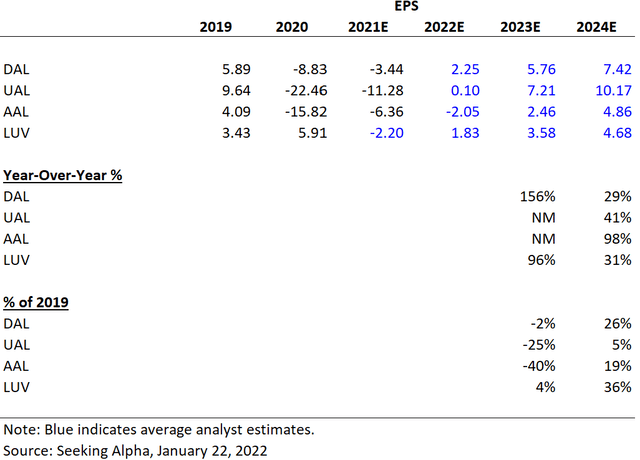

Most of the top airlines are forecasted to return to positive EPS on a full-year basis in 2022. The main driver is the rebound in revenue. Furthermore, analyst estimates for 2023 assume that EPS for Delta and Southwest will return to approximately the same levels as 2019. United and American are expected to lag a bit and reach 2019 levels by 2024.

Airline EPS Growth

Seeking Alpha, Average Analyst Estimates

Investors will be focused on the cost structure of the airlines in 2022. The following three dynamics are key to how much of the airlines’ revenue falls to the bottom line:

- Jet Fuel Prices – Oil prices have rebounded over the last two years, driving up the price in jet fuel. In fact, the rise of oil prices in mid-2021 was one of the drivers that caused headwinds for the stocks of the airlines in 2Q/3Q 2021.

- Labor Inflation – Wages are rising across the economy. The airlines have a high-skilled workforce, especially pilots and flight attendants. There is a lot of training that is required to hire new workers. Labor shortages due to COVID negatively impacted the airlines during the 2021 holiday season. The airlines are facing labor inflation pressures as they ramp-up operations in 2022.

- Operational Efficiencies – The airlines have significant opportunities to realize operational efficiencies in 2022 as they ramp-up operations. The airlines took significant cost out during the COVID downturn. Some airlines also reduced complexity by retiring older airplanes. As revenue ramps-up in 2022, the airlines will have an opportunity to see how their actions over the last two years translate into operating leverage.

Valuation

The S&P 500 is currently trading at 27.24x trailing EPS and 20.10x forward earnings per share (source: WSJ)

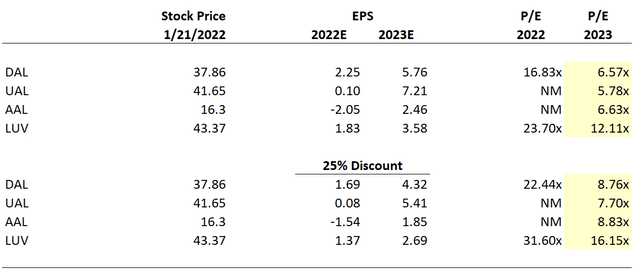

Delta and Southwest are trading at a 2022 P/E that is in-line with the market. However, the earnings potential for the airlines over the next two years makes the 2023 P/E very attractive at these levels.

In the table below, I also discounted the EPS estimates by 25%. Analysts tend to start out the year with high estimates and lower them over time. Even with a 25% discount to 2022 and 2023 estimates, Delta, United and American Airlines are all trading at a single-digit P/E level based on 2023 EPS.

Airline P/E Valuations

Seeking Alpha Estimates and Author’s Calculations

Conclusions

The JETS ETF was trading at approximately $30 per share pre-pandemic. It rallied in early 2021 almost back to that level. The COVID pandemic is coming to an end and airline revenues will be approaching pre-pandemic levels in about a year.

The market is in the grips of a selloff. But, the selloff will abate and I expect investors will continue to gravitate to cyclical sectors with earnings growth and attractive valuations. The airlines are trading at attractive valuations assuming they can achieve the expected 2022 and 2023 EPS targets.

[ad_2]

Source link Google News