[ad_1]

Michael Burrell/iStock via Getty Images

Don’t buy just because of P/E or nominal yield

Several articles have been written encouraging investors to pile into the relatively small Brazilian equity market on the basis of low price-to-earnings ratio, dividend yields, or just graphical analysis calling a bottom in the Bovespa equity index. Indeed, the price-to-earnings ratio is off lows, yet still much lower than other equity markets and its historical values, and the expected dividend yield of the index is attractive. However, the intelligent investor knows that these indicators don’t provide a complete picture. Let’s take a look beneath the surface.

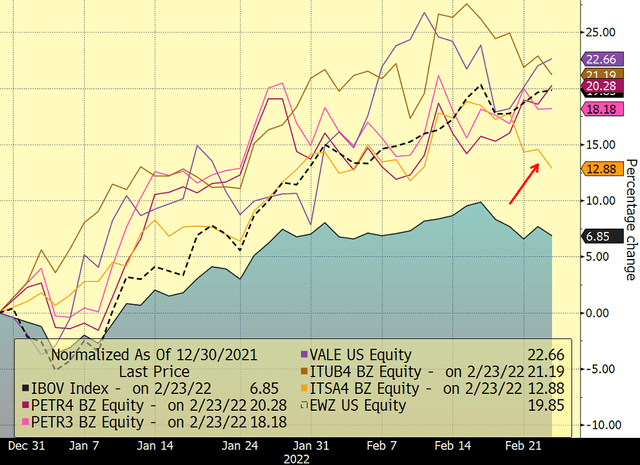

The iShares MSCI Brazil ETF (EWZ) holdings are highly concentrated: nearly 60% of its funds are concentrated in just ten holdings. Mining giant Vale (VALE) accounts for 18% of the fund. For scale, this is 1.15% of the company’s float. State-owned energy producer Petrobras (PBR) is nearly 15% of the fund and represents 1.22% of preferred float and 0.71% of common float. Latin America’s largest bank Itau (ITUB) accounting for a little over 6% (1.45% of float) is the third largest holding, though the actual ownership is slightly greater since the fund’s ninth largest holding, diversified conglomerate Itausa (OTCPK:ITVMF) also holds Itau as its flagship subsidiary. The Central Bank of Brazil’s sharp interest rate increases over the last year taking the target rate from a low of 2% to 10.75% in less than a year bodes well for large banks like Itau. Similarly, the rise in oil prices has lifted the price of all large energy producers all over the world. However, Itausa which operates in many more sectors ranging from real estate to chemicals to IT has been showing some weakness over the last two weeks along with the broad market index while the ETF’s price has not. Similarly, some manufacturing sectors of the Bovespa have had painful losses since the start of the year, like aeroplane manufacturer Embraer (ERJ) and shoemaker Alpargatas, most known for the Havaianas sandals, both losing over 30% since the start of the year. Rumo (OTC:RUMOF) owns and operates rail networks to transport agricultural commodities and intermediate goods like automotive parts, petrochemicals, and steel. Its activities are closely linked to Brazil’s extractive and manufacturing economy. And yet, its shares are down about 12% year-to-date. This points to further weakness under the surface. For now, however, these weaknesses are overshadowed by heavily-weighted outperformers. The MSCI Brazil ETF lost over USD 5 million in Rumo since the start of the year on a position just shy of 1.5% of the fund but this loss is overshadowed by the USD 11 million that it made on Vale, 18% of the fund.

Growth in prices since the start of 2022 for EWZ and some of its components, with the Bovespa index for reference (Bloomberg, MSCI)

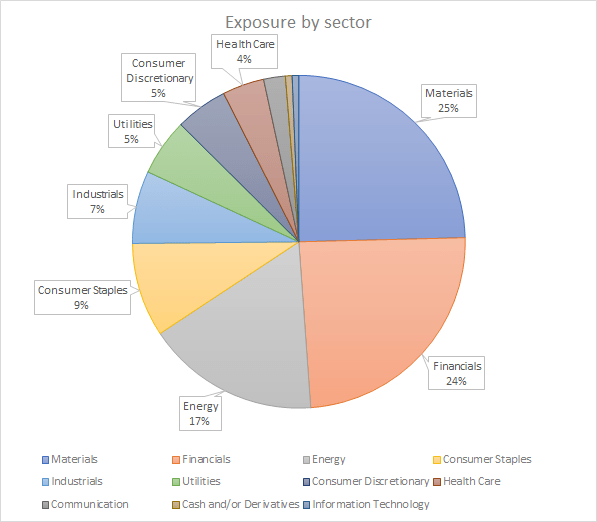

Keep looking and you’ll notice some other strange things below the surface. What is the best performer, by far, year-to-date in Brazil’s equity index? The stock of the stock exchange, Brasil, Bolsa, Balcao or B3, which accounts for 4.25% of the fund’s holdings. In fact, the ETF is not so much a bet on Brazil’s economy as a whole but rather a concentrated bet on a miner of hard commodities, a state-owned oil major, and large-cap financials.

Sectors of exposure provided by the MSCI Brazil ETF (Source: MSCI)

Commodities demand is not everything

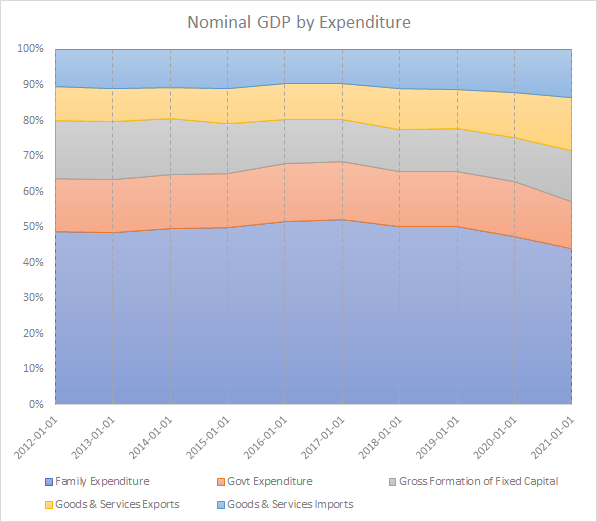

A prevailing story in financial publications is that a growing world — and particularly a growing China — will produce strong demand for commodities and therefore be good for countries like Brazil. It’s not wrong, just reductionist. For one, Brazil is much more than a simple commodity exporter, even if exports have been a growing share of GDP for the past few years.

Evolution of contributions to GDP by account (Bloomberg)

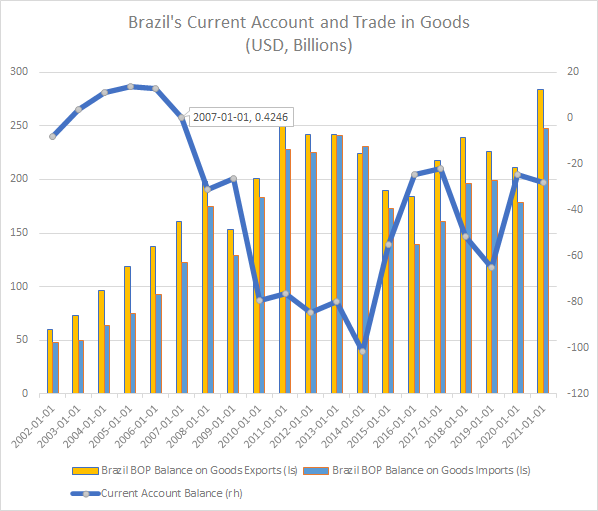

In fact, Brazil has had a persistent current account deficit for over a decade. The last time that Brazil had a current account surplus was before the Great Recession of 2007-2009.

Import and exports of goods, by value, and current account balance (Bloomberg)

The reason for this is the very large credit of primary income in the balance of payments — essentially wealth that flows out to foreign investors. On face-value this is not a problem, until one considers how fertile this issue is for populists. The risk which may not be fully appreciated by investors is that in a crowded political field in a year of general elections, someone will hatch a plan to do something about it if elected. And sometimes those people get elected, like in Peru where President Castillo did do something about it. He got to power “pledging to squeeze more money from Peru’s miners. His government […] already proposed ‘a new tax on profits’ for mining companies and ‘an end to tax breaks’,” according to a Financial Times article from November, 2021 also reporting that a miner’s shares dropped 27% on the day that Peru’s government decided to close mines on environmental grounds. It is also pushing a tax reform that increases the fiscal burden of mining companies when ore prices are rise. Although the proposal was rejected by the Peruvian Congress in late December 2021, the intelligent investor knows that the political forces pushing for more wealth to remain in the country to fund social programs to alleviate poverty have not vanished. There is a non-negligible risk that Brazilian political hopefuls will take inspiration from their neighbours.

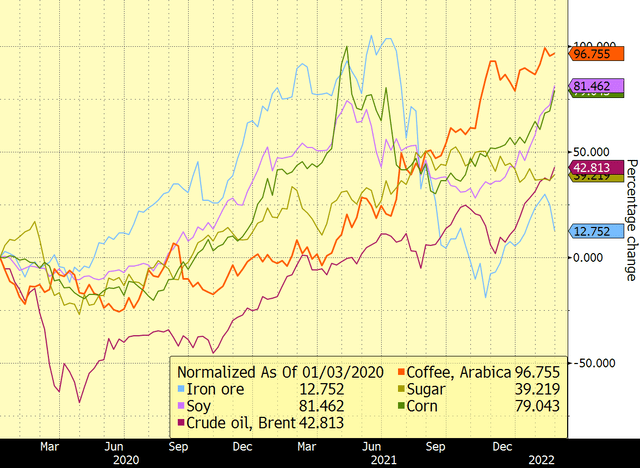

Two, commodity prices reflect supply and demand and higher commodity prices do not guarantee higher export revenues. Brazil’s principal exports by value are soy, iron ore, petroleum, corn, sugar, and coffee. All of these have increased since the start of 2020 but none like Arabica coffee which is up nearly 100% in U.S. dollar terms.

Growth of prices in commodities that Brazil exports (Bloomberg, OEC)

Of course, this sounds like fantastic news for a major global producer of Arabica coffee… until one learns that drought then frost decimated shrubs in Brazil and harvests will be disappointing this year and next. Brazil is the world’s largest producer of soybeans. Soy prices are surpassing nine-year highs! But this is because the harvest in South America will be reduced due to drought, in addition to a little boost from the Ukrainian supply now being at risk. Petroleum is up and so are prices at the pump and leading politicians are toying with the prospect of modifying the constitution in order help the population struggling to pay global rates charged by the state-owned Petrobras. Corn is up, too. Brazil is looking to barter five million tons directly to Iran in exchange of fertilizers. Yes, commodity prices are increasing globally but the commodity windfall for which several investors are placing bets needs closer examination. And ironically, the investors pouring money into Brazil are strengthening the currency with their investment capital inflows, which is decreasing incentives to sell commodities priced in US dollars further global crimping supply and increasing prices.

Bottom line:

When something is too good to be true, it probably is. Brazil has immense potential but it also faces a hefty amount of challenges. Stay prudent.

[ad_2]

Source links Google News