[ad_1]

imaginima/E+ via Getty Images

Investment Thesis

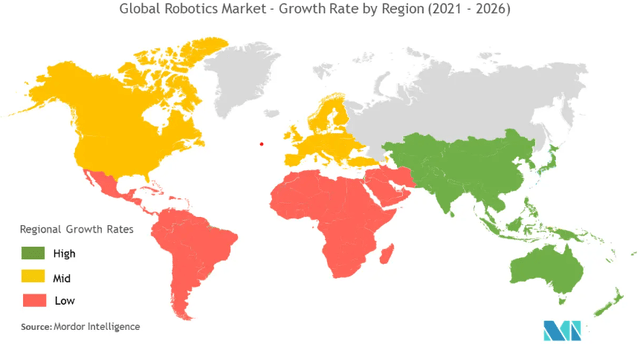

Robots have a wide range of benefits, from saving time and money to working in hazardous environments. According to Mordor Intelligence, the global robotics market was valued at $27.73 billion in 2020 and is expected to reach $74.1 billion by 2026, registering a CAGR of 17.45% during that period. The decline in the cost of robots served as one of the main catalysts for growth over time. For instance, the average cost of an industrial robot has dropped from $46,000 in 2010 to $27,000 in 2017 – and is expected to fall below $11,000 by 2025 as technology improves, enabling greater use across sectors.

Mordor Intelligence

On other hand, the global artificial intelligence market size was valued at $93.5 billion in 2021, and it is expected to increase at a CAGR of 38.1% from 2022 to 2030. The continuous research and innovation directed by IT giants are driving the adoption of sophisticated AI technologies across a large number of industries. All in all, I believe that robotics and AI have a large runway in front of them and both segments will grow at a higher rate than the global economy. In this article, I will review the Global X Robotics & Artificial Intelligence Thematic ETF (NASDAQ:BOTZ), which provides exposure to a basket of companies involved in the AI and robotics revolution.

Strategy Details

The Global X Robotics & Artificial Intelligence ETF (BOTZ) tracks the performance of the Indxx Global Robotics & Artificial Intelligence Thematic Index. The index invests in firms that stand to gain from greater robotics and artificial intelligence acceptance and use, such as those active in industrial robotics and automation, non-industrial robots, and autonomous cars.

If you want to learn more about the strategy, please click here.

Portfolio Composition

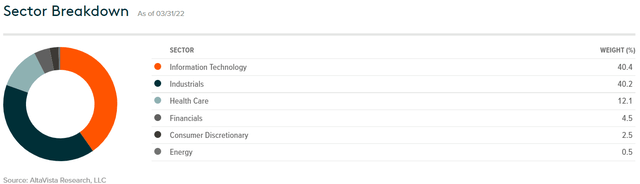

From the sector allocation chart below, we can see the index places a high weight on the Information Technology sector (representing around 40% of the index), followed by Industrials (accounting for 40% of the index) and Healthcare (representing around 12% of the fund). The largest three sectors have a combined allocation of approximately 94.55%.

Global X ETFs

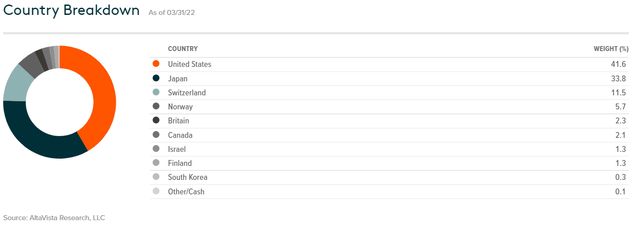

In terms of geographical allocation, the United States accounts for 42% of total assets, whereas other countries such as South Korea seem to be underrepresented given the low weight (only a 0.3% allocation to South Korea).

Global X ETFs

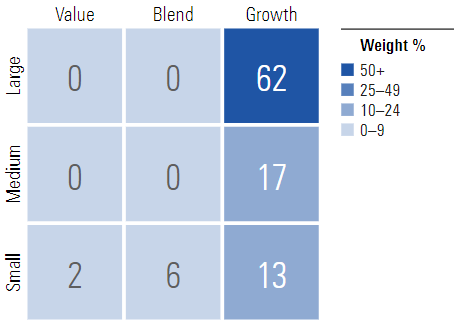

BOTZ invests over 62% of the funds into large-cap growth issuers, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is mid-cap growth equities. Unsurprisingly, this ETF allocates approximately 92% of the funds to growth stocks, which are generally more volatile than value stocks.

Morningstar

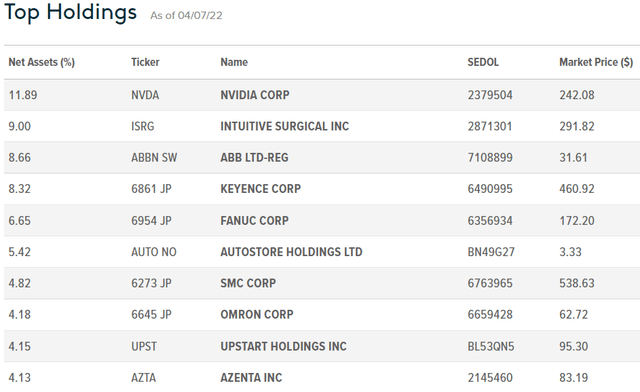

The fund is currently invested in 38 different stocks. The top 10 holdings account for ~67% of the portfolio, with no single stock weighting more than 12%. All in all, I would say the fund is pretty concentrated in a few high-conviction names. I think it is important to be comfortable with such a portfolio before buying BOTZ, as such concentration can remove some of the benefits of diversification and increase volatility.

Global X ETFs

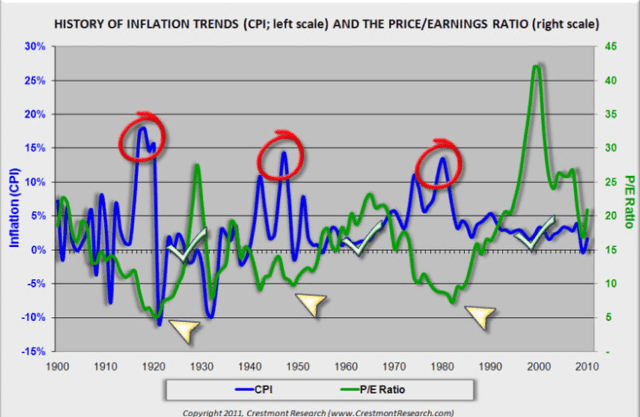

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to Global X ETFs, BOTZ currently trades at an average forward price-to-book ratio of 4.24 and an average forward price-to-earnings ratio of ~35. I generally consider a company trading at a forward price-to-earnings ratio above 20 to be richly valued. Moreover, I think it is hard to justify holding stocks with a P/E above 20 when the Fed and other central banks around the world are beginning to tighten monetary policy and raise interest rates.

Is This ETF Right for Me?

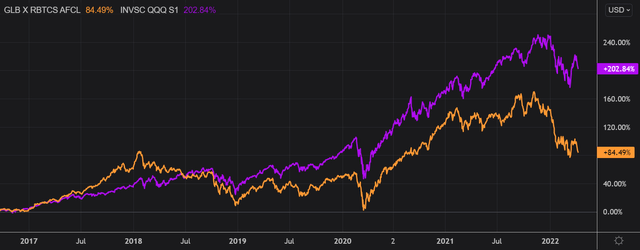

I have compared below BOTZ’s price performance against the Invesco QQQ ETF (NYSEARCA:QQQ) over the last 5 years to assess which one was a better investment. Over that period, QQQ outperformed BOTZ by over ~110 percentage points. To put BOTZ’s performance into perspective, a $100 investment in this ETF 5 years ago would now be worth ~$184.49. This represents a compound annual growth rate of ~13% excluding dividends, which is a good absolute return.

Refinitiv Eikon

Going forward, I would personally be cautious about BOTZ given the fact that we are now entering a new phase of monetary policy where liquidity is likely to be scarce compared to the previous decade. At the same time, we know that elevated inflation is likely to put a great deal of pressure on valuations and high PE stocks are the most vulnerable category in the current market environment. This is reflected in BOTZ’s performance over the last 6 months where we can clearly see that it has underperformed the market. I don’t see any catalyst that should reverse this trend in the near future. Thus, I expect BOTZ to underperform the market over the next couple of months.

Crestmont Research

Key Takeaways

Robotics and AI are among the fastest-growing industries in the IT sector. As a result, they are expected to grow much faster than the global economy, thus providing an interesting investment opportunity. BOTZ provides exposure to a basket of leaders in the fields of robotics and AI.

However, if we look at valuations across these two categories, a large number of companies are trading at more than 30x earnings and are overpriced in my opinion, leaving no margin of safety for potential buyers. This adds a lot of risk in my opinion in the current market environment given the fact that we are at an inflection point in monetary policy and inflation is running hot. I think that BOTZ’s recent underperformance is likely to continue over the next month, which should provide a good buying opportunity at some point for patient investors.

[ad_2]

Source links Google News