[ad_1]

cagkansayin

By Rob Isbitts

Summary

PIMCO Active Bond ETF (NYSEARCA:BOND) can be thought of as a proxy for the performance of active bond management. It is run by the iconic PIMCO, the former home of “Bond King” Bill Gross and, and current home of investment strategy icon Mohamed El-Erian (who continues his association with PIMCO as Chief Economic Advisor at Allianz, which bought PIMCO way back in the year 2000).

While the firm still has a deserved strong name in the investment management business, the BOND ETF has a history that shouts “track the index, but charge more.” I rate it a Strong Sell, despite its already tough-sledding in 2022.

Strategy

BOND tries to produce higher returns than the Bloomberg U.S. Aggregate Index, which is essentially the bond market’s version of the S&P 500 Index. That is, it is the most popular benchmark for how bonds are performing. To attempt to accomplish this outperformance, BOND actively trades bonds, leaning heavily toward “high-quality” bonds as its benchmark does.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Bonds & Cash

-

Sub-Segment: U.S. High-Quality Bonds

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

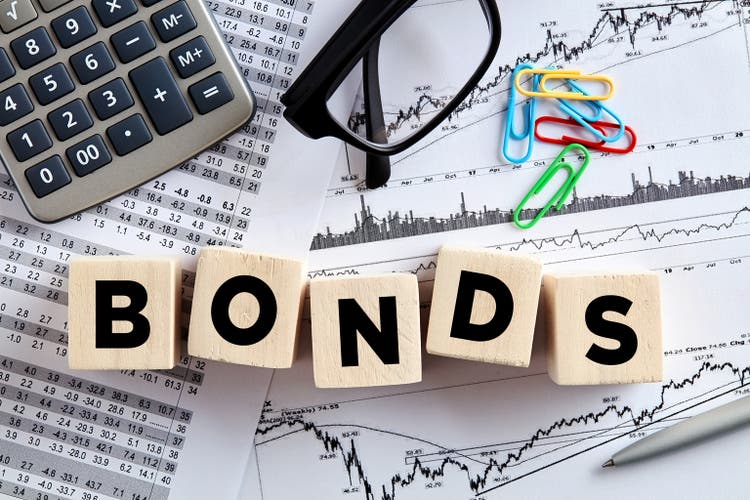

On the surface, BOND might appear to investors as something less-complex than it is. After all, it’s just a proxy for the high-quality U.S. bond market, right? Actually, it is, as long as nothing bad happens in the bond market. Then, as in the 2008 Global Financial Crisis, some things you don’t see in the “Top 10 Holdings” can bite your money in the wallet. This was taken from the holdings list from PIMCO’s website, on the page for the BOND ETF. I dropped it into Excel, and the sky opened up, so to speak.

Credit Default Swaps…OMG! (Pimco.com)

That’s just a partial list of all of the “not-bonds” holdings in the fund. Futures are a very liquid asset, at least in normal times. And, the fund holds over 1,000 bonds. Why over 1,000? Because the fund and the firm (PIMCO) are so big, they can’t just drop into the bond market like an individual or small investment management firm can, buy what they need off a screen, and be done with their transaction. Instead, as with other giant bond managers, they have to get their bond portfolio, in part, by buying “exposure” to bonds. That leads them to some notorious areas of the derivatives market, including “Credit Default Swaps.” These were at the heart of the 2008 crisis, and yes, they still exist. Will they blow up a fund like BOND? That’s not something we can predict. But it is a risk, especially compared with buying bonds piece by piece.

Strengths

The biggest strength for BOND is the presence of PIMCO, assuming that firm does not suffer from the current bond bear market the way equity firms suffer in every stock bear market. PIMCO is the closest we may have to a “too big to fail” bond manager, and has diversified its offerings to equities and other asset classes over the years. That’s the best thing BOND has going for it.

As noted, active bond investing is a tough way to make a living right now. And with a trading turnover rate last reported at 380% (implying that the fund turns over completely about every 3 months), at least BOND is trying to make something happen for its shareholders.

Weaknesses

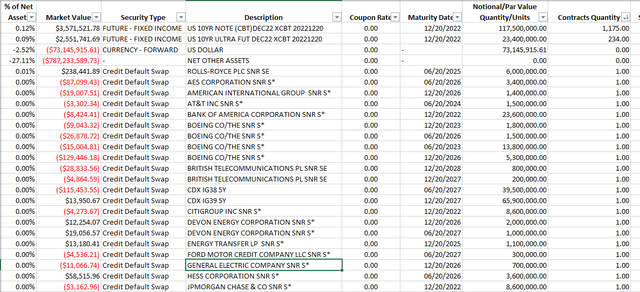

But we can’t give a lot of points for trying here. The fact is, this is a fund that is unlikely to stray too far from its benchmark, based on years of past performance history.

Above is a chart of 1-year rolling prices (monthly intervals) for BOND and the ETF-tracker for its benchmark index.

To be clear, I’m not bullish on buying bonds individually, either. And funds like BOND are a big reason for that pessimism. You see, the bond market doesn’t function like it used to. It is controlled by a limited number of players. That means that bond prices, bond liquidity and the broader state of bond investing, are now beholden to a very different set of risks than in the past. I’m old enough to remember buying bonds off things like the “blue list,” one bond at a time. But those days are long gone. Not because you can’t buy them individually, but because once you buy them, you own a different animal than you did in the past.

Opportunities

It’s a stretch, but the one opportunity we see for investors in BOND is that the bond market’s issues never come to fruition. That might allow the managers the type of room to add value through tactical management in an era of higher interest rates. Like back in the good old days for this fund. I don’t give that a high probability of coming to pass. But, as with any investment we analyze, there’s always a chance.

Threats

Aside from the generally bearish conditions in rates this year, there are bigger, more drastic threats to bond “investing” in any fashion beyond renting them as part of a tactical portfolio.

Years of Fed overreach in the bond market, propping it up by buying the bonds few others wanted, is how we got here. Now, with rates rising, it hits bond prices, and funds like BOND, particularly hard. That may all work out over time, but only if the bond market regains the confidence of global investors.

Many investors do not realize just how massive the bond market is, and how recent lack of liquidity (bonds for sale, buyers scarce) is perhaps the biggest risk in investing today.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Strong Sell

-

Long-Term Rating (next 12 months): Strong Sell

Conclusions

ETF Quality Opinion

BOND looks like a bond index fund with the added benefit of active, tactical management. But that’s not really what it is. The modern bond market and the firm’s sheer size are headwinds that won’t quickly disappear. So, we can’t endorse the fund construction as something of quality, even if the firm itself has a long history of success in raising and managing assets.

ETF Investment Opinion

I rate BOND a Strong Sell. There have been some fleeting opportunities over the years for BOND to add value to the index and earn a decent return for investors. But its active style has not produced when that style could have shown its best stuff, amid the 2022 bond bear market. And, given its necessary inclusion of credit default swaps and the limitations of its size, it seems like a futile exercise to try to wring significant long-term alpha out of any active bond strategy that is too big to be nimble.

[ad_2]

Source links Google News