[ad_1]

DKosig/E+ via Getty Images

A reader asked for my thoughts on the Vanguard Total International Bond ETF (NASDAQ:BNDX). BNDX is a diversified international bond index ETF, providing broad-based exposure to said asset class. Although there is nothing significantly wrong with the fund, it has few positives, and no compelling investment thesis. BNDX’s potential returns are quite low, due to the fund’s meager 2.6% yield to maturity, and as bonds rarely experience significant, long-lasting capital gains. BNDX focuses on long-term bonds, so losses could mount if rates were to increase, a distinct possibility in the current inflationary environment. Risks outweigh potential rewards, although both are relatively low. As such, I would not be investing in the fund at the present time.

BNDX Basics

- Investment Manager: Vanguard

- Expense Ratio: 0.07%

- Yield to Maturity: 2.6%

- Total Returns CAGR 5Y: 2.1%

BNDX Overview

BNDX is a diversified international bond index ETF. It is administered by Vanguard, the second-largest investment manager in the world, and the preeminent provider of simple, diversified, cheap, index funds. I’m generally quite bullish about Vanguard index funds, but BNDX focuses on a subpar asset class.

BNDX itself tracks the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged). Said index includes all investment-grade bonds, corporate and government, issued in foreign currencies, subject to a basic set of liquidity, maturity, size, etc., inclusion criteria. The index explicitly excludes dollar-denominated bonds, but is hedged against foreign currency fluctuations. The index also explicitly excludes non-investment grade bonds which, combined with other inclusion criteria, significantly reduces the index’s exposure to emerging market issuers. In general terms, BNDX’s underlying index successfully tracks its intended asset class, and has no significant issues or negatives.

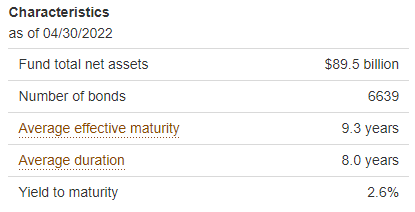

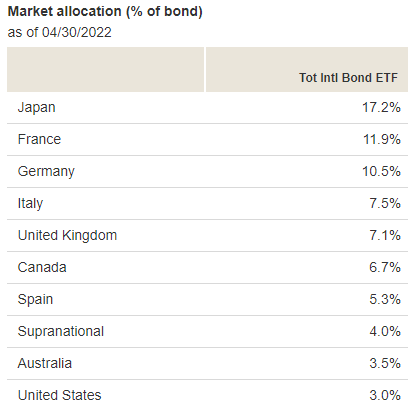

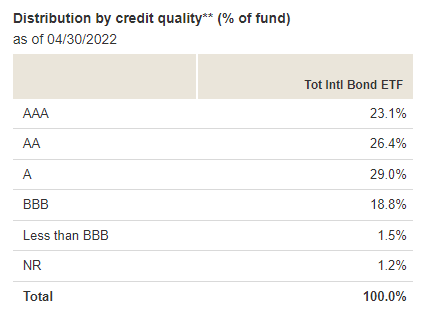

BNDX’s underlying index is quite broad, which results in an incredibly well-diversified fund, with investments in thousands of securities from most relevant bond sub-asset classes, and dozens of countries. Credit quality is quite high, with an average credit rating of AA.

BNDX Corporate Website

BNDX Corporate Website

BNDX Corporate Website

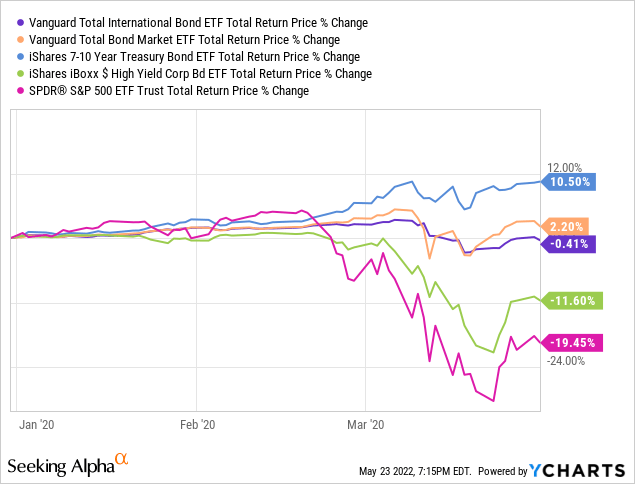

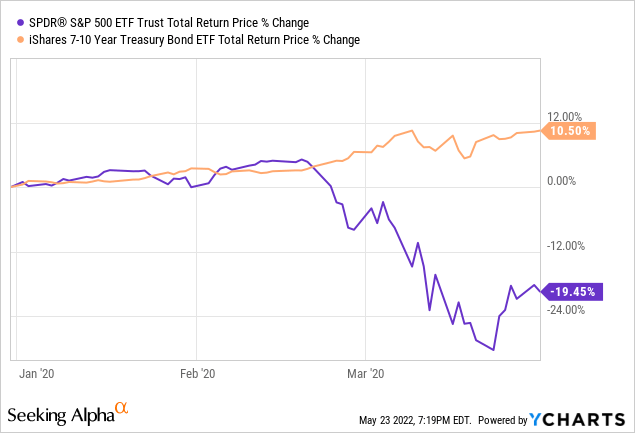

Diversification and quality both reduce portfolio risk and volatility, and minimize losses during downturns and recessions. As an example, the fund suffered minimal losses of 0.40% during 1Q2020, the onset of the coronavirus pandemic, and the most recent recession. BNDX significantly outperformed relative to equities and high-yield corporate bonds, slightly underperformed relative to dollar-denominated bonds, and significantly underperformed relative to treasuries. The fund is a reasonably safe investment, but not an effective hedge like treasuries.

BNDX’s diversified, safe holdings are a benefit for the fund and its shareholders, but pale in comparison to the fund’s negatives. Let’s have a look.

BNDX – Negatives

Low Potential Returns

BNDX’s potential returns are quite low, with the fund offering investors little in income, potential capital gains, or total returns.

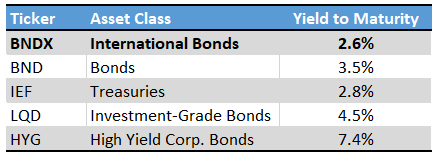

BNDX’s underlying holdings have a yield to maturity of 2.6%, an incredibly low figure, and below-average for a diversified bond fund. BNDX’s low yield is due to the fund focusing on high-quality, low-yield bonds, and due to the persistently low yields on Japanese and European bonds. Interest rates are rising across the board, so yields will likely increase in the coming months, but currently yields remain extremely low, a negative for the fund and its shareholders.

Fund Filings – Chart by Author

As an aside, the fund’s trailing twelve-months yield currently stands at 4.0%, quite a bit higher than above. BNDX’s trailing yield is higher as there was a relatively large special distribution in late 2021, due to regulatory and accounting issues surrounding foreign investments. Lots of international funds paid special distributions during the year, but these were generally not reflective of underlying generation of income, or indicative of future expected distributions. Yield to maturity figures are much more informative, in my opinion at least.

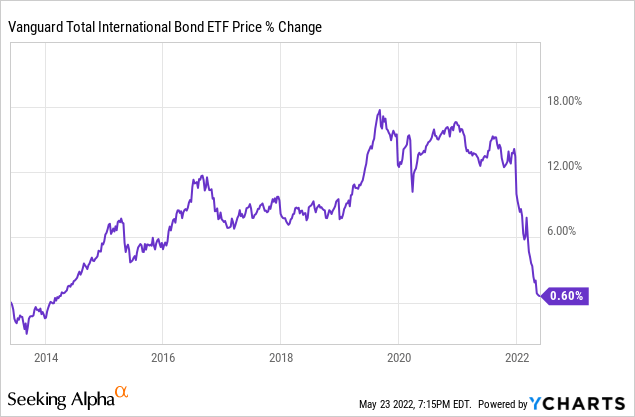

BNDX’s potential capital gains are also quite low, as the fund invests in bonds which, in the vast majority of cases, simply don’t see significant, long-lasting capital gains. Bonds are basically loans with interest rate payments, which get distributed to shareholders as dividends, and a predetermined price at maturity (face value). Bonds can see temporary, and generally reasonably small, changes in price, but the fact that prices at maturity are set anchors their prices, and effectively prevents long-term capital gains. BNDX itself has seen 0.6%, effectively zero, in capital gains since inception, around nine years ago. Results are broadly in-line with expectations.

BNDX offers investors a meager 2.6% yield and almost non-existent capital gains, so total returns will almost certainly be quite low moving forward, a significant negative for the fund and its shareholders.

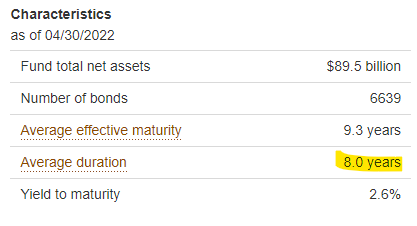

High Interest Rate Risk

BNDX’s holdings are generally older bonds, issued in the past couple of years. Yields are generally quite low, as bonds were issued when interest rates were at rock-bottom levels. Maturities are generally quite long, as issuers wanted to lock-in said low yields for as long as possible. As interest rates increase, investors will generally sell these older, lower-yielding issues to buy newer, higher-yielding alternatives. Selling pressure should lead to lower prices for these older bonds, and capital losses for their holders and their investors, including BDNX. The fund would be able to take advantage of higher interest rates once its holdings mature, which is in 9 years, on average. Higher interest rates would mean immediate capital losses, and higher yields in about a decade, so the net effect is overwhelmingly negative for all but the longest-term investors.

BNDX Corporate Website

Little Increase in Diversification

Diversification almost always reduces portfolio risk and volatility, but there are exceptions. In general terms, diversification works when returns are uncorrelated, meaning gains and losses occur in different time periods. Diversification is particularly impactful when returns are negatively correlated, meaning gains and losses occur in opposite time periods. Equities and treasuries are negatively correlated, especially during downturns, in which equities go down while treasuries go up. This was the case during 1Q2020, the onset of the coronavirus pandemic.

Negatively correlated assets can be used as hedges against one another. An equity investor might decide to hedge their equity portfolio with some treasury investment, which should lead to lower portfolio losses during downturns, as above.

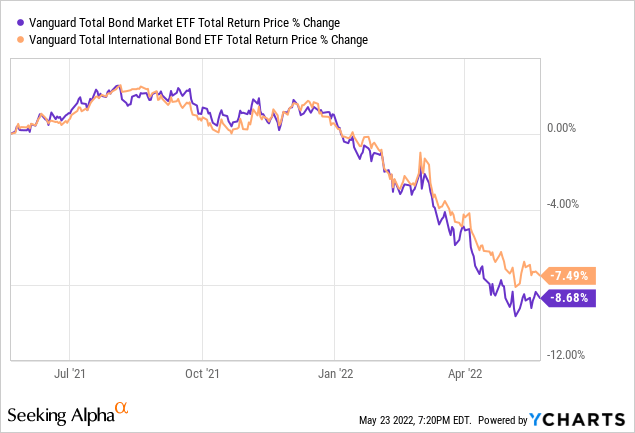

Positively correlated assets can’t generally be used as hedges against one another, as they both suffer losses at the same time. In general terms, BNDX is significantly positively correlated to dollar-denominated bonds, due to interest rate parity. In simple terms, credit markets are structured in such a way that the risk-adjusted yields on most bonds are as similar as possible, because traders arbitrage away all cases in which this is not the case. Foreign currency hedges are also generally structured in such a way as to make interest rate parity hold, although the specifics of this are outside the scope of this article. Performance for the past year has been very similar between these two asset classes, as expected.

Although there are periods of time in which these two asset classes do diverge in their performance, these are few and far between.

In my opinion, and considering the above, investing in BNDX does not materially increase diversification from a portfolio perspective, assuming investors have exposure to U.S. bonds. Although this is not a negative per se, it does mean the fund lacks a significant benefit. As mentioned previously, the issue with BNDX is that it lacks a viable investment thesis, and the lack of increased diversification is part of that.

Conclusion – No Compelling Investment Thesis

BNDX is a diversified international bond index ETF, providing broad-based exposure to said asset class. Although there is nothing significantly wrong with the fund, it has few positives, and no compelling investment thesis. As such, I would not be investing in the fund at the present time.

[ad_2]

Source links Google News