[ad_1]

ryasick/E+ via Getty Images

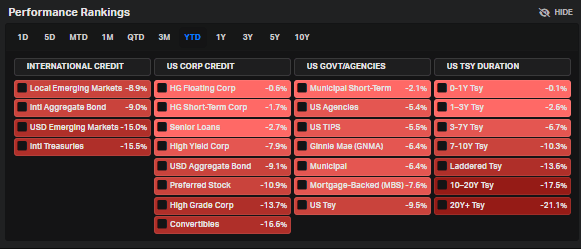

Short-term bond funds are top of mind among investors. Fears of continued higher interest rates frighten fixed-income investors as rising yields mean lower bond prices. A popular strategy this year has been to shorten duration and perhaps step out onto the risk spectrum among corporates. Of course, high-yield bonds have done very poorly in 2022, but even investment-grade debt has been dreadful. Rising rates have been a bigger negative factor on the global bond market versus credit and solvency concerns.

As a result, short-term, high-yield funds have been among the best performers in the bond universe. Among U.S. corporate credit factors, according to Koyfin Charts, the Invesco Senior Loan ETF (NYSEARCA:BKLN) is a top-tier performer in 2022.

BKLN: Decent Relative Returns in 2022

Koyfin Charts

Invesco’s BKLN is based on the S&P/LSTA U.S. Leveraged Loan 100 Index (Index). The Index is designed to track the market-weighted performance of the largest institutional leveraged loans based on market weightings, spreads, and interest payments, according to Invesco.

BKLN features a massive 5.48% current yield to maturity. That means holders receive a large monthly distribution rate, but also must take on significant credit risk. The ETF’s expense ratio is 0.65% while the median bid/ask spread is just five basis points. Digging into the portfolio, you’ll find that 51% of bond holdings have a “B” rating which is in the “junk” debt category.

Year-to-date, BKLN is down 4%, but that beats the aggregate bond market’s 10% total return loss.

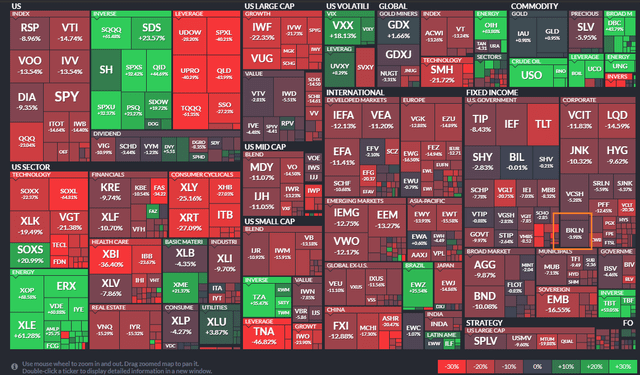

BKLN: A 2022 Outperformer In A Sea of Red

Finviz.com

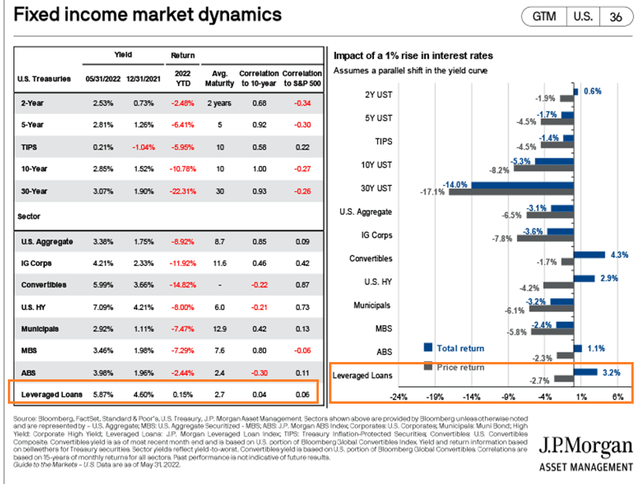

BKLN can be thought of as a leveraged loan fund. According to J.P. Morgan Asset Management, that category’s yield has increased materially from the end of 2021 and sports very little correlation to both the U.S. 10-year Treasury rate and the S&P 500. Moreover, even if rates rise by 1% over the next year, leveraged loans would still return a positive 3.2% total return. So, BKLN is an ideal way to have bond exposure if you are worried about market interest rates rising further.

Leveraged Loans Offer a Juicy Yield With Little Correlation to Traditional Stocks and Bonds

J.P. Morgan Asset Management

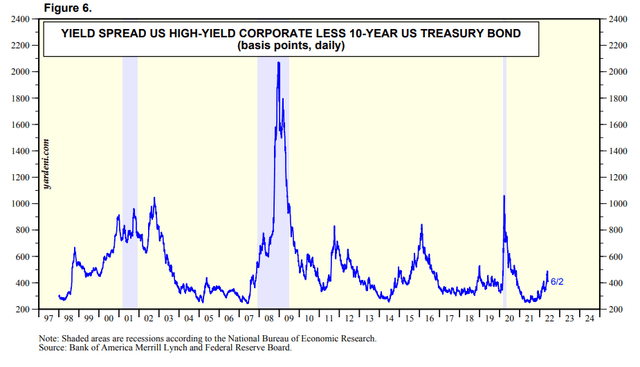

But you must be mindful of credit risk. I like to look at the high-yield credit spread chart to see where we stand with respect to fears of corporate bankruptcies leading to bond defaults. Right now, that spread is higher than year-ago levels, but still historically depressed.

High-Yield Corporate Credit Spreads Ticking Up

Yardeni.com

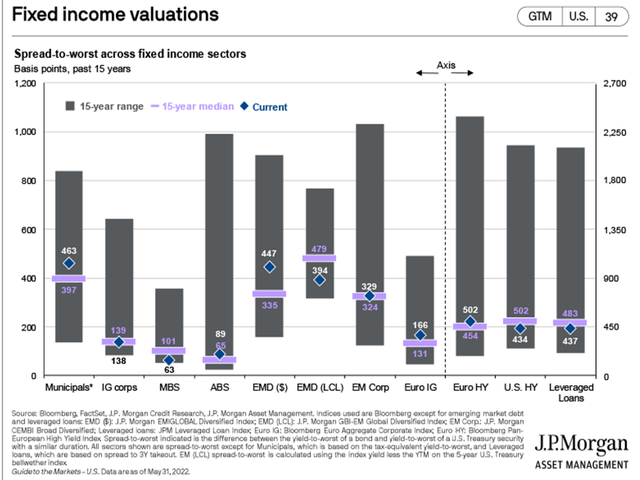

So with all the hoopla about credit concerns and tightening financial conditions, fixed income valuations, as measured by the spread-to-worst metric area very much in check. Buyers might want to consider buying BKLN when high-yield spreads blow out. Another strategy is to use technical analysis to identify favorable spread trends – buying as spreads trend lower can be a useful method.

Bond Spreads Remain Subdued Relative to History

J.P. Morgan Asset Management

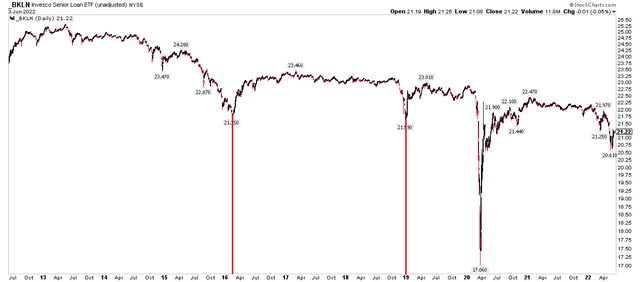

Indeed, let’s turn to the chart of BKLN. The long-term view shows that BKLN shares suffer when fear grips the market. There were significant lows in early 2016 which was the culmination of a weak global economic pullback, in early 2019 following a quick 20% drop for the S&P 500 following a Fed rate hike period, and of course, the Covid-Crash of March 2020 was a quick drop and recovery. The below chart is price-only (not including dividends).

BKLN Long-Term: Buy On Credit Panics

Stockcharts.com

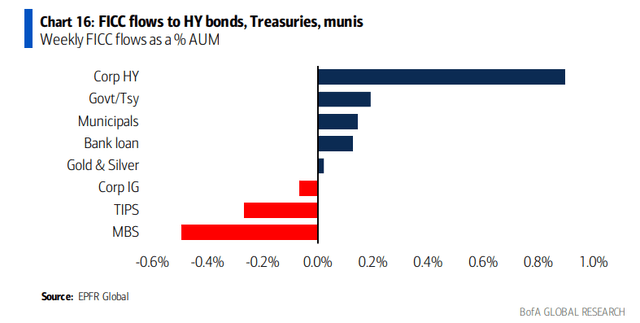

Short-term, conditions might be on the mend. According to BofA Global Research and EPFR flow data, bank loans experienced its first weekly inflow in four weeks as the Bank Loan ETF finally caught a bid.

BofA: First Weekly Bank Loan Inflow In A Month

BofA Global Research

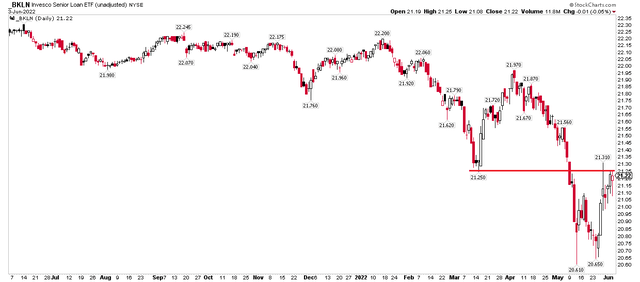

The near-term chart buttresses BofA’s investor positioning changes. BKLN has recovered recently but now finds itself at resistance near the $21 mark. For short-term horizons, I am a seller of BKLN here. Long-term investors should consider buying BKLN later this year as credit conditions deteriorate. Buying BKLN on the dip when credit spreads spike has historically been a winning formula.

BKLN: Trading At Resistance After A Rebound. Sell the Rip.

Stockcharts.com

The Bottom Line

I don’t see credit spreads hitting 2008 or March 2020 levels. Still, an ultimate move to the 600-800 basis point range on the HY spread makes sense to me for this cycle. I would buy BKLN once that happens. Right now, stay away from BKLN as it trades at resistance.

[ad_2]

Source links Google News