[ad_1]

Chinnapong

Since November 2021, Bitcoin (BTC-USD) and Ethereum (ETH-USD) fell to one-third the value at the most recent lows in late June. The leading cryptocurrencies put in a pair of bearish key reversal patterns on the daily charts late last year, leading to price carnage and what many market participants have called the crypto winter. Latecomers to the burgeoning asset class who bought Bitcoin, Ethereum, and over 20,000 other tokens have been licking their financial wounds in 2022. However, early buyers who purchased Bitcoin in 2010 when it was below $1 per token still had substantial gains at the recent low, which took the top cryptocurrency to above $17,600 per token.

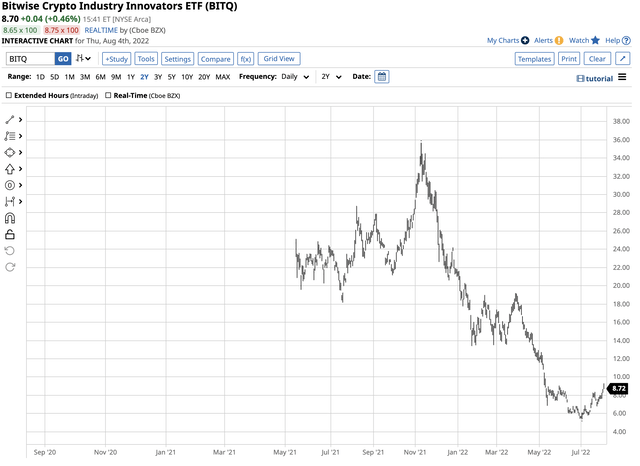

Meanwhile, the asset class’s market cap dropped from over $3 trillion at the high to just over the $1.06 trillion level on August 4. If cryptos have found a bottom, the Bitwise Crypto Industry Innovators ETF product (NYSEARCA:BITQ) could be an inexpensive path to exposure to the volatile asset class. At around $8.75 per share, BITQ was substantially lower than the all-time high from November 2021 of $35.68 per share. I like to call BITQ Bitcoin Soup or Bitcoin Stew because the ETF holds shares in a diversified group of companies that should move higher or lower with the token prices.

Sentiment has been bearish from November 2021 through June 2022, but that could be changing as the market seems to have found at least a temporary bottom in early August 2022.

Bitcoin and Ethereum may have found bottoms

After falling to below one-third of the price levels at the November 2021 highs, Bitcoin and Ethereum, the leading cryptocurrencies with nearly 60% of the cryptocurrency asset class’s market cap, have bounced. The short-term trends have turned higher.

Bitcoin Chart (Barchart)

The chart highlights Bitcoin’s bearish key reversal pattern on the daily chart on November 10, 2021, that ignited a bearish fuse taking the price from $68,906.48 to a low of $17,614.34 on June 20, 2022. The 74.4% decline took Bitcoin to below one-third the price at the high. Ethereum, the second-leading crypto, did even worse over the period.

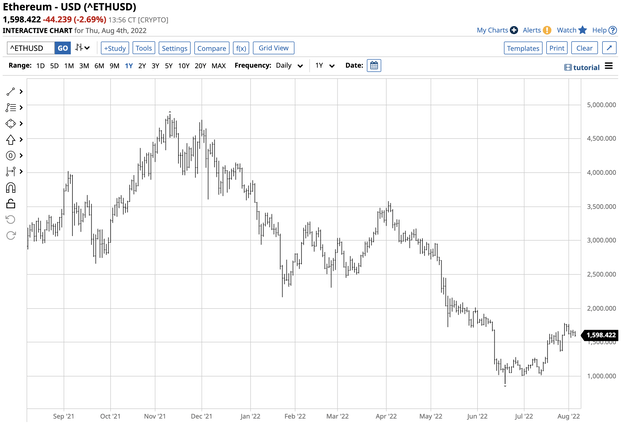

Ethereum Chart (Barchart)

The chart illustrates Ethereum’s decline from $4,865.426 on November 10 and the bearish reversal on that day to a low of $883.159 on June 20; the same day Bitcoin reached its bottom. The only difference is that while both leading cryptos put in a bearish reversal on November 20, Ethereum put in a bullish reversal on June 20, while Bitcoin could not close above the previous day’s high. Ethereum’s 81.8% decline was more severe than Bitcoin’s.

At the end of last week, Bitcoin was at the $22,550 level, over 28% above the June 20 low, while Ethereum at $1,600 was over 81% higher over the period.

Cleansing and shifting economic and geopolitical landscapes for cryptos

Over the past weeks, the casualties of the crypto winter that devastated prices mounted. Crypto lenders and platforms Voyager (OTCPK:VYGVQ) and Celsius (CEL-USD) filed for Chapter 11 protection after limiting customer withdrawals. Crypto hedge fund 3AC went under, and latecomers that purchased cryptocurrencies on the way to the record highs in late 2021 were left licking their financial wounds.

The crypto winter cleaned out the weakest players. Shares of the leading publicly traded crypto platform, Coinbase (COIN), fell to a low in mid-May before Bitcoin and Ethereum reached their June bottoms.

The chart highlights COIN’s decline from $429.54 on April 14, 2021, the day the NASDAQ listed the shares, to a low of $40.83 on May 12, a 90.5% drop. COIN was at the $89.33 level on August 4, as the shares more than doubled from the mid-May low.

Markets reflect the economic and geopolitical landscapes. The Fed’s commitment to addressing the highest inflation with Fed Fund Rate hikes and quantitative tightening to reduce its swollen balance sheet may have run into trouble after US GDP declined for the second consecutive quarter in Q2 2022. The textbook definition of a recession is two successive quarterly GDP declines.

While the Fed and Biden administration officials have downplayed the GDP data, with the administration calling it a “transition” instead of a recession, the statements are eerily reminiscent of the characterization of inflation in 2021. Inflation was “transitory” last year until it became apparent that rising prices were a structural problem. After blaming pandemic-inspired supply chain bottlenecks, the central bank and administration could not ignore inflation that had increased to an over four-decade high. Markets could be signaling that we will look back at 2022 as when the Fed’s economists and administration officials did not take the recession seriously. Meanwhile, the rebounds in cryptocurrencies and gold prices and the decline in the US dollar index after the latest Fed Funds Rate hike are signals that the markets believe the central bank’s enthusiasm for hawkish monetary policy could change given the economic slowdown. Rising rates may address inflation but are incompatible with a recessionary economy.

Meanwhile, the geopolitical landscape remains treacherous as the war in Ukraine continues to rage, with Russian relations with the US and Europe deteriorating. US Speaker of the House Nancy Pelosi visited Taiwan this week, causing tensions between Beijing and Washington to rise. The “no-limits” support alliance between Russia and China bifurcates the world’s nuclear powers. Gold and cryptocurrencies are alternative assets that could attract a herd of buying in the current worldwide political environment.

BITQ is Bitcoin Soup or Stew

Many market participants remain skittish about holding cryptocurrencies in wallets in cyberspace. The recent bankruptcies and his week’s hack of Solana (SOL-USD), the ninth-leading cryptocurrency with an over $13.4 billion market cap, only exacerbates the trepidation. While the most direct route for a risk position in the cryptocurrency arena is via purchasing tokens, the Bitwise Crypto Industry Innovators ETF product (BITQ) is an alternative as it holds shares in crypto-related companies that tend to move higher and lower with the asset class’s market cap. The most recent top holdings of the BITQ ETF include:

The Recent Top Holdings of the BITQ ETF Product (Yahoo Finance )

While BITQ holds shares in Voyager, the company that filed for Chapter 11 protection, it has an over 21% exposure to Coinbase (COIN), Riot Blockchain (RIOT), and Marathon (MARA), three proxies that often move up and down with Bitcoin and cryptocurrency prices.

At the $8.70 level on August 4, BITQ had $77.67 million in assets under management. The ETF trades an average of 129,908 shares daily and charges an 0.85% management fee.

The trend is bending: Long-term price action suggests that the selloff was routine

Bitcoin and Ethereum found bottoms over the past weeks, and the BTIQ ETF also has recovered from the lows.

Chart of the BITQ ETF (Barchart)

BITQ reached a high of $35.68 per share on November 9, 2021, one day before Bitcoin and Ethereum peaked. The shares fell to a low of $5.39 on July 5, after the leading cryptos reached the bottom. BITQ fell 84.9% during the crypto winter. At the $8.70 level on August 4, the shares rallied 61.4% from the low. At below $9, BITQ is an inexpensive route for crypto exposure for those looking for an instrument available for standard stock portfolios.

Meanwhile, the 74.4% decline in Bitcoin and 81.8% drop in Ethereum is nothing new. Bitcoin corrected 84.1% from the December 2017 high to the December 2018 low, and Ethereum fell 94.2% from the January 2018 high to the December 2018 bottom. Cryptocurrencies are not for the faint of heart as they have routinely exploded higher and imploded lower over the past years. If the pattern continues, the bounce from the June 2022 lows could be the beginning of another explosive period.

Be careful as risk is always a function of potential rewards

Whether directly investing in cryptos or choosing a proxy like the BITQ ETF product, the volatile history makes the asset class highly risky. The potential for substantial rewards comes with commensurate risks. Only invest capital you are willing to lose as the downside could be zero.

The short history of the cryptocurrency asset class dating back to 2010 suggests that we could be on the verge of another explosive period. At below $9 per share, BITQ is an attractive product for those seeking exposure. Never put all your eggs in one basket as BITQ is as risky as the other over 20,000 cryptocurrencies floating around in cyberspace.

[ad_2]

Source links Google News