[ad_1]

LL28

Life can only be understood backwards; but it must be lived forwards.”― Søren Kierkegaard

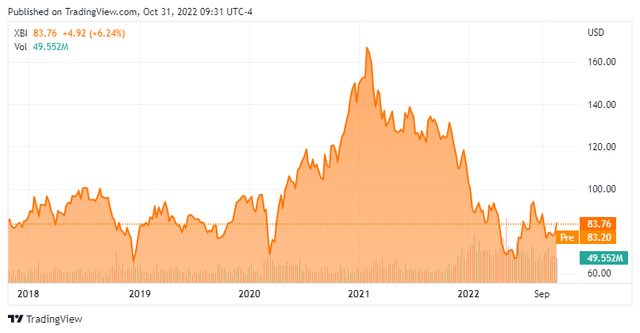

Today, we take a look at the SPDR S&P Biotech ETF (NYSEARCA:XBI) as we come to the end of October. This widely diversified ETF holds several hundred small and mid-cap biotech stocks and has a net asset value of nearly $7 billion. Only one holding accounts more than one percent allocation (1.18%) in this ETF. It is a solid proxy for the overall biotech sector.

Seeking Alpha

As you can see from the graph above, the ETF has been pummeled, as has the biotech sector since the start of 2021. It has lost approximately half of its market value from its five-year peak in early last year. However, I believe the bottom has now been established and the sector and ETF are poised to outperform the overall market in the year ahead for several reasons. As you can see above, this ETF bottomed in mid-June at just under the $75 level. This was the same support level the XBI found at the end of 2018 and the beginning of 2020 as the lockdowns began.

Seeking Alpha

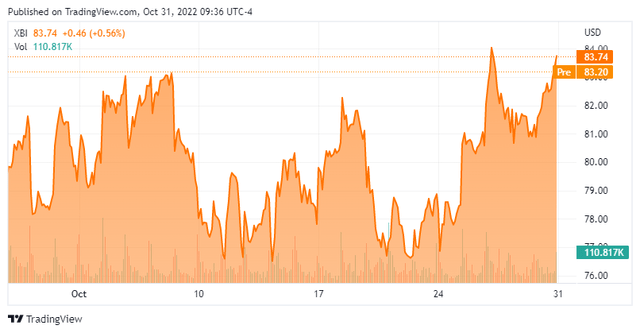

This ETF has successfully been retested just above that level several times here in October. So, from a technical level, it would seem a firm floor has been established about 10% below the current trading levels of this ETF.

Second, the Covid pandemic is at its end. The coronavirus is going the way of the flu and is likely to be a similar and seasonal affliction for many decades to come. The Covid outbreak significantly impacted the biotech space in a couple of significant and adverse ways.

Seeking Alpha

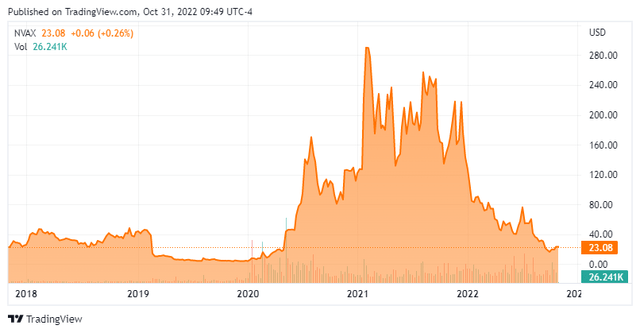

First, it shifts resources and investor attention to names that were developing vaccines and treatments for this new scourge. This pushed many of these Covid names like Novavax (NVAX) to the moon temporarily and sucked the life out of most of the rest of the biotech sector. When the air came out of these Covid-19 plays, it also acted as a large headwind to the overall sector as well as these stocks cratered.

In addition, sales traction for new products has been very difficult to come by in the Covid Age. First, we had the lockdowns that shut down all non-essential medical procedures and treatments for several months. Even after these ended, the normal sales process continued to be disrupted as medical facilities put in stringent new procedures to enforce social distancing and other Covid-related measures. Most of these are now being dropped, and the sector should benefit from the return of ‘normalcy’.

Nothing juices the ‘animal spirits‘ in small and midcap biotech stocks more than acquisitions that typically see small names purchased for huge buyout premiums. Unfortunately, M&A activity has fallen sharply in recent years in this space. From the back half of 2020 through the summer of 2021, the market saw a huge surge of biotech IPOs and SPACs. A lot of new investor money flowed to these newly public names, mostly to shareholders’ detriment as most of the small-cap biotech names birthed this way have lost 50% or more of their value since coming public.

In 2022, M&A activity across the market has ebbed considerably as interest rates have moved sharply and rapidly upward. When they stabilize and/or ebb, deal volume should start to pick up. Names like Pfizer (PFE), Johnson & Johnson (JNJ), AstraZeneca (AZN), and other drug giants have tens of billions of cash on their balance sheets, thanks partly to the profits from their Covid vaccines, tests, and treatments. As these areas ebb, I would look for them to deploy some of that ‘ammo‘ to acquire new engines of growth.

Seeking Alpha

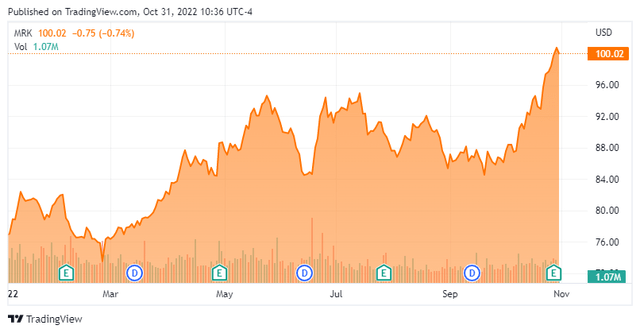

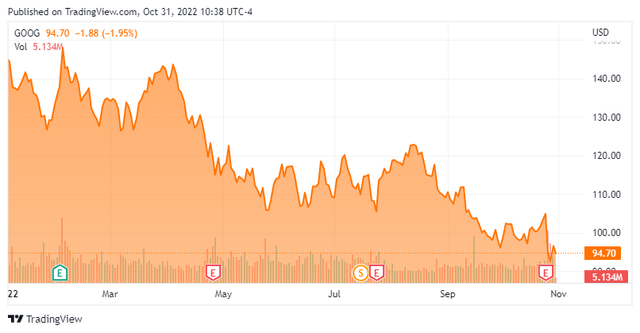

Finally, the sharp rise in interest rates has been detrimental to both growth and high beta names in 2022. One reason growth names like Alphabet (GOOG) have far underperformed value names like Merck & Co. (MRK) so far this year.

Seeking Alpha

As we get closer to a Fed ‘pivot‘ in the first half of 2023 and investors see signs inflation levels are ebbing, the headwinds for the high beta parts of the market like small biotech stocks should lessen substantially.

For these reasons, I have built up a large position in the SPDR S&P Biotech ETF since mid-June after the ETF successfully retested its long-term floor via covered call orders. This is now the biggest holding in my overall portfolio. I like using covered call orders as options are quite liquid and lucrative against this ETF. This simple strategy also provides additional risk mitigation on top of the broad diversification already baked into this ETF.

Never let the future disturb you. You will meet it, if you have to, with the same weapons of reason which today arm you against the present.”― Marcus Aurelius

[ad_2]

Source links Google News