[ad_1]

ETF Overview

Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) focuses on U.S. treasury bonds that will expire between 1~3 months. The ETF tracks the Bloomberg Barclays 1-3 Month U.S. Treasury Bill Index. BIL has very low credit risk as all of the bonds in its portfolio are U.S. Treasury bonds. Hence, it offers investors good protection in an economic downturn. BIL’s very low duration to maturity also means that its interest rate risk is low. The ETF offers a 2.1%-yielding dividend. It is a good investment choice for investors seeking safety in an economic downturn.

Data by YCharts

Fund Analysis

Low credit risk

BIL has a very low credit risk because all of its bonds that it invests are U.S. Treasury bonds. These bonds are backed by the credit of the U.S. government. At the moment, U.S. government bonds have credit ratings of AA+ stable (S&P) and AAA stable (Fitch, and DBRS). Therefore, we do not foresee any credit risk at all even in an economic downturn.

Low interest rate risk

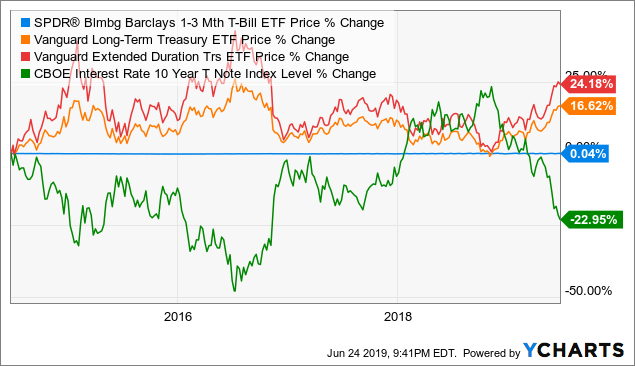

All of BIL’s bonds are ultra-short-term bonds that will mature within 1 – 3 months. This very short maturity duration means that its fund performance is not sensitive to interest rate changes. As can be seen from the chart below, unlike other long-term treasury ETF that are quite sensitive to the rise and fall of the interest rate, BIL’s fund performance is much less sensitive to the interest rate. In fact, the changes in fund price in the past 10 years is only 0.04%. On the other hand, Vanguard Long-Term Treasury ETF (VGLT) or Vanguard Extended Duration Treasury ETF (EDV) have much higher volatility as they are much more sensitive to the change of interest rate.

Data by YCharts

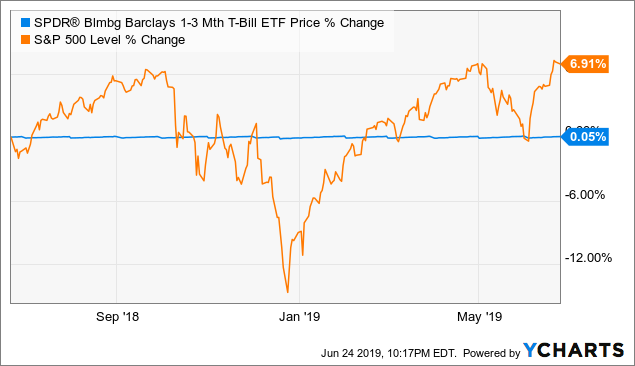

BIL’s low volatility is also evident when we compare it with S&P 500 Index. As can be seen from the chart below, fund price of BIL remained steady (only changed by 0.05% in the past year). On the other hand, S&P 500 Index can decline more than 15% between September and December 2018 and can climb by more than 15% between January and April 2019.

Data by YCharts

Low management expense ratio

BIL charges a low management expense ratio of 0.14%. BIL’s MER is slightly lower than iShares Short Treasury Bond ETF’s (SHV) 0.15% and Vanguard Short-Term Treasury ETF’s (VGSH) 0.20%, but higher than Schwab Short-Term U.S. treasury ETF’s (SCHO) 0.06%.

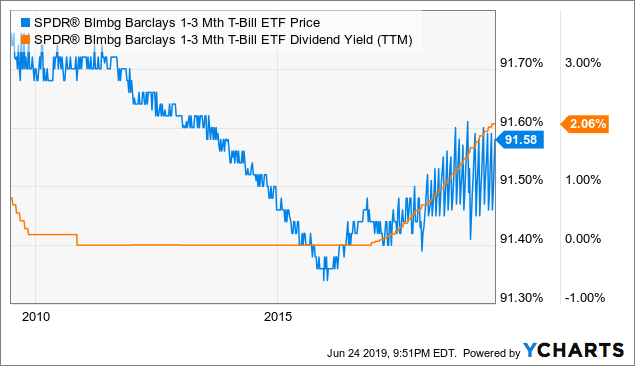

A 2.1%-yielding dividend

BIL investors will receive dividends with an annualized yield of about 2.1% on a trailing 12-month basis. This yield is the highest we have seen since the Great Recession.

Data by YCharts

High turnover ratio

Because the fund holds ultra-short-term Treasury bonds that matures within 1 months to 3 months, it needs to roll over its positions as they approach one month to maturity. Therefore, its turnover ratio of 620% is inevitably very high. This will limit some performance as there is some cost to trade.

Macroeconomic Analysis

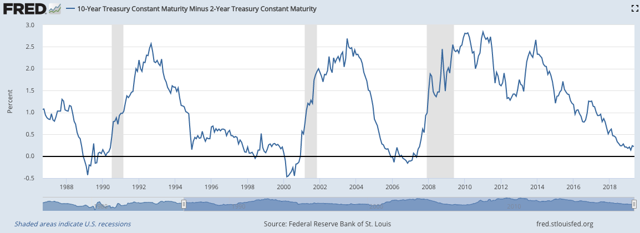

The current economic cycle has been well into its 10th year. Nevertheless, there are many signs that we are already in the late cycle environment. For example, treasury yield (10-year minus 2-year) is now near the point of inversion (see chart below). As can be seen from the chart below, economic recessions often precede with yield inversions (when the 10-year yield minus 2-year yield falls below 0%).

Source: Federal Reserve Bank of St. Louis

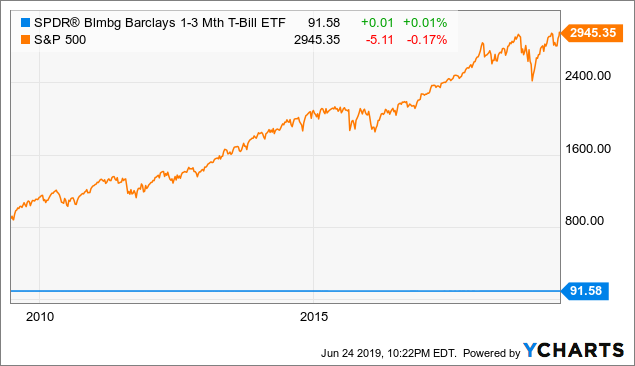

Besides yield inversion, we are also seeing signs of investors rotating from riskier assets (e.g., energy, industrial, etc.) towards defensive sectors (e.g. telecom, utilities, REITs, etc.). This equity rotation is often a sign of a late cycle environment. Fortunately, BIL’s low interest rate risk and credit risk means that its fund performance will likely not be impacted. In fact, we think it is a safe haven for investors in an equity market downturn as its fund price will likely remain the same or even increase slightly. Meanwhile, investors can still get a dividend with a dividend yield of about 2.1%. However, if the economy is to improve, this is not the place to park one’s money as its average annual return in the past 10 year is only 0.94%. This is much lower than the nearly 15% of S&P 500 Index.

Investor Takeaway

We think BIL is a good ETF to be included in one’s portfolio as it provides downside risk protection vs equity ETFs in an economic downturn. In addition, it provides a 2.1%-yielding dividend. Although it is always difficult to predict when the next recession will happen, investors should be prepared. Since we are likely already in the late stage of the current economic cycle, we think it may be wise to rebalance one’s portfolio and have a few bond ETFs such as BIL as it provides downward protection.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News