[ad_1]

Mo Semsem /iStock via Getty Images

Thesis

The SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (NYSEARCA:BIL) seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg 1-3 Month U.S. Treasury Bill Index (BBUTB13MTR). In essence the ETF provides exposure to zero coupon US Treasury securities that have a remaining maturity of 1-3 months. As rates rise due to a hawkish Fed the front end of the Treasuries curve is going to be lifted and BIL is going to provide an actual positive yield while being able to correctly capture the upswing in rates with minimal duration impact due to its extremely short portfolio maturity of maximum three months. By having such a short duration BIL is a great vehicle to achieve both NAV stability akin to a money market fund and obtain an increasing yield as the Fed raises rates. Unlike short dated corporate bond funds, BIL has no credit risk and really utilizes the very front end of the yield curve, being best suited for the move up in rates. With a $14 billion AUM the fund has ample liquidity and provides for a good vehicle for investors to park cash in today’s environment. We rate it a Buy through the lens of parking spare cash.

Holdings

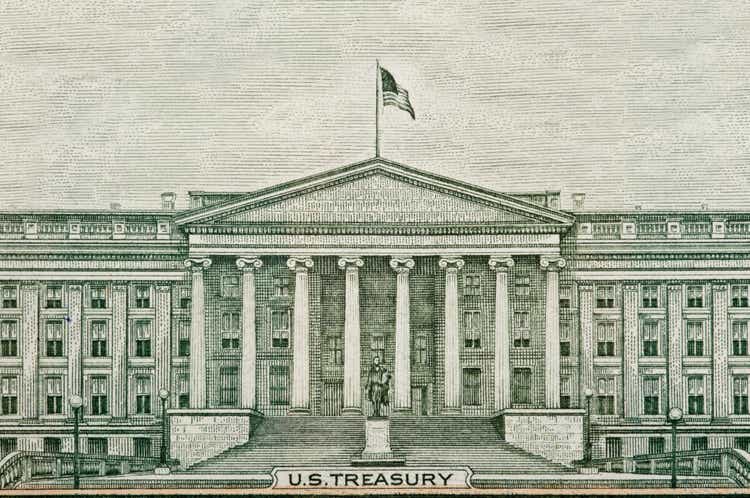

The top ten holdings in the fund account for over 80% of the portfolio:

Top Holdings

SSGA

In essence they are short-dated T-Bills with yields that are reflective of the short end of the curve. From a credit risk standpoint they are all AAA and are backed by the full faith and credit of the US Treasury so they represent risk free assets. The fund is going to re-balance at each month end to an equivalent maturity weighted portfolio.

Interest Rate Risk

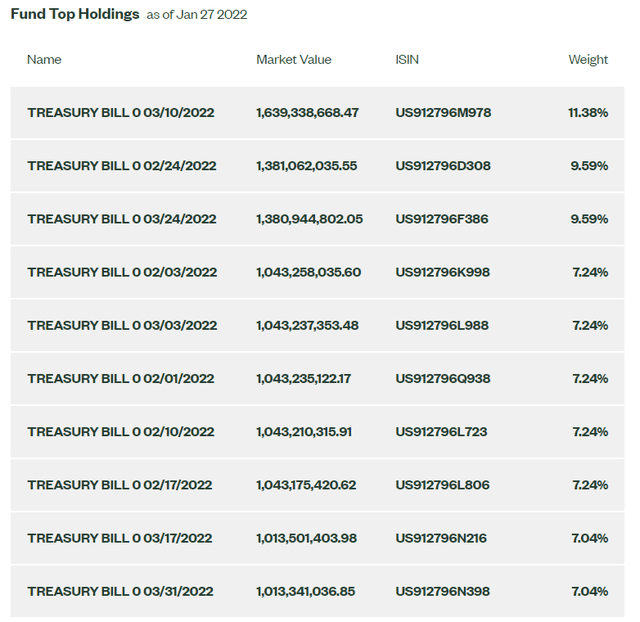

The Fed is set to raise rates in 2022 to fight inflation and the pace and number of anticipated hikes has been raised this year by market participants. Nomura is one of the first large financial institutions to project more than four hikes in 2022:

2022 Anticipated Rate Hikes

Nomura

In addition to projecting five hikes in 2022, Nomura is also expecting a shock 50bps hikes in March 2022, an outside prediction at this point. Higher rates mean pressure on fixed income instruments, with higher duration bonds being most affected.

BIL has an extremely low duration due to the maximum 3-months maturity of the underlying T-Bills:

Characteristics

SSGA

Every three months the fund fully rolls into new market yielding Treasuries fully. That means that as rates rise the fund captures that move and it increases the yield it pays to investors and cements the NAV stability. This type of very short-dated fund is the best place to be in a rising rates environment since it achieves a dual result: i) on one hand it has NAV stability in a rising rates environment, ii) and secondly it captures the move higher in yields by re-balancing monthly and fully replacing its securities every three months max.

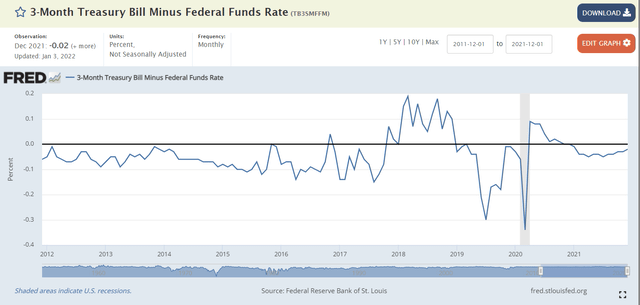

We can also observe the close correlation between Fed Funds and 3-month T-bills yields:

3-month T-bills vs Fed Funds

The Fed

The above chart shows us that historically 3-month T-bills have a yield that is fairly flat against Fed Funds – i.e. this means that as Fed Funds go up, the 3-month T-bill yields are going to follow in lockstep.

Performance

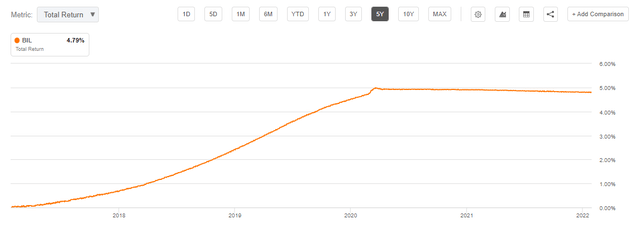

We particularly like the 5-year total return graph for BIL since it is such a clear cut illustration of the Fed policy – up to 2020 the fund used to provide a yearly total return of above 0% due to the interest rate environment which yielded more than 0.04% for short-dated T-bills:

5-Year Total Return

Seeking Alpha

As the Fed switched to a zero rate band, the fund basically stopped in its tracks and lost a couple of basis points each year due to the fund management fees being higher than the portfolio assets yield. Just like an option payoff profile that graph is going to start rising again as we have a rates lift-off.

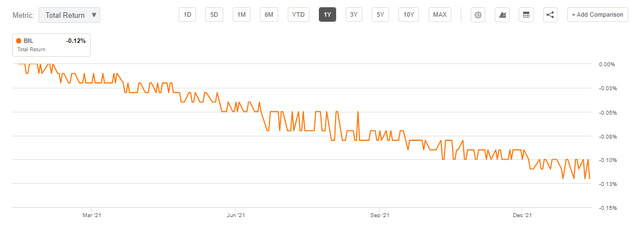

In the past year we can see how the fund was fairly stable, losing only -0.12% due to management fees being higher than the portfolio yield:

1-Year Total Return

Seeking Alpha

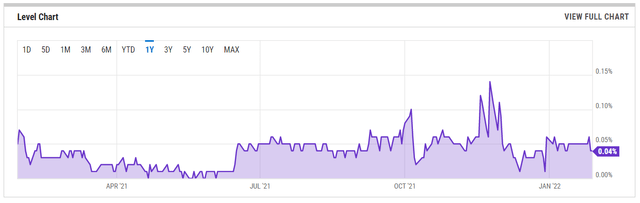

If we look at the historical yield for 3-month T-Bills, we can see the explanation for the negative carry BIL ran last year:

3-months T-bill yield

YCharts

3-month T-bills have averaged a yield of merely 0.05% in the past year. And 3-months is the highest tenor the fund can run, hence the maximum yield.

Conclusion

As the Fed normalizes the interest rate environment and we experience higher Fed Funds in 2022, BIL is a good vehicle to utilize to capture higher rates. With a very low duration and a maximum tenor of 3-months on its underlying portfolio, BIL is going to achieve both NAV stability as well as yield generation as rates move up. Constrained by the zero rate environment in the past years BIL is finally going to move to positive carry territory and ensure NAV stability is complemented by yield in 2022. We rate it a Buy through the lens of parking spare cash.

[ad_2]

Source links Google News