[ad_1]

Thomas-Soellner/iStock via Getty Images

Last December, I wrote my first Seeking Alpha article on the Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT). It seemed like a natural vehicle to invest in the lithium-battery supply chain that will obviously be needed to supply companies like Tesla, Ford, GM, BYD, NIO, and a host of other EV makers with the enormous battery capacity necessary to meet their production goals.

However, I started the ETF with a HOLD because I had some concerns – chief among them was my concern about the fund’s exposure to China-based companies and an increasingly involved Chinese government. Today I’ll take a fresh look at the BATT ETF and offer some alternatives for investors wanting diversified exposure to the critical metals and materials space.

Toyota

Investment Thesis

The investment thesis of investing in the lithium-ion based battery sector is simple and relatively straightforward: massive growth forecasts. As you no doubt already know, the global EV market – once relatively the purview mainly of Tesla (TSLA) and a couple of small China-based companies – has ballooned with the adoption of EVs by a host of big global EV manufacturers:

- In August of 2021, Toyota (TM), long a laggard in the space while it focused primarily on fuel-cell based vehicles, announced its new BEV lineup (Toyota bZ). The company expects to introduce 15 BEVs by 2025 (see photo above).

- In November 2021, Tesla announced plans to expand production capacity at its Shanghai giga-factory to 500,000 units per year. Note that Tesla delivered 310,000 units in Q1 and is on track to exit 2022 at a 2 million vehicle annual production rate.

- Mercedes (OTCPK:DDAIF) (OTCPK:DMLRY) has plans to unveil a plethora of various new PHEV and fully electric vehicles by 2025 from three electric-only manufacturing platforms.

- Ford (F) has announced plans to spend $11.5 billion on EV and battery facilities.

- And, of course, there are a host of Chinese EV makers (BYD, NIO, XPeng, Li, etc.) that are ramping up EV production.

Obviously, all these plans will require a huge increase in manufacturing capacity for lithium-ion based batteries. However, the precious metals required to make them go well beyond lithium: cobalt, nickel, copper, and aluminum are also critical components of the EV battery supply chain. Note that many of these metals are also required in the solar & wind renewable energy space as well.

Meantime, EV adoption in the US has significantly lagged that of China and the EU. I suspect that is going to change very soon. I say that because of the strong demand Ford has seen for the Mustang Mach-E and the F-150 Lightning. Contrary to the public’s view that EVs are too expensive (probably due to the Tesla-centric narrative…), Bloomberg recently reported that Ford’s $40 billion F-150 brand is the largest in the world next to Apple’s iPhone. That being the case, the fact that the F-150 Lightning EV costs 17% less (factoring in Federal subsidies) than the F-150 ICE-based model is a significant turning point in my opinion (as is the fact that the F-150 Lightning has neck-snapping acceleration that has really attracted test-drivers).

Meantime, and on an anecdotal basis, where I live it currently costs ~$10 to recharge a 300-mile range EV. To fill-up a 20 mpg ICE-based car or truck for 300 miles costs closer to $60, or a whopping 6x as much. That being the case, many American consumers – faced with the high price of gasoline and pain at the pump – are likely to consider EVs for the first time. Indeed, EVs are expected to be ~50% of new vehicle global sales by 2030.

With this fast-growing trend as background, let’s take a closer look at the BATT ETF to see how it has positioned investors to (hopefully) prosper going forward.

Top-10 Holdings

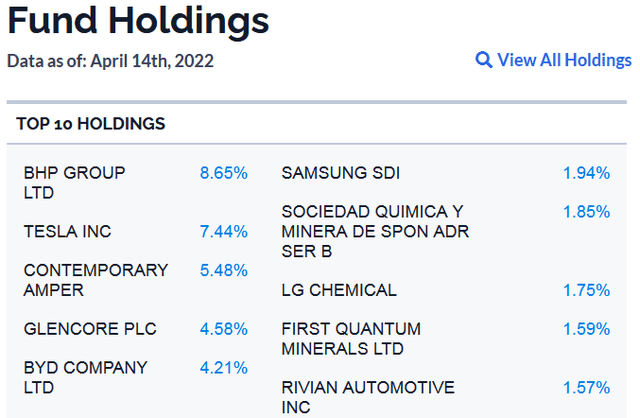

The top-10 holdings in the BATT ETF are shown below and equate to what I consider to be relatively moderate diversification (39%) of the entire 87 company portfolio.

Amplify ETFs

The #1 holding with an 8.7% weight is BHP Group (BHP). BHP is an Australia-based global mining giant (market cap $195 billion) who has emerged from the consolidation in the mining space over the past decade as a leading producer of copper, gold & silver, zinc, molybdenum, uranium, and iron ore. BHP is up 10.9% over the past year, trades with a forward P/E of only 11.4x, and currently yields 7.7%.

Tesla is the #2 holding with a 7.4% allocation. TSLA is so well-covered on Seeking Alpha I won’t comment further other than to note the company’s upcoming plans to split the stock (again) attracted investors and pushed the stock up to reclaim the $1000 level. However, it has dipped below that this morning on news that Elon Musk has made an offer to buy all of Twitter (TWTR) and take it private.

Contemporary Amperex Technology Co. (SZSE: 300750) (“CATL”), a Chinese company and one of the largest EV battery makers on the planet, has fallen to the #3 spot with a 5.5% weight. Note that last December when I first covered BATT, CATL was the #1 holding in the fund with a 7.2% weight.

BYD Company Limited (OTCPK:BYDDY) (OTCPK:BYDDF), which was one of my favorite EV companies until China’s leadership decided to move away from its quasi-capitalist market strategy to embrace an even greater government involved model, is the #5 holding with a 4.2% weight. (see BYD: Growing Market Share As August Sales Zoom Higher).

Three more non-US based mining/chemicals companies – Sociedad Química y Minera de Chile S.A. (SQM), LG Chemical (OTCPK:LGCLF), and First Quantum Minerals (OTCPK:FQVLF) – occupy the #7-9 slots and, in aggregate, equate to 5.2% of the entire portfolio.

The top-10 holdings is rounded out by Rivian (RIVN) with a 1.6% weight. RIVN came out of its IPO on fire due to its relationship with Amazon (AMZN), but note that the stock is down 60% YTD.

As for the portfolio as a whole, the metals & mining sector has the biggest allocation (32.7%), followed by EV and component makers (20.7%), and electrical equipment and utilities (17.9%).

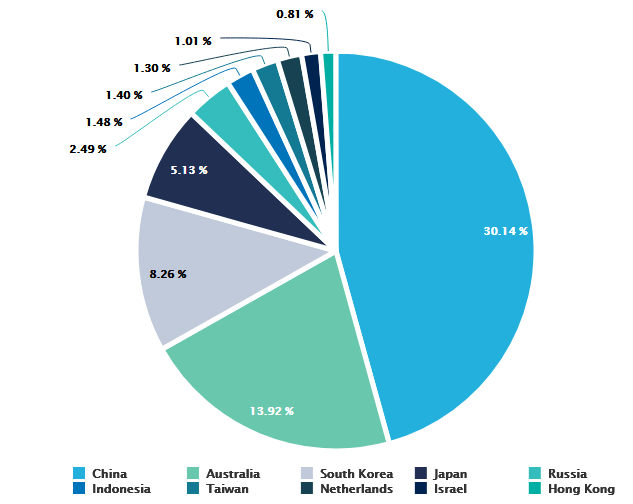

On a regional basis, the portfolio has a very large foreign allocation:

Amplify ETFs

However, I don’t understand this graphic because Tesla alone is reported to be 7.4% of the fund, yet I don’t see the U.S. anywhere on this graphic. So, take it with a grain of sale. But what is true, and what is the biggest takeaway from this graphic, is that China-based companies equate to the overall largest allocation within the fund.

Performance

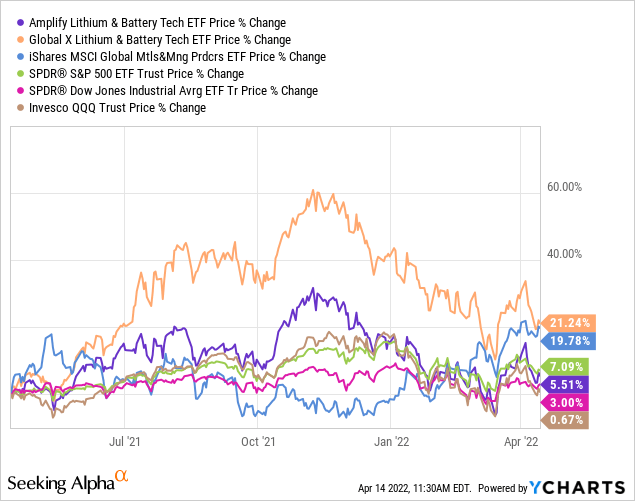

The 1-year price performance of the BATT ETF is shown below as compared to several other equities.

As can be seen by the graphic, over the past year, BATT has only outperformed the (QQQ) and (DIA) ETFs. The Global X Lithium & Battery ETF (LIT) has outperformed BATT by over 15%. Meantime, the iShares MSCI Global Metals & Mining ETF (PICK), has also significantly outperformed BATT and all the broad market indexes over the past year.

Risks

All the standard macro market risks apply to the BATT ETF: Covid-19 impacts of shut-downs and supply-chain disruption, high inflation, rising interest rates, and the massive geopolitical uncertainty as a result of Putin’s horrific war-of-choice in Ukraine and the resulting economic sanctions on Russia by the U.S. and its Democratic NATO allies. All of these factors could have a negative impact on the global economy and could push it into recession. This would obviously put pressure on metals miners and global EV market growth.

Summary & Conclusion

I am still very bullish on the global EV market and the miners that supply the key precious metals that are required to make the batteries that power EVs. That said, I am changing my rating on BATT to SELL based on its relatively poor performance and its over-emphasis on China-based companies combined with China’s unwillingness to criticize Putin and Russia for invading Ukraine.

That being the case, democratic countries will be more intent than ever before on diversifying supply chains out of China and also opens up the prospect of significant free-world sanctions on China by the Democratic free world. That being the case, I much prefer the PICK ETF (see Seeking Alpha Contributor Andrew Hecht’s recent article PICK: Lots of Upside With New Highs In Copper).

[ad_2]

Source links Google News