[ad_1]

The internal combustion engine (ICE) has reigned supreme for 100 years and auto lore is firmly ingrained in American culture.

Television’s Duke boys used (and destroyed) over 250 Dodge Chargers. Millions thrilled over James Bond’s exploits with his Aston Martin. Corvette clubs, antique auto shows, drive-throughs and more exemplify the love affair Americans have with their cars and trucks.

But times and culture change. Wheels may no longer be a top priority with young people. Technology, as manifest in the smartphone, appears to be the new idol.

And, complicating things even further, there is now a new kid in town: the electric vehicle (EV).

This article explores why EVs are likely to displace ICEs in the near to mid-term future and how investors can profit by avoiding traditional auto and investing instead in ETFs holding EV related companies.

Was 2018 the year of peak ICE sales?

Global auto sales appear to be on the skids. Nothing particularly new there; vehicle sales usually decline as economies falter. But in the past, auto sales have snapped back when times improve. Will it happen again? Several analysts think not, at least not for ICEs.

The future, of course, is very difficult to predict. But let’s look at the reasons why EVs will likely displace EVs in the near to mid-term future.

EV sales are now quickly growing

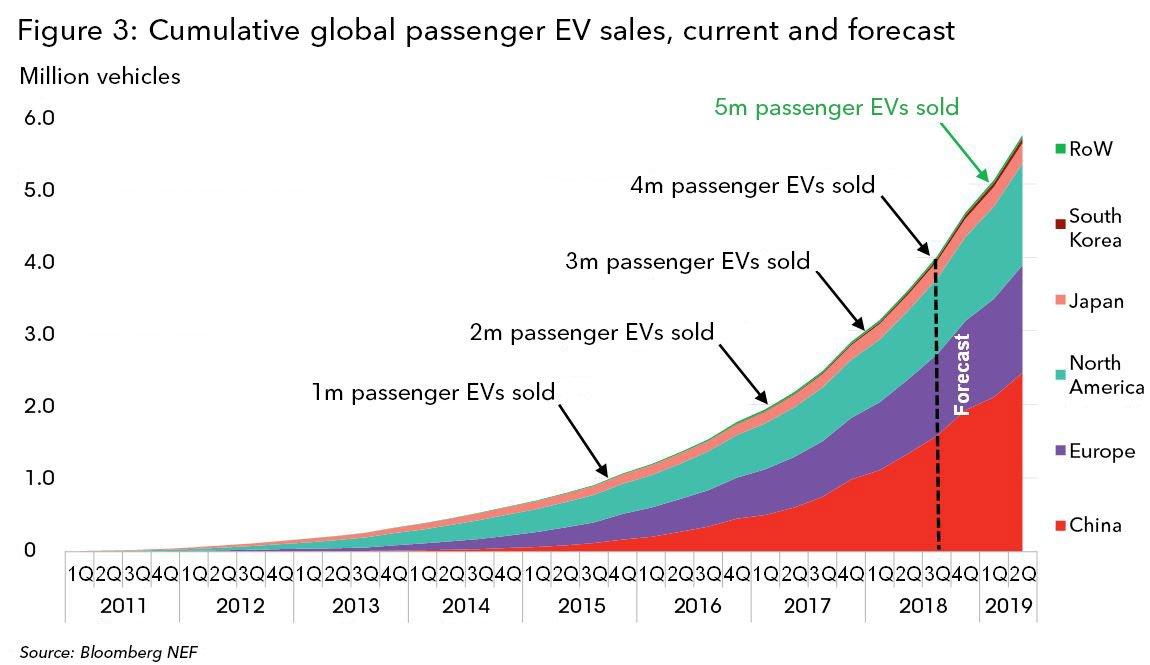

Electric car sales have grown each year since the introduction of the Nissan Leaf in 2010, especially in the last 2-3 years.

EV sales were 64% higher globally in 2018 than in 2017; they now comprise roughly 2.2% of all sales. In the U.S., EV sales were a little over 2% of car sales in 2018. In China, the world’s largest auto market, January saw EV sales at 4.8% of all sales, while in Norway, the top EV sales county, EV sales were 31% of 2018 sales.

The Tesla (TSLA) Model 3 was by far the world’s best-selling EV in 2018. China’s BAIC-EC series was second, and the Nissan Leaf third. It’s expected that in 2019, EV sales will hit 3.5 million vs. 2 million in 2018, up 75%.

Five reasons consumers are, and will, pick EVs over ICEs

For starters, a Tesla Model 3 Standard Plus today costs $39,500. The car goes up to 140 mph, accelerates from 0-60 in 5.3 seconds, has a 240-mile range, and gets 133 mpge. You may say, “Well, that’s a Tesla.” The thing, however, is the other EVs aren’t far behind in those numbers.

There’s more, read on.

Fuel, Technology, and Maintenance

EVs never need gasoline or oil changes. And, with 80% fewer moving parts, they require a lot less maintenance.

Tesla has a dedicated smartphone app which gives you the ability to remotely lock/unlock the car, control charging, turn on/off cabin climate, and give the car’s location at all times (good if the car is stolen, maybe not so good when your spouse tracks you). The app automatically unlocks the car when you approach and then locks and turns everything off after you exit.

Tesla uses its website to sell its vehicles. Since an encounter with a fast-talking salesman at a dealership ranks right up there with a root canal in popularity this appeals to consumers. Tesla is not the only company using the internet to buy and sell; fast-growing Carvana (CVNA) also does.

Electric, internet-connected vehicles can use over-the-air software upgrades for repairs, and enhancements such as battery upgrades. Tesla, again, appears to be the leader here but I suppose others will soon follow.

The Wow Factor

When I was a kid, back in the early 1960s, whenever a family brought home a new car all the neighbors showed up to ooh and aah over it. In our jaded times that just doesn’t happen anymore. Yet, when I took delivery of my Model 3, it was deja vu all over again. Neighbors and friends all wanted a look and get a ride. The excitement is back.

You know the ICEs’ days are numbered when a $60,000, 5-passenger, 4-door Model 3 sedan outruns a $294,250 built-for-the-kill Porsche 911 GT2 RS. Of course, most of us don’t race but I wonder just how enamored folks will be with their ICEs when they regularly get left behind at the light by funny-looking EVs.

Climate change is the elephant in the room, the one that no one in the fossil fuel industry wants to talk about.

The facts, however, are indisputable: Levels of CO2, a greenhouse gas, are rising relentlessly. Not surprisingly, the earth’s temperature is going up right along with the CO2 levels. New records for both are set each year now. No, these are not procrastinations from wild-eyed ecofreak groups as climate change deniers would like you to believe. Rather, almost every mainstream scientific organization which studies the subject agrees: Climate change is not only coming, it’s here already.

Oceans are hotter than they’ve ever been in recorded history, coral reefs are dying, ice sheets are melting at unprecedented rates, extreme weather events are on the rise. Now the arctic environment appears to be falling apart. No one, not even scientists, knows how this will play out.

As stuff like this sinks in many will want to do something and one thing many can do is switch to an EV.

Falling Prices

Currently, unsubsidized upfront costs for EVs are higher than that for ICEs. However, EV prices (especially batteries) are steadily falling. Bloomberg claims that the unsubsidized upfront cost of EVs will soon (starting in 2024) be competitive with ICEs.

Once EV costs reach parity (and then fall below ICE prices) it will be pretty much over for ICE sales – the vehicles will fade from the roads. Not right away of course; 98% of the vehicles out there today are ICEs.

Safety

EVs are safer to drive and ride in than ICEs. Why? With no engine, gas tank, and fuel system space is freed up which can be used to add more safety to the passenger compartment.

It’s true, EVs have large batteries but they can be configured in advantageous ways. For example, Tesla has, and Volkswagen AG (OTCPK:VWAGY) plans on having, table-shaped batteries under the seats which have the additional advantage of lowering the vehicle’s center of gravity, making rollovers less likely.

With no engine in the front, EVs have a larger Crumple Zone. In a frontal collision, it’s better to have a suitcase thrust toward you than a hot iron engine.

Then, of course, EVs do not generate noxious combustion products such as carbon monoxide and cancer-causing particulates. (Though in high traffic areas you pick up those things from adjacent ICE vehicles.)

Another safety feature I wasn’t really aware of until I began driving my Model 3 is the regenerative braking. Think of it: Lose control of an ICE vehicle and the only thing that will stop the vehicle will be other cars, telephone poles, people, buildings, you name it. Lose control of an EV and the regenerative braking quickly slows the vehicle, even if you’re nowhere near the brake pad.

Not surprisingly, once people own electric cars the vast majority of them never go back to ICEs.

Invest in these ETFs instead of legacy auto

Avoid legacy auto companies such as General Motors Company (GM) Ford Motor Company (F), and Toyota Motor Corporation (TM). Sales for these companies will, for reasons noted above, stagnate or fall.

Tesla is the leading EV company and only pure EV play. I feel Tesla will do well but if you don’t like the drama, look at ETFs which hold companies which are involved in EV-related businesses. Here are two.

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN), as you might guess, invests in clean energy companies. (See the ETF summary here.) This fund has net assets of $103 million with holdings in 41 companies. The top 3 holdings are ON Semiconductor (ON), Universal Display (OLED), and Albemarle (ALB).

QCLN’s top holding, at 8.36%, is ON Semiconductor which provides EV solutions and products for autonomous driving, vehicle electrification, battery power management and lighting.

Albemarle, the fund’s third-largest holding, at 6.60%, supplies, among other things, lithium compounds for the batteries used in electric vehicles and consumer electronics.

Tesla, the fund’s 4th largest holding, at 6.23%, designs, develops, manufactures and sells electric vehicles.

QCLN has returned 21.9% YTD, compared to the S&P 500’s SPDR S&P 500 Trust ETF (SPY), up 17.7%, and the Invesco QQQ ETF (QQQ), up 23.5%.

ARK Innovation ETF (ARKK) For the more adventurous. This ETF, as its name implies, invests in innovative technologies. (See ARKK’s summary here.) ARKK has net assets of $1.6 billion and holds 34 companies. The top 3 holdings are Tesla, Invitae (NVTA), and Stratasys (SSYS).

Though Tesla is the fund’s largest holding at 10.5%, the bulk of ARKK’s holdings are in other innovative and disruptive technologies such as 3D printing, data and machine learning, molecular diagnostics, industrial innovation, and other leading-edge technologies.

ARKK is up 31% YTD, beating both the S&P 500 and NASDAQ.

Conclusion

Likely, the first indication that EVs are displacing ICEs will not be what you see on the road (ICE vehicles last an average of 11 years) but rather a falling off in ICE sales while EV sales climb robustly.

We already know consumers are fascinated by EVs. Even if they don’t lease or buy one immediately they may put off buying an ICE while they think it over.

I suspect that once unsubsidized EV prices reach parity with ICEs, in a few years the floodgates will open and EV sales will rapidly climb and surpass ICEs’ sales. Some legacy companies, such as Volkswagen see the writing on the wall and are preparing for the transition.

Disclaimer: As always, investors should do their own research and exercise due diligence before investing in any of the companies or funds mentioned in this article.

Disclosure: I am/we are long QCLN, TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News