[ad_1]

Richard Drury/DigitalVision via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on February 17th, 2022.

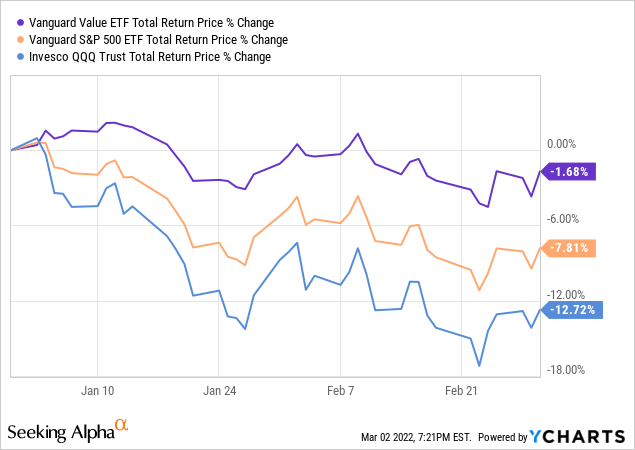

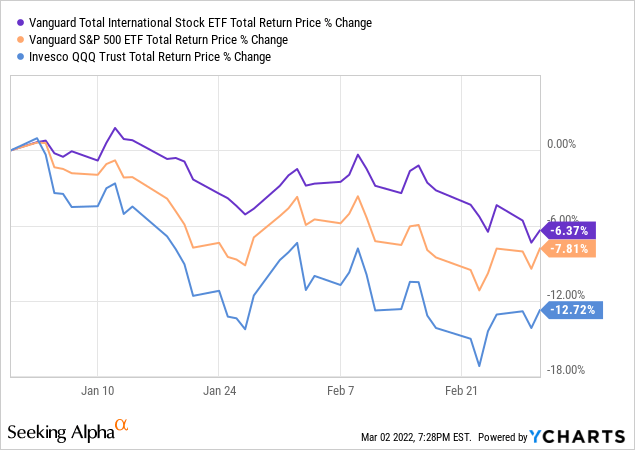

Value stocks are trading at historically below-average valuations, and could see strong, market-beating returns if valuations were to normalize. This has been the case YTD, as the prospect of higher interest rates has caused investors to reassess the frothy valuations of most growth stocks.

Small-cap stocks are also trading at historically below-average valuations, and could also benefit from valuations normalizing.

International stocks are also trading at historically below-average valuations, and could also benefit from valuations normalizing.

The Avantis International Small Cap Value ETF (AVDV) is an actively-managed fund investing in international small-cap value stocks, the most undervalued equity market niche right now. AVDV could see significant, market-beating returns if valuations were to normalize on all three fronts. The fund is a buy, but only appropriate for more aggressive investors. AVDV yields 2.53%, an above-average yield, but not a core aspect of the fund’s investment thesis.

Equity Markets Valuations Overview

AVDV invests in international small-cap value stocks. The fund’s characteristics and investment thesis are effectively equivalent to that of its underlying securities. As such, let’s start with a quick overview of these.

Companies have a fundamental value, based on their assets and cash-flows.

Companies also have a (market) price, partly dependent on their fundamental value, and partly dependent on market sentiment, expectations, and the like.

Price tends to track value, but there are many exceptions.

Value stocks are those with strong fundamental value, but low share prices. Value stocks offer investors above-average yields, due to their cash-flows, and strong potential capital gaps, assuming investors bid up their price to more closely align with their fundamentals.

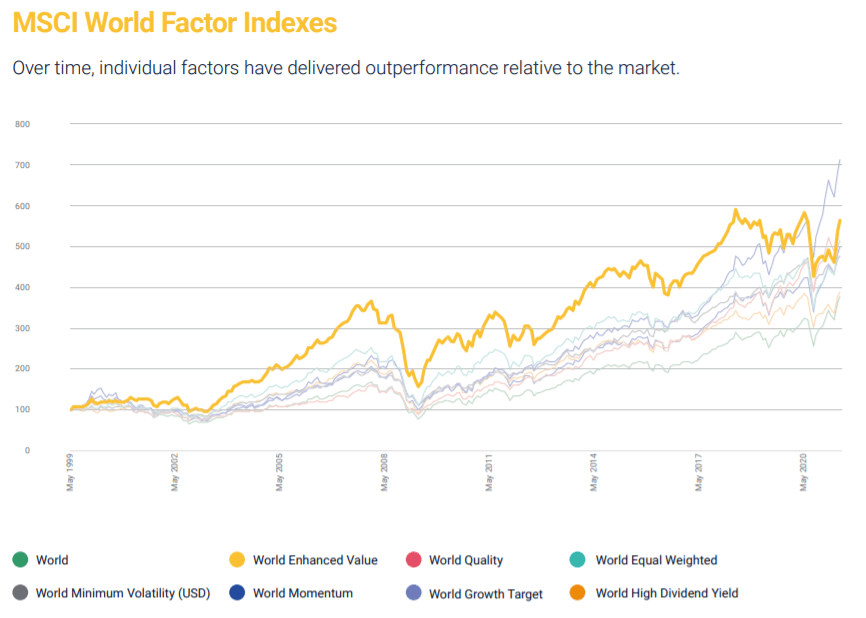

Value stocks tend to outperform, although their track-record is spotty, and volatile.

MSCI

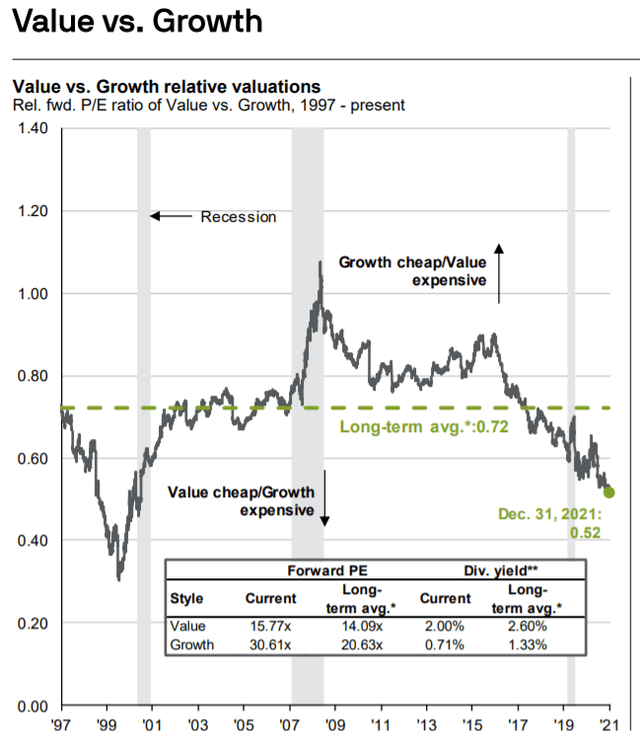

Value stocks are always cheaper than the market, but they are currently much, much cheaper than is normal. As per J.P. Morgan, value stocks have not been this undervalued since the dot-com bubble of the late 90s

J.P. Morgan Guide to the Markets

Valuation gaps as large as the above rarely persist for long. The dot-com bubble burst in 2000, and mega-cap tech stocks are having a rough 2022. Value has outperformed too, if only due to avoiding significant losses.

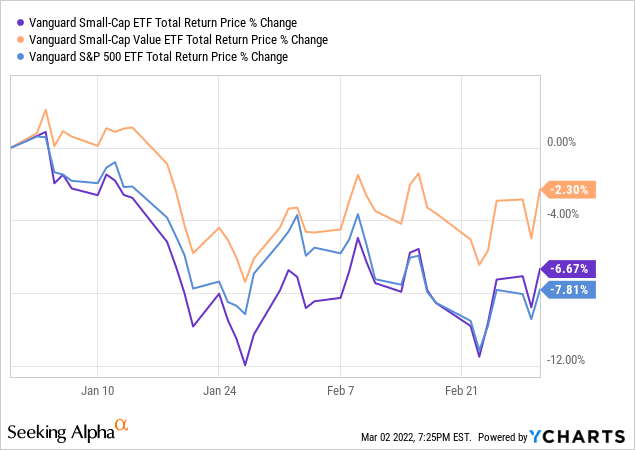

Small-cap value stocks are looking particularly cheap, as smaller companies fared worse during the pandemic, leading to sluggish share price growth and cheaper valuations. Although the market’s reaction was broadly logical, small-cap stocks did fare worse during the pandemic, it was also somewhat excessive: the pandemic is mostly over, and the economy has since recovered.

J.P. Morgan Guide to the Markets

Although small-cap equities have rarely been as undervalued as they currently are, the valuation gap is barely budging. Small-cap equities have slightly outperformed YTD, but by very little, and results are spotty. Valuations have not materially normalized or narrowed.

Finally, international stocks are also looking cheaper than average, trading with a +30% discount to U.S. equities. International stocks are generally cheaper, the U.S. trades with a well-deserved premium, but the gap is more than twice as large as its historical average.

J.P. Morgan Guide to the Markets

International stocks have slightly outperformed these past few months, including YTD, as investors reassess frothy mega-cap, tech, and growth valuations.

Let’ summarize the above.

Value stocks, small-cap stocks, and international stocks are all are trading at historically below-average valuations, and could outperform in the near future if valuations normalize. International small-cap value stocks are, logically, trading at significantly below-average valuations, and could see significant outperformance in the near future. International small-cap value stocks seem like a reasonable investment opportunity, which is where AVDV comes in. Let’s have a look.

AVDV – Basics

- Investment Manager: Avantis Investors

- Expense Ratio: 0.36%

- Dividend Yield: 2.53%

- Total Returns CAGR (Inception): 14.16%

AVDV – Overview

AVDV is an actively-managed ETF investing in international small-cap value stocks. The fund is managed by Avantis, a niche investment manager, but one with a strong performance track-record across several different market niches.

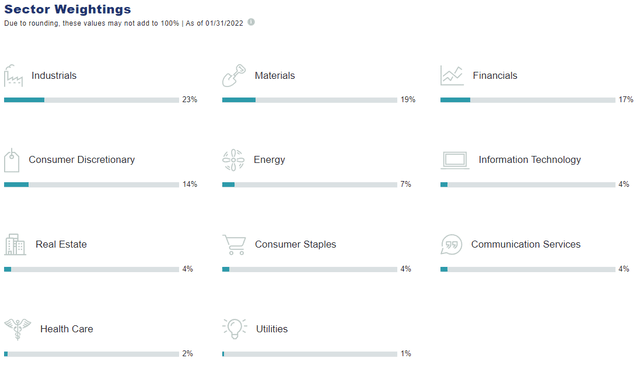

Although AVDV is actively-managed, the fund tries to provide investors with sufficient diversification in its market niche, with some active management / potential alpha on top. The fund is broadly successful in this endeavor, with the fund providing exposure to most relevant international markets and industry groups. AVDV is overweight old-economy industries, including industrials and financials, due to their comparatively cheap valuations. The fund is also overweight materials, partly due to valuations, and partly as an active bet on rising commodity prices / industry valuations. Industry diversification reduces risk and volatility, but being overweight the volatile materials industry increases both.

AVDV Corporate Website

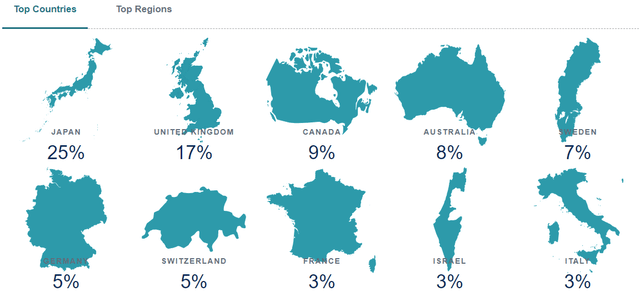

AVDV provides investors with exposure to most relevant international equity markets, including Japan, United Kingdom, Canada, and Australia. The fund focuses on larger countries, and is slightly overweight smaller, commodity-producing countries like Canada and Australia. AVDV’s holdings are as expected for an international small-cap value ETF.

AVDV Corporate Website

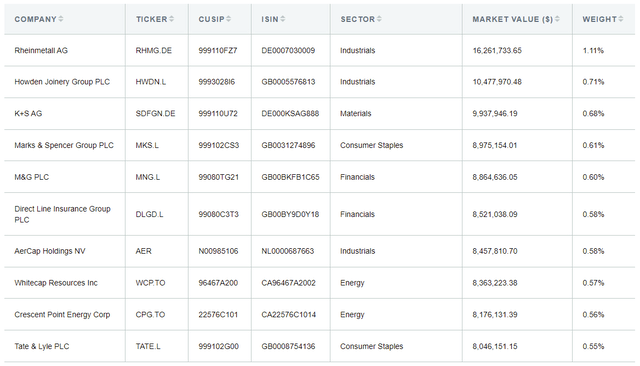

AVDV’s holdings themselves are quite diversified, with the fund investing in 1298 securities. As the fund is actively-managed, there is no set weighting methodology, but weights seem to be somewhere between equal-weighted and market-cap weighted. This significantly lowers concentration, and makes the fund very light at the top, with the fund’s ten largest holdings accounting for less than 10% of its value. These are as follows.

AVDV Corporate Website

I think that AVDV’s lack of concentration is a positive, insofar as it reduces the possibility of significant losses or underperformance due to weakness in one specific holding. This is sometimes an issue for undiversified small-cap equity funds, so the fact that AVDV’s managers structure the fund to avoid said issue is a positive.

AVDV’s holdings and strategy provide investors with diversified exposure to international small-cap value stocks, as expected. With this in mind, let’s have a look at the fund’s investment thesis.

AVDV Investment Thesis – Pure Value Play

AVDV’s investment thesis is remarkably simple: the fund is a pure value play, and could outperform broader equity indexes if valuations normalize.

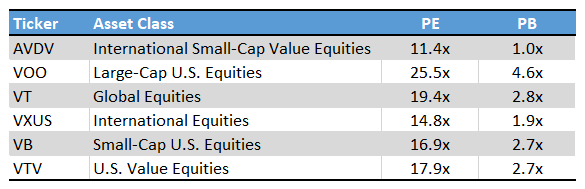

The fund invests in international small-cap value stocks, the equity market niche with the cheapest valuations right now, as per J.P. Morgan data. AVDV itself sports a 11.4x PE ratio, and a 1.0x PB ratio. Both figures are low on an absolute basis, and lower than that of its peers. Importantly, the fund’s valuation is lower than that of its individual components / segments. Meaning, international small-cap value stocks are cheaper than international, small-cap, and value stocks. Focusing on the intersection of these serves to minimize valuations, as expected. For reference.

Fund Filings – Chart by author

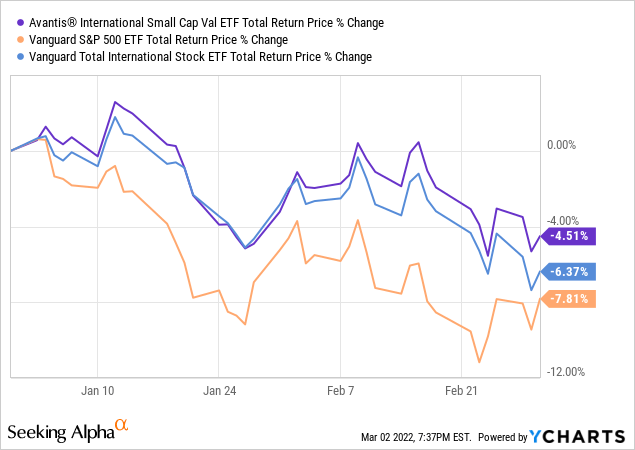

AVDV’s cheap price and valuation could lead to significant, market-beating returns if valuations were to normalize. That has been the case YTD, with the fund moderately outperforming relative to the S&P 500, and slightly outperforming international equity indexes.

AVDV Negatives – Risky Holdings and Strategy

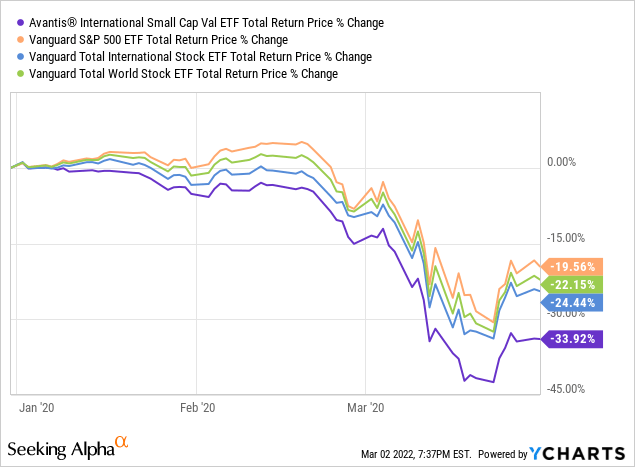

AVDV is a relatively good investment opportunity, but it is also a relatively risky one. International small-cap equities tend to be significantly riskier than average, due to foreign currency risk, the relative lack of safety in foreign markets, and the (general) lack of diversified revenue streams and strong balance sheets. Some international small-cap equities are fine, but most are simply not as resilient as mega-cap companies like Apple (NASDAQ:AAPL) or Microsoft (MSFT). As such, investors should expect the fund to significantly underperform during downturns and recessions, as was the case during 1Q2020, the onset of the coronavirus pandemic.

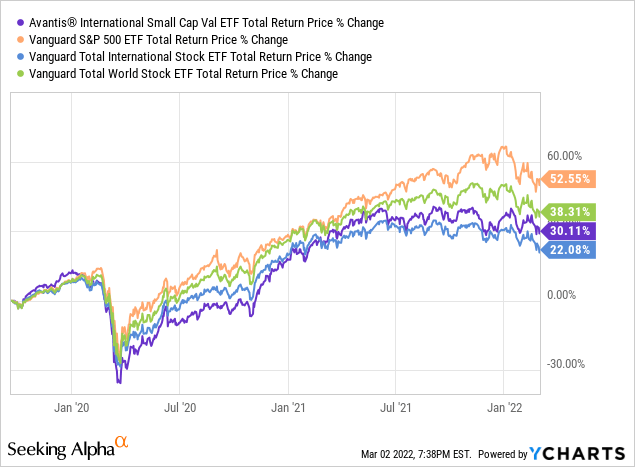

At the same time, although the fund’s investment thesis is reasonably strong, there is no guarantee that valuation gaps will continue to narrow. As they say, markets can remain irrational longer than you can remain solvent. Even though current valuations do not seem warranted, there is no guarantee they will narrow any time soon. As mentioned previously, said valuation gaps have persisted for close to a decade, with value stocks underperforming for years. AVDV has mostly underperformed too, at least relative to most U.S. equity indexes, although the fund has outperformed international equity indexes.

Conclusion

AVDV’s cheap price and valuation could lead to significant, market-beating returns if valuations continue to normalize. The fund is a buy, but only appropriate for more aggressive investors.

[ad_2]

Source links Google News