[ad_1]

amphotora/E+ via Getty Images

Avantis International Small Cap Value ETF (AVDV) is an actively-managed fund bringing together size, value, and quality factors in a portfolio of ex-U.S. developed-world equities.

Managed by American Century Investment Management Inc., AVDV had total assets under management of around $1.4 billion as of February 3.

Incepted in September 2019, the fund offers a unique exposure to the corner of the global capital markets that is not that easy to reach for U.S. retail investors (considering most stocks it picks are either not quoted in the country or have totally lackluster liquidity over the counter), with an active management component on top.

Even U.S. small-cap stocks, let alone those with a primary listing in less liquid markets, are mostly undercovered, underfollowed by analyst themes, and frequently overlooked or intentionally ignored by institutional players, which creates plentiful opportunities for those investors hunting for grossly mispriced equities and ready to patiently wait for a momentous catalyst for a value thesis to play out. Truly a contrarian’s paradise.

Since AVDV is free to make investment decisions within its selection pool, it can exploit this mispricing, placing bets opportunistically and ignoring those stocks it sees as lifeless, with zero or negative capital appreciation potential.

And this strategy comes for just 36 bps a year, while most of its international equity peers have at least a half percentage point expense ratio. And wait, a 2.4% dividend yield is another pleasant bonus coming with this value portfolio to boot. The mix with investment allure, isn’t it?

However, the risks inherent even to the quality-tested international small-cap value strategy (mindful of cash flows, among other things) are substantial enough to give the ETF a pass. In my view, it is the FX question that has not gone anywhere. In its current iteration, the fund’s portfolio is tilted towards the Japanese and UK equities, with ~24.7% and ~16.5% allocated, as of February 3. The soft period for the yen might not be over, despite the currency currently being at the weakest level compared to the U.S. dollar in five years, as the safe-haven JPY appeals to bears given the interest rate increases looming in the U.S. For the pound sterling, the bullish case is also hard to defend, owning to the reasons I touched upon in the article. Speaking about other currencies like the euro (AVDV is long French, German, Italian, Austrian stocks, etc.), I would not say that they do have the potential to appreciate vs. the USD this year at least, precisely because of persisting dovishness in the eurozone, even though inflation has recently surprised to the upside.

AVDV is benchmarked against the MSCI World ex USA Small Cap index. As of end-January, the index had 2,588 constituents vs. just 1,307 equity holdings in the ETF’s portfolio.

Please take notice that like a few ETFs I have already reviewed on Seeking Alpha, AVDV does not necessarily hold only companies with market values between $300 million and $2 billion, which are typically considered small-caps. Its definition of a small-cap company is what I would call rather mercurial. As detailed on page 2 of the prospectus,

When selecting investments for the fund, the portfolio managers consider the distribution of market capitalization of all companies in each country in which the fund invests, meaning that a company of a given size may be considered small in one country, but not in another.

A small though necessary quality ingredient is added to the mix more likely to ensure value traps do not qualify. No one wants an already risky international small-cap portfolio to be rife with low-quality stocks on the brink of collapse. As explained on the same page, the adjusted cash flows/book value ratio is the principal metric used in profitability assessment, though other unmentioned ratios can also be applied, if necessary.

For the value factor, portfolio managers use adjusted B/P; I personally believe this metric is a suboptimal choice, though it is necessary to remark that it allows gauging value across all sectors, including financials, where cash-based metrics lose relevance.

Industrials (22.7%), materials (19.2%), and financials (17.4%) are AVDV’s key allocations at the moment. London-quoted Marks & Spencer Group (OTCQX:MAKSF) is, for now, its key stock, with almost 0.8% of the net assets. It is a mid-cap British retail company, with a market value of around £4 billion. With a P/E of ~134x, the stock looks like a strange admixture in the value mix, but the issue with the ratio is the compression of the net income margin, which should be temporary. If assessed from a different angle, it has a staggering 20% FCFF yield (FCFF/EV) and Price/LTM Sales of ~0.39x. Another way of saying, the company is phenomenally cheap.

Peers

AVDV’s only closest peer I am aware of is the passively-managed iShares International Developed Small Cap Value Factor ETF (ISVL), with a 30 bps net expense ratio. The downside is that ISVL’s methodology is constrained by the index it tracks, the FTSE Developed ex US ex Korea Small Cap Focused Value Index. ISVL is a much more concentrated, Canada-heavy (AVDV has just 9% of the net assets in Canadian stocks) nouveau investment vehicle with less than a year in the books. However, the main similarity with AVDV is its focus on industrials/materials/financials trio.

Returns

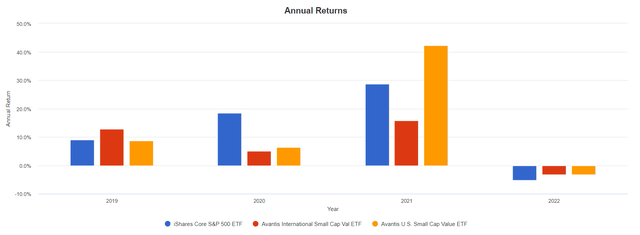

Though promising at first glance, AVDV’s strategy has not delivered excess returns compared to the S&P 500 ETF (IVV), also performing much weaker than its U.S. focused counterpart the Avantis U.S. Small Cap Value Fund (AVUV), at least for now, though I should acknowledge that it always takes time for a truly contrarian thesis to play out.

AVDV, AVUV, IVV annual performance (Portfolio Visualizer)

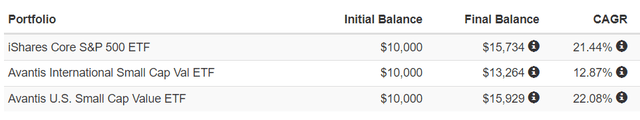

The table below shows CAGRs for the 30 September 2019 – 31 January 2022 period:

AVDV, AVUV, IVV CAGRs (Portfolio Visualizer)

Still, as data on its website illustrate, it did grossly outperform the benchmark within one year, which points to the fact its portfolio management team is highly proficient.

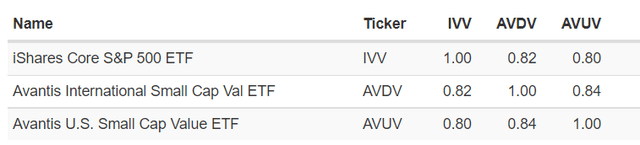

Besides, it is worth noting that both AVUV and AVDV are more or less correlated with IVV, despite the latter focusing on entirely different market/country segments.

AVDV, AVUV, IVV correlation matrix (Portfolio Visualizer)

Final thoughts

AVDV might look like an ETF clearly possessing investment allure, especially considering its focus on the (almost) cheapest companies in the world, excluding less stable and thus riskier emerging markets, except for just one Hong Kong-listed Chinese stock (labeled as such in the holdings dataset available in the AVDV website), Fullshare Holdings (OTCPK:FLLHF) with a 0.2% weight. Adjusted cash flows analysis included in the quality assessment is yet another strength.

In an environment where the richly valued U.S. market is still experiencing bouts of volatility amid valuation resets arriving seemingly out of the blue, like the epochal one we have recently seen in the case of Meta Platforms (FB), the inherently inexpensive small-cap universe might offer relief for investors looking for safety.

It is nicely diversified, with only ~6.4% allocated to the ten key holdings, which is better compared to ISVL’s over 12%. Asset Flows are exceedingly robust, with healthy volumes and AUM changes pointing to growing investor interest. As I said above, the ~2.4% LTM yield is a nice by-product of its value strategy. All these contribute to its allure.

However, the principal downside is the FX question. Depreciation of the advanced economies’ currencies it is most exposed to can dent otherwise strong returns if achieved. So, to express a bullish opinion on AVDV I should simultaneously explain why I am bearish on the USD, while I am certainly not assuming the looming interest rates increases.

That said, investors seeking exposure to the underappreciated players from the lower stock market echelon can take a closer look at the Avantis U.S. Small Cap Value Fund that I have reviewed twice, with the most recent note published in December.

[ad_2]

Source links Google News