[ad_1]

DNY59/E+ via Getty Images

Article Thesis

ARK Investments has seen its ETFs, including ARK Innovation (ARKK), ARK Genomic Revolution (ARKG), ARK Fintech Innovation (ARKF), and ARK Next Generation Internet (ARKW) drop significantly over the last year. In 2022, these ETFs have, so far, performed very badly, and further downside is material. Rising rates and high inflation work against ARK’s ETFs, and selling pressure in ARK’s investments, combined with outflows in its ETFs, could accelerate things further. It does also not really help that Cathie Wood has made a number of high-profile macro calls that have, so far, turned out to be pretty bad. With many of ARK’s holdings still trading at pretty high valuations, it seems unlikely that things will turn around quickly.

2022 Performance

ARK’s main ETF, ARKK, has severely underperformed both the broad market as well as the tech and innovation-heavy Nasdaq index this year:

In January alone, ARKK has dropped by 19% in price, while assets under management dropped by 24% over the same time frame. The difference can be explained by net outflows in the ETF. Looking at the last year and starting to count from the all-time-high from early 2021, ARKK has lost 50% to date, while AuM dropped by 55%. This means that shares would have to double, or rise by 100%, for ARKK to get back to the all-time high, which shows the serious capital destruction we have witnessed in the recent past.

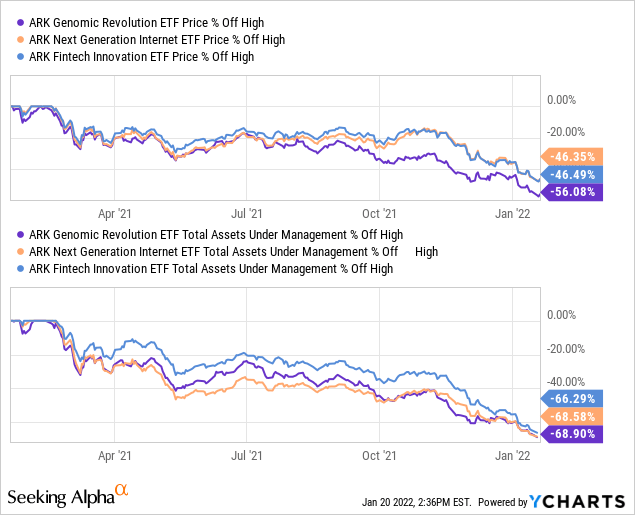

Other ARK funds have not done a lot better:

The Fintech and Internet ETFs have declined by 46% in price, while the Genomics ETF has seen its share price drop by a massive 56% over the last year. On an AuM basis, all three ETFs are down by around two-thirds compared to the respective highs seen in early 2021.

The Bubble Pops

The huge underperformance – remember that the broad market is up 19% over the last year – can be explained by several factors. First, there are macro headwinds at play.

Inflation has been surging in 2021, despite hopes that it would be temporary only. It does, however, not look like inflationary pressures will cease anytime soon:

The house price index in the US is up 17% year over year, which should continue to have an impact on CPI rates due to the owner’s equivalent rent part of the index. At the same time, the producer price index is up by 10% in the US over the last year. Companies will mostly try to pass on higher expenses to customers, thus it does not look like CPI increases will fall meaningfully in the next couple of months. They could, in fact, climb further, as producer prices are up more than consumer prices so far, and since there is usually a time lag between these two.

High inflation does run contrary to Cathie Wood’s thesis of the economy being in a deflationary environment. Cathie Wood is predicting that deflation will be the real concern for the economy going forward, but so far that has not materialized. Instead, inflation is running at a multi-decade high right now. This hurts her funds because they don’t offer any commodity exposure (e.g., energy stocks, mining stocks) which would protect them from higher inflation. Instead, most of her picks seem to offer pretty bad inflation protection, if any at all, which makes them vulnerable in a high-inflation environment.

Even more importantly, high inflation will force the Fed to raise rates significantly in the coming quarters. Higher interest rates do, all else equal, result in higher discount rates for equities. This, in turn, has an outsized impact on expensive growth stocks, where the majority, or all of the future profits are many years away. ARKK’s strategy of buying barely profitable or non-profitable, expensive growth names thus makes the ETF very vulnerable versus such increases in interest rates. Since rates could climb a lot further from where they stand today – the 10-year rate is 1.8%, which is well below the rate of inflation – equities, and especially ARK’s expensive growth stocks, could feel further pressure going forward.

On top of that, ARKK and the other ARK funds do also have to battle other headwinds. ARK’s ETFs benefited from huge inflows during the pandemic, which allowed ARK to increase their investments in their favorite names. This resulted in rising share prices in names such as Tesla (TSLA) or Teladoc (TDOC), which, in turn, resulted in NAV growth for the ARK funds. This only works until it doesn’t, however. Since assets under management are no longer growing, as inflows have turned into outflows, ARK Investment has turned from a net buyer into a net seller. This naturally hurts the share prices of ARK’s favorite holdings, which, in turn, hurts the net asset value of these ETFs. This makes investors bail, resulting in more outflows, which results in more forced selling, and so on. The former virtuous cycle – rising prices lead to rising prices – has thus turned into a vicious cycle, as declining prices put more pressure on ARK and its holdings.

Valuations For Many ARK Stocks Are Still High

The average ARK stock is down quite a lot over the last year, but nevertheless, many of these picks are still far from cheap. This means that there is still ample downside potential in many of these companies, despite their typically bad one-year performance.

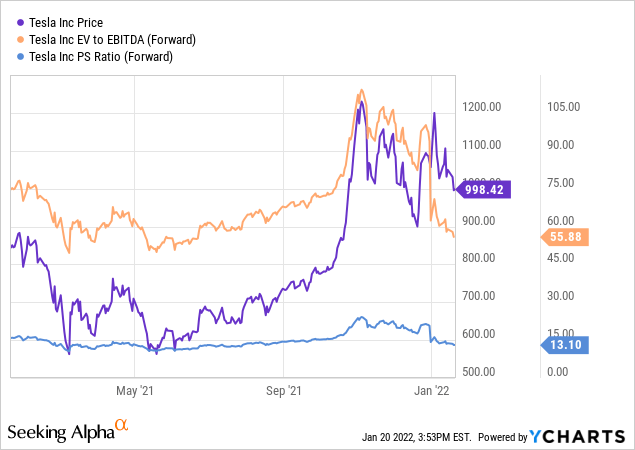

Tesla has held up a lot better than most other ARK picks, as it is actually up over the last year:

Shares trade at around $1000 today, down from $1200 at the peak, but still way ahead of where shares traded one year ago, or during the summer of 2021. Shares are, I believe, pricey. With a sales multiple of 13, and an EV/EBITDA ratio of 56, there is no fundamental reason that will stop Tesla from falling in case sentiment sours or broad markets continue to drop. An EBITDA multiple of 30 would still represent a quite large premium over other auto companies, and it would allow for shares to fall close to 50% from current levels.

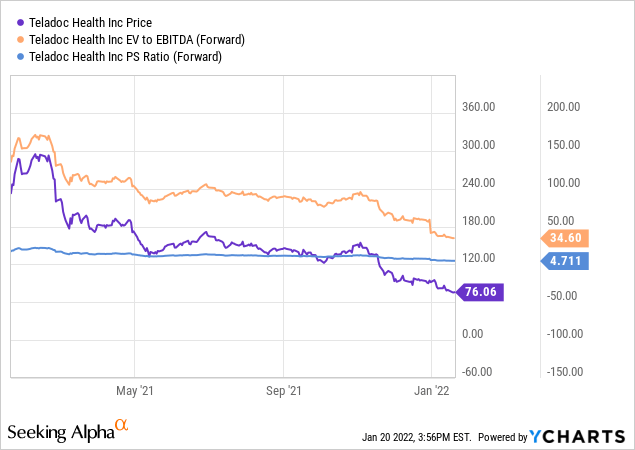

Teladoc is another favorite at ARK, and it has performed abysmally bad over the last year, as shares dropped by roughly 70% from the stock’s highs. Even today, Teladoc is still trading at an EBITDA multiple of 35, however. With growth slowing and considering the company’s relatively weak profitability, there is further downside potential in the stock, unless sentiment improves markedly. If, for example, Teladoc were to trade at 25x EBITDA, which would still not be a low valuation, shares would drop by another 30%.

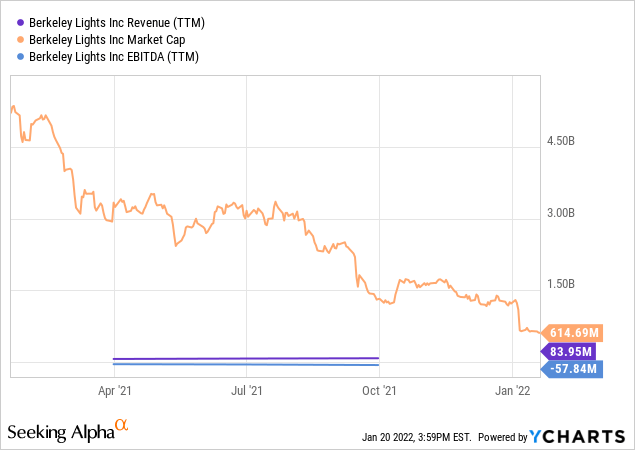

Berkeley Lights (NASDAQ:BLI) is another ARK pick where shares could drop a lot further going forward, I believe. The stock is down more than 40% year to date, but it does still not look attractive:

The company, which is losing money even on an EBITDA basis, is still trading at 8x revenue. That could be a very reasonable valuation for a profitable software company with attractive valuations, but for a cash-burning, deeply unprofitable healthcare company, the current valuation is not low at all. I do believe that shares could easily fall by another 50% if sentiment remains weak.

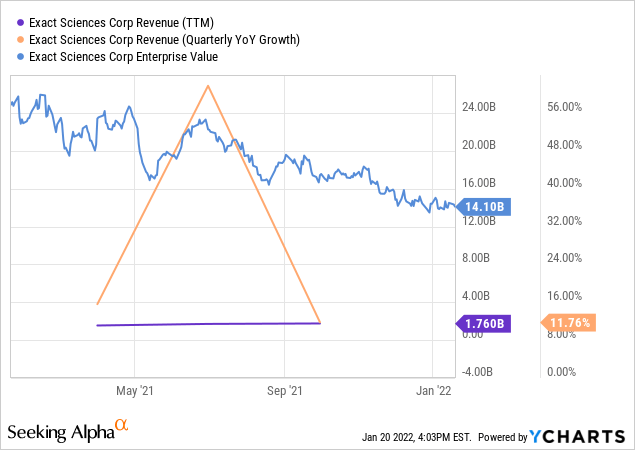

Exact Sciences (EXAS), a medtech company providing diagnostic products, trades at around 8x revenue. The company is, despite ARK touting its focus on disruptive growth companies, only growing its revenue at 12%. For a company that is not profitable (EXAS reports negative EBITDA), and that grows at just above 10%, this does not seem like a low valuation at all.

Many more names in the ARK investment universe still seem pricy:

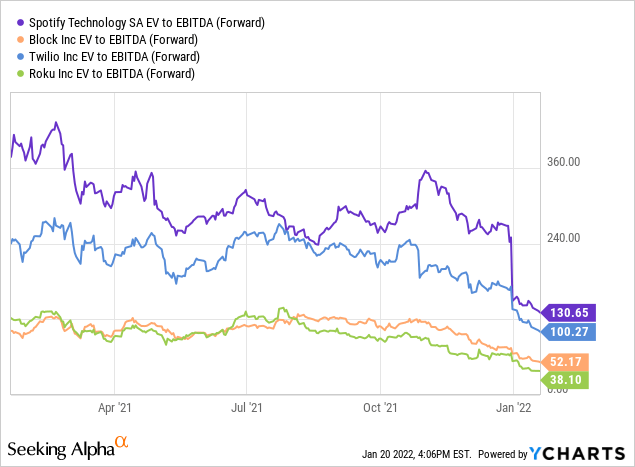

Spotify (SPOT), Block (SQ), Twilio (TWLO), and Roku (ROKU) all have seen their valuation compress considerably over the last year. Still, none of these stocks seem particularly cheap. I do not believe that there is a fundamental reason that can prevent these stocks from dropping further. If sentiment around growth names remains weak, why shouldn’t Spotify see its EBITDA multiple decline to 100, 80, 50, or even lower? The same holds true for the other stocks in the above chart, as all of them could, I believe, drop by another 20%, 30%, or more. That does not mean that they will necessarily do that, of course. I also do not want to bet on them doing that, as I am not short any of the stocks mentioned in this article. I just want to showcase that many ARK picks remain, despite their weak performance, pricy. This means that there is a lot of risk for further price declines for these individual stocks, and for the ARK ETFs.

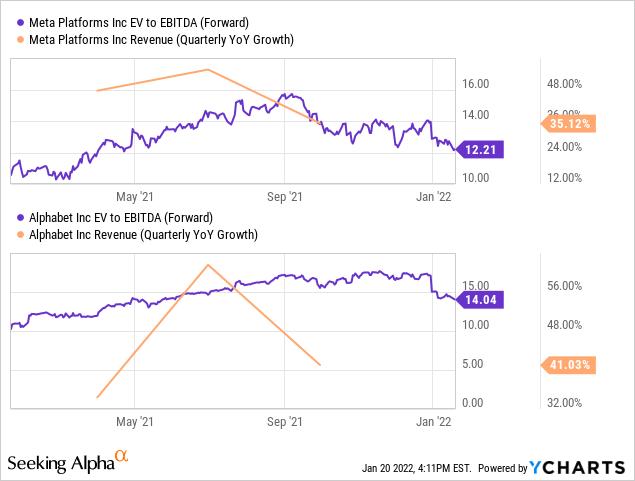

There are, it should be mentioned, growth names that do look fundamentally cheap:

Meta Platforms (FB) or Alphabet (GOOG) trade at just 12x and 14x EBITDA, respectively, and they are growing faster than many of the ARK names. I am convinced that these stocks, with compelling growth and an undemanding valuation, will not drop by 30%, or more from the current level unless we see a bear market of epic proportions. The same can’t be said about Spotify and other ARK names, however, as those are incredibly expensive compared to the likes of FB and GOOG. It is noteworthy that Spotify has grown its revenue at a high-20s rate in the recent past, which means that it is a lower-growth name compared to Meta and Alphabet – and yet it trades at a 900% premium to them on an EBITDA basis.

Takeaway

ARK funds, with ARKK being the most important one by far, have offered a very bad performance over the last year, and especially over the last month. Due to bad macro calls (Cathie Wood forecasts deflation while inflation is at a 40-year high), and due to the forced selling in many ARK names, ARK’s ETFs could continue to decline. From a fundamental basis, there is, I believe, no reason to assume that these ETFs can’t decline further – many holdings are still pricy. If sentiment around growth stocks remains weak, and if these ETFs continue to experience outflows, investors might be better off staying away from ARKK and the other ARK funds.

[ad_2]

Source link Google News