[ad_1]

Eoneren/E+ via Getty Images

Star investor Cathie Wood knows how to make the headlines. Most recently, she stated that her ARK Innovation ETF (NYSEARCA:ARKK) could be on the verge of climbing 50% per year over the next half decade. This is how much conviction she has that the growth and tech factors are overdue for a rebound.

However, it’s not hard to take the other side of the argument. ARKK’s astounding share price decline that started in early 2021 might be simply a correction following years of irrational exuberance, not a buy-the-dip opportunity. After all, why should the uber-growth ETF do well during a period of high inflation, rising interest rates and lower appetite for risk?

When it comes to investment strategy, I prefer to simplify and not even engage in this debate. To me, ARKK is only investable if buy and sell decisions are driven by price action. Below, I revisit my preferred approach to owning shares of the fund, and how it has worked well since the start of the pandemic.

Yes, it’s a bubble

Early in 2022, I shared my opinions on how ARKK should be traded. To start, I think that a fundamental, long-term belief that investing in “the technologies of the future” will eventually pay off. The premise here is that tech-driven, multi-decade growth is a more important investment theme than the cyclical forces that we have witnessed so far in 2022: higher inflation, rising interest rates, decelerating global economies, war in Europe, oil and gas crises, etc.

The next step is to realize that ARKK was, and maybe still is, a bubble. The ETF skyrocketed by over 500% from 2015 through December 2020. Shortly after that, starting in February 2021, the fund fell apart and lost just about 70% of its value in roughly 15 months. Since the 2014 inception, ARKK has returned 8.3% per year, which is consistent with historical gains in the S&P 500 – but the timing of the entries and exits would have made all the difference in separating winners from losers.

If this bubble-type behavior reminds you of Japan in the 1980s and young tech stocks in the 1990s, but on steroids (the boom-bust cycle has been playing out incredibly quickly), you are in good company.

ARKK: trading bubbles

Bubbles are not necessarily a bad thing if an investor knows “when to hold ’em, when to fold ’em”. Pulling from memory, legendary money manager Stan Druckenmiller has said in an interview that he is in favor of trading bubbles as they inflate, regardless of whether fundamentals justify the rally. The key, in his view, is to know when to step away and not be caught holding the bag.

Following the same rationale, I have justified owning ARKK, a.k.a. the most popular bubble story of the 2020s so far, only if the ETF is trading above the 50-day moving average. If the price drops below the line, the risks of hanging on to ARKK all the way down to oblivion becomes, in my view, unacceptable. At that point, shares of the ETF should be sold.

The idea is that investors can strategically ride the bullish wave when it finally happens – again, we are assuming here that a recovery will eventually take place. At the same time, they can avoid being caught in a downward spiral. The key here is diligence and patience.

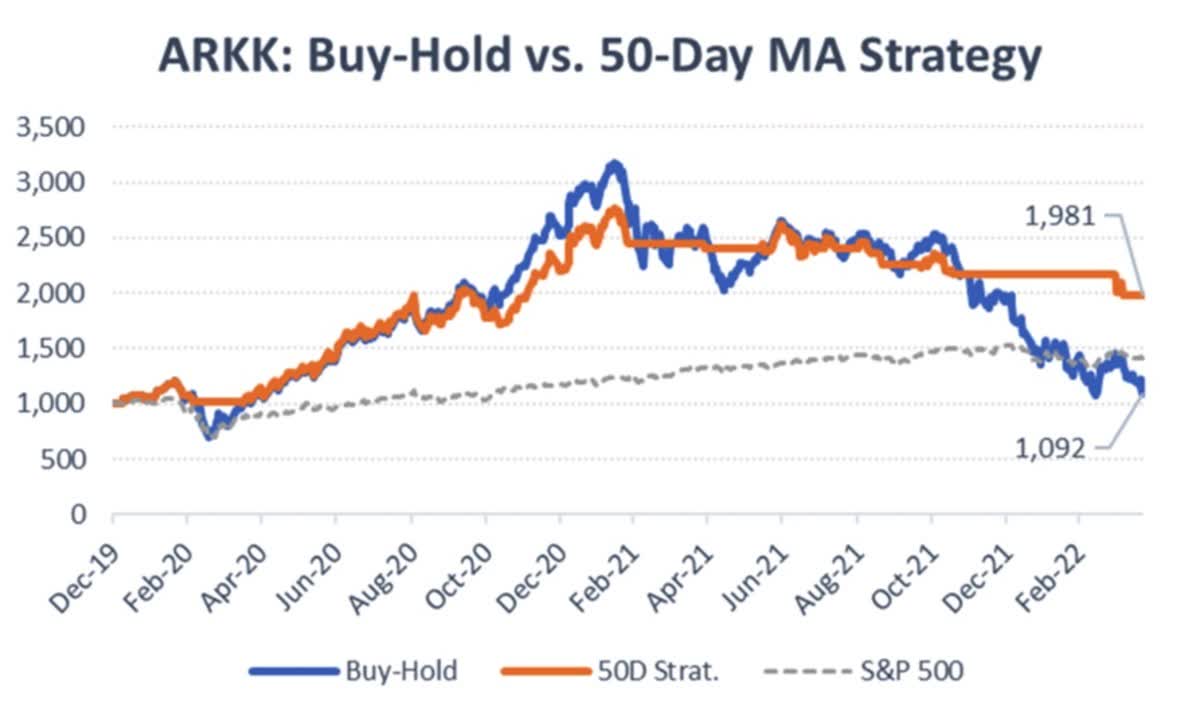

Below is a chart showing how, by using the simple strategy described above, ARKK could have been a great play since just before the start of the COVID-19 crisis. In this case, investors would have still been up nearly 100% since early 2020, after enduring a maximum pullback of only about 28%. By contrast, over the same period of time:

- buyers-and-holder of ARKK would have been down 4%.

- the S&P 500 has returned only 32% cumulative.

ARKK buy-hold vs. 50-day moving average strategy (DM Martins Research)

Being wrong, but limiting losses

The 50-day moving average “told me”, in late March, that it was time to buy ARKK. Bad timing, as we all know what has happened to the ETF so far in April: down another 27%, from $66 per share to below $50.

But this is why following a chosen investment strategy very closely is crucial. Case in point, the same 50-day moving average would have indicated that ARKK should have been sold on April 5. Yes, it is annoying to enter a trade today and exit it five days later with a small loss. But following the simple set of rules would have prevented much larger losses from being realized.

In for the debate or for the money?

I understand, it can be fun and intellectually stimulating to have conversations about Cathie Wood’s investment philosophies and about ARKK’s holdings. With Teladoc (TDOC) down an overwhelming 45% for the day and Ms. Wood doubling down on her bet, I am tempted to offer my own two cents on business fundamentals, valuations, the market environment, etc.

But if ARKK holders and potential investors want to make money and not waste too much of their precious time in the process, I think that they should relax and just watch the fund’s share price once per day. If the ETF behaves as I believe it will – e.g., continue to dip, find a floor and bounce back to new highs – diligently following a moving-average strategy is all that is needed to ride the eventual bullish wave.

[ad_2]

Source links Google News