[ad_1]

Marco Bello

The ARK Innovation ETF (NYSEARCA:ARKK) has become one of the most notorious investments products of this 21st century, largely because investors view the fund as being synonymous with the rise – and bursting – of the tech bubble. The vocal fund manager Cathie Wood has at times seemingly ignored valuation in favor of focusing on the long term outlook – an investment strategy that worked well during the pandemic but has been brutally punished over the past year. While it is not clear if the investment processes have changed, the valuation of the underlying holdings has fallen so drastically that the ETF is highly buyable today.

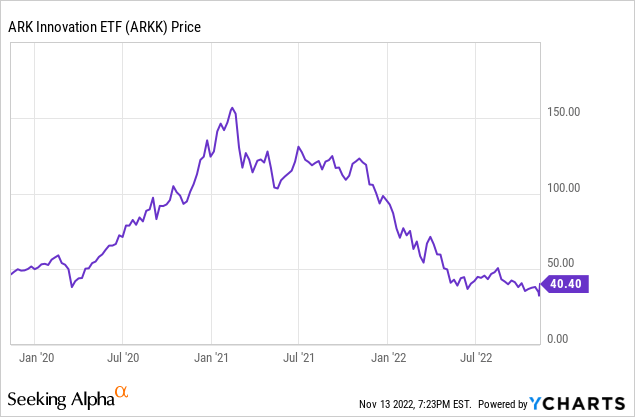

ARKK ETF Price

ARKK is an ETF which means it should be diversified, but diversification has not stopped it from crashing.

I last covered ARKK in December and it has crashed another 60% since then. At the time, I rated it a buy over the long term. The vicious crash of the past year, however, is making ARKK look like a compelling pick over near term time horizons as well.

ARKK ETF Outlook

For some, the near term outlook for ARKK may depend on interest rates. Last week, the ETF soared after October CPI came in at 7.7%, lower than 7.9% as expected and potentially signaling that the Federal Reserve may slow down its pace of increases.

Some may be skeptical that the 0.2% surprise is enough to justify such a rally, and I share such doubts. But in my view, interest rates are not necessarily the critical factor at play. There is a notion that tech stocks crashed because interest rates rose. That is in part true, as many tech stocks previously traded at bubbly valuations and the tightening monetary policy proved quite efficient in addressing the bubbles. But valuations have arguably swung too far in the other direction. Consider that Alphabet (GOOG) (GOOGL) is now trading at 20x earnings (that is before accounting for net cash and includes losses from Google Cloud and Other Bets) yet Pepsi (PEP) trades at 26x earnings. You’ll be hard pressed to find many investors who believe that PEP has a stronger long term outlook than GOOGL. All things being equal, GOOGL arguably should trade at a materially higher multiple than PEP.

While it is a plain fact that tech stocks crashed while interest rates rose, the correlation is not necessarily absolute as it appears emotions are also at play. There is no inherent reason why tech stocks should have greater correlation with interest rates than other sectors. If anything, tech stocks are arguably more inflation-resistant due to their high gross margins and stronger growth rates. Even as many tech stocks see growth rates decline to “only” 15%-20%, that still represents substantially faster growth than other sectors. I expect mega-cap tech stocks like GOOGL to rally significantly moving forward which in turn may lead to unprofitable tech stocks to rally significantly as well – and that is in spite of prevailing interest rates. Rising interest rates may lead to pressured growth rates in the near term, but I am of the view that current valuations in large part already reflect that.

ARKK ETF Top Holdings

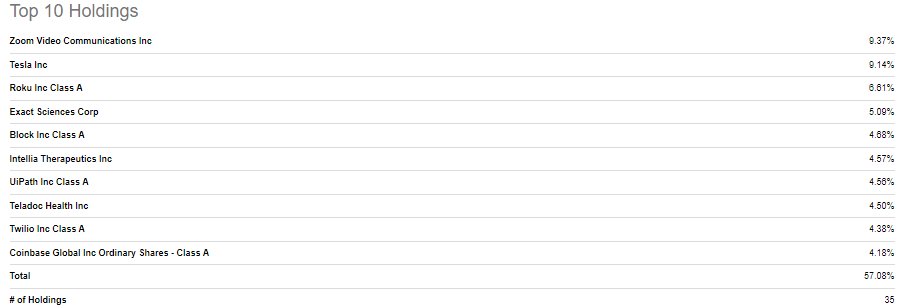

Cathie Wood has famously stated that her investment strategy during extreme volatility is to focus on “high conviction names.” We can see the top holdings of ARKK below.

Seeking Alpha

ARKK is not a tech-only fund as Wood has sought innovative growth across various sectors. There definitely is a strong weighing in tech as evidenced by the 9.63% allocation in Zoom (ZM).

Is ARKK ETF A Buy, Sell, Or Hold?

It can be difficult to judge the outlook for an ETF due to the various positions, but one can attempt to do so by analyzing the underlying holdings. Growth stocks can be attractive due to the annual growth but the potential for multiple expansion is really what makes ARKK so appealing here.

ZM is currently trading at 6x sales and continues to generate GAAP profits. I see ZM eventually sustaining at least 35% net margins over the long term. I expect ZM to sustain above average growth for many years as it continues to digitize meetings. Assuming a return to just 15% growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I see fair value at around 8x sales, implying over 30% potential upside.

Roku (ROKU) is trading at just 6x gross profits in spite of owning a “walled garden” platform in smart TVs. I expect the shift to video streaming to persist and for growth to return to the 15%-20% range over time. Assuming 40% net margins (based on gross profits) and a 1.5x PEG ratio, I see fair value at around 9x gross profits, implying 50% potential upside.

Block (SQ) has been hit hard due to decelerating fintech growth post-pandemic as well as its exposure to the crashing cryptocurrency market. Yet the stock trades at only 8x gross profits and the company generates positive non-GAAP margins. I can see SQ rebounding to at least 15% growth and sustaining 50% net margins based on gross profits over the long term. Applying a 1.5x PEG ratio, the stock might trade at 11.3x gross profits complying over 40% potential upside. This same kind of analysis can be done with the same results on much of the funds’ holdings. Even though ARKK has rallied nearly 25% in just a matter of days, there’s real fundamental reason to believe that the rally has more room to run.

What are the risks? At this point, I do not find valuation to be the main risk. Instead, it may arguably be the active management, as it is unclear how Cathie Wood will manage the portfolio from here. In particular, I am unsure if her decision to overweight names like ZM and Tesla (TSLA) makes the most sense here. It appears that she has done so because these offer stability relative to the higher risk names in the portfolio on account of their stronger margins (as in the case of ZM) or stronger secular growth story (as in the case of TSLA), but I am not of the opinion that these names offer nearly as much upside as the more beaten down names in the portfolio, such as Twilio (TWLO) or Unity (U). There is the risk that Cathie Wood ends up positioning the portfolio in a way that does not benefit from the tech recovery, if and when it does occur. Another risk comes due to the lack of profitability at many of the funds’ holdings. A lot of the valuation analysis assumes a long term profitability profile, but there is no guarantee of that occurring. If growth does not return for many years, then ongoing operating losses and shareholder dilution would make these dangerous stocks to own even at these valuations. One must have confidence not just in Cathie Wood but also in the underlying holdings. While I would not personally construct a growth portfolio in the exact same manner as Cathie Wood has, I see enough undervaluation in ARKK to justify buying at these levels.

[ad_2]

Source links Google News