[ad_1]

lcva2/iStock Editorial via Getty Images

FOMO buyers are back

CPI for the twelve months ended October increased by 7.7% vs. 8% consensus. This was the first time in a while that inflation came in below expectations. Markets celebrated, risk-off turned into risk-on, shorts got squeezed, and Wharton professor Jeremy Siegel now thinks inflation is basically over. Following the October report, shares of ARKK (NYSEARCA:ARKK) have rallied by 24% as investors rushed back into the Cathie-Wood-led ETF that invests in hyper-growth companies that are “on the right side of change.”

While the recent inflation report was a positive sign that prices may be cooling, investors are getting ahead of themselves and behaving as if a Fed pivot is soon happening. Again, let me remind everyone that Fed Chair Powell has indicated many times that rates will remain high until inflation falls back to the 2% target, which means the economy will face the impact of either a hard or soft landing.

Judging from the recent price action of ARKK, it’s clear that FOMO buyers are back as no one wants to feel silly for not participating in these massive daily rallies that give everyone an adrenaline rush. While the short-term uptrend may continue as more shorts are forced to cover, those who keep chasing the action without any regard to the fundamentals are again setting themselves up for trouble.

Unfortunately, not much has changed

Thus far in the earnings season, many companies in the ARKK portfolio have already reported materially slower growth and little visibility as the pandemic is no longer a tailwind for their top-lines. Considering ARKK’s 3 biggest holdings, these names remain overvalued and fundamentally challenged in the current macro backdrop.

Zoom (ZM) (largest position at 9.6% of portfolio) has seen its TTM revenue growth fall from 326% in 4Q20 to just 18% in 2Q22. The video communication company has reported YoY top-line growth of just 12% and 8% in Q1 and Q2, while the Street expects just 5% of growth in the back half of 2022.

At the height of the pandemic, investors were so enthusiastic about the company that shares were once valued at 50x NTM revenue. If there’s one thing thrilling about the stock, it’s watching it drop from $580 in October 2020 to $88 today.

Zoom’s top-line growth is expected to slow down materially to 9% in 2023, but markets are still valuing the stock at 5.5x 2023 sales (0.6x growth adjusted) despite the existence of many alternatives such as Microsoft Teams (MSFT), Google Meet (GOOG), Amazon Chime (AMZN), Webex (CSCO) and TeamViewer. However dire the situation may be from a valuation standpoint, there’s always that one analyst who’s willing to look that far out into the future. Based on his/her estimates, Zoom is trading at just 8.7x 2031 estimated earnings.

Tesla (TSLA) (2nd largest position at 7.9% of portfolio) remains the most overvalued car company, in my view, with over $600 billion in market cap, 3x/6.5x/6.9x that of Toyota (TM), Porsche, and Volkswagen (analysis here). Despite Tesla’s faster growth and higher margins, the outrageous valuation shows future results will have to materially exceed expectations just to keep share prices from falling.

In 3Q22, Tesla again disappointed the Street with total deliveries of 343k that came in 6% below consensus, and the stock dropped almost 7% despite a 56% YoY growth in Q3 revenue. As usual, management was ambiguous about the outlook but reiterated a 50% increase in deliveries over a multi-year horizon. Additionally, CEO Elon Musk believed the company could one day be worth more than Apple (AAPL) and Saudi Aramco combined.

While there’s no question that global EV penetration will continue its upward trajectory going forward, rising interest rates and intensifying competition will not make things any easier for Tesla. In the US, Tesla is currently the leader with a 64% market share at 2Q22, but most automakers have joined the EV race and it’s been estimated that there will be more than 130 EV models available by 2024 including the likes of GM (GM) and Ford (F).

In Europe, Volkswagen is the leader with a 20% share of the EV market while Tesla does not even belong to the top-5 list with just an 8% share. In the Chinese market where 30% of all cars sold are EVs, Tesla’s share has fallen from 11.6% in 2Q21 to 9% in 2Q22, behind the leader BYD (OTCPK:BYDDF) at 28% and the runner-up SGMW at 9%. Recently, Tesla has cut prices for Model 3/Y by as much as 9% in China, causing concerns over an intensifying price war with lower-priced domestic EV makers.

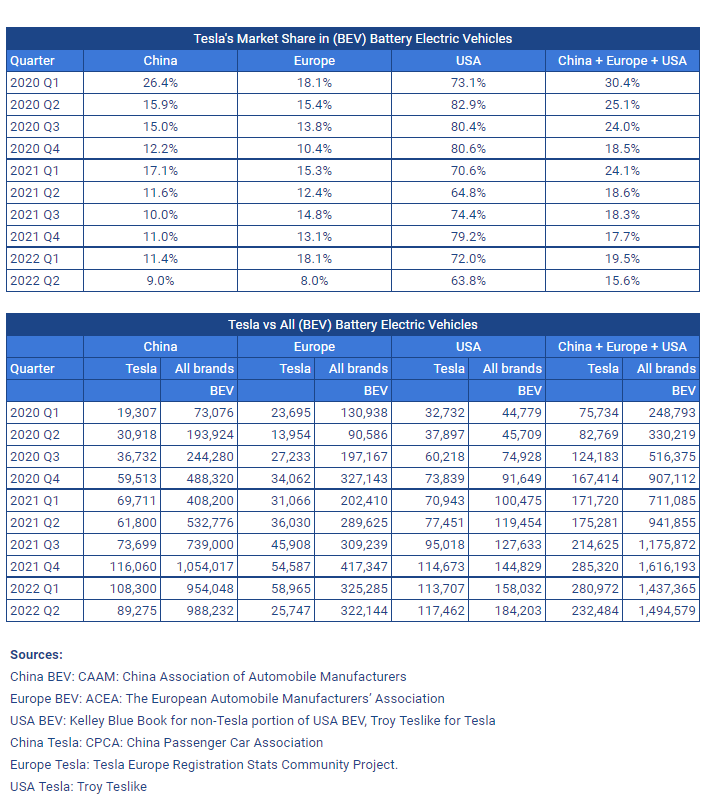

Per the table below, we can see that Tesla’s share in China, Europe and the US has almost been cut in half from 30% in 1Q20 to 16% in 2Q22.

Troy Teslike

Fundamentals aside, the issue surrounding Twitter’s bankruptcy adds nothing but headache for Tesla investors as Elon Musk recently had to sell almost $4 billion worth Tesla’s shares to fund his side project.

It’s unclear why Musk would want to acquire a dying social media platform, but it’s clear that Twitter is in a difficult financial position that will require additional resources in the form of time and money from Musk. Considering Tesla is entering a much more difficult environment characterized by higher interest rates and rising competition, Musk’s effort in trying to rebuild Twitter is probably the last thing Tesla investors want to see.

Roku (ROKU) (3rd largest position at 7% of portfolio) was a phenomenal growth during the Covid era as consumes couldn’t wait to receive their Roku sticks and TVs during lockdowns. Unfortunately, the company is now facing serious issues for both macro and micro reasons.

In Q3, Roku reported revenue growth of 12% which was above consensus, but again disappointed the Street on its Q4 outlook as management noted that “big advertisers are not spending with anyone” (analysis here).

Aside from a weakening Platform (advertising) business that faces a challenging scatter market where advertisers can turn off their campaigns in just a click, Roku’s Player business continues to weigh heavily on the bottom-line as management thinks it makes sense to sell those Roku players at a loss to drive active accounts that can later be monetized via advertising.

While this may not be a problem if revenue can grow 40%-50% a year, Roku’s Q4 guidance of an 8% YoY revenue decline offers no reasons for investors to be optimistic about the future. Whether Q4 may be a kitchen-sink quarter or not, the key takeaway is that when Roku’s declining top-line growth meets unprofitability, markets are unlikely to find any valuation support for the stock. At 2.6x 2023 revenue, Roku may still be one expensive stock given the bottom-line remains largely negative.

Takeaway

Animal spirits are back and markets are again chasing growth stocks based solely on price momentum while forgetting the fact that there’s no longer any growth to speak of. As a result, I believe investors should treat ARKK’s recent rally as a selling opportunity as many of its core holdings remain wildly speculative with few fundamental reasons pointing to an improving outlook. Of course, shorting the rally can always be risky as prices can always go higher in the near term thanks to FOMO. But when markets start to pay attention to the fundamentals again, ARKK buyers will likely face another round of painful selling.

[ad_2]

Source links Google News