[ad_1]

kupicoo/E+ via Getty Images

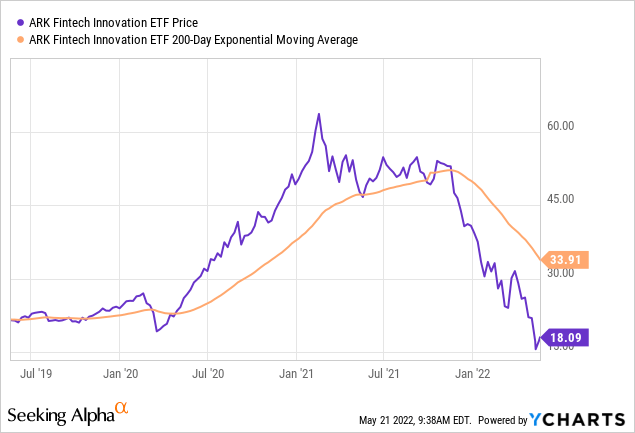

To say that ARK’s Fintech Innovation ETF (NYSEARCA:ARKF) has had a rough year would be an understatement. Since the beginning of the year, its Fintech fund is down more than 55%. I’ll explore what ARKF’s fund is all about, why the fund experienced this downturn, and why I reckon the selloff is overdone.

Where Is ARKF At Now?

After reaching a high of $64.49 in February 2021 last year, the fund fell to an all-time low of $14.64 last week, or a 77.30% drop from peak to trough.

The reason for the drop is presumably due to a concentration in Ark’s high conviction names. In fact, 42% of the ETF’s weighting is concentrated in the top 5 stocks. In total, the ARKF ETF owns 30 stocks.

Fund Details/Holdings

Since a significant portion of the ARKF ETF is concentrated in its top 5 holdings, let’s take a look at what those holdings entail, what their performance looks like, plus some of the key events that have taken place recently.

Performance:

- Block (SQ): -49.13% YTD

- Shopify (SHOP): -73.31% YTD

- Twilio (TWLO): -60.72% YTD

- Coinbase (COIN): -73.65% YTD

- UiPath (PATH): -60.31% YTD

So as you can see, Cathie Wood’s top 5 stocks for ARKF have completely toppled over the past 5 months.

Overview, Key Events And Stats

- Block: financial services. Developer of apps Square, Cash App, Spiral, TIDAL and TBD. Its leading app “Square” targets sellers with a complete ecosystem of software, commerce solutions and banking services. Cash app allows users to send money, spend and invest in stocks or Bitcoin.

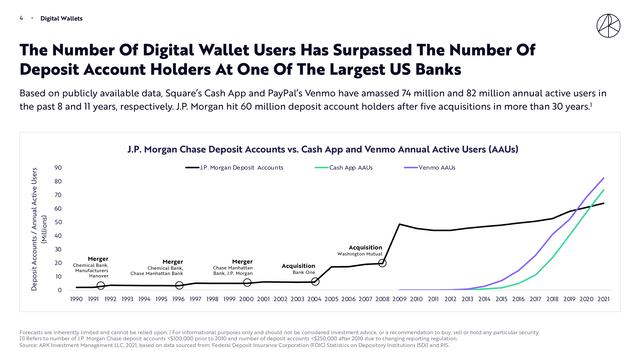

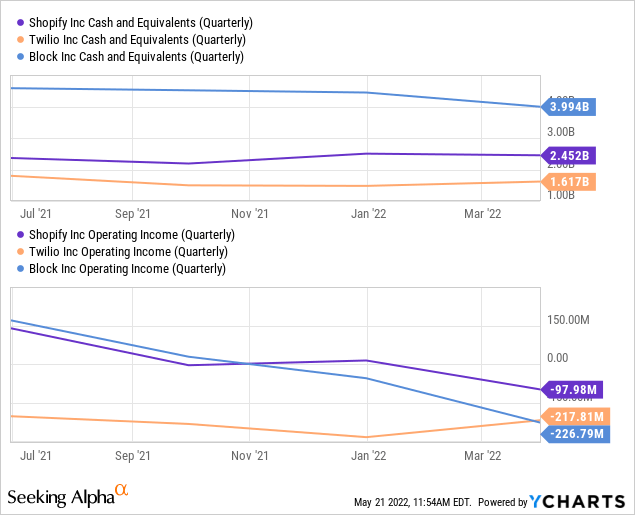

The recent collapse of certain algorithmic stablecoins, a Bitcoin crash and a possible Crypto-Winter lurking around the corner may worry investors of Block. The biggest problem with Block right now seems to be its EBITDA margin, which is only 0.76%. In contrast, they do have a good gross margin of 28.68%. Despite these concerns, the growth in digital wallets is quite immense.

Ark Invest

- Shopify: e-commerce platform designed for online and brick and mortar retail stores. In the field of fintech, Shopify offers Shopify Payments and other solutions such as payment terminals in stores and “Shop Pay” within the “Shop App”.

Shopify notably disappointed in its revenue growth in the first quarter of 2022, and still doesn’t have substantial net income if you discount their recent gains due to their investment in Affirm (AFRM), which went public last year. The company is also trading at nearly 10x sales, although it has had excellent revenue growth in recent years. Read my full article on Shopify here.

- Twilio: a cloud communications platform that allows developers to build and scale real-time communications across multiple channels within a single platform.

Shares of Twilio have traded much lower this year as the company showed signs of slowing revenue growth, negative operating margins and a declining gross margin.

- Coinbase: One of the largest cryptocurrency companies. Provider of financial infrastructure and technology through the blockchain. Primarily focused on building a cryptocurrency ecosystem, both for individual investors and institutional investors.

Coinbase’s investors have been concerned about the crash in stablecoins such as Luna/Terra. In their Q1 earnings call, Coinbase also said it had made a decision to increase investments and temper short-term revenues and focus on long-term growth. However, Coinbase managed to grow annual revenue to US$7.84BN by 2021, and increase verified users by 75% YoY.

- UiPath: Business specializing in automation software. Mainly focused on robotic process automation, which automates daily office activities.

UiPath’s shares have crashed this year due to the uncertain macroeconomic outlook, interest rate hikes, high inflation and the fact that the company does not yet have positive cash flow. Despite the current headwinds, it is believed that robotic process automation will play a major role in the future of fintech.

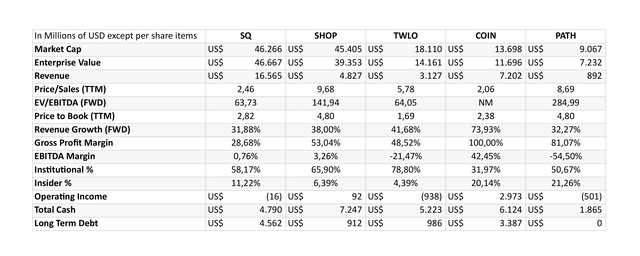

Author’s Dataset

The Price Tag

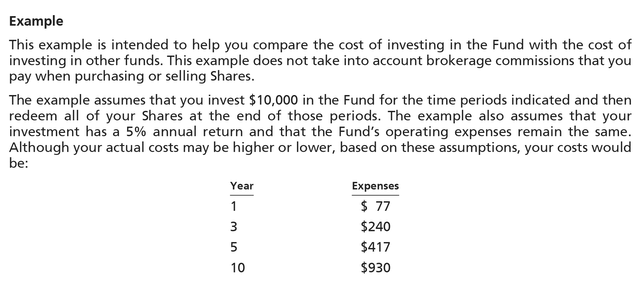

Since investment managers do not work for free, they usually do not talk about expense ratios. Ark Invest generally has an expense ratio of 0.75%. At first glance, this may not seem like much. But in fact, this can add up to a lot of money over time, given the compounding nature of investments and the fees levied by the fund on those investments.

For example, if you invest $10,000 and realize 5% growth annually on your original investment, after 10 years you will have paid $930 in management fees, or 10% of your initial investment. With that said, it is only rational to say that you should only invest if you think they can beat all other broadly diversified funds with low expense ratios by a significant degree.

Simulation Of Ark’s Management Expenses (Ark invest)

Market Research

Fintech is also converging with other sectors, which are seeing stunning growth. For example, blockchain technologies, ecommerce and the expansion of the internet are at the hearth of Fintech’s growth. Robotic Process Automation is also one of the key factors driving this growth, hence why they have UiPath in this ETF.

It is also strange to see that the ARKF ETF is trading at levels it reached at the low point of the market decline during the Covid pandemic, as this has actually fueled growth in sectors such as e-commerce, digital payments and online communications.

Ark Invest

There is varying consensus on how fast the Fintech market will grow globally. However, most consensus gives the Fintech market a CAGR of about 20% between now and 2028, which is significantly better than most sectors in the broad market.

Valuation And Macroeconomics

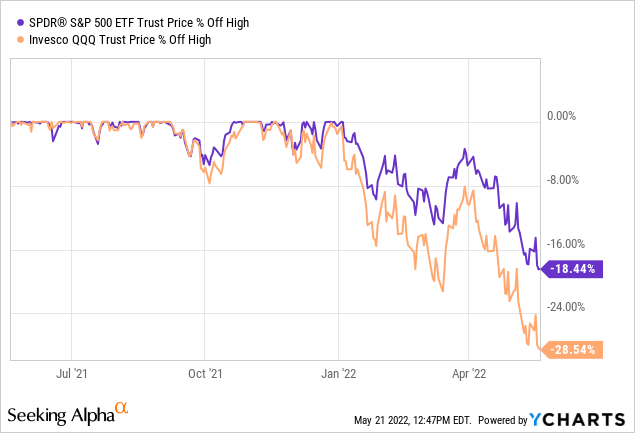

As mentioned earlier, the macroeconomic outlook has weighed heavily on most of these stocks. Since many of these fintech companies are software companies, which do not yet have positive free cash flow, they have been heavily defeated by the unfavorable macroeconomic outlook.

Personally, I think that once these macroeconomic fears are over, ARKF could experience a strong rise, as many of these companies have high gross profit margins, such as Shopify (53%), Twilio (49%), Coinbase (100%) and UiPath (81%). All of these companies are also well funded and should be able to weather these macroeconomic headwinds for at least a few years.

In terms of macroeconomic fears, the stock market has been in a rut due to several factors. Those factors include the inversion of the yield curve, fears of a slowdown in global GDP, rampant global inflation and fears of a serious failure of Federal Reserve policy.

The OpEx at these companies is quite high because they are growth companies still in their early stages. I believe that once these companies get past the growth phase and scale back operating costs, and once macroeconomic fears are tempered, these stocks have the potential to trade at a significantly higher valuation.

Currently, I also believe that the ARKF fund is the safest buy of all ARK funds. ARKF has a P/S ratio of 5.2, which is quite cheap compared to its Genomics fund (ARKG) with a P/S of 13.5, the Robotics and Automation fund (ARKQ) at 11.1 and its flagship fund (ARKK) at 13.3.

The average P/S ratio for financial services was 3.13 in January 2022. Given that these top 5 stocks are showing very strong revenue growth between 32% and 74% year-over-year, I think the P/S ratio of 5.2 is very conservative and may underestimate the long-term potential of these innovative companies.

Conclusion

Of all Cathie Wood’s ETFs, the ARKF fund gives you perhaps the best asymmetric risk-benefit ratio, in our favor. The near-term macroeconomic outlook has punished stocks that do not show strong free cash flows, or in the case of ARKF, are predominantly negative.

All of these companies should be adequately funded to get through a few difficult years as fears of a recession loom. I am convinced that once these macroeconomic headwinds pass, and they begin to cut their operating costs after their focus on growth, these companies can rebound very strongly.

[ad_2]

Source links Google News