[ad_1]

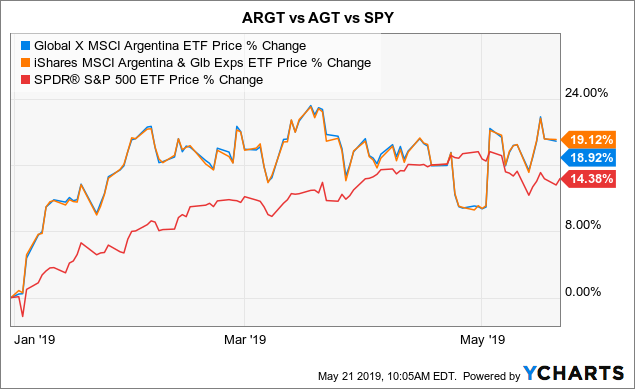

Global X MSCI Argentina ETF (NYSE:ARGT) is the largest and most liquid Argentina country-specific exchange traded fund with current assets of $90.2 million compared to $22.7 million for the iShares MSCI Argentina and Global Exposure ETF (NYSE:AGT). Each of these funds is up approximately 20% YTD which is in contrast to the less than exuberant macro outlook for the country. Argentina is amidst a serious economic downturn under high inflation and weak activity levels. Economists are forecasting a decline in annual GDP of 1.3% this year, continuing its official recession that started in 2018. This article highlights that the current strength in the Argentine ETFs is more based on the out-performance of a single stock and not indicative of the underlying country fundamental. Indeed both ARGT and AGT have similar compositions with a large 31% concentrated exposure to Latin America e-commerce and payments leader MercadoLibre, Inc. (NASDAQ:MELI) which is up 95% in 2019. On the other hand, the performance of the more domestic-based companies is a more accurate reflection of the underlying macro risks in the country.

Data by YCharts

Data by YCharts

In the methodology for index construction and formation of the ARGT and AGT ETF basket, stock market capitalization and liquidity are among the primary factors. It is therefore reasonable that MercadoLibre with a market cap of $28 billion has quickly become the most important stock with a relation to Argentina. The company is headquartered in the capital city of Buenos Aires although the country only represents about 20% of net revenues. In its latest earnings release, results outperformed expectation and growth has been impressive. The company’s e-commerce business reported gross merchandise value growth of 27% in constant currency while its payments arm volume increased 35% year over year. Although the company’s valuation and growth premium are beyond the scope of this article, the point here is to show that MELI’s stock performance YTD nearly singlehandedly held up the Argentine ETF against otherwise large declines from more domestic companies.

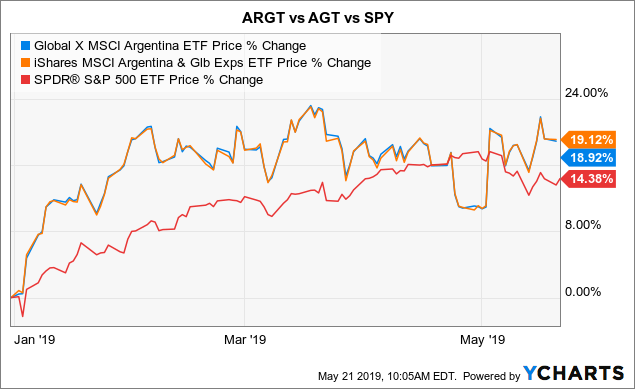

The top 10 holdings for both funds include ADR shares that trade on U.S. exchanges or in the case of MELI is traded in the U.S. as its primary listing. The 31% concentration in MELI is not something ETF investors should want to see in terms of diversification, but I doubt anyone is complaining this year given the result. The data below shows that over the past year, losses have been significant for the major Argentine equities with cyclical exposure including the largest bank, Grupo Financiero Galicia S.A. (NYSE:GGAL) with a 6% weighting in the ETF, down (-46%) over the past year. Utility stocks Pampa Energia SA (NYSE:PAM) and Transportadora de Gas del Sur (NYSE:TGS), are each down (-27%) and (-14%) in 2019, respectively. Auto parts manufacturer Tenneco Inc. (NYSE:TEN) is the second largest holding in ARGT with 14.3% weighting and is down (-56.8%) this year amid a deep downturn of the regional car market in Latin America. IT and consulting services company Globant SA (NYSE:GLOB) also headquartered in Argentina with global operations is worth further research, up 50% YTD and has a 5.5% weighting in the ETF.

Top 10 holdings ARGT and AGT ETFs. source: data by yCharts/ author table

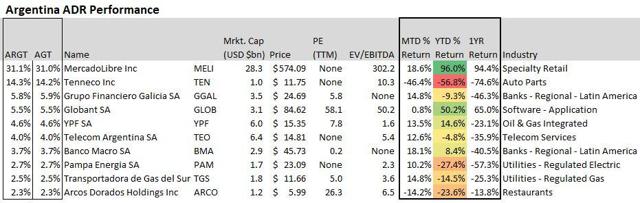

The performance of Argentine ADR stocks as tracked by the ETF is in large part related to the currency depreciation with the peso down (-16%) in 2019 and down over (-60%) since the beginning of 2017. The consumer price index of inflation is up 55% at an annual rate and has actually been above estimates in recent months, highlighting the difficulty authorities are facing in stabilizing the economy.

Argentine Peso performance and CPI Inflation. Source: OECD

Macro Outlook

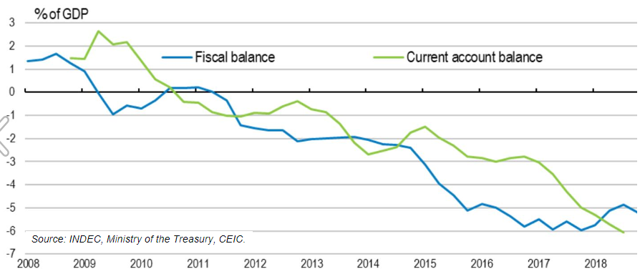

The Macri administration took office in December of 2015, leading to a wave of investor optimism and even sovereign ratings upgrades out of default introducing a number of structural reforms that were well received by the market. Reforms introduced included removing trade restriction and currency controls along with a move to deregulate a number of industries. Unfortunately, it became apparent by late 2017 that growth was underperforming, and fiscal targets would not be reached, renewing concerns over the trajectory of public debt. Runaway inflation led to a rapid deterioration in confidence and coupled with weak external accounts data resulted in a speculative attack on the currency exacerbating the situation. The current account and fiscal deficit have both widened over the past decade, coincidentally each ending the year 2018 at -5.2% of GDP. The combination of deteriorating external account, high inflation environment and weak growth helps explain the recent current crisis in the Argentine peso.

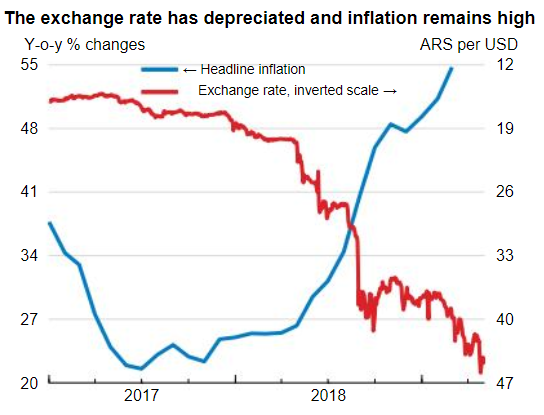

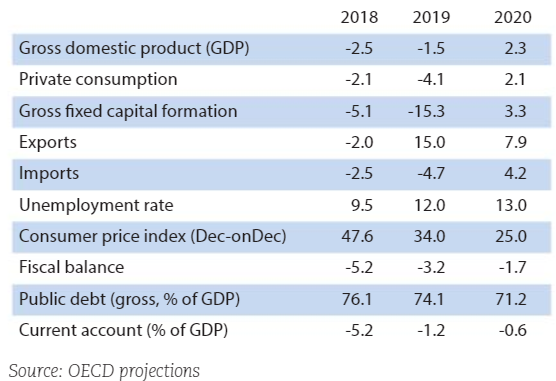

Argentina Economic projections. Source: OECD report

The OECD just released its updated economic forecast for global growth including a report on Argentina. The group expects GDP to contract 1.5% this year, a moderation of the 2.5% contraction in 2018. A benefit to the weaker currency has been an improvement in exports while slowing import demand is helping to stabilize the trade balance. Austerity measures are taking its toll on growth but the effort appears to be working with a narrower deficit expected this year. There is an expectation of a rebound by 2020 with a forecast of positive GDP growth but in context would still be below the level of 2017 in real terms. Higher rates by the Central Bank in an effort to control inflation have depressed credit growth, stalled investments and hurt consumer dynamics. The unemployment rate should move higher to 13% by next year.

Argentina Economic projections. Source: OECD report

Overall, there is a potential for light at the end of the tunnel and the expectation of a recovery that could make distressed equities attractive. The next big test will come with the Presidential election with the first round set for October 27. The Macri administration, with best of intentions and following as much free market liberal policies as possible, has just not delivered the results promised for the people of Argentina. Polls suggest Macri will face a serious challenge in the left Peronist party by Alberto Fernandez with news of the still popular yet divisive former President Cristina Fernandez as the running mate. A victory by any left-leaning candidate could jeopardize the progress of recent hard but necessary reforms and be a negative for the country in my opinion. The thinking is that a leftist administration would abandon austerity measures, implicating fiscal balance targets which could lead to new weakness in the peso.

Conclusion

I’m not taking a position on ARGT. I recognize the significant upside potential in Argentine equities should the peso currency rebound and trend higher, but overall more bearish on the macro outlook and political developments. My opinion is that ARGT is a poor vehicle to take a position on Argentine macro and domestic equity factor trends given the lack of sector diversification and concentrated exposure to MELI. Investors should look at individual ADRs and consider appropriate position-sizing to better manage risk. Argentine equities overall remain highly speculative with significant risks of a further economic deterioration amid a volatile currency.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News