[ad_1]

When we last talked about the InfraCap MLP ETF (NYSEARCA:AMZA), we left with the message that:

Still, if we have seen a bottom (finally) for the MLP sector, AMZA by use of its leverage could perhaps outperform the index. That said, we expect options to hinder, rather than help its performance.

We had titled that piece “Distribution Secured,” and in case anyone missed it, that was full of sarcasm for an ETF which has never ever covered its distribution in the last three years.

With five full months of the year gone and MLPs having enjoyed a good bounce from the December lows, we decided to check in and see how this fund was doing.

The raw numbers

AMZA trailed its benchmarks over every recent time frame, again.

Source: Virtus

This does not get any better if we go out all the way back to inception of the fund where the fund’s NAV is down 14.59% compounded versus a negative 7.94% compounded for the index.

Source: Virtus

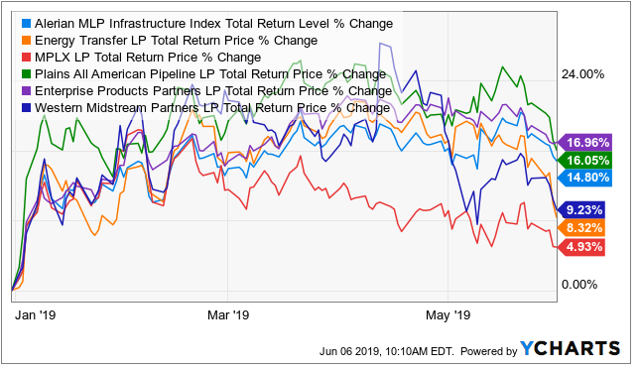

However, for us, the surprise was the year-to-date numbers which were shown above trailed the benchmark by about 3.5%. By any measure, we have had a decent bull market off the lows, and one would expect AMZA with its leverage of 30% (or 130% if you want to frame it that way) to outperform.

What is causing the drag?

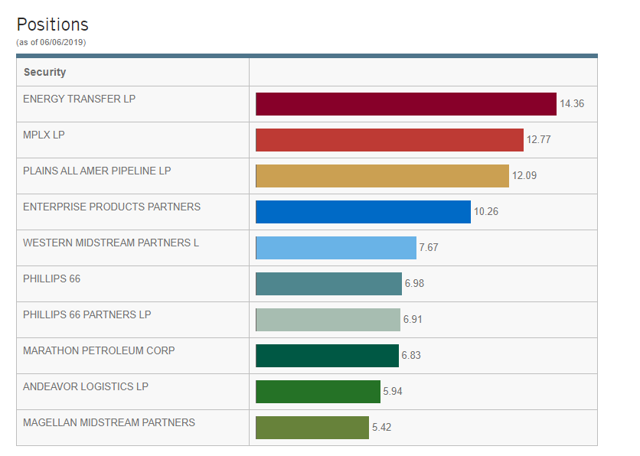

Looking at the most recent AMZA positions, we can see that management has doubled down on its top holdings.

Source: Virtus

We have examined almost all of these companies at some point or another, and let us make it clear at the start that we think these are all great companies trading way below their fundamental values in our opinion. But the key point here is that AMZA has still lagged its benchmark in spite of using leverage, so we decided to see if any of the top holdings might be the cause.

Three of the top five holdings, Energy Transfer LP (ET), MPLX LP (MPLX) and Western Midstream Partners LP (WES), significantly underperformed the benchmark in terms of total returns, while the two that did beat the index, Plains All American Pipeline LP (PAA) and Enterprise Products Partners LP (EPD), did so by very narrow margins.

While being overweight the wrong names can hurt, we were still surprised that the leverage did not overcome that handicap.

What about the option writing?

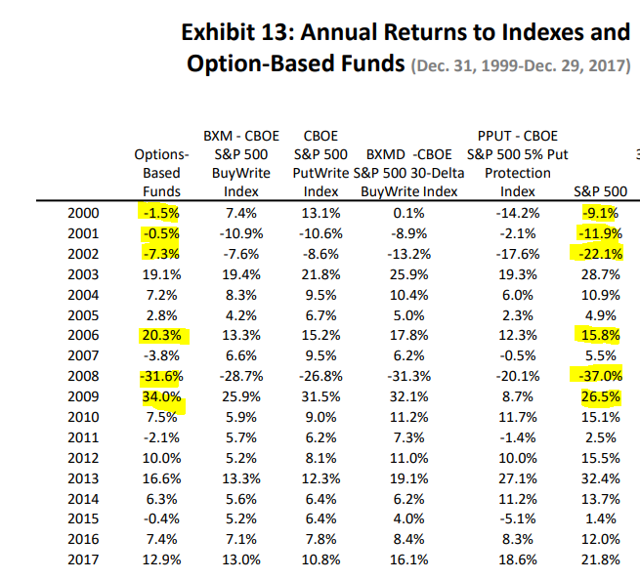

The investor community has been fascinated with the idea that “option writing”, a strategy that AMZA employs, can be used to outperform the indices. In the right hands, yes, option writing can help, and we are big fans of that methodology. However, there are a few problems with this idea. The first being that AMZA’s management has never shown that this has worked. Our definition of the strategy working would mean that AMZA should outperform in at least bear markets where option writing gives the biggest bang for the buck. As we showed in the past, AMZA has not.

The other problem with this idea is that option writing can enable outperformance during bull markets. That is completely wrong. Yes, the occasional fund in the occasional bull run can outperform. But the bulk of the time, call selling will land up costing you tons of upside in a bull run.

We have shown this before, but it deserves mentioning again. Over 18 years, option-based funds outperformed the index in only six years.

Source: CBOE

The interesting part about that data is that option-based funds outperformed in each and every down year! But they outperformed only in 2 out of the 14 up years, one of which was 2009 where the index nosedived in the beginning of the year.

We are certain that AMZA is not capturing any free-money with those option sells and likely had to buy back called positions higher than it sold them for.

Distribution coverage

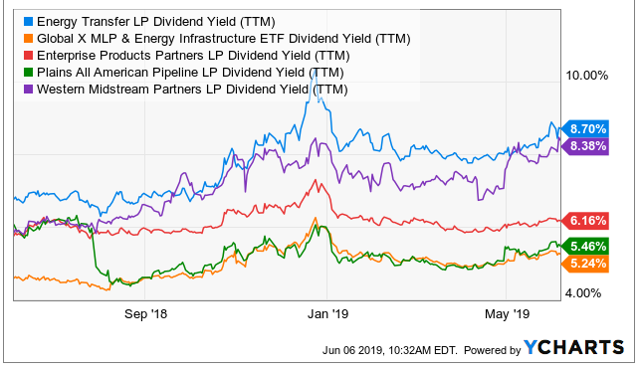

AMZA’s yield has now jumped to almost 18% while the index yields a lot less. The Alerian MLP ETF (AMLP), which seeks to follow the index, yields closer to 8.5%. AMZA’s top five holdings don’t even average as much.

We estimate that after fees and interest, AMZA currently generates about 7.0% of a real yield on its assets. That is 38 cents a year versus the current distribution rate of 96 cents a year. The current yield of 17.7% is thus returning about 10-11% of liquidated fund assets back to its owners. That is a rather awful rate, and we think we are now entering another distribution cut window.

Conclusion

We still remember the good old days when we metaphorically lost our voice trying to convince the masses that regardless of what management said, the $2.08 of annual distributions were not covered or sustainable. True coverage is now down to 38 cents annually, and AMZA is paying about 150% more than that. We suspect that the next cut will take the distribution down to 5 cents a month, although realistically it should go down to 3 cents. Of course, management can choose to keep paying at this rate, but we suspect it won’t be too keen on a sub $5 price for the shares. Barring a big rally, the third distribution cut will come very soon. For those interested in getting paid what is earned by the fund, check the Nuveen Energy MLP Total Return Fund (NYSE:JMF) for a fully covered 10%-plus yield.

Author’s Note: If you enjoyed this article, please scroll up and click on the “Follow” button next to my name to not miss my future articles.

The Wheel of FORTUNE is a most comprehensive service, covering all asset-classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, and CEFs.

Take advantage of the two-week free trial, and gain access to our:

- Monthly Review, where all trades are monitored.

- Trading Alerts. We don’t trade every day, but we issue one trade per trading day, on average.

- Model Portfolio, aiming at beating the S&P500 performance.

- “Getting Ready For 2019“, a 19-part series, featuring our top picks across eleven sectors plus eight segments.

Spin the Wheel, Make a Fortune!!!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

TIPRANKS: HOLD

[ad_2]

Source link Google News