[ad_1]

Prostock-Studio/iStock via Getty Images

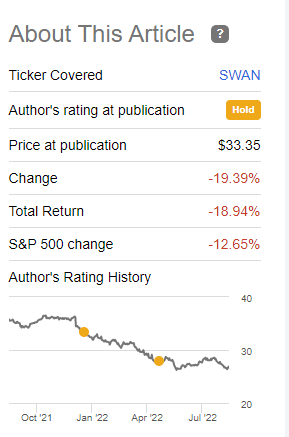

When we last covered Amplify BlackSwan Growth & Treasury Core ETF (NYSEARCA:SWAN) we left with a cold shoulder.

We have no clue where the SPY will be then, but if volatility stays high, SWAN will be again purchasing expensive volatility via call options. Yes, due to their deep in-the-money nature, you will get a good bang for your buck. But this again goes against our strategy. Investors buying this were thinking of the COVID-19 crash as the most likely outcome. The opposite is true. Just like with Nationwide Risk-Managed Income ETF (NUSI), which also did well during the COVID-19 crash, both SWAN and NUSI are no match for bubble values imploding over time. We remain neutral on the fund and don’t consider it a fit for our portfolio.

Source: Why The Strategy Failed To Protect

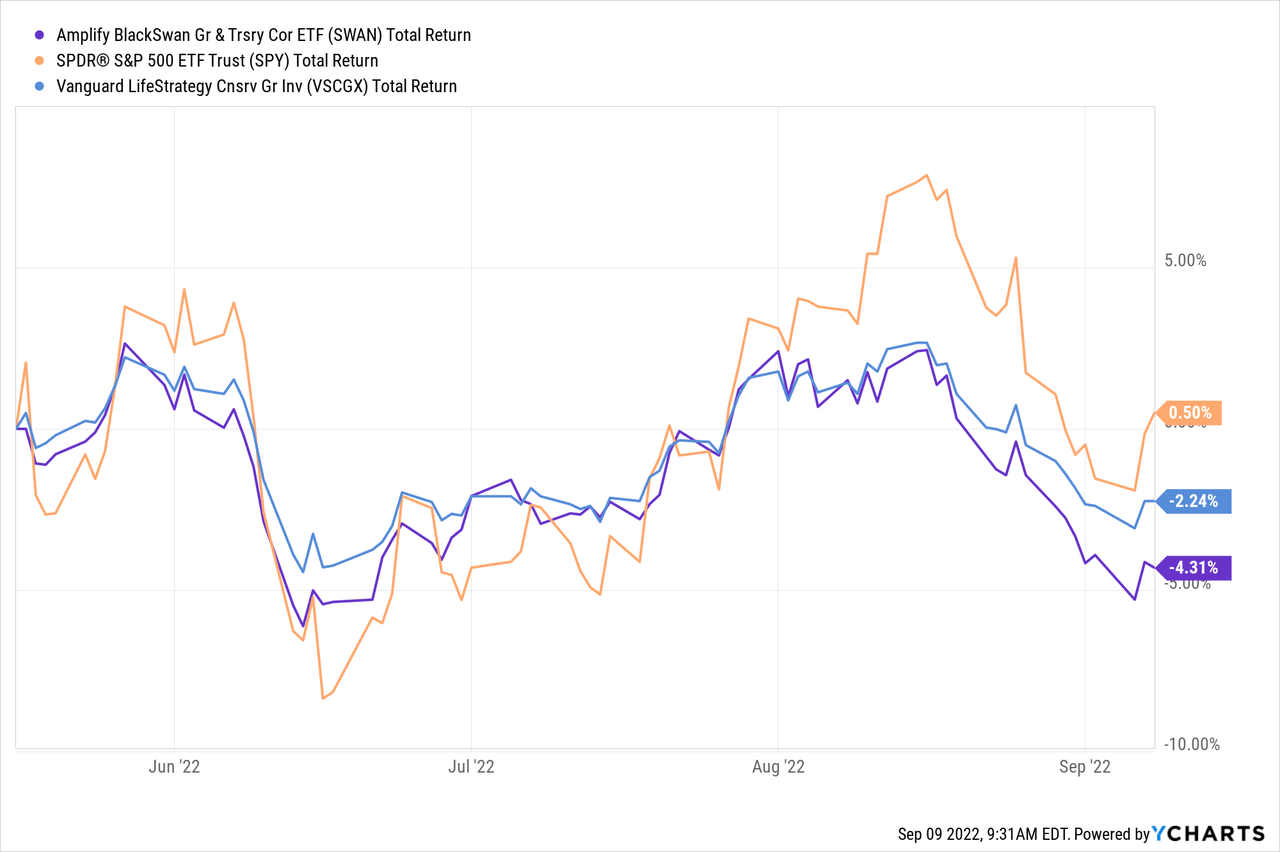

That was not a bad call. SWAN has lagged the S&P 500 ETF (SPY) and also lagged Vanguard Lifestyle Conservative Growth Investors Fund (VSCGX).

We had warned about the risks of this fund which were not readily apparent even back in January 2022. Even in that timeframe, the fund has been an extreme disappointment for the “Sleep Well At Night” crowd.

Seeking Alpha, Returns Since First SWAN Article

We look at what happened and where we think this one goes next.

Positioning At The Time

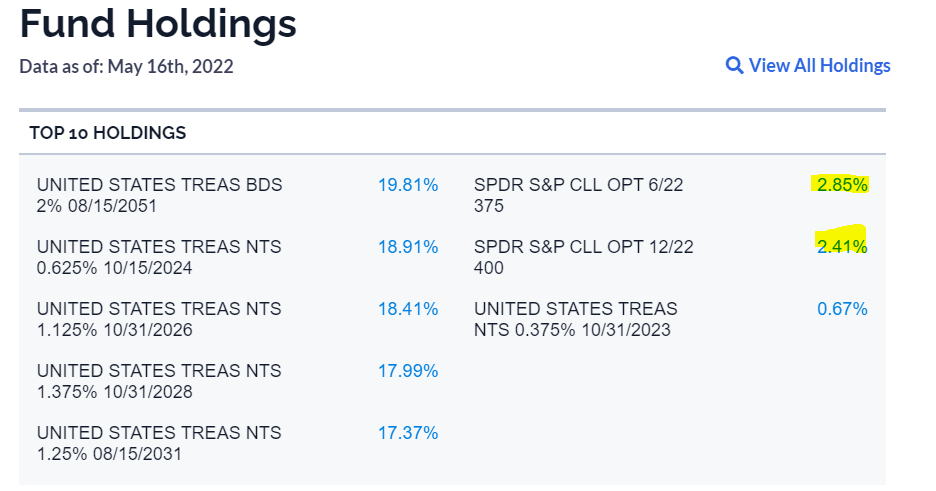

SWAN had become a proxy Treasury Bond fund at the time (on May 16, 2022) with equity exposure coming from just two options amounting to 5.26% of the fund.

SWAN Holdings May 16, 2022

The first one was annihilated as SPY closed below the $375 strike on June expiration. A full loss assuming they held that one till expiration (which is what we think happened).

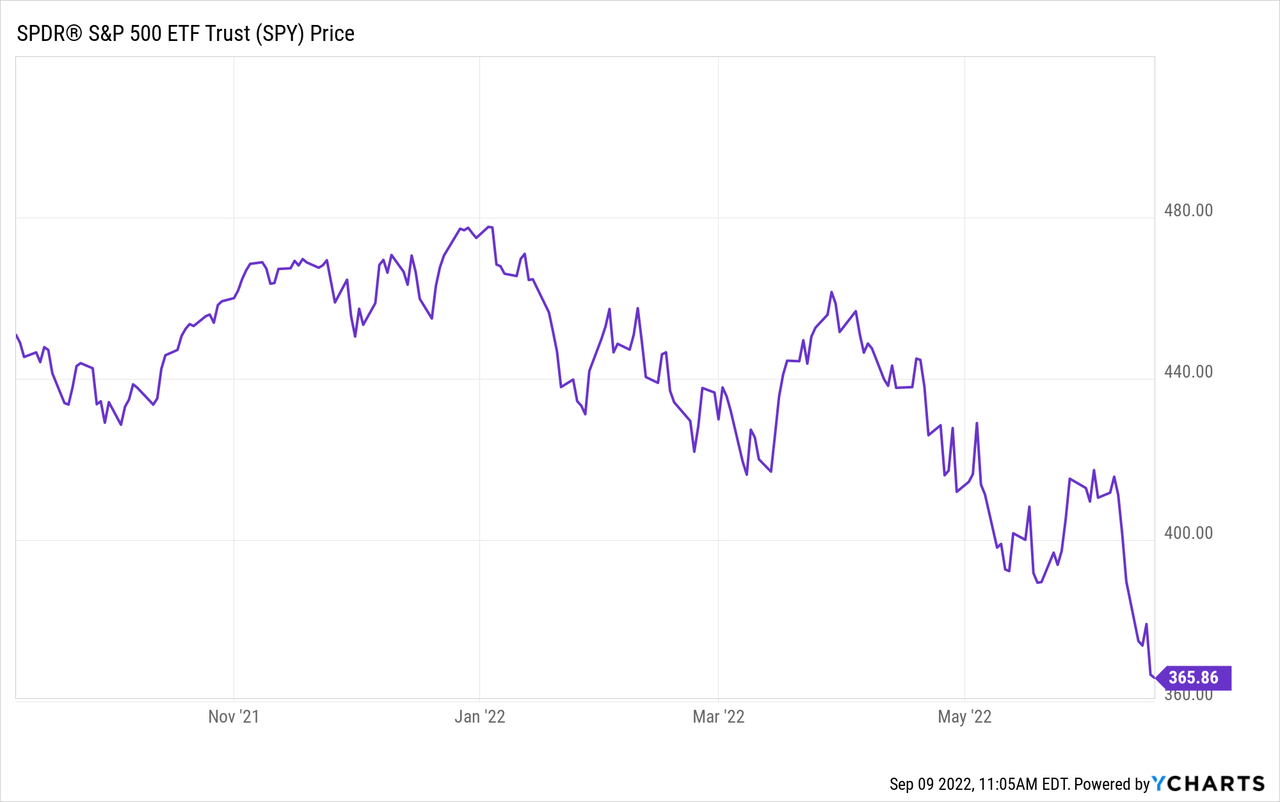

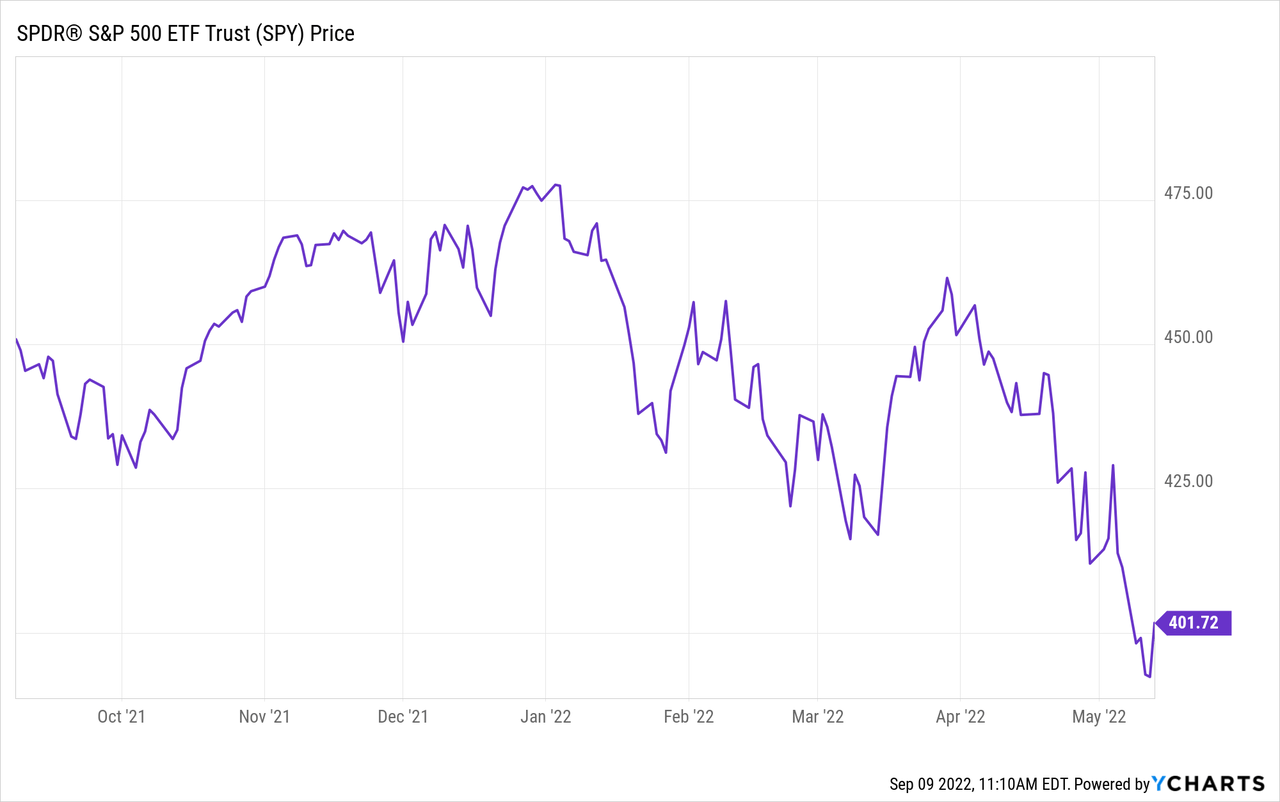

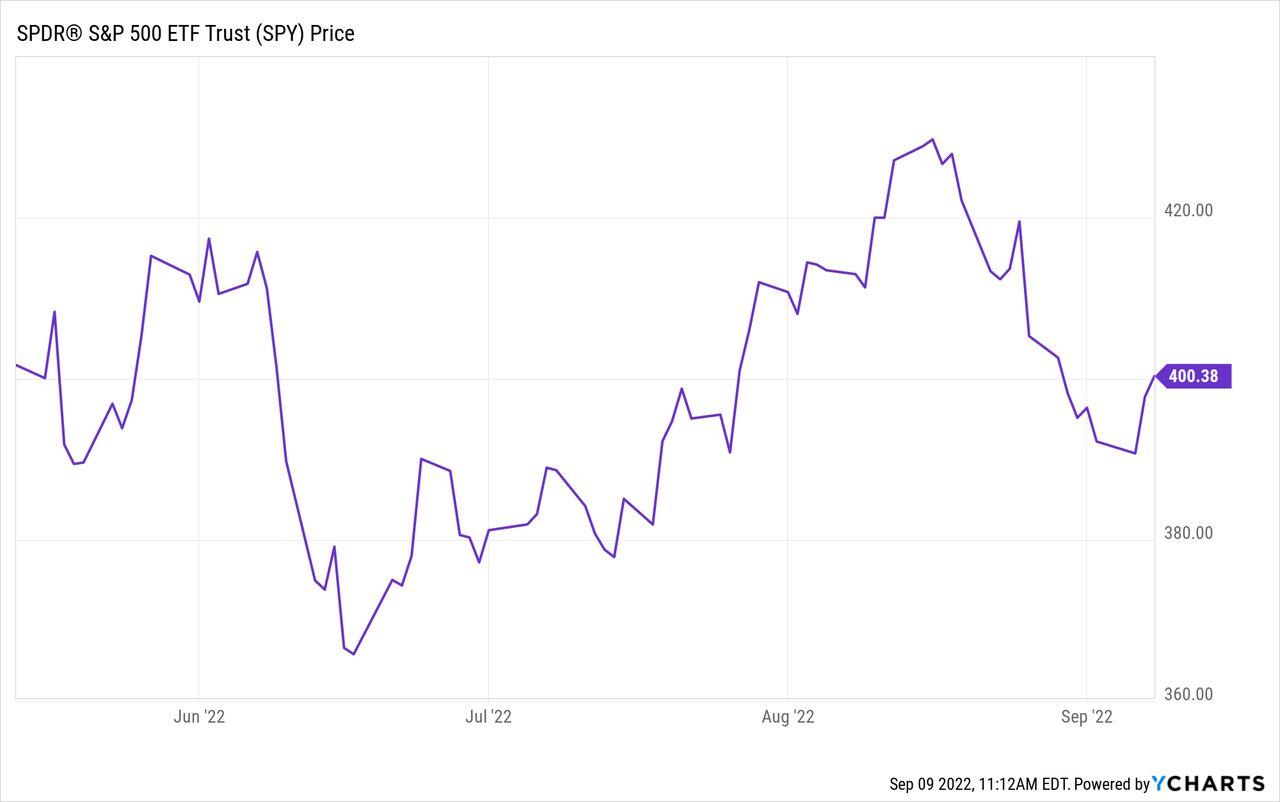

The December $400 call options were trading at $19.50 on September 8 end of day. This is down from $31.00 at the time of the last article. This is actually one of the most beautiful setups to explain the inherent decay of options and by extension, this fund. The price at the time of the last article for SPY was $401.72. That is the May 13, 2022 (Friday) closing price.

The price on September 8, 2022 was $400.38.

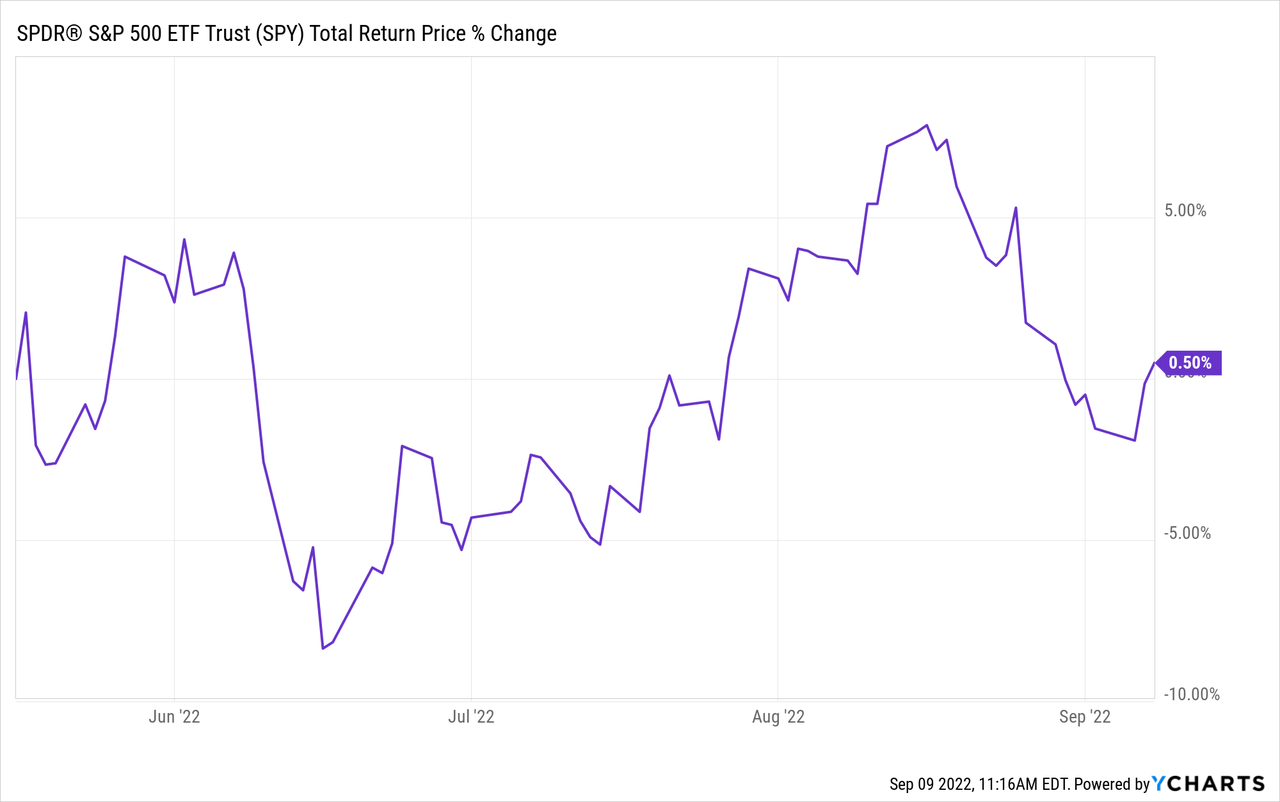

That action overall is flat as a pancake. If you add the dividends doled out by SPY total return is a positive 0.5% in this timeframe.

Our point here is that for a total return of 0.5%, that December Call option had a decay of 37%.

This is the problem with buying volatility in one form or another. You have decay and that never sleeps. The bulk of the losses we saw can be attributed to SPY exposure via calls.

Fund Holdings Today & Outlook

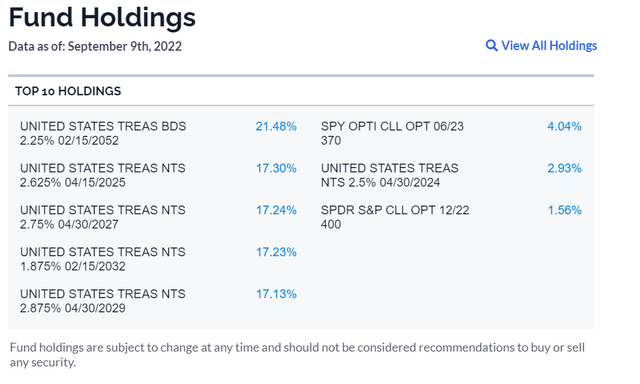

The fund rolled its Treasury holdings at the last rebalancing.

SWAN Holdings Sep 9, 2022

Treasuries while on our naughty list in 2021, have got a passing grade of C minus recently. We don’t see a lot of room to lose money here. The duration of this fund is also moderate unlike that seen in funds like Vanguard Extended Duration Treasury ETF (EDV). At this point the income in relation to the asset also acts as an offset to losses. We rate this section as neutral with some upside in case of a market crash.

On the S&P call options, we think odds of losses are very high. The fund has 5.60% in two call options. Ignoring rolls and rebalancing, we think both could go to zero in the next nine months (June 2023 option expiration). This would lead to a loss of 5.6% just based on that. One point we will make here is that that 5.6% NAV loss will happen if SPY closes below $370 by then. In other words a 7.5% SPY drawdown can create a 5.6% loss over time in SWAN. If you held SPY you would get a dividend as well. That means SPY’s loss and SWAN’s loss could be identical for smaller movements in SPY over time.

Verdict

We continue to avoid this fund as we are a premier volatility selling outfit. Buying volatility in any form is not for us. Yes the fund will outperform in a sudden market crash. But most slow prolonged drawdowns and long periods of sideways movements are not conducive for such strategies. Investors bullish on both Treasuries and the stock market could take a position here as the fund will do modestly well with low volatility in such a scenario. We rate this as Hold/Neutral at present.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source links Google News