[ad_1]

mrbfaust/iStock via Getty Images

If you want a portfolio with spacious skies and purple mountain majesties to sing about, Amberwave Partners may have the solution.

Just started last month, Amberwave (IUSA) is an ETF that aims to create a new impact-investing ecosystem based on the three tranches of Jobs, Security, and Growth (JSG). Impact investing is where fund managers devise portfolios based around an investor’s principles, so they can attain their financial goals while also making an impact on the world.

Historically, impact investing was a relatively rare phenomenon, with investors intentionally excluding companies from their portfolios if they were involved in something they disagreed with morally, like gambling or pornography or unfair trade coffee.

Nowadays, it’s become vogueish to appeal to more formalized standards of ESG: Environmental, Social, and Governance. While ESG has its plusses and minuses, Amberwave’s JSG strategy is built around universally accepted and – it appears – profitable priorities. JSG wants to nudge corporate decision-making to bring economic benefit to all communities across the United States, rather than continuing to consolidate wealth in a few elitist, coastal power centers.

The fund’s managers score potential companies based on these three standards to evaluate if they belong in the fund.

Jobs: This measures a company’s contribution to the strength of the U.S. jobs market, asking if it is providing opportunities for Americans, rather than – say – using slave labor in China. Factors that are measured include job creation, how well workers are treated, focus on US-based hiring, etcetera.

Security: This evaluates how a company contributes to America’s overall national security: if a company’s business ventures are not keeping the US resilient, it is not a good long-term investment. Amberwave has a particular emphasis on US energy independence, cybersecurity, and supply chain strength. As we’ve seen in the last two years, globalized supply chains are wonderful right up until they’re terrible.

Growth: Measuring the healthy long-term economic growth of the United States seems like a no-brainer, but Amberwave also measures anticompetitive behavior, because monopolies are bad for everyone except the few who benefit from them. And because business tyrants wear hoodies now instead of top-hats and monocles, Amberwave has completely excluded high-profile tech companies, including Meta Platforms (FB), Twitter (TWTR), Match Group (MTCH), Alphabet (GOOG) (GOOGL), and Apple (AAPL).

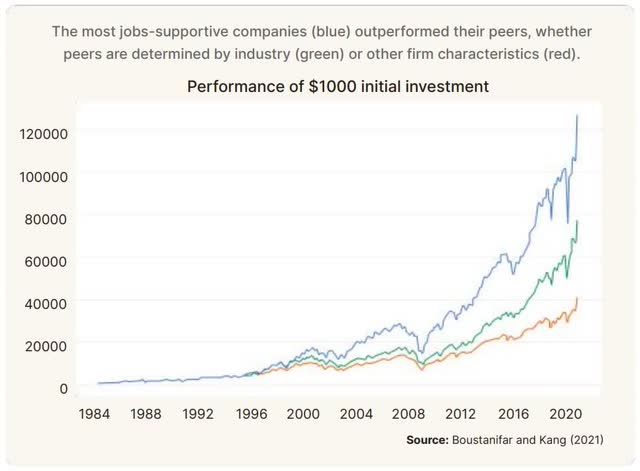

Boustanifar and Kang (2021)

Once Amberwave has assembled and scored its initial library of names, it weighs them 50% jobs, 25% security, 25% growth. Companies in the top one-fifth of each sector are selected. Then the fund managers use their proprietary algorithm – the secret sauce, if you will – to determine final weights. Then they readjust each month.

Values-based investing is very stylish right now, with Bloomberg predicting it will grow from $35 trillion of assets under management to $50 trillion by 2025. The actual, bottom-line benefit of ESG-driven investing is, however, highly questionable, as it frequently seems more like billionaires squandering mom and pop’s investment to pat themselves on the back for their righteousness.

But there’s irrefutable evidence that JSG outperforms. Companies that support their workers the most generate 2.3% to 3.8% over their competitors.

Amberwave points to similar research supporting the need for security and growth factors in investment.

The leadership of Amberwave is three former US Treasury officials with decades of combined experience. Most recently, they oversaw $3 trillion in pandemic-related financial support, helping stave off the potential depression. They are Dan Katz (former Senior Advisor for International Affairs), Stephen Miran (former Senior Advisor for Economic Policy), and Thomas Emanuel Dans (former Counselor for International Affairs).

The fund is down slightly from the $17.90 where it started on January 19, but given the volatility of recent weeks, a fund that’s down only slightly is AOK. And if more of Wall Street decides to follow Amberwave’s example by investing more in American jobs, security, and growth, the rising tide will lift all ships – from sea to shining sea.

[ad_2]

Source links Google News