[ad_1]

da-kuk/E+ via Getty Images

Investment Thesis

The Global X Future Analytics Tech ETF (NASDAQ:AIQ) has high growth potential. This fund invests in companies that provide software and hardware facilitating the use of AI for the analysis of big data. According to Fortune Business Insights, the global AI market is projected to grow from $387.45 billion in 2022 to $1,394.30 billion by 2029, exhibiting a CAGR of ~20.1%. At the same time, as AI improves, it could unlock untold opportunities for new applications that are not yet considered. However, the market is fully recognising the potential of this sector and this is reflected in the valuations of publicly listed AI stocks. I believe that higher volatility in the market might provide an opportunity for long term investors to accumulate shares at a lower price in the coming months.

Strategy Details

The Global X Artificial Intelligence & Technology ETF tracks the Indxx Artificial Intelligence & Big Data Index. The strategy seeks to invest in companies that potentially stand to benefit from the further development and utilization of artificial intelligence in their products and services, as well as in companies that provide hardware facilitating the use of AI for the analysis of big data.

If you want to learn more about the strategy, please click here.

Portfolio Composition

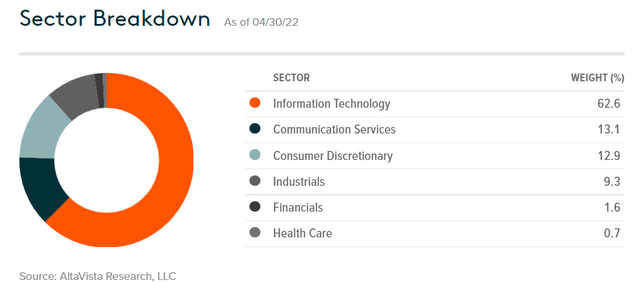

AIQ places a high weight on the Information Technology sector (representing around 63% of the index), followed by Communication Services (accounting for 13% of the index) and Consumer Discretionary (representing around 13% of the fund). The largest three sectors have a combined allocation of approximately 89%.

Global X ETFs

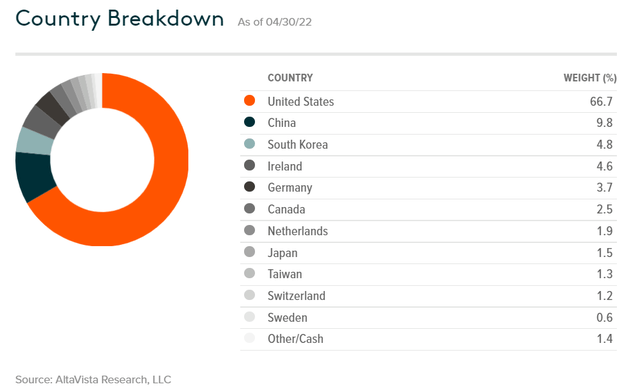

In terms of geographical allocation, the top 10 countries represent 98% of the portfolio. The United States accounts for 67% whereas other countries such as Japan appear to be underrepresented given the low weight (only a 1.5% allocation to Japan).

Global X ETFs

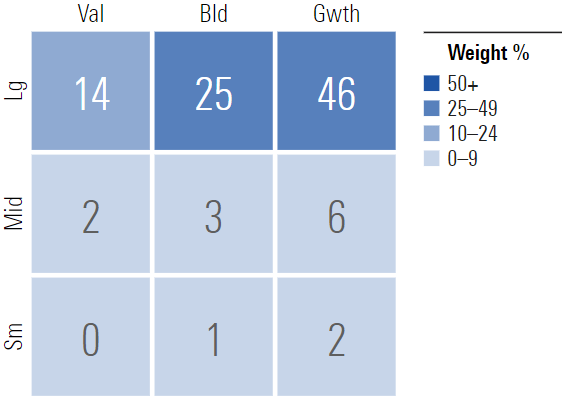

46% of the portfolio is invested in large-cap growth stocks, characterized as large-sized companies where growth characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap blend equities. It is interesting to see that this ETF allocates 85% of the total assets to large-cap issuers, which generally tend to underperform small and mid-cap stocks over the long term.

Morningstar

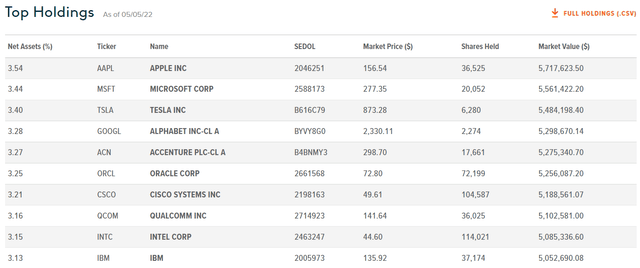

The fund is currently invested in 84 different stocks. The top ten holdings account for 33% of the portfolio, with no single stock weighting more than 4%. AIQ is well-diversified and has a very low level of unsystematic risk as a result.

Global X ETFs

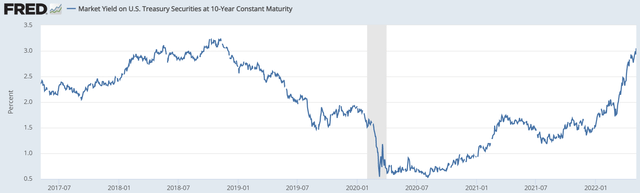

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to Global X ETFs, the fund currently trades at an average forward price-to-book ratio of 3.83 and at an average forward price-to-earnings ratio of 20.6. The fund is cheaper than a plain vanilla NASDAQ 100 ETF which trades at around 22x earnings at the moment. However, yields on US treasuries are rising fast and are starting to compete with stocks, making it expensive from an absolute perspective. The earnings yield on AIQ is approximately 4.8% which isn’t much higher than what you could get on a 10-year government bond today. I think there is more downside risk for equities from the current level as yields are likely to move higher in the near future, putting further pressure on valuations.

Board of Governors of the Federal Reserve System (US)

Is This ETF Right for Me?

I have compared the price performance of AIQ against the Invesco QQQ ETF (QQQ) over the last 4 years to assess which one was a better investment. Over that period, QQQ outperformed AIQ by a 32.5 percentage points margin. AIQ and QQQ share a large number of constituents and it is pretty clear by now that you would have been better off holding the NASDAQ 100 portfolio. What makes AIQ pretty interesting is the international exposure that you can get through it compared to QQQ which mostly invests in the US.

Going forward, I think it is hard to tell if AIQ will outperform QQQ. All in all, I think equities aren’t yet attractively priced to justify a sizeable portion of the portfolio allocated to this asset class. The recent weeks have shown how volatile the market can be, which is something that long-term investors need to take advantage of by picking up shares when valuations are lower. There is nothing that makes me believe volatility will go away in the near future, thus I think there will be many opportunities to pick up shares cheaper.

Refinitiv Eikon

Key Takeaways

AIQ provides exposure to a well-diversified basket of international AI stocks. The sector is expected to grow much faster than the global economy over the next 10 years, which represents an interesting opportunity for investors today. However, valuations are high across the board. For instance, AIQ trades at more than 20x earnings at a moment when yields are rising and volatility is high. I don’t think the current valuation provides a good margin of safety. Instead, investors should use volatility to their advantage by accumulating shares when prices will be lower.

[ad_2]

Source links Google News