[ad_1]

Andrii Yalanskyi

Thesis

The iShares Interest Rate Hedged U.S. Aggregate Bond ETF (AGRH) is a brand new offering from iShares. The fund was launched mid June and has only two weeks of trading activity. As per the fund literature:

1. Holds shares of the iShares Core U.S. Aggregate Bond ETF (AGG) and positions in interest rate swaps

2. Aims to track an index that seeks to mitigate interest rate risk

3. Use to manage interest rate risk or express a view on credit spreads

The ETF seeks to track the investment results of the BlackRock Interest Rate Hedged U.S. Aggregate Bond Index which seeks to minimize the interest rate risk exposure of a portfolio composed of U.S. dollar-denominated, investment grade bonds. Basically the Index tracks the iShares Core US Aggregate Bond ETF with a pre-determined hedge profile composed of up to 10 swaps:

Index Criteria (BlackRock)

The swaps are designated to minimize the interest rate risk for each duration bucket for the respective ETF:

Each Index in the Series is constructed by combining its single associated ETF with 10 Interest Rate or Inflation Swaps with maturities of 1, 2, 3, 5, 7, 10, 15, 20, 25, and 30-year. The weight of each swap contract is calculated to best achieve neutral Key-Rate Durations (KRDs) of the Index at the 1, 2, 3, 5, 7, 10, 15, 20, 25, and 30-year points. The ETF for each Index will be held with a fixed number of shares (to be adjusted in the event of any stock splits), while the weights of the swaps will be rebalanced daily. The rebalance takes place at the end of each Business Day, with the new weights being effective on the following Business Day

Source: Index Methodology

Ultimately an investor should think about AGRH as an interest rate hedged exposure to the underlying AGG ETF. By buying AGRH you are locking in credit spreads and should be neutral to interest rate risk. The fact that iShares is coming up with such a product after a vicious fixed income rout in 2022 (AGG is down over -10% year to date) should signal a bit of a contrarian signal to rates traders. Usually products like these pop-up at cycle tops. AGRH is nonetheless a good choice to pursue if an investor purely looks at credit spreads or desires a hedged product for the next monetary tightening cycle. AGG has a duration of 6.7 years, thus most of the price move this year was due to rates. There are no analytical metrics yet for AGRH since it just started trading, thus we cannot present any risk/reward metrics for the fund.

The ETF has a fairly low expense ratio of 0.13% and a duration close to zero (stated fund duration is 0.06 years). We view AGRH as a packaged institutional product that is now available to retail investors as well. An institutional investor already has the ability to undertake interest rate swaps and thus hedge a position in AGG, but a retail investor does not. Moreover the fact that the fund manager is responsible to adjust the swap notionals and keep the duration profile for AGRH close to zero, removes an operational and trading burden for an institutional investor as well.

Holdings

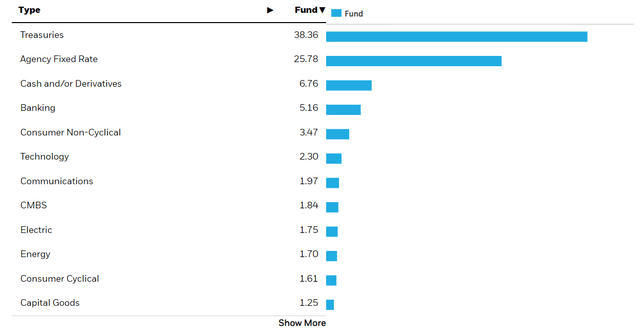

The current sectoral composition is as follows:

Holdings (iShares)

The top concentrations are in treasuries and fixed rate agency securities which account for more than 60% of the fund.

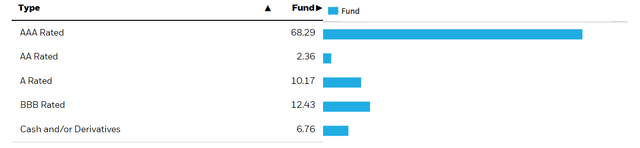

The assets ratings breakdown follows the aggregate index composition:

Asset Ratings (iShares)

The fund is composed mostly of AAA securities where the credit spreads are minimal. By hedging out the interest rate risk the fund basically offers an investor exposure to credit spreads and balance sheet cost (i.e. the incremental yield a security has to offer in order to be kept in the balance sheet).

AGG ETF Performance

Given that AGRH is an interest rate hedged version of AGG let us have a look at the underlying ETF performance:

YTD Total Return (Seeking Alpha)

AGG is down over -10% on a price basis in 2022. Most of the move is due to the fund duration which clocks in at 6.7 years and the violent reset higher in rates.

On a 5-year basis AGG sports an annualized total return lower than 1%:

5-Year Total Return (Seeking Alpha)

We can see how AGG’s performance is mostly driven by rates – as the Fed decreased rates in 2020 the ETF recorded most of its gains. Given its composition which is AAA for over 68% of the collateral the total return for the fund comes mostly from the rates component.

We would expect AGRH to have a much more normalized total return profile that shows a slightly accreting feature every year.

Conclusion

The iShares Interest Rate Hedged U.S. Aggregate Bond ETF is a brand new offering from iShares. The ETF offers an investor an interest rate hedged exposure to AGG. The ETF ultimately has the same underlying collateral composition as AGG with up to ten interest rate swaps layered in to hedge the duration risk. AGRH has a net duration of 0.06 years, but has just started trading two weeks ago hence no significant total return data is available. After a vicious rout in fixed income year to date due to the rise in rates, we feel the launch of new product like AGRH which aims to hedge interest rate risk might mark a top in rates.

[ad_2]

Source links Google News