[ad_1]

The S&P 500 is the benchmark US index for investors to compare their returns and track the market’s fluctuations. Moreover, the S&P 500 and total market options that largely track it have become popular core investment options. There are many available options for investors seeking S&P 500 exposure, with nearly identical holdings and associated portfolio risk profiles, but other significant differences exist between the available options. This is an overview of the attributes of the main ETF options for direct S&P 500 as well as a review of their shared current market risk profile.

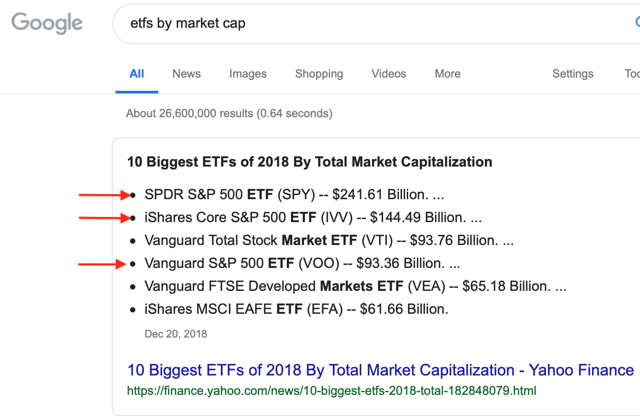

There are numerous ways to invest in the S&P 500 through ETFs, and even more through mutual funds, but the largest and most popular ETF options for individual investors are the SPDR S&P 500 ETF (SPY), the iShares Core S&P 500 ETF (IVV), and the Vanguard S&P 500 ETF (VOO). These ETFs are not merely the largest and most popular S&P 500 ETFs, but three of the four largest ETFs by assets under management.

Each of these options clearly resonates with a significant investor group, and the concept of general S&P 500 investing is a dominant theme for ETF investors. So, which of these three is right for you? The answer depends upon various factors, but primarily whether you are making a long-term investment or a short-term trade, and your brokerage’s possible commission-free trading rules.

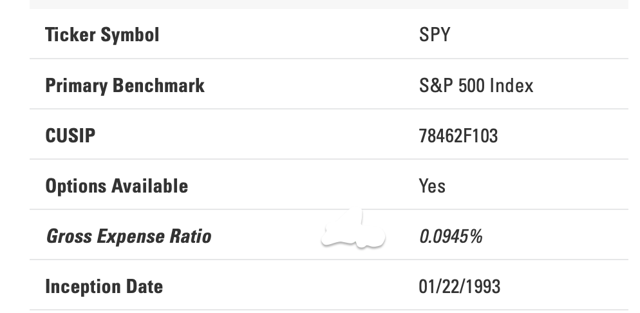

SPDR S&P 500 ETF

SPY is not just the largest S&P 500 ETF, but the largest ETF of any type. SPY also has the richest options market among the S&P 500 ETFs and the largest average trading volume (it and EEM are the highest volume ETFs). Of the three S&P 500 ETFs being discussed here, it has the highest fees. Despite being a low fee ETF, SPY’s 0.0945% gross expense ratio is over double to triple that of the other two.

(Source: SSGA SPY website)

Of course, there are considerations other than fees, and that is where SPY shines. SPY was the first ETF, launched back in 1993. That is a large part of why it has accumulated such significant assets under management. Also, it has the highest average trading volumes of ETFs and some of the tightest spreads, which means it is the most liquid and generally offers investors the best opportunity to obtain a fair market price when buying or selling.

Similarly, SPY offers the richest options market among these S&P 500 ETFs and SPY options are usually among the highest volume ETF options, while the other two main S&P 500 ETFs have rather small options markets. These attributes of size and richer options markets make SPY the probable choice for traders that intend to hold their position for a brief period of time or for investors that intend to regularly sell covered calls on a sizable existing position.

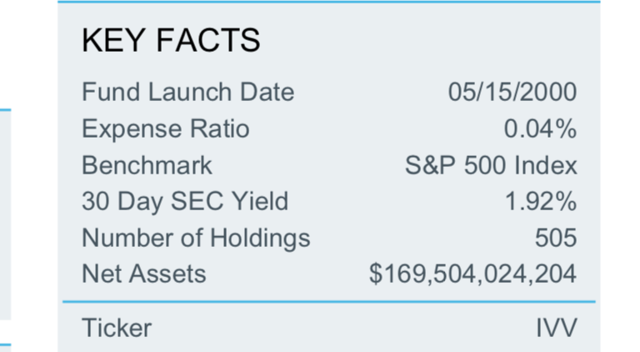

iShares Core S&P 500 ETF

The iShares Core S&P 500 ETF is the second largest ETF, but IVV’s trading volumes aren’t in the top 50. IVV’s expense ratio of 0.04% makes it less than half as costly as SPY.

(Source: iShares IVV Fact Sheet)

Because over 25x as many shares of SPY trade each day, the average bid/ask spread is generally smaller with SPY, but the difference should be limited due to the still large enough market to keep IVV’s average spread as low as 0.01 percent.

If you do not intend to trade in and out of your S&P 500 holdings, IVV’s much lower expense ratio makes it likely to be a superior choice to SPY. You would likely prefer SPY if you intend to sell covered calls or expect to hold your position for a brief period of time. More sizable investments and, especially, large short-term trades are nearly certain to prefer the greater volume and liquidity that SPY provides.

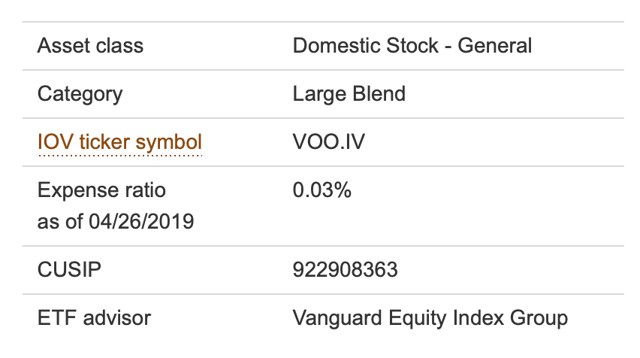

Vanguard S&P 500 ETF

Despite being such a dominant provider of index funds, VOO is only the third largest ETF. Still, it is paired with Vanguard’s S&P 500 mutual fund (VFIAX), which is about as large as SPY. Vanguard’s pairing of mutual funds with ETFs also allows for Vanguard to perform patented tax advantaged trades. Vanguard recently reduced its management fees on several ETFs, including taking both VOO and its Total Stock Market ETF (VTI) down to a 0.03% expense ratio. This means that VOO has the lowest expense ratio of the S&P 500 ETFs.

(Source: Vanguard’s VOO profile page)

Much like was the case for IVV, VOO’s lower trading volume means that it may have wider spreads and worse pricing than SPY in some instances, but it still maintains a 0.01% average spread. Even though all three have low fees, the differences are significant, with VOO having less than one-third the fees of SPY and 75% of the fees of IVV. This difference is significant enough that VOO is likely the best option for long-term investors that do not plan to sell covered calls, presuming all other factors are equal.

Your broker could dictate your best choice

The decision on which S&P 500 ETF is best for you may not be as simple as the fund’s fees even if fees are your sole concern. Transaction costs can easily be another major source of friction against portfolio growth and, especially, if an investment is been accumulated in regular installments. Thankfully, many common ETFs now trade commission-free at various brokers.

Vanguard happens to allow all three to trade commission free if the trade is made online, so it is likely that VOO is the best option there for long-term investors unless they intend to sell covered calls and find VOO’s market insufficient. E-Trade offers commission-free trading of VOO, but not of the other two, so VOO is likely also there if you have a small position and are buying in installments.

Alternatively, Fidelity offers commission-free trading of IVV, but not VOO or SPY. At Fidelity, whether VOO or IVV are superior will likely depend upon the exact size of your position and the frequency in which you may transact. Also, many offer mutual funds that have even lower expense ratios. For example, Fidelity has its 500 Index Fund (FXIAX) and the Zero Large Cap Index Fund (MUTF:FNILX), both of which have lower fees than any ETF (respectively 0.015% and 0.0%).

| Symbol | Fees | Who uses |

| SPY | 0.09% |

traders ; options sellers |

| IVV | 0.04% |

trades commission free at Fidelity |

| VOO | 0.03% |

default pick due to fees ; trades commission free at E-Trade |

If you are trading a sizable position and, especially, intra-day or high-speed trading or if you are intending on selling covered calls, SPY may be a better vehicle due to the superior liquidity and tighter spreads.

Recent performance and near-term outlook

All of these S&P 500 ETFs share the same holdings and general market risks. Their near identical performance means they appreciated significantly through the first five months of 2019 and that strength has recently disappeared.

Shares are now trading at a point of prior resistance and support and appear poised to decline another 2.5% to 5% in the near term, but possibly further.

The S&P 500 appears likely to remain reasonably anchored to this price until the broad market reacts to some new information. The current market narrative is deeply concerned with global growth and the ongoing trade tensions between the US and China, as well as interest rate and credit uncertainty. These risks could easily develop into a stronger decline for equities. In short, the S&P may be rolling over here.

Moreover, given the strong recent appreciation and repetitive testing of these levels, it is reasonable to presume the market will remain weak in the near term and may retest lower support levels. Spike downs will likely represent strong short-term trades and buying opportunities for accumulating core positions in passive index funds.

Conclusion

There are many ways to get exposure to the S&P 500, and even several ETFs that directly track the index. The cheapest current S&P 500 ETF is VOO, with a 0.03% fee, which is also available for commission-free trading at brokers including Vanguard and E-Trade, but it should be noted that some mutual funds offer even cheaper exposure to the index The second cheapest S&P 500 ETF is IVV, with a 0.04% fee, which is available for commission-free trading at Vanguard and Fidelity. SPY is the most liquid S&P 500 ETF, making it the choice for short-term traders and covered options sellers, but those attributes come at the cost of a 0.0945% expense ratio, making it considerably more expensive than these other funds. Long-term investors that do not sell covered calls would likely be best invested in VOO, among these choices, depending on their broker.

An accompanying video comparison of these three ETFs is available here:

Disclosure: I am/we are long FXAIX, VTI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News