One of the biggest healthcare conferences of the year just ended—the American Society of Clinical Oncology Annual Meeting.

Since ASCO was founded in 1964, funding for cancer research has gone from less than $200 million to more than $5 billion, and the number of drugs available for treatment has grown from a handful to more than 170. ASCO’s Annual Meeting is ground zero for this progress.

Some of the biggest names in healthcare presented abstracts to healthcare professionals and investors alike, shedding light on potential new treatments on more than a dozen different types of cancer.

Names like Amgen and Eli Lilly (top components in the Direxion Daily Healthcare Bull 3X Shares ETF (CURE) will be presented data, as did MacroGenics, Mirati Therapeutics, and Blueprint Medicines (components in the Direxion Daily S&P Biotech Bull 3X Shares (LABU) and Direxion Daily S&P Biotech Bear 3X Shares (LABD).

The meeting came at an interesting time for the healthcare market. Against a backdrop of several Congressional hearings on the rising costs of drugs in this country, healthcare and biotech stocks have underperformed the overall market in 2019.

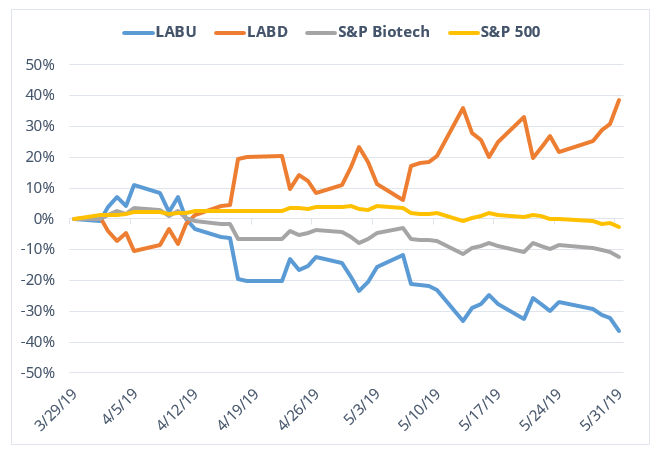

The iShares NASDAQ Biotechnology ETF has seen $164 million in outflows in May alone, as investors have shifted away from “risk-on” assets. Interestingly, LABU and LABD have seen a bit of a divergence over this period, as the former is down 28% and the latter is up 14%, due to volatility. This suggests that short-term traders have been especially focused on playing biotech from the short side.

Source: Bloomberg. Date range: 3/29/2019 – 5/31/2019. Past performance is not indicative of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For standardized performance and the most recent month-end performance, click here.

Though the abstracts presented were already public, the market received more detailed explanations from these companies about what worked, what didn’t work, what’s in the pipeline, and how they expect their drugs to sell.

Results presented at ASCO may have major ramifications for the market, even as macro events cast their shadow. Last year’s ASCO star, Loxo Oncology, got bought by Eli Lilly in January.

And though the long-term picture on the sector will remain cloudy until we get some clarity on how Congress intends to act on drug pricing, one way or the other we’re going to see some volatility this weekend.

Related Leveraged ETFs

Direxion Daily Healthcare Bull 3X Shares ETF (CURE)

Direxion Daily S&P Biotech Bull 3X Shares (LABU)

Direxion Daily S&P Biotech Bear 3X Shares (LABD)

This leveraged ETF seeks investment results that are 300% of the return of its benchmark index for a single day. The ETF should not be expected to provide returns which are three times the return of its benchmark’s cumulative return for periods greater than a day. Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged investment results and intend to actively monitor and manage their investment.

CURE Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund’s concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause its price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of its underlying index for periods other than a single day. Risks of the Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, Daily Index Correlation/Tracking Risk, Other Investment Companies (including ETFs) Risk, and risks specific to investment in the securities of the Health Care Sector. The profitability of companies in the healthcare sector may be affected by extensive, costly and uncertain government regulation, restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure, an increased emphasis on outpatient services, limited number of products, industry innovation, changes in technologies and other market developments. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

LABU/LABD Risks – An investment in each Fund involves risk, including the possible loss of principal. The Funds are non-diversified and include risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Each Fund does not attempt to, and should not be expected to, provide returns which are three times the performance of their underlying index for periods other than a single day. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Aggressive Investment Techniques Risk, Liquidity Risk, Counterparty Risk, Intra-Day Investment Risk, and risks specific to investment in the securities of the Biotechnology Industry and Healthcare Sector. Companies within the biotech industry invest heavily in research and development, which may not lead to commercially successful products. Additional risks include, for the Direxion Daily S&P Biotech Bull 3X Shares, Daily Index Correlation/Tracking Risk and Other Investment Companies (including ETFs) Risk, and for the Direxion Daily S&P Biotech Bear 3X Shares, Daily Inverse Index Correlation/Tracking Risk, and risks related to Shorting and Cash Transactions. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

S&P Biotechnology Select Industry Index (SPSIBITR) – Provided by Standard & Poor’s and includes domestic companies from the biotechnology industry. The Index is designed to measure the performance of the biotechnology sub-industry based on the Global Industry Classification Standards (GICS). One cannot directly invest in an index.

S&P 500® Index (SPXT) – Standard & Poor’s® selects the stocks comprising the S&P 500 on the basis of market capitalization, financial viability of the company and the public float, liquidity and price of a company’s shares outstanding. The Index is a float-adjusted, market capitalization-weighted index. One cannot directly invest in an index.