[ad_1]

During the first nine months of 2018, there were 291 dividend increases by S&P 500 constituents, including 75 that occurred in the third quarter. Increases this year were widely spread across the now-11 GICS [Global Industry Classification Standard] sectors, a reminder that dividend ETFs can serve as a great vehicle for tapping into the equity income from large-caps.

In August 2018, S&P 500 industrial sector constituent Illinois Tool Works (etf.com/stock/ITW) raised its quarterly dividend to $1.00 per share, from a prior $0.78 per share.

In September, McDonald’s (etf.com/stock/MCD) raised its quarterly cash dividend to $1.16 per share, from the previous $1.01 per share payment. These increases were nothing new, as both stocks are members of the S&P 500 Dividend Aristocrats Index, which consists of companies that have raised dividends for 25 or more years.

In the third quarter of 2018, the average dividend increase was 17%, according to S&P Dow Jones Indices, up from 14% in the second quarter of 2018 and 11% a year earlier.

Dividend ETF Choices Abound

By the end of September, 81% of S&P 500 constituents paid a dividend, providing many choices for income-oriented investors. Meanwhile, the dividend-payers yield of 2.3% was above the 1.9% yield for the broader S&P 500 Index, though the yield for both remains below the 3.0%-plus yield for the 10-year Treasury bond following recent hikes by the Federal Reserve.

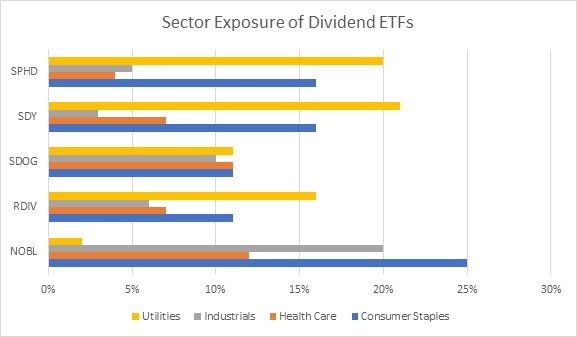

Not surprisingly, there are a variety of ETFs that track an S&P dividend index consisting primarily of S&P 500 companies; however, the security and exposure characteristics of each of the ETFs are distinctly different.

The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) tracks the aforementioned index of S&P 500 companies with 25 years of consecutive dividend increases. There are 53 companies represented in the index, with consumer staples (25% of assets), industrials (20%) and health care (12%) companies comprising the largest weightings. In contrast, utilities (2%) is the smallest of the sectors represented, despite the sector’s 3.49% yield being the highest for the broader S&P 500 Index.

Multi-Cap Dividend ETF

The SPDR S&P Dividend ETF (SDY) is a larger ETF that differs from NOBL because it fishes from the multicap S&P 1500 Index and only requires 20 years of dividend increases. There are 111 holdings, including midcaps like Aqua America (WTR) that raised its quarterly dividend to $0.22 per share, from a prior $0.21 in July 2018. While consumer staples (16% of assets) and industrials (16%) are the largest sectors, the utilities sector at an 11% weighting, is the fourth largest. By comparison, health care makes up just 7% of the portfolio.

Another SPDR dividend ETF tied to an S&P index, the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), is focused on yield rather than historic growth. The fund currently tracks an index of the 79 highest-yielding stocks in the S&P 500 Index. As such, real estate (24% of assets) and utilities (21%) are the two largest sectors, while the industrials sector is the second smallest, at just 3%. Holdings include AES and UDR.

Source: CFRA Research, 10/9/2018

[ad_2]

Source link