Unrest over China’s zero COVID policy has boiled over into protests across China, as a recent rise in COVID-19 infections has prompted lockdown responses in many cities and regions. The protests, a rarity in China, have roiled local markets as foreign investors seize on the buying opportunity in Chinese equities.

The protests began Friday after an apartment fire killed 10 in an area that has been locked down for months: locals blamed the COVID regulations for the inability of fire personnel to rescue the residents in time, according to CNBC. Protests broke out Friday in the area and had spread to Shanghai, Beijing, and other cities by Saturday.

The surge in COVID cases recently has caused lockdowns in Beijing that forbid residents from leaving their homes, and is part of China’s zero-tolerance COVID response that has had major economic impacts for the world’s second-largest economy.

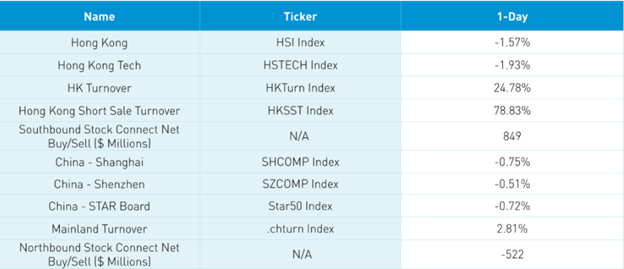

Whereas the uncertainty and risk of COVID lockdown impacts has caused many advisors and investors to sit on the sidelines for the last two years when it comes to China, the foreign response to the price opportunities of Chinese stocks currently has caused an influx of investment on Monday. The Hang Seng index in Hong Kong was down -1.57% overnight, and the Shanghai Composite was down -0.75%.

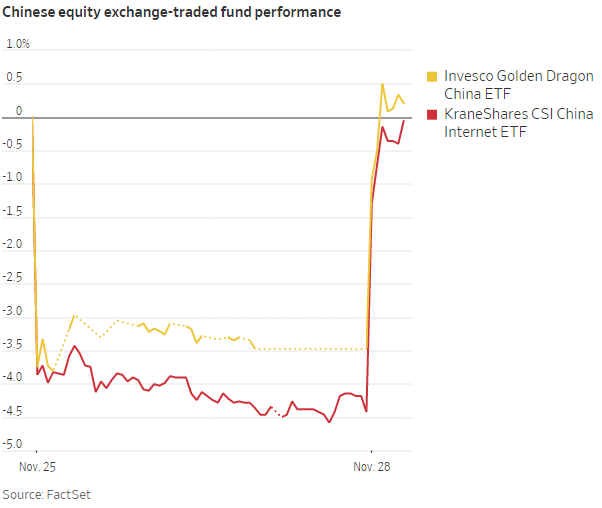

Advisors and investors are piling into China-centric ETFs on “buy the dip” mentality: the broadly allocated Invesco Golden Dragon China ETF (PGJ ) is up 4.4% in trading Monday morning while the more growth-oriented KraneShares CSI China Internet ETF (KWEB ) is up 4.2% according to WSJ.

Content continues below advertisement

“It is worth noting that reopening plays were strong overnight in Mainland China as the top sub-sectors included restaurants, airports, and retailers. US-listed Chinese stocks opened higher after Pinduoduo (PDD US) reported before the US open, beating on the big three: revenue, adjusted net income, and especially adjusted EPS,” explained Brendan Ahern, CIO of KraneShares, on the China Last Night blog.

Investing in Chinese Equities with KWEB

The KraneShares CSI China Internet ETF (KWEB ) tracks the CSI Overseas China Internet Index and measures the performance of publicly traded companies outside of mainland China that operate within China’s internet and internet-related sectors. This includes companies that develop and market internet software and services, provide retail or commercial services via the internet, develop and market mobile software, and manufacture entertainment and educational software for home use.

KWEB provides exposure to the Chinese internet equivalents of Google, Facebook, Amazon, eBay, and the like, all companies that benefit from a growing user base within China and a growing middle class. The fund has worked to convert all possible share classes over to Hong Kong shares instead of ADRs to protect investors in case of a Chinese company delisting within U.S. markets.

Pinduoduo has a 5.75% weighting in the fund, and KWEB has an annual expense ratio of 0.69% with $5 billion in AUM.

For more news, information, and analysis, visit the China Insights Channel.