[ad_1]

Torsten Asmus

Today’s article assesses the Alpha Architect U.S. Quantitative Momentum ETF (BATS:QMOM). I’ve followed Alpha Architect’s work for quite some time now, spending many late nights researching concepts for my Ph.D. thesis. Based on anecdote, Alpha Architect hosts concepts that are well ahead of the investment industry’s time, and I won’t be surprised if the company’s ETF products experience significant inflows in the coming years.

The company’s momentum ETF utilizes a high-conviction momentum investing approach, which sorts portfolios based on style-based quantiles. The ETF suits those seeking U.S.-based equity momentum exposure at minimal cost while retaining a balanced portfolio.

We assessed the vehicle collectively, and here’s what we discovered.

Momentum Investing Explained

The Momentum Anomaly

I’ve explained the momentum anomaly in previous articles. However, it’s critical to reiterate what momentum investing means before delving into Alpha Architect’s Momentum ETF.

Mark Carhart commercialized the momentum anomaly in the 1990s. According to Carhart’s study, investors could outperform the market by selecting stocks that beat the market in the previous twelve months while selling stocks that underperformed the market during the same time horizon.

The method behind the madness is that investors stay invested longer than they ideally should due to factors such as confirmation and survivorship biases.

Types of Momentum

Cross-Sectional Approach

A cross-sectional momentum approach ranks stocks in quantiles, whereby the upper quantiles of market performers would be retained in a portfolio while the lower quantiles would be sold. The strategy follows a “high minus low” approach and is empirically backed by many researchers.

Time Series Approach

Time series momentum investing follows the same thought process; however, the approach doesn’t segment stocks into quantiles but instead looks at each asset in isolation, selecting stocks that gained value in the previous twelve months while disposing of assets that underperformed.

Both cross-sectional and time series anomalies can be measured with various horizons; however, 12-month horizons are a rule of thumb.

Drawbacks

Momentum investing has a few drawbacks. Firstly, the theoretical process is easier to execute and more complex. And secondly, momentum investing is a statistical approach, which means it has limitations regarding market inefficiencies. Thus, momentum investing requires additional consideration, which Alpha Architect’s Momentum ETF possesses.

What Sets QMOM Apart

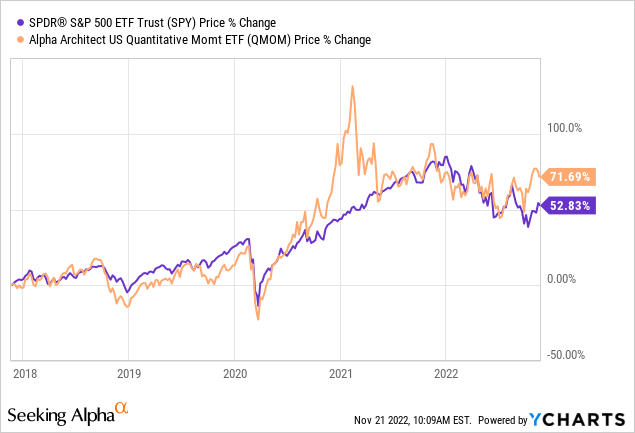

As previously mentioned, momentum investing is empirically backed to outperform the market; however, it takes skill to execute. Yet, Alpha Architect has successfully implemented the strategy as its momentum ETF has outperformed the SPY (an S&P 500 tracking fund) since its inception.

Furthermore, the fund has achieved its stellar returns with conviction. If you revert to our article about BlackRock’s iShares Edge MSCI USA Momentum Factor ETF (MTUM), you’ll notice that we were critical of the fund’s lack of sector conviction. However, the same can’t be said about Alpha Architect’s Momentum ETF.

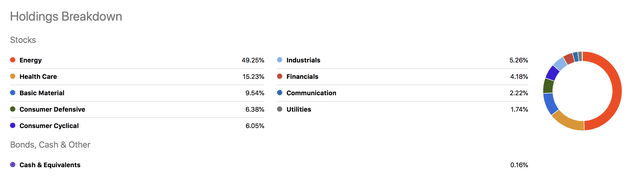

Nearly 60% of the ETF is invested in resources, with approximately 49.25% of that allocation being in energy stocks. The fund rebalances this ETF quarterly and selects the top 10% of momentum stocks as its sample, whereafter it selects 40 to 50 stocks to invest in. Thus, illustrating the ETF’s conviction and conveying its nimble asset allocation.

Seeking Alpha

Fundamentally, we’re not overly excited about oil and gas stocks as they could be set for a cyclical mean reversion whenever the market prices deep recession risk. In addition, commodity prices are usually priced in advance, and much of the global energy short-supply noise will likely fade out soon, causing prices to recede.

Nonetheless, we think the ETF’s conviction strategy will see it pivot whenever needed, avoiding cyclical exposure.

Valuation, Dividends, and Cost

Although this ETF focuses on momentum anomalies, it holds relative value in abundance. For example, its price-to-earnings ratio is at a significant discount to the SPY’s 17.39. In addition, its price-to-book is lower than the SPY’s 3.75. Thus, a peer analysis collectively conveys that the ETF is undervalued relative to the S&P 500.

Alpha Architects

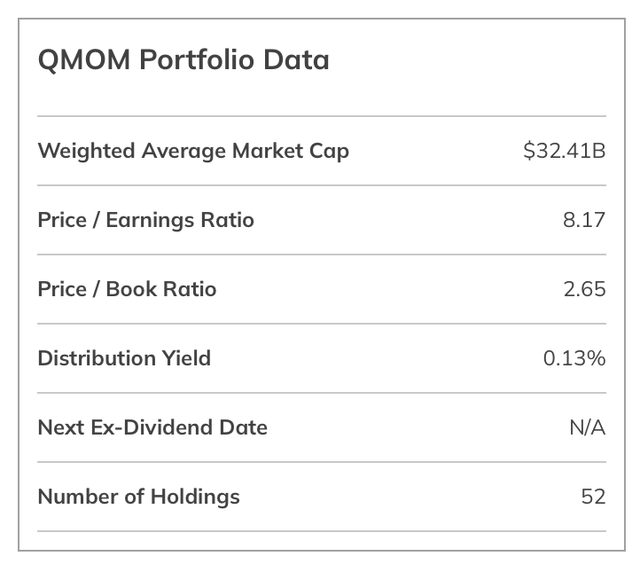

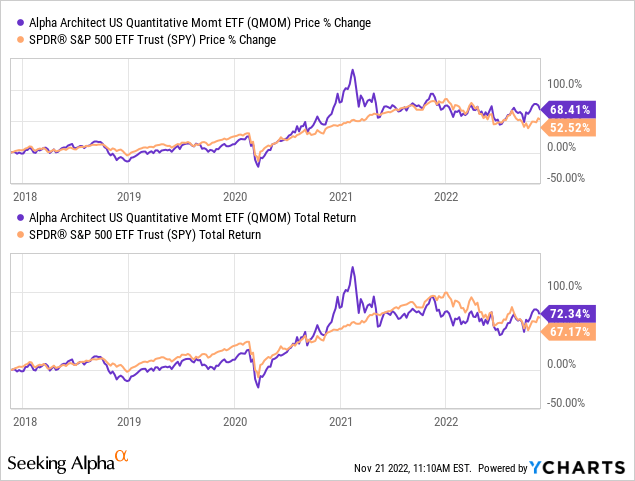

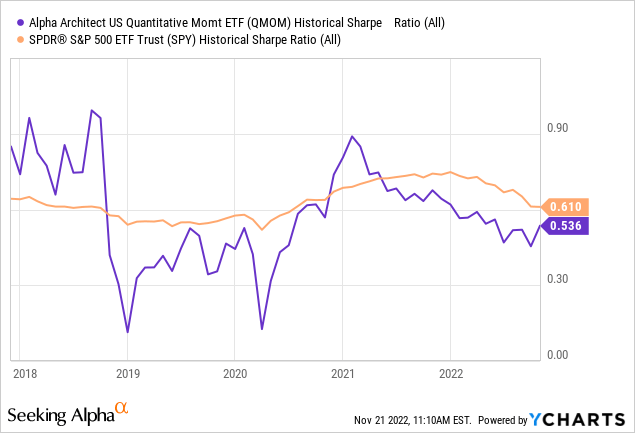

Despite the ETF’s impressive valuation metrics, it doesn’t distribute a dividend, which is a concern as it somewhat dilutes the vehicle’s total return prospects. For example, the total return arbitrage between the ETF and the SPY is significantly smaller than the price return discrepancy mentioned earlier. Moreover, the ETF exhibits a worse Sharpe Ratio than the SPY, indicating that it hosts an abundance of volatility per unit of return.

Lastly, to the point of cost. Alpha Architect’s U.S. Quantitative Momentum ETF isn’t overly expensive to own, and its 0.49% expense ratio is reasonable for a hybrid actively/passively managed ETF. The ETF possesses high tracking errors. However, it’s an unconstrained fund; therefore, we don’t consider it a substantial influencing factor.

Concluding Thoughts

In conclusion, Alpha Architect U.S. Quantitative Momentum ETF exhibits one of the best momentum strategies we know of. Furthermore, the ETF’s strategy execution is, without a doubt, sublime, as it has outperformed the S&P 500 since its inception.

Although not fundamental to its influencing variables, the ETF hosts attractive valuation metrics and a reasonable expense ratio.

We assign a strong buy rating with an indefinite time horizon.

[ad_2]

Source links Google News