[ad_1]

gesrey

iShares Edge MSCI Intl Quality Factor ETF (NYSEARCA:IQLT) is an exchange-traded fund that provides investors with direct exposure to mid- and large-cap stocks in developed markets outside of the United States which exhibit positive return characteristics. These include: high returns on equity, stable long-term earnings growth rates, and low financial leverage. These characteristics are deemed to reflect higher quality. The implication is that low-quality stocks relate to companies with weak financial performance and higher debt loads, which is difficult to argue with.

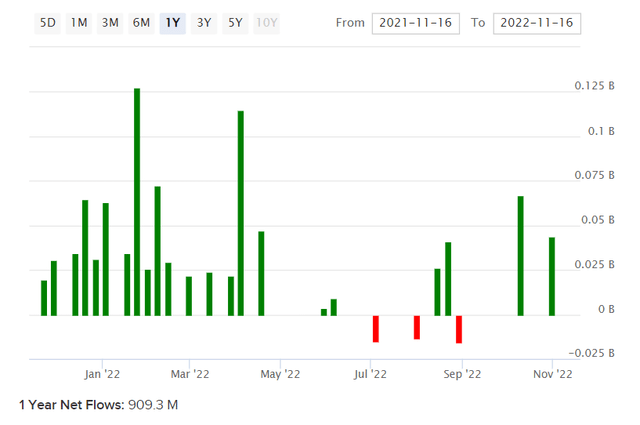

While “value” is a more abstract assessment to take using only a categorical approach, “quality” is perhaps less subjective in the investing context; no argument is made in respect to price paid. During more economically (and indeed politically) turbulent times, it would make sense that higher-quality businesses would become more popular as investment cases, independent of their relative performance. Given macroeconomic and geopolitical uncertainties over the past twelve months, it is therefore not surprising to me that net fund flows into IQLT have been positive (see chart below) by circa +$909 million. This does however indicate a materially strong performance given that equity funds have generally fallen over the past twelve months.

ETFDB.com

As of November 16, 2022, IQLT had $4.1 billion in assets under management, which would make it one of iShares’ most popular ETFs and strategies. The expense ratio is 0.30%, which is still quite high for a popular fund, but in line with other iShares funds, especially those that invest internationally (which admittedly tends to involve a higher-cost implementation).

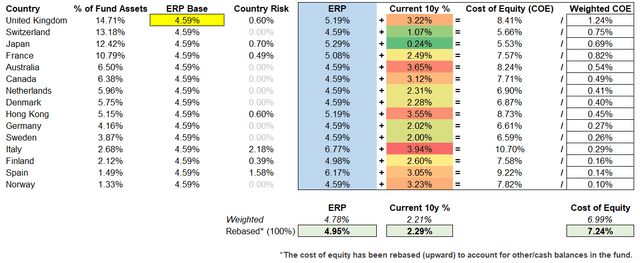

IQLT has a diverse international exposure, with its largest country exposures being the United Kingdom (15%), Switzerland (13%), and Japan (12%), as of November 15, 2022. I have calculated the cost of equity as per the table below, which uses 10-year bond yields as risk-free rates and equity risk premia data (including country risk premium estimates) from Professor Damodaran.

Author’s Calculations

The cost of equity comes to 7.24%, which is to say that given the risk associated with investing in IQLT’s international equity portfolio, we should be asking for an IRR of at least 7.24%; if we can calculate an implied IRR above this, one could argue that IQLT is undervalued, but also vice versa.

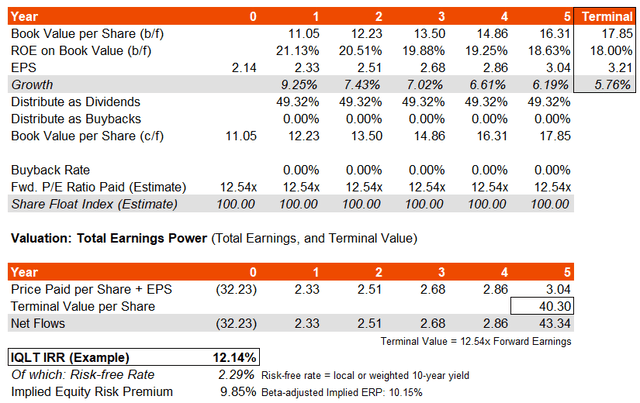

To gauge IQLT’s earnings power, I would begin with identifying the fund’s benchmark index, which is the MSCI World ex USA Sector Neutral Quality Index. The most recent factsheet for the index as of October 31, 2022 reveals trailing and forward price/earnings ratios of 13.70x and 12.54x, respectively, with a price/book ratio of 2.65x. The indicative dividend yield was 3.60%. These numbers imply a forward return on equity of 21.13% and a dividend distribution rate of 49.32%. Holding the majority of these numbers constant, but assuming that returns on equity drop to 18% by year six, I am able to generate the following basic IRR model.

Author’s Calculations

My implied three- to five-year average earnings growth rate at the portfolio level is 7-8%. This contrasts only slightly with Morningstar’s current consensus estimate for the same period of 8.33%, hence my model is basically in line with forecasts (not generous or conservative). The IRR estimate suggests a potential annual return of 12% over the next five years or so. I have also assumed that the terminal earnings multiple of 12.54x holds over time; if anything, some earnings multiple expansion is possible.

Therefore, IQLT does appear undervalued. Bear in mind the U.S. dollar has strengthened quite a bit recently (although most recently the dollar has shifted downward); a stronger U.S. dollar on a multi-year basis increases a U.S. investor’s buying power abroad. That applies to both consumer spending and, in this case, investing. Also, the average 10-year bond yield weighted by some low-return countries in IQLT’s portfolio helps to support the underlying equity risk premium substantially. Using a U.S. 10-year of 3.77% (at the time of writing) instead would squeeze the implied ERP from 9.85% to 8.37%, but this is still low, especially given that IQLT’s historical beta is sub-1.00x.

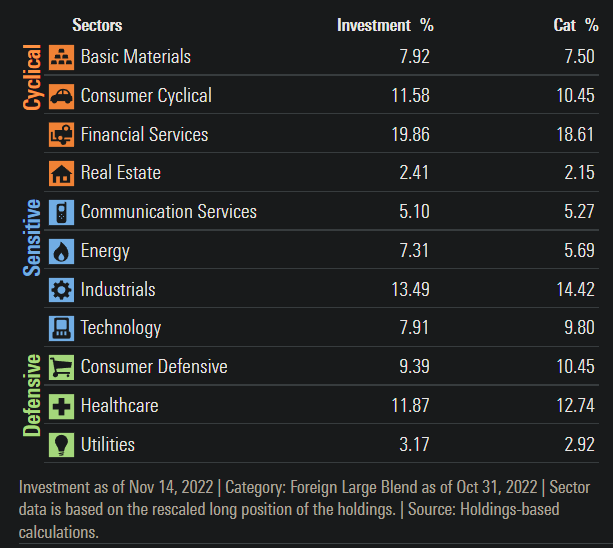

I would also argue that IQLT’s sector exposures are nicely balanced across cyclical, sensitive, and defensive sectors.

Morningstar.com

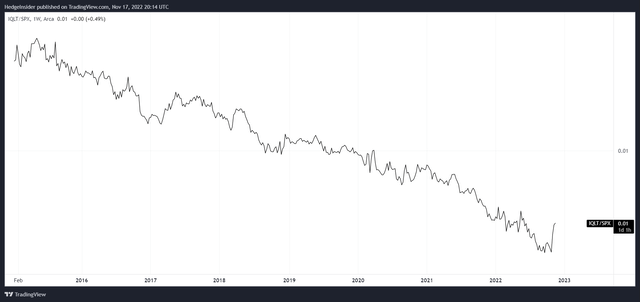

The chart below shows the relationship between IQLT and the S&P 500 U.S. equity index. This reflects under-performance on a price-only basis (excluding the impact of dividends). Very recently, IQLT has however managed to prop itself up against the S&P 500.

TradingView.com

My current bias is that the value here is strong enough, with the U.S. dollar’s recent weakness helping, that IQLT’s out-performance relative to the S&P 500 on a price basis could continue. I would take a bullish stance. IQLT also offers an implicit short-USD FX hedge given its non-U.S. equity exposures.

[ad_2]

Source links Google News