[ad_1]

chonticha wat

By Alex Rosen.

Summary

Gold… what can be said about it that has not been said already? The Spanish sailed a vast armada on it. The entire global monetary system was for a long time based on it. It’s a commodity, it’s jewelry, it’s a rare earth element used in airbags. It’s found everywhere from the earth to the moon. It has been traded for over 3500 years. If you do not know gold, then you probably aren’t reading this article.

Goldman Sachs Physical Gold ETF (BATS:AAAU) tracks the daily spot price of gold and holds the physical asset in a safe in Australia. If you want, you can trade your shares for as little as one gram of gold.

Strategy

The exchange-traded fund (“ETF”) offers investors access to physical gold. The price of the fund less expenses and liabilities follows the daily spot price of gold. The total fund assets as of this writing are around $408.5 million, or roughly 7,131 kgs. That is a big safe.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Commodities

- Sub-Segment: Gold

- Correlation (vs. S&P 500): High

- Expected Volatility (vs. S&P 500): Very low.

Holding Analysis

AAAU holds physical gold. Nothing more complicated than that. Short of going to a pawn shop and buying gold in coins and ingots, this is about the best way to hold the individual asset.

Strengths

Crypto goes up and crypto goes down. Today the dollar is strong and tomorrow it’s a hot mess. The Pound Sterling is at historic lows, and then there’s gold. It was, is, and will probably forever be the commodity upon which all other currencies compare themselves. Every country and every culture values it. When all other global currencies fail, gold will still exist as the medium of international trade.

Weaknesses

Gold is not a rare commodity, in fact it is extremely abundant, and more and more of it is found every day. This past summer, Uganda found a gold strike worth approximately $13 trillion dollars (yes, that’s trillion with a T). The law of supply and demand doesn’t really apply to gold, but it is really just a metal, and who knows, maybe one day people will decide it’s not that valuable.

Opportunities

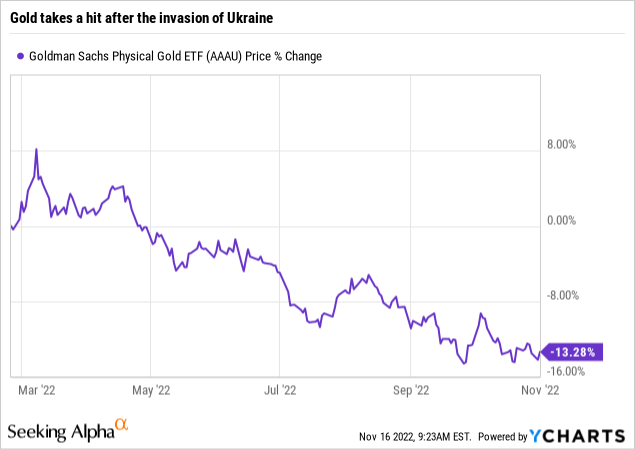

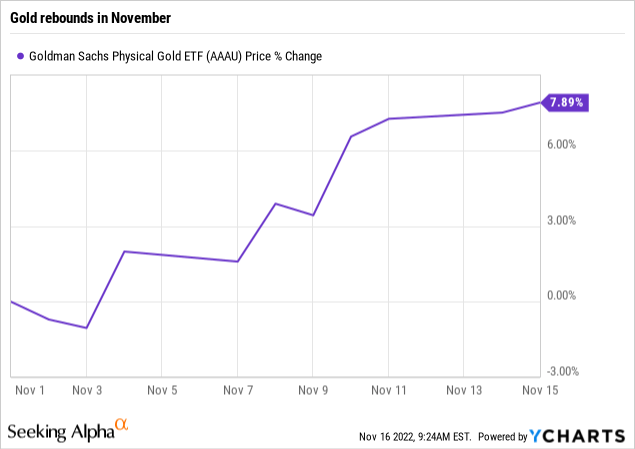

Despite its abundance, the world demand for gold remains high. In order to fund its war in the Ukraine, Russian mercenaries can be found all over Africa looking for gold. Last quarter saw central banks around the world purchase a record amount of gold. Essentially, when the world seems like it’s on the verge of collapse, people turn to gold. As you can see, the price of gold peaked just after the invasion of Russia, and since then was down 13.28% through November 1st. However since the start of November, gold has rebounded nicely, showing an almost 8% gain.

Gold takes a hit after Russia invades (Ycharts)

Data by YCharts

Gold rebounds in November (Ycharts)

Threats

Single-asset ETFs are always subject to exogenous threats. The gold market could collapse as the U.S. fed decides to ease inflation by continuing to increase interest rates. Suddenly a flood of gold could end up on the market, causing the price to plummet, or the markets could stabilize and put people’s fears to rest. Any of these events could have an adverse effect on the price of gold, and by proxy AAAU.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Buy.

Conclusions

ETF Quality Opinion

AAAU is as basic as it gets when it comes to ETFs. No active management, no rebalancing, no hedging, just gold. If you believe in gold, this is the fund for you.

ETF Investment Opinion

We rate gold and AAAU a hold, as gold is coming off historic lows and is showing a nice rebound. Gold has always been a solid buy and better hold if you already own it. However, do not go looking to suck out your fillings and sell them anytime soon.

[ad_2]

Source links Google News